What is Swan Bitcoin?

Swan Bitcoin is what happens when bitcoiners get tired of shitcoin casinos pretending to be exchanges. Founded by Cory Klippsten and Yan Pritzker in 2019, Swan does one thing obsessively well: helping you buy bitcoin and get it into self-custody. No trading. No leverage. No "earn 8% on your crypto" scams. Just automated DCA, fair pricing, and actual education about why bitcoin matters.

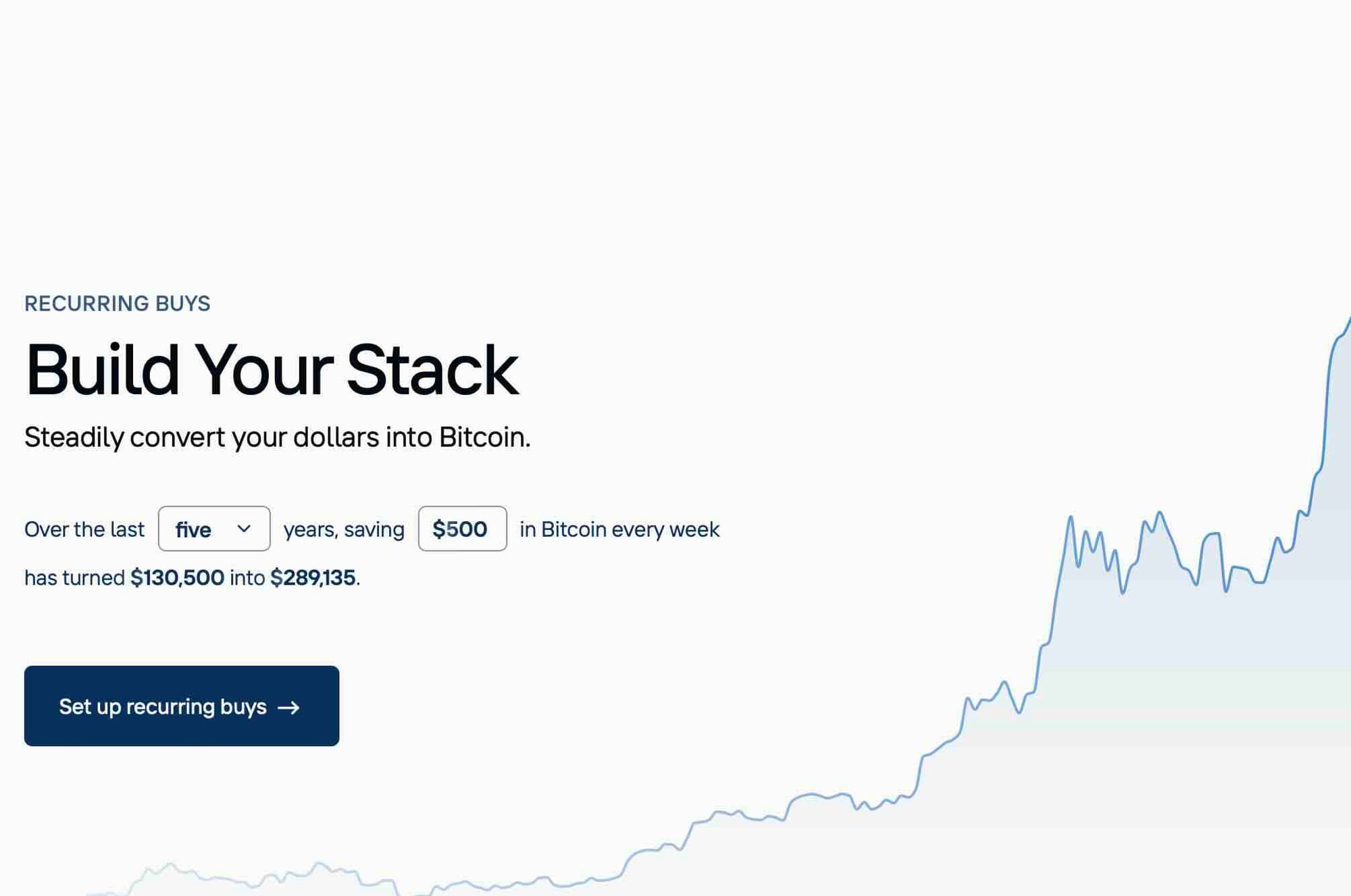

Think of Swan as the Vanguard of bitcoin buying, boring, reliable, and focused on long-term accumulation instead of making you a day trader. They've processed over $1 billion in bitcoin purchases and have become the go-to recommendation for anyone asking "where should I DCA?"

At a Glance

🏷️ Type: Bitcoin-Only Exchange/Savings Platform

* 📅 Launched: 2019

* 🌍 Team: USA-based (Austin, TX)

* 💰 Pricing: 0.99% fee (goes to 0.49% above $100k volume)

* 🔗 Site: swan.com

Beyond DCA: Swan's Wealth Platform

Swan has quietly evolved from a simple DCA app into a full bitcoin wealth management platform. If you're past the "stack sats" phase and thinking about serious wealth preservation, Swan now offers services that used to require hiring a bitcoin-focused financial advisor.

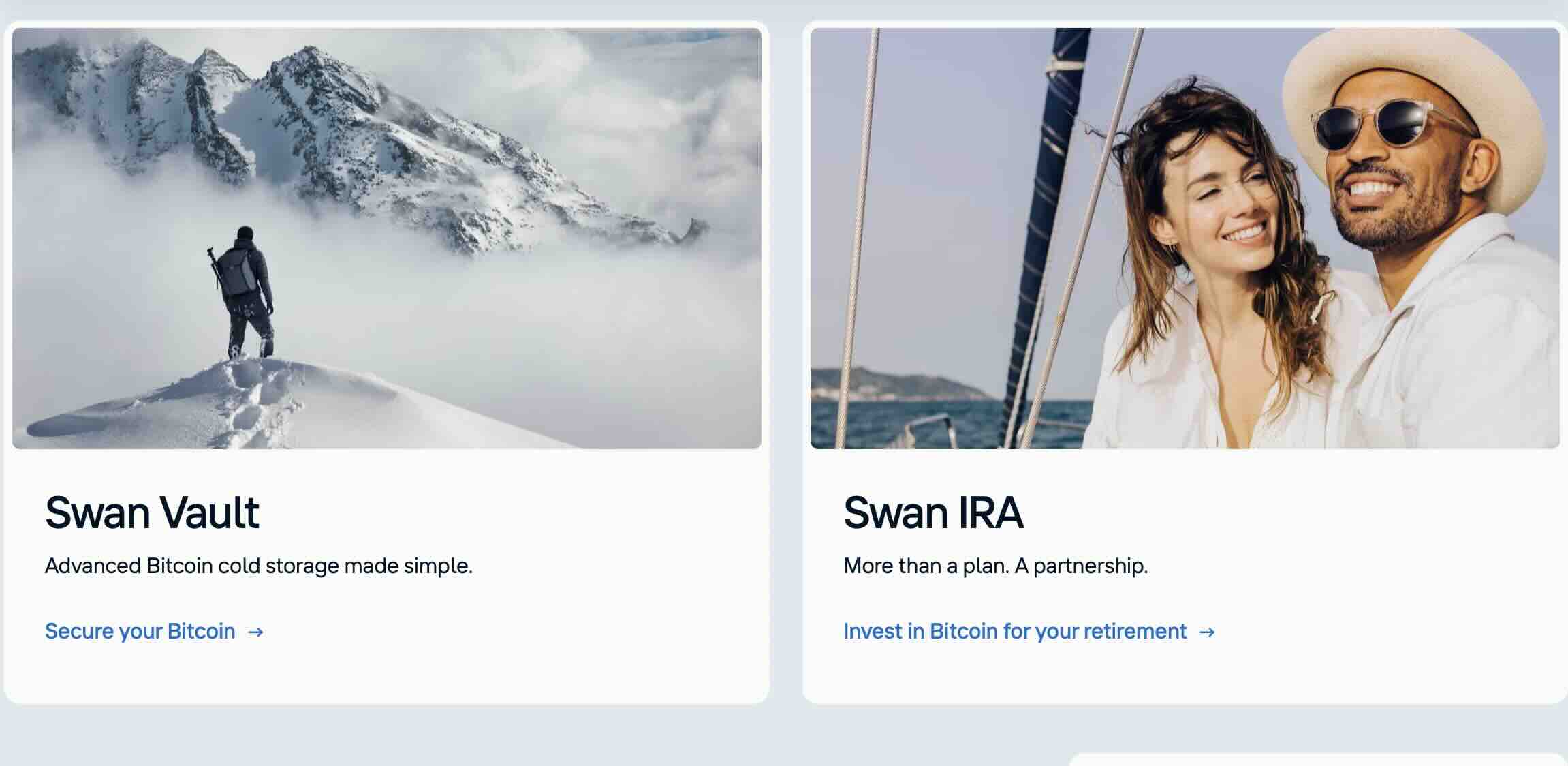

- Swan IRA lets you hold bitcoin in tax-advantaged retirement accounts (Traditional or Roth). This is huge if you're thinking 20+ year timeframes—imagine buying bitcoin at $30k in your Roth and never paying capital gains. They handle all the custodial headaches and IRS compliance.

- Swan Vault is their institutional-grade cold storage solution. Multi-sig setup, geographic distribution, the whole nine yards. If you're holding 5+ BTC and don't want to manage your own hardware wallets, this is cleaner than most self-custody setups I've seen.

For high-net-worth individuals, Swan Private offers concierge service with dedicated bitcoin advisors, institutional-level liquidity (execute large orders without slippage), tax-loss harvesting strategies, and even inheritance/estate planning. Think of it as a bitcoin family office for people with serious stacks.

The fact that Swan offers Bitcoin Treasury services for corporations shows how far they've come. They're not just for retail stackers anymore, they're helping companies add BTC to their balance sheets with proper accounting and custody guidance.

Why we love Swan ✅

- Bitcoin-only philosophy No distractions, no shitcoins, no tokens. Swan won't try to sell you on the next Ethereum killer or earn yield products. They're laser-focused on bitcoin, which means the team actually understands what they're selling. Refreshing in 2024.

- Auto-DCA that actually works Set it once, forget it. Daily, weekly, biweekly—whatever. Your fiat hits Swan, it buys bitcoin, done. I've had mine running for 2+ years without a single issue. Compare that to Coinbase's recurring buys which randomly fail every few months.

- Withdrawal culture Swan actively encourages you to withdraw to self-custody. They have wallet integration with Specter, Sparrow, and Trezor. They literally send you educational emails about "why you should get your bitcoin off Swan." Name another exchange doing that.

- Best-in-class education Their Bitcoin & Beyond podcast is legitimately good. Free guides, webinars with bitcoiners like Saifedean Ammous and Lyn Alden. They're not just selling you sats, they're teaching you why bitcoin matters. The onboarding experience explains UTXO management and private keys, not yield farming.

- Transparent pricing 0.99% flat fee up to $100k lifetime volume, then drops to 0.49%. No hidden spread. No "market price" BS where they pocket 2-3%. What you see is what you pay.

The pain points ⚠️

USA only If you're not American, Swan isn't an option. They've been "expanding internationally" since 2021 but still haven't launched outside the US. Europeans, you're out of luck.

Fees aren't the cheapest River and Strike offer lower fees (0.5% and ~0.3% respectively). If you're moving serious volume (>$50k/month), those savings add up. Swan's 0.99% is competitive but not market-leading.

No instant buys for beginners ACH transfers take 3-5 days. If you're new and want bitcoin NOW, you'll be frustrated. Swan is built for disciplined accumulators, not FOMO buyers. Wire transfers are instant but cost $30+ at your bank.

Limited advanced features No Lightning integration yet (they're working on it). No options for spending or borrowing against your stack. It's a pure buy-and-custody play. If you want a full bitcoin bank, look at River.

Who is Swan for? 🎯

For DCA stackers: If you want to automate $100-$1000/week and not think about it, Swan is probably the best option in the US. Set up auto-withdrawal to your hardware wallet and you're golden.

For bitcoin-only purists: You don't want exchanges pushing shitcoins. Swan's philosophy aligns with yours. The team is deeply embedded in bitcoin culture (Klippsten is everywhere on Twitter).

Not for traders: If you want to time the market or trade alts, this isn't your platform. Swan doesn't even have a "sell" button. They assume you're here to accumulate and hold.

Not for non-Americans: Obvious but worth stating. If you're in Europe/Asia/LatAm, check out Relai, Pocket, or River instead (when they expand).

Pricing & Business Model 💰

Fee structure:

- 0.99% on all purchases up to $100k lifetime volume

- 0.49% after you cross $100k

- Free ACH deposits (3-5 days)

- Free bitcoin withdrawals (they cover the network fee)

- Wire deposits possible ($30 bank fee on your end)

Swan makes money purely on those transparent fees. No lending your bitcoin, no hidden spreads, no "we got liquidated by 3AC" drama. It's a straightforward business model.

Our verdict 🏆

Swan is the answer to "where should I DCA bitcoin?" for 90% of American bitcoiners. The education, the bitcoin-only focus, the reliable auto-DCA—it's the complete package for long-term accumulators. River is the only real competitor (slightly better fees, Lightning integration), but Swan's educational content and community edge it out for beginners.

If you're stacking <$10k/month and want a "set and forget" solution, Swan is your best bet. If you're moving $50k+/month, River's lower fees make more sense.

Alternatives to consider 🔄

- River Financial: Lower fees (0.5%), Lightning integration, better for power users. Smaller education library.

- Strike: Lowest fees (~0.3%), Lightning-native, but less focused on education and custody best practices.

- Cash App: Easiest for absolute beginners, but higher fees (1.5%+) and owned by Block. Less sovereignty-focused.

- Relai (EU): The Swan of Europe. If you're not in the US, this is your closest alternative.

Rating: 4,6/5

The missing points: international availability and slightly higher fees. Everything else is 🔥.

Last updated: December 2025

Disclaimer : This article is provided for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. Bitcoin-builder.com is not affiliated with, sponsored by, or receiving compensation from Bisq or any related entities. The information presented reflects research and analysis conducted independently. Cryptocurrency trading carries significant risk, including the potential loss of capital.