My Journey with Wirex: The Early Days

I got my first Wirex card back in 2019, and honestly, it felt revolutionary at the time. The crypto card space was still pretty new, and Wirex was one of the few players that actually worked. I remember the excitement of being able to spend Bitcoin at regular stores, it genuinely felt like the future of money.

Back then, the competition was limited. Wirex, along with a handful of others, were the pioneers. The app was decent, the card worked most of the time, and the novelty factor alone made the fees feel worth it.

Fast forward to 2026, and I still have my Wirex card. But here's the thing: the landscape has changed dramatically.

What Wirex Still Gets Right

It Actually Works (Most of the Time)

After seven years, I can confirm: Wirex is reliable. Really. The card works at ATMs, at point-of-sale terminals, for online shopping, basically everywhere a regular Mastercard works. That consistency matters more than you'd think. I've tried newer services that promised the moon but couldn't handle a simple grocery store transaction.

The OG Crypto Rewards Program

Wirex was one of the first to introduce crypto cashback (they call it "Cryptoback"), and it still exists. You earn up to 2% back in their WXT token on purchases. In the early days, this felt amazing. Now? It's... okay. The WXT token hasn't exactly been a stellar performer, and 2% cashback is pretty standard across the industry these days.

Multi-Currency Support

One thing Wirex does well is supporting multiple cryptocurrencies and fiat currencies. I can hold Bitcoin, Ethereum, XRP, and about 30 other currencies in the app, plus traditional currencies like USD, EUR, and GBP. For someone who travels or deals with multiple currencies, this is genuinely useful.

Established and Licensed

Here's something that matters more as you get older and hopefully wiser: Wirex is actually licensed and regulated. They have FCA authorization in the UK and various licenses across Europe. After watching several "exciting new crypto card startups" implode over the years, there's something to be said for boring regulatory compliance.

The App Has Improved

Credit where it's due: the Wirex app in 2026 is miles better than the clunky interface from 2019. They've added features like in-app exchange, better security options, and a cleaner design. It's not perfect, but it's functional and gets regular updates.

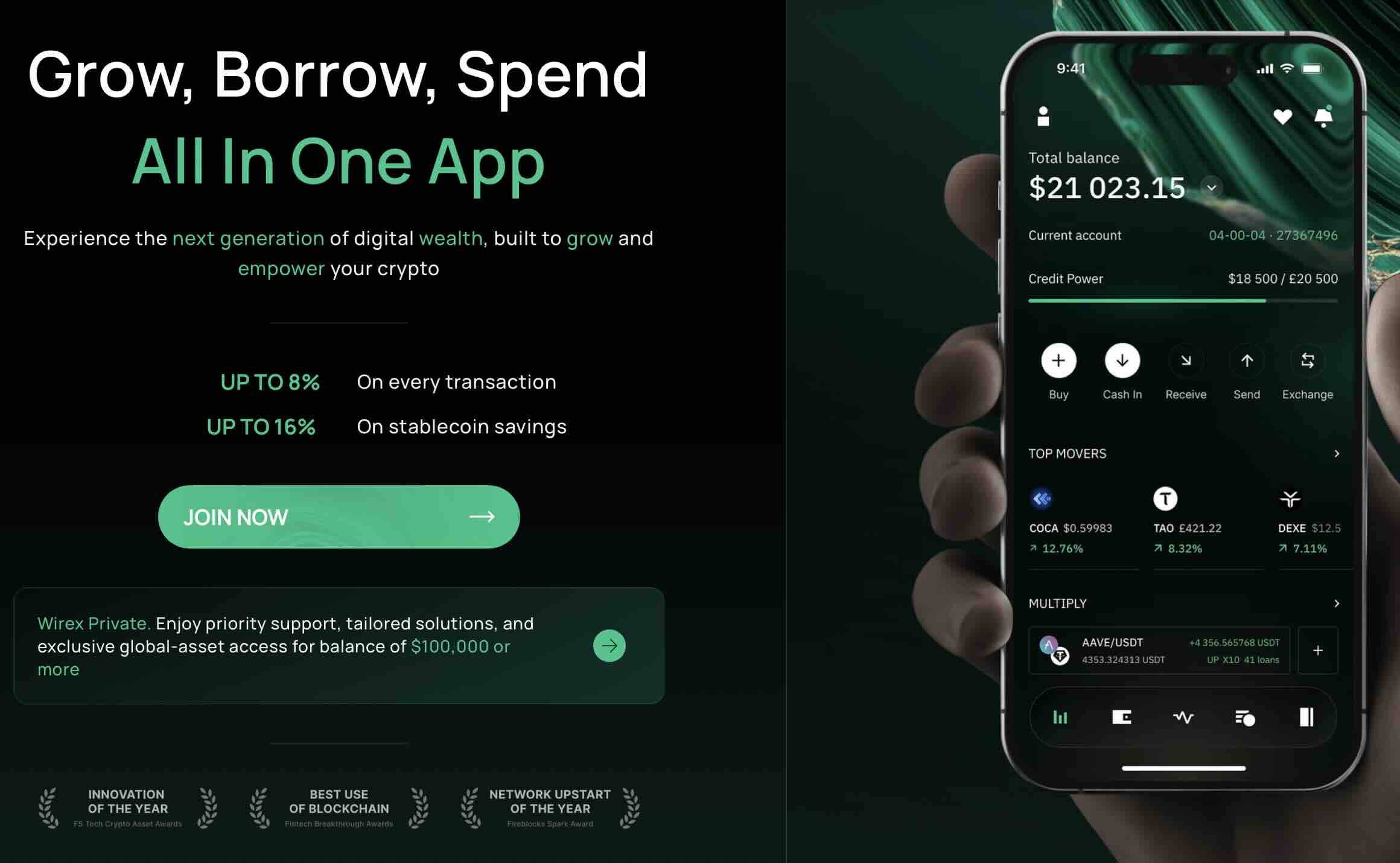

What You Can Actually Do on Wirex

Beyond just spending, Wirex has expanded into other financial services:

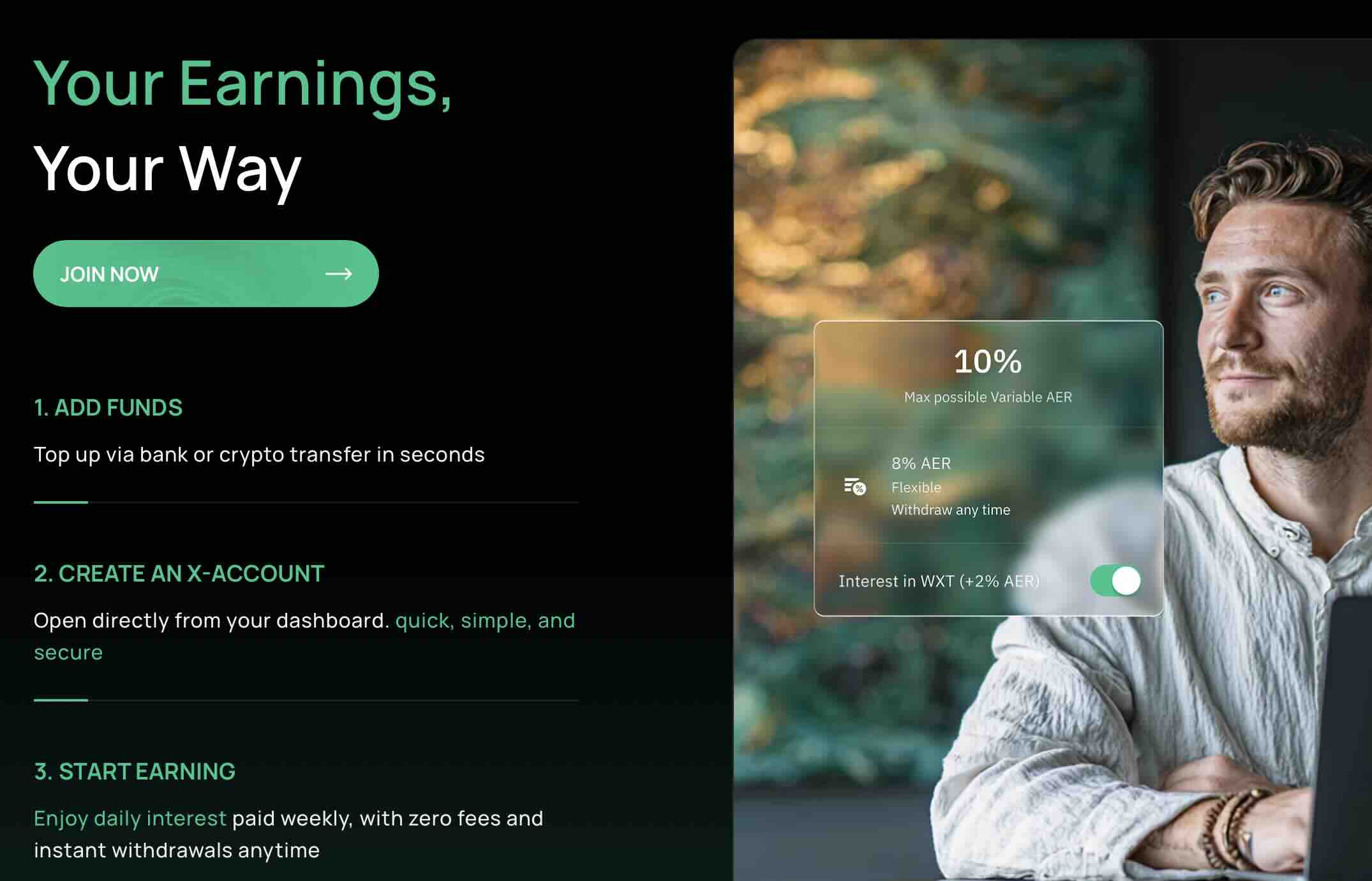

➡️ Wirex Grow (Savings): You can earn interest on your crypto holdings. Sounds good in theory, but here's the catch, the rates vary significantly depending on the asset, and there are fees involved. You'll pay a spread on deposits and withdrawals, and the APY rates change frequently without much notice.

➡️ Wirex Borrow: They offer crypto-backed loans where you can borrow against your holdings. The interest rates are competitive compared to traditional loans, but watch out for:

- Origination fees (typically around 2%)

- Monthly interest rates that can fluctuate

- Liquidation risks if crypto prices drop

- Processing fees for early repayment

➡️ In-app Exchange: You can swap between different cryptocurrencies directly in the app. Convenient? Yes. Cheap? Not really. The exchange spreads are noticeably wider than what you'd get on dedicated exchanges like Kraken or Coinbase. For small amounts it's fine, but for larger swaps, you're leaving money on the table.

The Problems I've Encountered Over the Years

The Yield Problem: My Biggest Disappointment

This deserves its own section because it's honestly become my main frustration with Wirex, and it might be the thing that finally pushes me to switch.

When I signed up back in 2019, Wirex offered interest on your crypto holdings, and here's the crucial part: the interest was paid in the same cryptocurrency you deposited. If you held Bitcoin, you earned Bitcoin. If you held Ethereum, you earned Ethereum. This made perfect sense and was genuinely attractive.

Then, in 2025, everything changed.

Wirex switched their yield program to pay interest exclusively in their native WXT token, regardless of what crypto you're holding. So now, if I hold Bitcoin in my Wirex account to earn interest, I don't get more Bitcoin, I get WXT tokens.

Why is this a major problem?

🫰 Sorry, but I don't want WXT tokens. I hold Bitcoin because I believe in Bitcoin. If I wanted exposure to a random utility token from a fintech company, I'd buy it myself. Being forced to accept yield in a token I have no interest in completely defeats the purpose of earning interest in the first place.

🫰 WXT token performance has been mediocre at best. Looking at the charts since 2019, it's not exactly a stellar performer. So not only am I being paid in something I don't want, but it's also something that's been losing value relative to the major cryptocurrencies I actually hold.

🫰 Tax complications: Every WXT token I receive is a taxable event in most jurisdictions. So now I'm creating additional tax paperwork for rewards I didn't even want in the first place.

🫰 Forced selling: If I want to actually realize the "yield," I have to sell the WXT tokens back into the crypto I originally held, which means:

- More taxable events

- Exchange fees and spreads

- Time and hassle

Other platforms do it better: Plenty of competitors, Nexo, Bleap Card, Kast, even some DeFi protocols, pay yield in the same cryptocurrency you deposit. It's not rocket science. It's what users actually want.

This change genuinely feels like a bait-and-switch. I signed up for one thing, and they changed the rules of the game. And look, I understand companies need to evolve and adapt, but this particular change benefits Wirex (by propping up their token) at the expense of users.

For me personally, this is a dealbreaker for using Wirex's yield features. I still keep the card active because of inertia and because it works for spending, but for earning any kind of return on my crypto? I look elsewhere now. There are simply too many better options that pay you in the actual crypto you're holding.

Fees Have Gotten Worse

Let me be blunt: the fee structure has become increasingly complicated and expensive. When I started in 2019, things were simpler. Now there are:

- Monthly account fees (unless you meet certain spending thresholds or stake WXT)

- ATM withdrawal fees (with low free limits)

- Foreign exchange fees that aren't always transparent

- Inactivity fees if you don't use the card regularly

- Top-up fees depending on your method

I've done the math multiple times, and unless you're a heavy user who strategically uses the card, the fees eat into any rewards you're earning. It's death by a thousand cuts.

The KYC Process Has Become Painful

I get it, regulations have tightened since 2019. But the verification process has become increasingly invasive and buggy. I've had to re-verify my account twice due to "system updates," which meant going through the whole process again: uploading documents, taking selfies, waiting for approval. Each time took weeks.

Exchange Rates Aren't Great

The crypto-to-fiat exchange rates within Wirex have never been the most competitive. There's always a spread, and it's wider than what you'd get on a dedicated exchange. Over time, this hidden cost adds up significantly.

The Real Question: Is Wirex Still Worth It in 2026?

Here's where I need to be honest with you, and with myself.

When I got Wirex in 2019, it was one of maybe three legitimate options. Today? There are dozens of alternatives and numerous other services have entered the market, many offering better rates, lower fees, or more innovative features.

Indeed, there are DeFi options and non-KYC alternatives (like Goblin Cards) for those who prioritize privacy. The reality is that Wirex's main advantage, being established and reliable, isn't as compelling when newer services are also proving their reliability.

The Competition Has Caught Up (and Surpassed)

Cards like Goblin offer:

- Lower fees

- Better exchange rates

- More modern apps

- Sometimes better rewards programs

- Easier KYC processes

When Wirex Still Makes Sense

That said, there are scenarios where Wirex remains a solid choice:

- If you're already using it and it works for your needs: The switching cost (time, effort, new verification) might not be worth it if Wirex is functioning well for you.

- If you value regulatory compliance: For larger amounts or if you need the paper trail and legal protections, Wirex's licensing matters.

- If you use multiple currencies frequently: The multi-currency support is genuinely comprehensive and well-integrated.

- If you're in a region with limited alternatives: Wirex operates in many countries where newer services aren't available yet.

When You Should Look Elsewhere

You should probably explore alternatives if:

- You're a new user starting from scratch: Why not test the newer services with better terms?

- Fees are eating into your usage: Calculate your actual costs—you might be better off elsewhere.

- You've had multiple issues with freezes or support: Fool me once, shame on you; fool me five times...

- You want cutting-edge features: Wirex is stable, not innovative.

- You prioritize privacy: The extensive KYC makes this a non-starter for privacy advocates.

My Personal Decision

I'm keeping my Wirex card, but let me be crystal clear about why: inertia and operational reliability for spending, nothing more.

The card works when I need to spend crypto abroad, it's accepted everywhere, and honestly, I'm too lazy to go through the whole setup process with a new provider right now. That's the truth.

But for yield and earning interest on my crypto? Absolutely not. I've moved that business elsewhere to platforms that actually pay me in the cryptocurrency I'm holding, not in some token I have zero interest in accumulating. This is a major flaw in Wirex's current offering, and it's a dealbreaker for anyone who cares about maximizing their crypto returns.

What Wirex still has going for it:

Wirex's real strength in 2026 is that it's rock solid and operational. They've been around, they've survived multiple industry crises (remember the Terra/Luna collapse? FTX? The 2022 crypto winter?), and they're still standing. That counts for something in an industry where companies disappear overnight.

They've won awards, they're properly licensed across Europe, and they're a recognized name in the European fintech landscape. For spending crypto while traveling, making purchases, and having a reliable card that actually works at ATMs and stores, Wirex delivers.

But here's the thing: reliability and survival aren't the same as being attractive.

Wirex is like that one restaurant that's been on your street for 20 years. It's still there, the food is decent, you know what you're getting, and it won't give you food poisoning. But is it the best restaurant in town? Not even close. And with all the new places opening up with better menus, better prices, and more interesting options, why would you keep going there except out of habit?

The brutal reality: For new users starting fresh in 2026, I honestly can't recommend Wirex as your first choice unless you specifically need their European licensing or multi-currency features. The yield program is a joke compared to competitors, the fees have crept up over the years, and newer services simply offer better terms.

For existing users like me? I get it, switching is a pain. But if you're using Wirex for yield, seriously reconsider. You're leaving money on the table by accepting WXT tokens instead of earning in the actual crypto you hold.

The Brutal Truth About Crypto Cards in 2026

Here's what I've learned after seven years in this space:

➔ There are too many choices now, and that's both good and bad. Good because competition drives innovation and better terms. Bad because it's genuinely overwhelming to evaluate all the options, and the "best" choice depends heavily on your specific use case.

➔ No card is perfect. Every service has trade-offs. Wirex is reliable but expensive. Newer services might have better rates but less track record. Non-KYC options offer privacy but more risk.

➔ Your needs change over time. What worked for me in 2019 as an early adopter excited about crypto spending isn't necessarily what I need in 2026 as someone who wants the most efficient way to use my crypto.

Final Verdict

Is Wirex still okay in 2026? Yes, it's okay for spending crypto. It works, it's legitimate, it's reliable for transactions and travel.

Is it attractive for yield or maximizing your crypto returns? Absolutely not. The WXT token yield program is a major downgrade from what they offered in 2019.

Should you get one if you're starting fresh? I'd honestly suggest looking at newer alternatives first. Test a few options with small amounts and see what works best for you.

This review reflects my personal experience as a Wirex user since 2019. Your experience may vary. Always do your own research and start with small amounts when testing any crypto service.