What is Stacks?

Stacks is a Bitcoin Layer 2 blockchain that brings smart contracts and decentralized applications to Bitcoin without altering Bitcoin's core protocol. Think of it as giving Bitcoin the programmability of Ethereum while maintaining all of Bitcoin's legendary security and decentralization.

Unlike traditional Layer 2 solutions that focus solely on scaling transaction throughput, Stacks extends Bitcoin's capabilities by enabling smart contracts and dApps while leveraging Bitcoin as a secure base layer through its Proof-of-Transfer consensus mechanism.

This integration positions Stacks as the first Bitcoin Layer 2 with a regulated, verifiable stablecoin, unlocking new possibilities for lending, borrowing, and trading within Bitcoin-native applications.

Who Built Stacks?

Stacks was co-founded by Muneeb Ali and Ryan Shea, who went through Y Combinator in 2014. Dr. Muneeb Ali, a Pakistani-American computer scientist, received his PhD from Princeton University in 2017, with his doctoral dissertation forming the theoretical foundation for the Stacks network.

Ecosystem Organization

Stacks operates as a decentralized ecosystem with multiple independent entities:

- Hiro Systems: Builds developer tools for the Stacks ecosystem (formerly led by Ali as CEO, now Chairman)

- Trust Machines: Founded by Ali in 2021 to accelerate Bitcoin adoption through Stacks (Ali serves as CEO)

- Stacks Foundation: Supports ecosystem governance, research, and education

- Independent developers: Hundreds of projects building on Stacks

The project has raised over $200 million from top-tier investors including Union Square Ventures, Y Combinator, Lux Capital, and Winklevoss Capital.

What Can You Do on Stacks? Concrete Use Cases

1. DeFi (Decentralized Finance)

Stacks has become a thriving DeFi ecosystem with total value locked (TVL) reaching an all-time high of $189.19 million in April 2024, up 241.5% from January 2024.

Top DeFi Applications:

ALEX (Automated Liquidity Exchange)

- Full-service "Super App for Bitcoin" offering trading, lending, borrowing, and yield farming

- Bridge between Bitcoin L1 and L2 technologies

- One of the largest DEXs on Stacks with over 97% of exchange TVL

Bitflow

- Leverages atomic swaps and decentralized liquidity pools

- Offers seamless trading with sBTC integration

- Major liquidity provider in the Stacks ecosystem

Velar

- Multi-feature DeFi app with Bitcoin finality

- 15+ token pairs for liquidity provision and yield farming

- Rewards users for adding liquidity

- Collateralized debt position platform

- Borrow USDA stablecoin against STX collateral

- Features "self-repaying loans" using stacking rewards

- Includes governance token (DIKO) for DAO participation

- Bitcoin-focused lending protocol

- Multi-asset lending pools for institutional lenders

- Integrating USDCx for stable dollar asset support

Granite

- Non-custodial Bitcoin-backed loans

- Borrow USDCx against Bitcoin without giving up custody

- Community-powered liquidation protection

Hermetica

- Automated DeFi vaults for Bitcoin

- Earn, trade, and accumulate more Bitcoin

- Never give up custody while earning yield

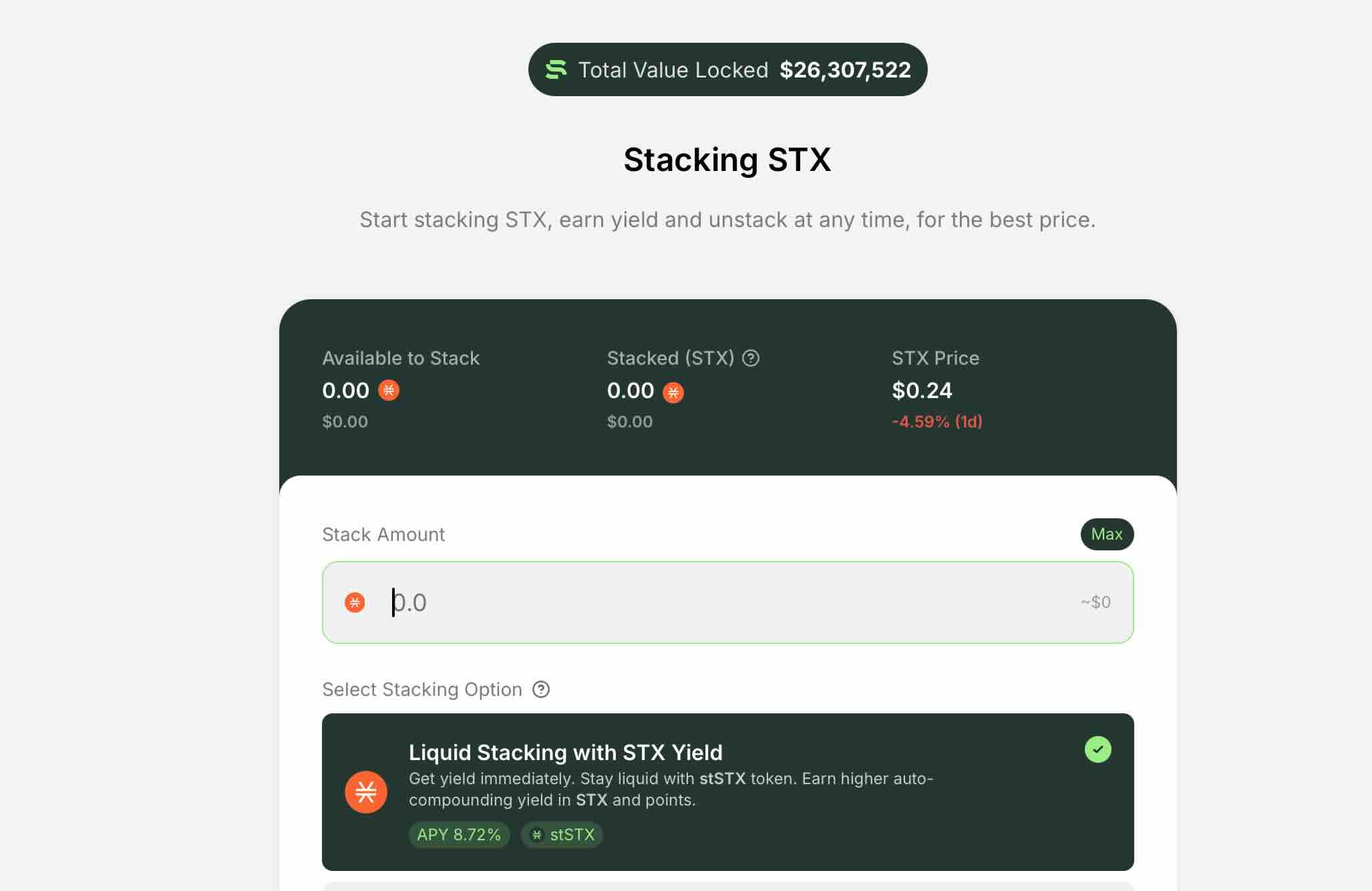

- Liquid stacking protocol with multiple products:

- stSTX: Auto-compounding liquid stacking token (7%+ APY in BTC)

- stSTXbtc: Earn sBTC rewards daily while maintaining liquidity

- Native Stacking: Direct delegation with zero fees

- Solves the liquidity problem for Stackers who must lock STX

- Can be used across DeFi to earn additional yield

What You Can Do:

- Trade BTC-backed assets and SIP10 tokens on DEXs

- Provide liquidity and earn trading fees + rewards

- Lend assets to earn yield or borrow against your holdings

- Use stablecoins (USDA, USDCx) to hedge volatility

- Participate in liquid stacking to earn BTC while maintaining flexibility

- Access synthetic dollar products for Bitcoin-native finance

APY Highlights:

- Stacking rewards: 7-10% APY in BTC (increased from 2% pre-Nakamoto)

- Various yield farming opportunities across protocols

- Lending and borrowing rates competitive with major DeFi platforms

2. NFTs (Non-Fungible Tokens)

Stacks NFTs are secured by Bitcoin's proven durability, with ownership and provenance encoded on the world's most robust blockchain.

Gamma Marketplace

- Prominent NFT marketplace with over 600,000 NFTs sold and 3,000+ creators who have earned over $5 million

- Largest NFT/Ordinals marketplace on Stacks

- Full-featured platform for creating, buying, and selling NFTs

NFT Creation Tools

- SIP-009 NFT standard ensures wallet compatibility

- Create portal allows custom smart contract deployment

- Full documentation and tutorials available

- Bitcoin Creator Program offers mentorship for NFT launches

What You Can Do:

- Create and mint NFTs secured by Bitcoin

- Trade Bitcoin-native digital collectibles

- Build NFT-based applications and games

- Leverage programmable NFTs with smart contract functionality

- Benefit from Bitcoin's proven long-term durability for provenance

3. Web3 Applications and Identity

Bitcoin Name Service (.btc domains)

- Decentralized identity system on Bitcoin

- Use .btc names across Stacks applications

- Portable identity across the ecosystem

Decentralized Applications

- Build censorship-resistant software on Bitcoin

- Access games, social apps, and productivity tools

- All secured by Bitcoin's base layer

4. Earning Bitcoin Yield (Stacking)

One of Stacks' most unique features is the ability to earn native Bitcoin by "Stacking" STX tokens:

How It Works:

- Lock STX tokens for 2-week cycles

- Help secure the Stacks network as part of the consensus mechanism

- Earn BTC rewards distributed by Stacks miners

- Current APY: 7-10% in Bitcoin (up from 2% pre-Nakamoto)

Options:

- Direct Stacking: Lock 100,000+ STX directly

- Stacking Pools: Participate with smaller amounts

- Liquid Stacking (via Stacking DAO): Maintain liquidity while earning rewards

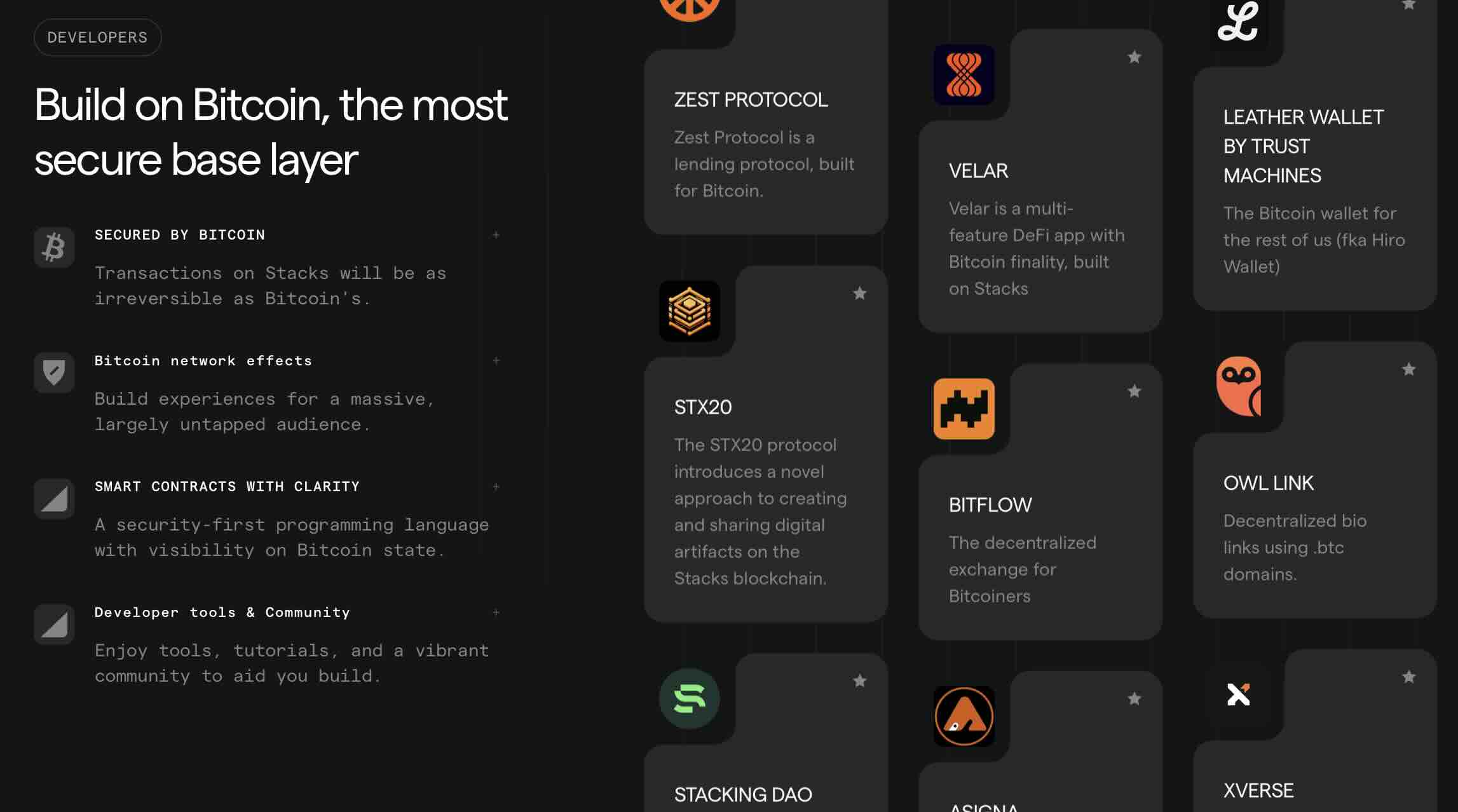

5. Developer Opportunities

Clarity Smart Contract Language

Clarity is a decidable smart contract language designed for predictability and security, created with lessons learned from common Solidity exploits.

Key Features:

- Decidable: Code behavior is fully analyzable before execution

- Human-readable: Understand what contracts do before deployment

- Secure by design: Prevents common smart contract vulnerabilities

- Bitcoin-aware: Can read and interact with Bitcoin state

Developer Tools

- Comprehensive documentation and tutorials

- Clarinet local development environment

- Integration with major development frameworks

- Growing library of example contracts and templates

What You Can Build:

- DeFi protocols (DEXs, lending platforms, yield aggregators)

- NFT platforms and marketplaces

- Bitcoin-backed stablecoin systems

- Cross-chain applications leveraging USDCx

- Gaming and social applications

- Bitcoin credit markets and institutional lending

Who is Stacks For?

If you believe Bitcoin is the ultimate form of sound money but want to do more with it, Stacks is your answer. Build on Bitcoin without compromising its security or requiring changes to the base layer.

DeFi Users and Yield Seekers

- Earn native BTC yields through Stacking (7-10% APY) - You can try it with Leather.io here https://app.leather.io/stacking

- Access Bitcoin-native DeFi without bridging to other chains

- Use institutional-grade stablecoins (USDCx) on Bitcoin

- Participate in lending, borrowing, and liquidity provision

Developers

- Build on the world's most secure blockchain

- Access $1+ trillion in Bitcoin capital

- Use Clarity's secure, decidable smart contract language

- Create applications that inherit Bitcoin's network effects

NFT Creators and Collectors

- Mint NFTs secured by Bitcoin's proven durability

- Benefit from Bitcoin's long-term permanence for digital collectibles

- Access programmable NFT functionality unavailable on Bitcoin L1

Institutional Players

- First Bitcoin L2 with SEC-qualified token offering history

- Regulated stablecoin (USDCx) integration

- Verifiable Bitcoin finality for enterprise applications

- Professional-grade infrastructure and security

Bitcoin HODLers

- Put dormant Bitcoin to work productively

- Maintain Bitcoin exposure while accessing DeFi

- Earn Bitcoin yields without selling or leaving the ecosystem

- Access stablecoins without converting to fiat

Verdict: Stacks is Bitcoin's DeFi Future

The Good

✅ Unmatched Security: 100% Bitcoin finality means Stacks transactions inherit Bitcoin's legendary security

✅ Real Bitcoin Yield: Earn 7-10% APY in native BTC through Stacking—not wrapped tokens or IOUs

✅ Tier 1 Stablecoin: USDCx brings institutional-grade, regulated liquidity to Bitcoin for the first time

✅ No Compromises: Build on Bitcoin without changing Bitcoin—preserving decentralization and security

✅ Proven Track Record: SEC-qualified token offering, 7+ years of development, battle-tested infrastructure

✅ Fast Blocks: Post-Nakamoto 5-second confirmations enable real-time DeFi applications

✅ Clarity Language: Decidable, secure-by-design smart contracts that prevent common vulnerabilities

✅ Growing Ecosystem: 50+ active projects, $150M+ TVL, thriving NFT marketplace, comprehensive DeFi suite

✅ Institutional Readiness: Regulatory clarity, professional infrastructure, backed by top-tier investors

The Challenges

⚠️ Smaller TVL vs. Ethereum L2s: $150M TVL compared to $90B+ on Ethereum L2s—but this represents enormous upside potential

⚠️ Learning Curve: Clarity is different from Solidity; developers need to learn a new paradigm

⚠️ Network Maturity: While 7+ years old, Stacks is still earlier-stage than Ethereum's DeFi ecosystem

⚠️ sBTC Still Rolling Out: The full 1:1 Bitcoin-backed asset is launching in phases through Q1 2025

The Opportunity

Stacks sits at the intersection of Bitcoin's $1+ trillion market cap and the programmability revolution. Comparing Bitcoin's total capital of over $1 trillion to the roughly $5 billion market cap of Bitcoin L2s (with Stacks comprising approximately 90%), the growth potential is extraordinary.

Conclusion

With the Nakamoto upgrade complete and USDCx now live, Stacks has entered a new phase of maturity. It's no longer just about potential—it's about production-ready infrastructure bringing smart contracts, DeFi, and programmability to Bitcoin without compromise.

Bitcoin just got its Tier 1 stablecoin. Bitcoin just got 100% finality. Bitcoin just got fast blocks.

For the first time in Bitcoin's 15-year history, you can build fully programmable, institutional-grade financial applications on the world's most secure blockchain. That's not hype—that's infrastructure.

The question isn't whether to build on Bitcoin. The question is: are you early enough to make your mark?

Welcome to Bitcoin DeFi. Welcome to Stacks.