If you've been deep in the Bitcoin and crypto space for a while, you know the frustration. You've built up a decent stack of digital assets, maybe you're self-custodying like a proper bitcoiner should, but when it comes time to actually spend that wealth in the real world, you hit a wall.

Traditional banks don't want to touch crypto users. Cards get frozen. Accounts get shut down. It's enough to make you wonder if financial freedom is just a myth.

What Trustyfy Brings to the Table

Enter Trustyfy, a platform that's trying to solve this exact problem with a different approach. Instead of forcing you to give up custody of your crypto to some centralized exchange just to get a debit card, Trustyfy lets you keep full control of your funds while still giving you access to the traditional financial rails you need for everyday life.

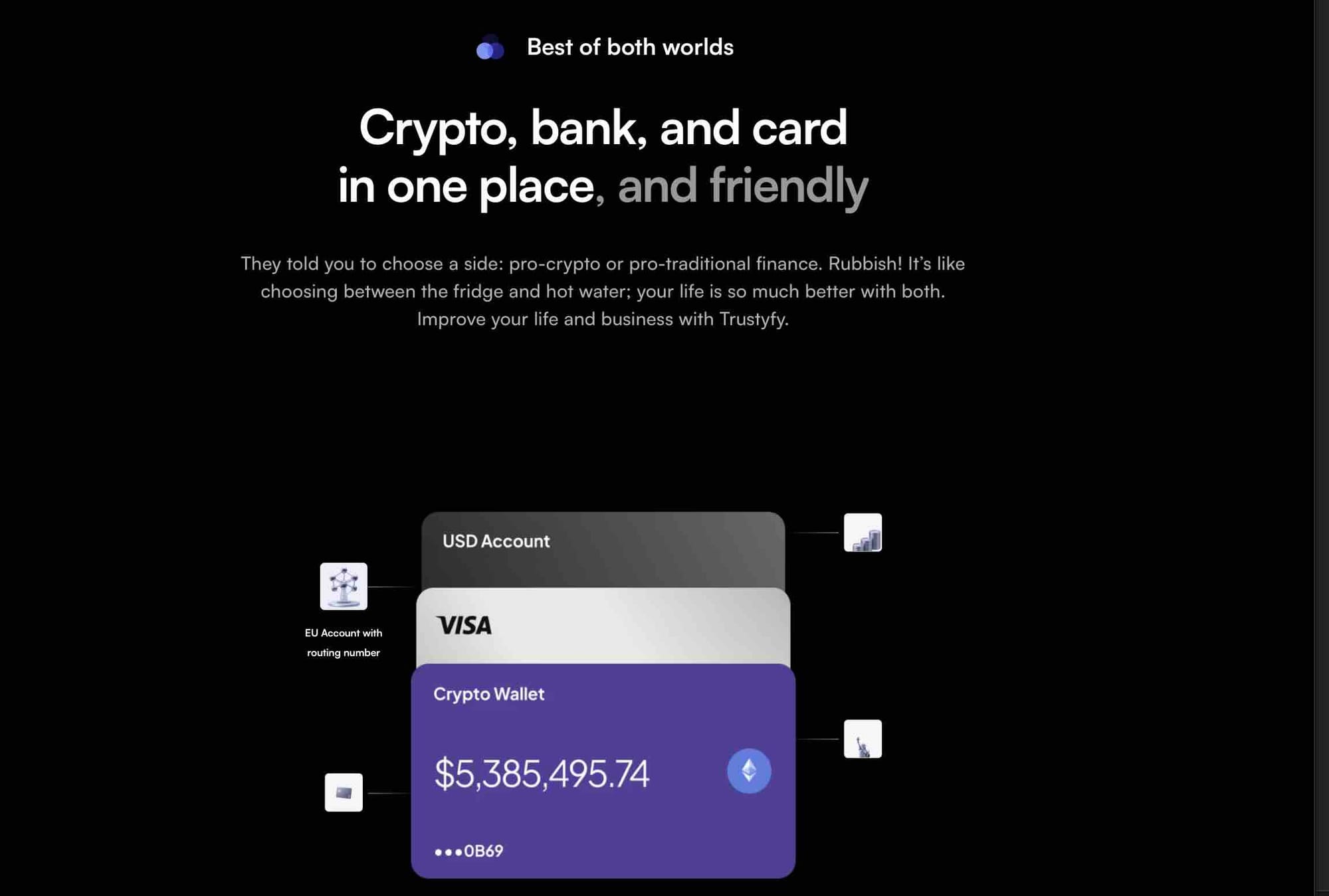

The core promise is simple but powerful. You connect your own self-custody wallets to the Trustyfy platform, and they provide the banking infrastructure on top. Your crypto stays in your wallets, under your control, but you can now access crypto-friendly bank accounts and debit cards that let you convert and spend when you need to. It's like having one foot in the decentralized future and one foot in the legacy system, which honestly is where most of us live anyway.

The Non-Custodial Advantage

What makes Trustyfy particularly interesting for bitcoiners and crypto enthusiasts is the non-custodial nature of the setup. The platform itself doesn't hold your funds, doesn't have access to your private keys, and can't freeze or seize your assets. They're explicit about this in their terms: "We don't have access to your wallets and funds; therefore, we can't suspend, freeze, or cancel them."

That's a refreshing change from the typical crypto card provider that requires you to deposit everything into their custody first.

Card Options and Pricing Plans

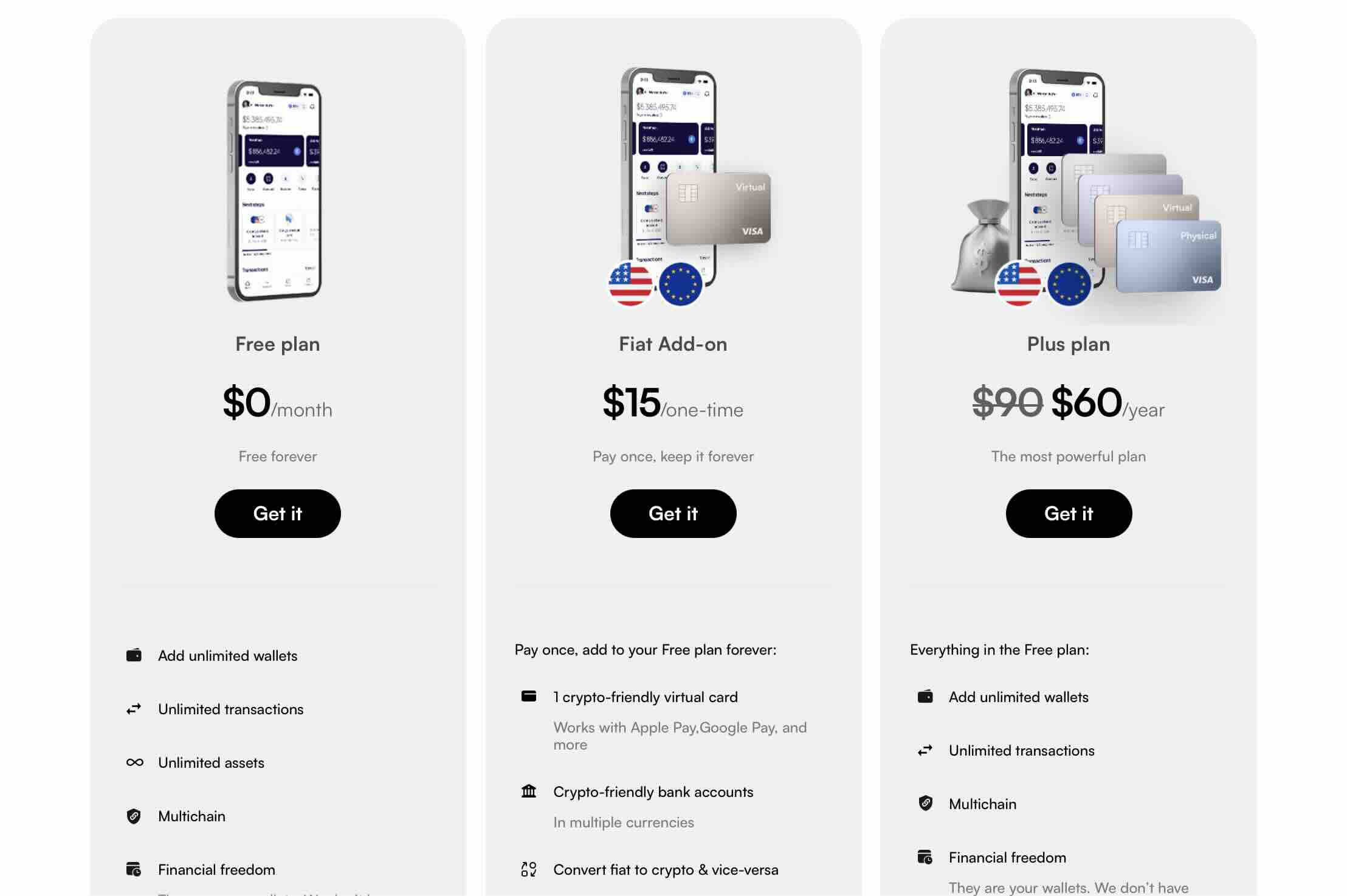

The card itself comes in two flavors depending on which plan you choose. With the basic Fiat add-on, you get one virtual card that works with Apple Pay and Google Pay.

This is a one-time payment ( 15$) that stays active indefinitely, making it a low barrier to entry if you just want to test the waters.

For those who want more functionality, the Plus plan runs $60 per year and gives you three virtual cards plus one physical card.

The physical card is what most people actually want since it lets you spend anywhere Visa is accepted, whether that's online shopping, paying at restaurants, or withdrawing cash from ATMs.

The Reality of KYC Requirements

Now let's talk about the elephant in the room: KYC. Yes, Trustyfy does require identity verification, but here's the nuance.

Trustyfy itself is just a technological platform. The actual card and banking services are provided by third-party regulated financial institutions, and those providers are the ones who require the KYC checks.

According to their terms, this can include providing your email, full name, residential address, valid identification documents proving your age and address, and potentially documentation related to the source of your funds. It's not ideal for privacy maximalists, but it's the reality of getting access to traditional banking rails. You can't have a Visa card that works everywhere without playing by some of the legacy system's rules.

Who Can Actually Use Trustyfy?

The question of who can actually use Trustyfy is a bit murky based on publicly available information. The platform is provided by Trustyfy FZCO and TFY Inc. in the United States, with some operations also handled by Trustyfy Labs SL and Trustyfy OÜ.

Their presence at events in Dubai and Abu Dhabi suggests they're targeting a global audience, particularly in crypto-friendly jurisdictions.

Blockchain Support: Multi-Chain Focus

On the blockchain side, Trustyfy supports multiple chains including Ethereum, Binance Smart Chain, and Polygon, with Bitcoin integration noted as "coming soon" and Solana listed as next in line.

This is where things get a bit complicated for hardcore bitcoiners. If you're Bitcoin-only, you might be waiting for that Bitcoin support to launch before this becomes truly useful. The focus on multiple chains suggests Trustyfy is targeting the broader crypto community rather than Bitcoin purists specifically.

Key Features and Transaction Speed

One of the standout features is what they call "Super Swap," their proprietary technology that lets you move and swap coins between different blockchains with one click. For people who hold assets across multiple chains, this could be genuinely useful. You can maintain your multi-chain portfolio while still having seamless access to fiat conversion and spending when needed.

The pricing is straightforward and relatively affordable compared to some competitors. The basic Fiat add-on is a one-time payment, though the exact amount isn't prominently displayed. The Plus plan is $60 annually, which breaks down to $5 per month for multiple cards and expanded features. There's no mention of cashback rewards or yield on card spending, so this is purely a utility tool rather than a way to earn rewards on your crypto spending.

Speed is another selling point. Trustyfy claims transfers can be executed in under three seconds, which is genuinely fast whether you're talking about crypto or fiat. That's faster than most traditional bank transfers and competitive with other crypto platforms. The platform is built as a web app rather than a native mobile app, which means it works everywhere without the risk of getting frozen by Apple or Google's app store policies. For anyone who's seen crypto apps get arbitrarily banned from app stores, this approach makes sense.

Business and Corporate Features

For businesses, Trustyfy offers corporate plans with multi-signature accounts, which is essential for companies that need to manage crypto collectively without the risk of a single point of failure. You can give your accountant access, delegate to team members, or share with partners without anyone having to trust a single keyholder with everything. This is a huge improvement over how many crypto businesses currently operate.

Who Should Consider Trustyfy?

The target audience for Trustyfy seems to be crypto users who want financial flexibility without giving up self-custody. If you're someone who believes in "not your keys, not your coins" but also needs to pay rent and buy groceries, this kind of solution makes sense. It's not perfect and it's not fully decentralized, but it's a pragmatic bridge between two worlds that don't naturally talk to each other.

The platform won't appeal to everyone. If you're a Bitcoin maximalist who refuses to touch any altchains, you'll need to wait for Bitcoin support. If you're a privacy absolutist who won't do any KYC under any circumstances, this isn't your solution. And if you're looking for rewards and cashback, you'll need to look elsewhere. But for the majority of crypto holders who just want a simple, reliable way to spend their digital assets when needed while maintaining control the rest of the time, Trustyfy represents a solid middle ground.

How Trustyfy Stacks Up Against Competitors

The crypto card space is getting more crowded by the day, with plenty of competitors offering similar services. What sets Trustyfy apart is the emphasis on self-custody and the multi-chain approach. You're not trusting them with your assets, you're just using their infrastructure to connect to the traditional financial system. That's a meaningful difference, even if it doesn't solve every problem.

The Broader Picture: Why Bridges Matter

Looking at the broader picture, services like Trustyfy are important for crypto adoption. Most people aren't going to fully abandon the traditional financial system anytime soon, no matter how much we might want a Bitcoin standard. We need bridges, and those bridges need to work reliably without forcing users to give up the core benefits of crypto like self-custody and censorship resistance. Trustyfy is trying to build that bridge, walking the tightrope between regulatory compliance and user sovereignty.

The fact that they're explicit about not having access to user funds, not investing or loaning customer money, and allowing users to stop using the platform anytime without losing their wallets shows they understand what matters to the crypto community. These aren't just marketing claims, they're fundamental to how the platform is architected.

Trustyfy vs. Competitors: Side-by-Side Comparison

To help you see how Trustyfy measures up against other popular crypto cards, here's a detailed comparison table:

| Feature | Trustyfy | Wirex | Nexo | RedotPay | Bleap |

|---|---|---|---|---|---|

| Card Type | Debit (Virtual/Physical) | Debit (Virtual/Physical) | Dual Credit/Debit | Debit (Virtual/Physical) | Debit (Virtual/Physical) |

| Custody Model | Non-custodial | Custodial | Custodial | Custodial | Non-custodial (MPC) |

| KYC Required | Yes (via 3rd party) | Yes (mandatory) | Yes (mandatory) | Yes (mandatory) | Yes (mandatory) |

| Annual Fee | $60 (Plus plan) | Free - $359.88/year | $0 | $0 | $0 |

| Physical Card Fee | Included in Plus plan | Free | Free (Gold tier+) | $100 one-time | Free |

| Virtual Card | $0 (Fiat add-on) | Instant, free | Instant, free | $10 ($5 with promo) | Instant, free |

| Cashback/Rewards | None | Up to 8% (in WXT token) | Up to 2% (in crypto) | None | 2% (in USDC, $10/month cap) |

| Foreign Exchange Fee | Varies | 0% | 0.2% (EEA/UK), 2% (elsewhere) | 1.2% | 0% |

| ATM Withdrawal Fee | Not specified | Free up to $200/month, then 2% | Free up to €2,000/month, then 2% | 2% | Free up to $400/month |

| Crypto Conversion Fee | Not specified | ~1.5% | ~0.75% | 1% | 0% |

| Supported Cryptos | ETH, BNB, MATIC (BTC coming) | 159+ cryptos | 86+ cryptos | BTC, ETH, USDT, USDC | BTC, ETH, SOL, USDC, USDT, 40+ |

| Supported Regions | Global (some restrictions) | 130+ countries | EEA & UK only | 158+ countries (excl. US, China) | Europe, Latin America (not US) |

| Network | Via 3rd party | Mastercard/Visa | Mastercard | Visa | Mastercard |

| Apple/Google Pay | Yes | Yes | Yes | Not specified | Yes |

| Minimum Balance | No minimum | No minimum | $50 (virtual), $5,000 (physical) | No minimum | No minimum |

| Key Benefit | Self-custody + banking | High rewards potential | Dual credit/debit modes | High transaction limits | Zero fees + real cashback |

| Main Drawback | Bitcoin not yet supported | Rewards in volatile token | EEA/UK only | High card issuance fee | $10/month cashback cap |

What the Comparison Reveals

- Trustyfy stands out for its non-custodial approach, meaning you maintain full control of your crypto. However, it lags in the rewards department with no cashback program, and Bitcoin support is still pending. The $60 annual fee for the Plus plan (which includes the physical card) is competitive but not free like some alternatives.

- Wirex offers the highest potential rewards at up to 8%, but those rewards come in their native WXT token, which introduces volatility risk. The platform is also custodial and charges conversion fees around 1.5%, which can eat into your rewards.

- Nexo is unique with its dual credit/debit functionality, allowing you to borrow against your crypto without selling. This is powerful for tax planning and maintaining crypto exposure while spending. However, it's currently limited to European Economic Area and UK residents only, and requires a $5,000 balance for physical cards.

- RedotPay is designed for high-volume users with massive transaction and ATM withdrawal limits. The $100 physical card fee is steep, and the cumulative fees (1% conversion + 1.2% FX + 2% ATM) make it expensive for everyday spending. It's more suited for OTC-style cash movements than daily use.

- Bleap is the fee-free champion with 0% conversion, 0% FX, and 0% ATM fees (up to $400/month). The 2% USDC cashback is stable and immediately usable, though capped at $10/month. Like Trustyfy, it's non-custodial, giving users full control through MPC wallet technology.

Final Verdict

The bottom line is this: Trustyfy gives you a way to spend your crypto in the real world without giving up custody. You'll need to do KYC, you'll need to pay annual fees for the full feature set, and you won't earn rewards on spending.

But in exchange, you get crypto-friendly banking infrastructure that works globally, connects to your self-custody wallets, and processes transactions in seconds. For many crypto users, that's a fair trade.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. The crypto card landscape changes rapidly, features, fees, and availability mentioned here may have changed since publication. Bitcoin-builder.com is not responsible for any losses or issues arising from the use of any crypto card service mentioned in this review.