A Comprehensive Review

In the rapidly evolving world of cryptocurrency, finding a platform that balances simplicity, security, and functionality can be challenging. Strike has emerged as a standout solution for both Bitcoin newcomers and seasoned users seeking a reliable payment and savings app. But what exactly is Strike, and does it live up to the hype?

This comprehensive review explores everything you need to know about this Bitcoin-powered financial platform.

What is Strike?

Strike is a Bitcoin-based financial services platform that enables instant, low-cost global payments using the Lightning Network. Founded by entrepreneur Jack Mallers, Strike bridges the gap between traditional finance and cryptocurrency, allowing users to send money, buy Bitcoin, receive paychecks, and even take out Bitcoin-backed loans, all within a single intuitive application.

Founding and History

Jack Mallers, born in Chicago in 1994, comes from a financial dynasty. His grandfather served as chairman of the Chicago Board of Trade, and his father founded one of Chicago's largest futures brokerages. Despite this traditional finance background, Mallers saw Bitcoin's transformative potential early on.

In 2017, Mallers founded Zap, a company focused on Lightning Network technology. This venture laid the groundwork for what would become Strike, which officially launched in 2020. The platform was designed with a clear mission: make Bitcoin accessible to everyone by removing the complexity that often intimidates new users.

Strike gained international prominence in 2021 when Mallers played a pivotal role in El Salvador's historic decision to adopt Bitcoin as legal tender. Working directly with President Nayib Bukele, Mallers helped establish the infrastructure for the country's Bitcoin implementation, including Strike's involvement in facilitating remittances to Salvadorans. Since then, Strike has expanded to over 95 countries worldwide, serving millions of users.

Key Features and Capabilities

Strike offers a comprehensive suite of features that extend far beyond basic Bitcoin transactions:

✅ Lightning Network Payments

At the heart of Strike's technology is the Bitcoin Lightning Network, a second-layer protocol that enables near-instant transactions with minimal fees. Users can send money globally in seconds, often for fractions of a penny, making it ideal for both large transfers and micropayments.

✅ Bitcoin Buying and Selling

Strike allows users to purchase Bitcoin directly from linked bank accounts or debit cards. The platform offers competitive pricing with tiered trading fees starting at 0.99% for monthly volumes under $250, decreasing as volume increases. Users can also set up recurring purchases for dollar-cost averaging strategies, and withdraw Bitcoin to personal wallets at any time for free.

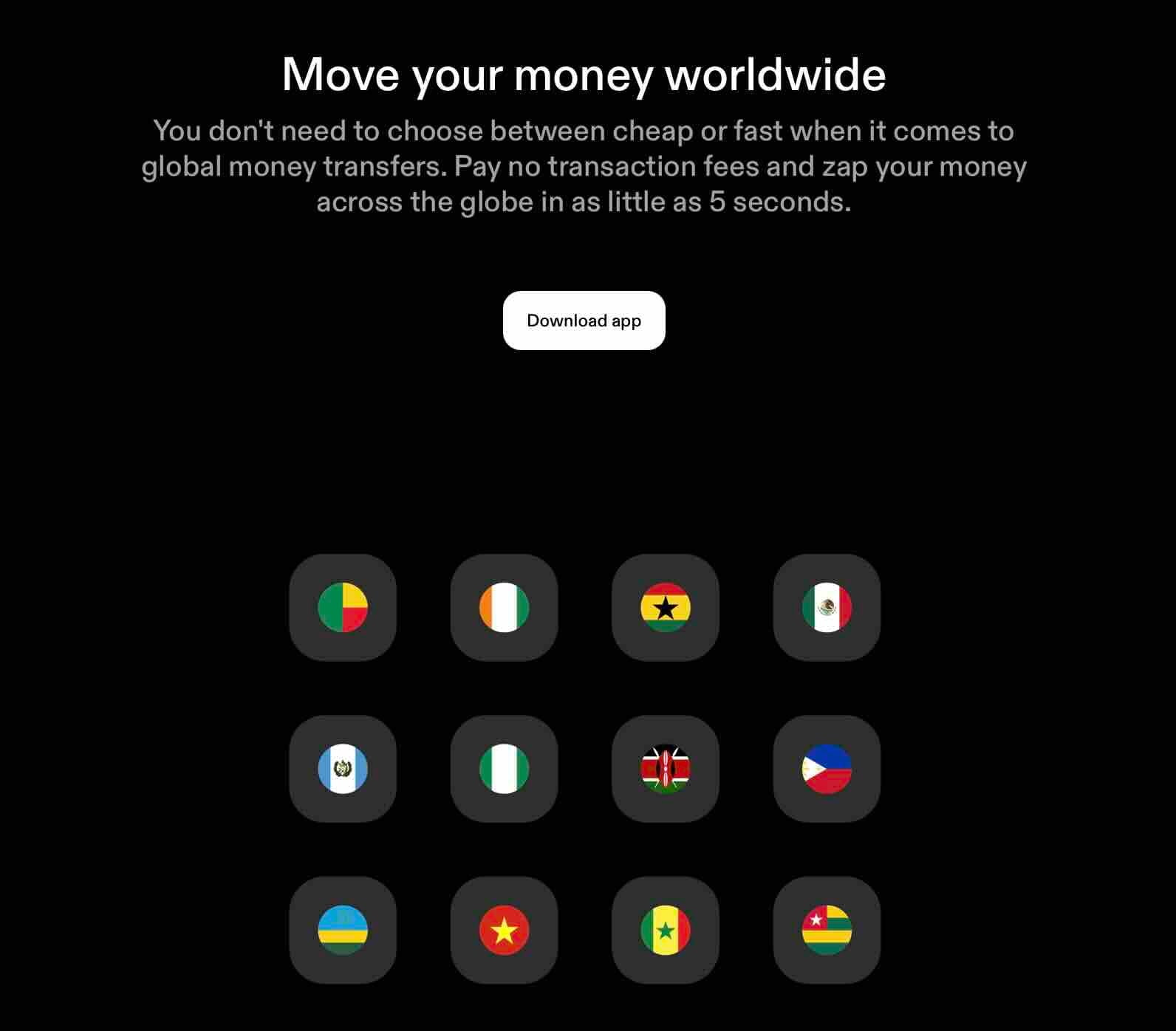

✅ Cross-Border Payments

One of Strike's most compelling features is its 'Send Globally' service, which enables instant international money transfers. Recipients don't need to use Bitcoin or even have a Strike account. The platform handles currency conversion seamlessly, allowing users in different countries to transact in their preferred fiat currencies while Bitcoin operates invisibly in the background.

Sending Money Globally with Strike

Strike's "Send Globally" feature represents one of the platform's most revolutionary capabilities, transforming international money transfers into a simple, instant process. Unlike traditional remittance services like Western Union or bank wire transfers that can take days and charge fees ranging from 5% to 10%, Strike leverages the Lightning Network to enable near-instantaneous cross-border payments at a fraction of the cost.

The beauty of Strike's global payment system lies in its simplicity and flexibility. Users can send money from the United States to numerous countries including Mexico, Guatemala, the Philippines, Vietnam, and various African nations, with Strike continuously expanding to new corridors. What makes this particularly powerful is that recipients don't need to have a Strike account, own Bitcoin, or understand cryptocurrency at all. The sender initiates a payment in their local currency, Bitcoin moves across the Lightning Network in seconds, and the recipient receives the funds directly in their bank account in their local currency.

✅ Direct Deposit and Paycheck Conversion

Strike's 'Pay Me in Bitcoin' feature allows users to receive their paychecks directly into the app, with the option to automatically convert a specified percentage into Bitcoin. This innovative feature makes Bitcoin savings effortless for anyone receiving regular income.

✅ Bitcoin-Backed Loans

In 2025, Strike expanded into lending with Strike Lending, offering Bitcoin-backed loans starting at $75,000 with a minimum 12% APR. Users can borrow against their Bitcoin holdings without selling, allowing them to access liquidity while maintaining exposure to Bitcoin's potential appreciation.

Advantages of Using Strike

Strike offers several compelling benefits that set it apart from traditional financial services and other cryptocurrency platforms:

- Ultra-low fees: Most payments are free or carry minimal network fees. Trading fees are competitive and decrease with volume. On-chain Bitcoin withdrawals only incur standard network fees.

- Lightning-fast transactions: Payments settle in seconds rather than hours or days, making Strike ideal for real-time transactions and urgent transfers.

- User-friendly interface: Strike's design prioritizes simplicity. The onboarding process requires minimal information, and the intuitive dashboard makes Bitcoin accessible to non-technical users.

- Global reach: With availability in over 95 countries, Strike facilitates truly borderless payments, particularly valuable for international workers and families sending remittances.

- Minimal KYC requirements: Getting started requires only a name and phone number for most users, making onboarding fast and accessible.

- No Bitcoin ownership required: Users can send and receive payments without holding Bitcoin, as Strike handles conversions automatically in the background.

- Regulatory compliance: Strike operates as a registered Money Services Business in the United States, overseen by FinCEN, ensuring adherence to anti-money laundering and consumer protection standards.

Disadvantages and Limitations

Despite its strengths, Strike has several drawbacks that potential users should consider:

- Custodial wallet model: Strike holds users' Bitcoin in a custodial wallet, meaning the company controls the private keys. While convenient for payments, this arrangement requires trusting Strike's security and operational practices. Users concerned about true self-custody should withdraw funds to personal hardware wallets.

- Limited customer support: Strike lacks live chat or phone support for most users. Support is primarily handled through in-app messages and email, which can be frustratingly slow for urgent issues like account lockouts, stuck withdrawals, or security incidents requiring immediate action.

- Account restrictions: Some users report sudden account suspensions or holds on deposits, sometimes requiring extensive documentation to resolve. These security measures, while intended to prevent fraud, can cause significant inconvenience.

- Bitcoin-only focus: Strike exclusively supports Bitcoin. Users interested in other cryptocurrencies will need to use additional platforms.

- Geographic limitations: Strike is not available in New York state, and features vary significantly by country. Some regions have limited payment methods or restricted access to certain services.

- Lightning Network vulnerabilities: While not unique to Strike, Lightning nodes face potential issues like spam attacks with micropayments and eclipse attacks, which can cause congestion without stealing funds.

- Mixed user reviews: Trustpilot ratings are divided, with an overall score of 2.8 stars from 122 reviews at the time of writing. Common complaints include delayed transactions, unclear communication during security holds, and difficulty resolving account issues.

Security Features

Strike implements several security measures to protect user funds and data:

- Two-factor authentication (2FA): Users can enable 2FA for an additional layer of account protection. This should be activated immediately upon account creation.

- Cold storage: The majority of customer Bitcoin is held in cold storage with multi-signature vaults and geographically distributed, encrypted keys, protecting funds from online threats.

- Direct custody: Strike owns and operates its infrastructure, eliminating third-party custodial intermediaries and reducing counterparty risk.

- Regular security audits: The platform undergoes third-party security assessments, including SOC 2 certification and regular penetration testing.

- Encryption and monitoring: Strike employs encryption for all transactions and maintains continuous monitoring with vulnerability activity logs to address potential risks proactively.

- KYC/AML compliance: As a registered MSB, Strike implements know-your-customer and anti-money laundering procedures, helping prevent fraud while ensuring regulatory compliance.

Pricing and Fees

Strike maintains a transparent and competitive fee structure that makes it accessible for users at all levels.

| Service | Fee |

|---|---|

| Bitcoin Trading | 0.99% for volumes under $250/month (decreases with volume) |

| Lightning Network Payments | Free or fractions of a penny |

| Receiving Payments | Free |

| Bank Transfer (ACH) Deposits | Free |

| Debit/Credit Card Deposits | 2% - 4% |

| On-Chain Bitcoin Withdrawals | Standard Bitcoin network fee only (user adjustable) |

| Send Globally (International Transfers) | Free or minimal fees |

| Bitcoin-Backed Loans | Minimum 12% APR, 0% origination fee, 0% early repayment fee |

| Recurring Bitcoin Purchases (DCA) | Free (standard trading fees apply to purchases) |

The Verdict

Who Should Use Strike?

Strike is an excellent choice for:

- International workers and families sending remittances who want to avoid high traditional money transfer fees

- Bitcoin beginners seeking an accessible entry point without technical complexity

- Regular Bitcoin accumulators who want to automate purchases and convert portions of their paycheck

- Users prioritizing speed and low fees for frequent transactions

- Those living in countries with limited banking infrastructure where Strike operates

Who Should Consider Alternatives?

Strike may not be ideal for:

- Privacy-focused users who prefer non-custodial solutions and minimal KYC

- Multi-cryptocurrency traders seeking exposure to altcoins beyond Bitcoin

- Those requiring immediate customer support for time-sensitive issues

- Users storing large amounts long-term who should prioritize hardware wallet self-custod

Final Thoughts

Strike represents a significant step forward in making Bitcoin accessible and practical for everyday financial needs. Its combination of Lightning Network technology, intuitive design, and comprehensive features creates a compelling package for users looking to incorporate Bitcoin into their financial lives without dealing with technical complexity.

The platform's strengths—ultra-low fees, instant transactions, and global reach—are genuinely transformative, particularly for cross-border payments and remittances. Jack Mallers' vision of democratizing Bitcoin access is clearly realized in Strike's user experience.

However, the platform's limitations cannot be ignored. The custodial model, limited customer support, and occasional account issues present real concerns, especially for users dealing with significant amounts. The mixed user reviews suggest that while many have excellent experiences, some encounter frustrating problems that can be difficult to resolve.

Ultimately, Strike works best as part of a broader Bitcoin strategy. Use it for its strengths—quick payments, regular purchases, and international transfers—but maintain self-custody solutions for long-term storage. Enable all security features, start with small amounts to test the platform, and always have backup plans for accessing your funds.

For those seeking a Bitcoin-focused payment solution with minimal friction, Strike delivers on its promise. Just approach it with realistic expectations and appropriate security practices.

📌 Excellent for payments and cross-border transfers, but consider self-custody for long-term holdings.

Disclaimer : This article is provided for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. Bitcoin-builder.com is not affiliated with, sponsored by, or receiving compensation from Bisq or any related entities. The information presented reflects research and analysis conducted independently. Cryptocurrency trading carries significant risk, including the potential loss of capital.

Readers should conduct their own research and consult with qualified professionals before making any financial decisions. The views expressed are those of the author and do not necessarily represent the official position of Bitcoin-builder.com.