Bitcoin mining has evolved dramatically since the early days when anyone could mine from a laptop. In 2025, the industry demands specialized hardware, cheap electricity, and professional infrastructure—barriers that keep many individuals from participating directly in securing the Bitcoin network. Sazmining addresses this challenge by offering Bitcoin Mining as a Service, allowing individuals to own mining rigs while the company handles all operational complexities.

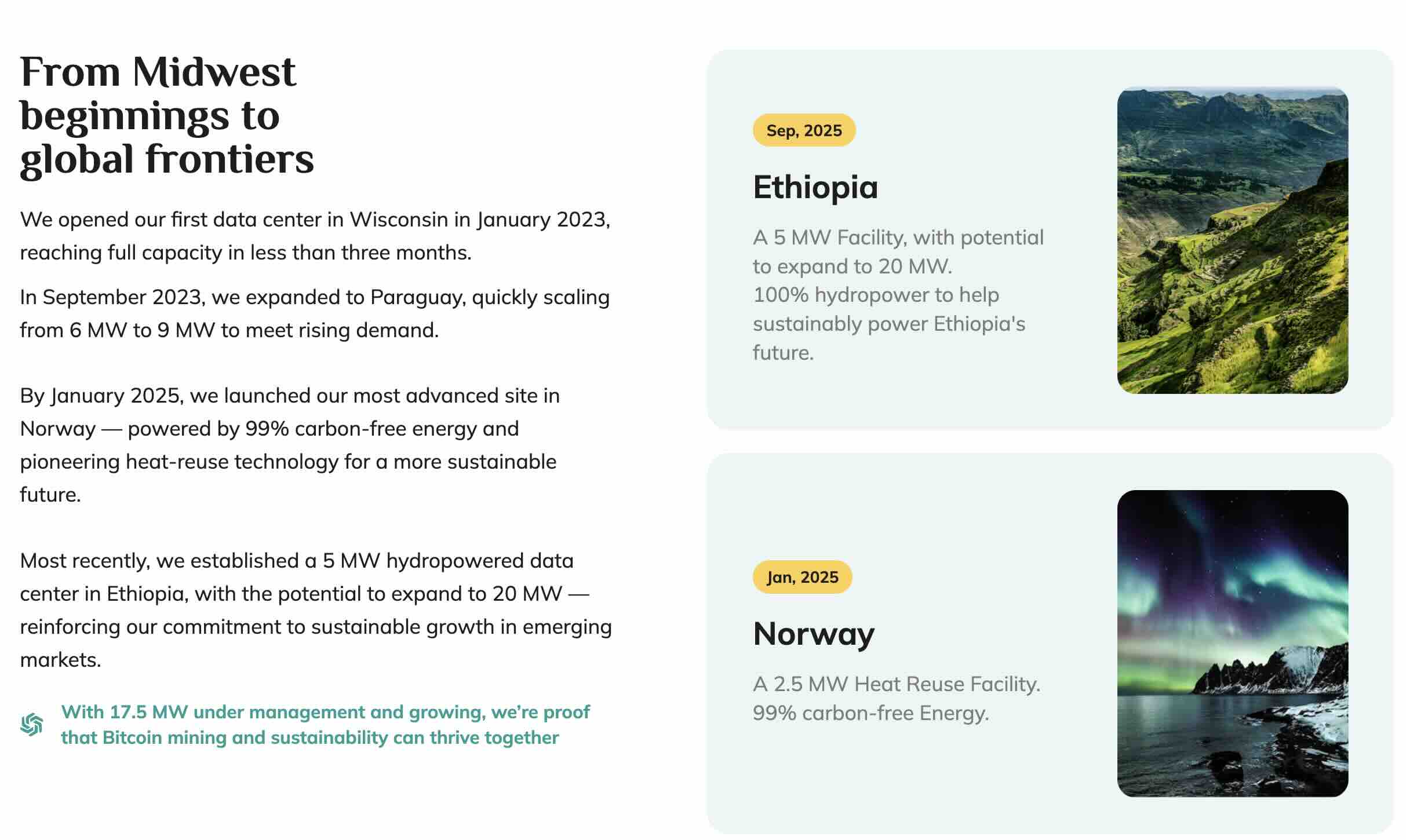

Founded by Kent Halliburton with a mission to make Bitcoin mining accessible to retail investors, Sazmining has carved out a unique position in the competitive mining landscape. The company operates multiple data centers powered by renewable energy, primarily in Paraguay, Norway, and Ethiopia. Their model is straightforward: you purchase ASIC mining rigs at cost, Sazmining deploys them in their facilities, and you receive freshly mined Bitcoin directly to your wallet.

This review examines whether Sazmining delivers on its promises of transparency, profitability, and hassle-free mining in 2025.

What is Sazmining?

Sazmining is a Bitcoin Mining as a Service provider headquartered in Bethesda, Maryland. Unlike cloud mining services where you rent hashrate from a company's equipment, Sazmining's model involves actual hardware ownership. You purchase ASIC miners through their platform, and they handle everything else: shipping to data centers, installation, maintenance, monitoring, and optimization.

The company operates on an aligned incentive model. Sazmining takes a revenue share (typically 15-20% depending on location) of the Bitcoin you mine, meaning they only profit when your rigs produce. This contrasts sharply with traditional hosting services that charge fixed fees regardless of your mining success.

Key Features

✅ Full Hardware Ownership: You own your mining rigs outright. This isn't rental or cloud mining where equipment belongs to someone else. The hardware is yours, registered with unique serial numbers, and you can theoretically take possession if you choose to exit the service.

✅ Renewable Energy Focus: Sazmining commits to powering operations with at least 20% more carbon-free energy than the Bitcoin network average. Their Paraguay facility runs on hydroelectric power, Norway uses renewable sources, and Ethiopia leverages clean energy infrastructure. For environmentally conscious Bitcoin enthusiasts, this represents a genuine commitment beyond greenwashing.

✅ Turnkey Management: The service handles every operational aspect. Installation, cooling, security, firmware updates, performance monitoring, and repairs during the warranty period all fall under Sazmining's responsibility. You simply monitor your dashboard and receive Bitcoin payouts.

✅ Transparent Billing: Monthly service fees cover electricity, facility operations, maintenance, and management. The company provides detailed breakdowns of power consumption, hashrate performance, and costs. Notably, Sazmining doesn't upcharge on electricity or hardware—you pay cost for equipment and transparent service fees.

✅ Multiple Mining Pool Options: Currently, Sazmining offers access to Luxor Pool and OCEAN. Luxor provides optimized operations with a 0.7% fee, while OCEAN offers a more decentralized approach with direct payouts from the Bitcoin network. This choice respects different philosophical approaches to mining.

How Sazmining Works

The process of starting with Sazmining follows a straightforward four-step path that removes most barriers to entry for individual miners.

Step 1: Purchase Mining Rigs

Browse available ASIC miners on Sazmining's store. Inventory changes based on availability, but typically includes models like Bitmain Antminer S19 series, S21 models, and other current-generation hardware. The company sells equipment at cost without markup, which is verifiable by comparing prices to direct manufacturer quotes or other retailers.

Payment options include credit card, ACH transfer, or Bitcoin. There's no limit to how many rigs you can purchase, though if you're ordering 20 or more, the customer success team recommends scheduling a consultation to optimize your deployment strategy.

Step 2: Deployment to Data Centers

After purchase, Sazmining handles all logistics. Your equipment ships to one of their data centers—typically Paraguay for most customers due to excellent power rates, though Norway and Ethiopia facilities are also available. The company manages customs, installation, connection to power and internet, and initial configuration.

Deployment timelines vary based on location and current queue, but customers typically see their rigs operational within 2-4 weeks from purchase. The company provides updates throughout this process via email and their customer dashboard.

Step 3: Start Your Service Plan

Once your rigs arrive and deploy, you initiate your monthly service plan. This covers electricity consumption, facility operations, maintenance, security, and management. Service fees vary by location due to different electricity rates, but the company provides clear cost breakdowns before you commit.

The billing model is consumption-based—you only pay for electricity your rigs actually use. This differs from some competitors who charge flat rates regardless of actual power consumption, potentially overcharging customers. Sazmining uses a precision billing engine that monitors real-time energy usage.

Step 4: Receive Bitcoin Payouts

Bitcoin mined by your rigs transfers directly from the mining pool to your wallet. Sazmining never holds or controls your Bitcoin—it flows straight to an address you control. Default payout frequency is weekly, assuming you meet the site's minimum threshold, but this can be adjusted to daily or monthly based on preference.

After Sazmining's revenue share (15-20% depending on location), you keep the remainder. The company's incentive alignment means they're motivated to maximize your uptime and efficiency, as their earnings directly correlate with your mining success.

Pricing and Costs Breakdown

Understanding the complete cost structure is essential for evaluating mining profitability. Sazmining's pricing has three main components.

Hardware Costs

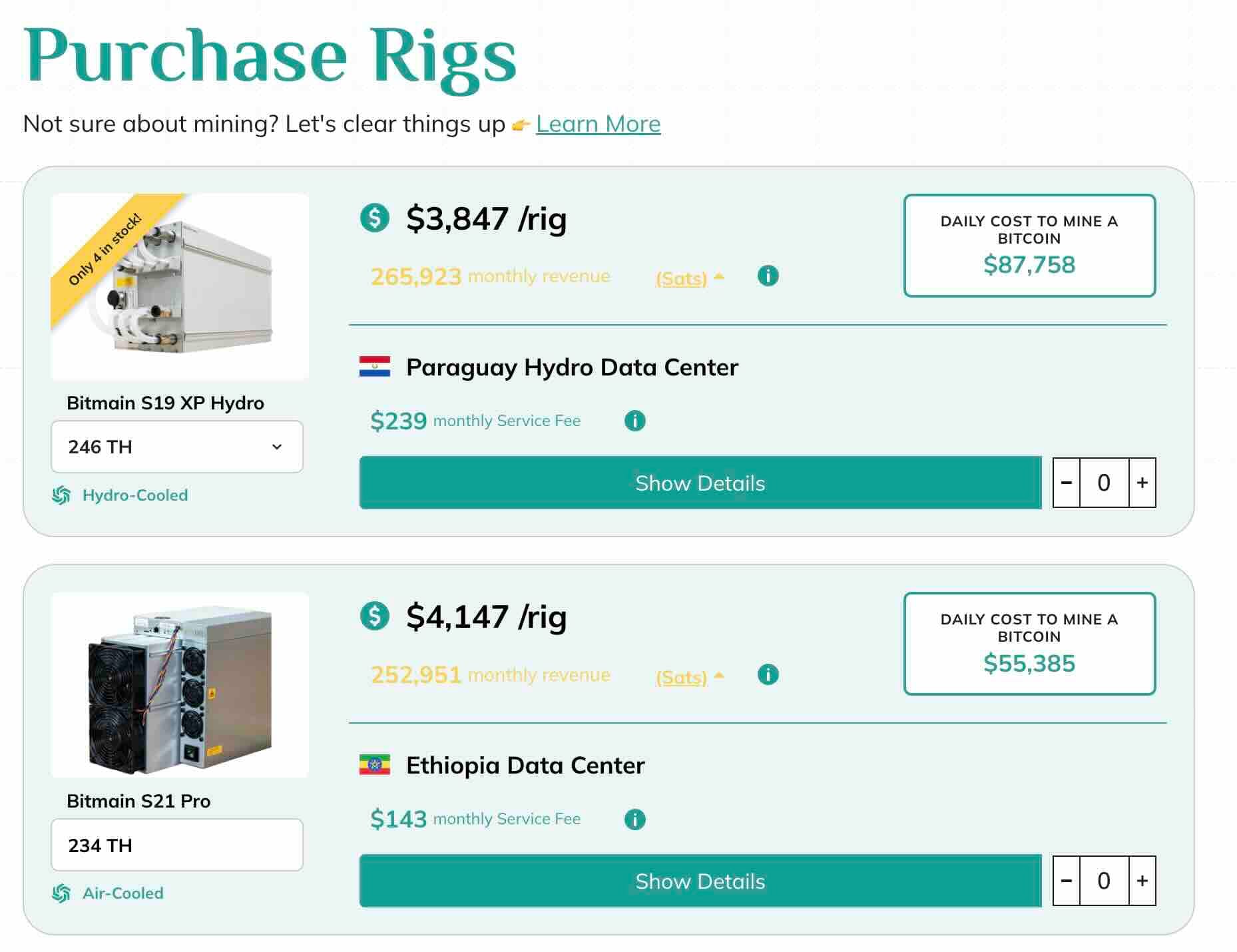

ASIC miner prices fluctuate based on Bitcoin's price, network difficulty, and hardware availability. As of December 2025, a high-performance Antminer S19 XP might cost $1,500-3,000, while newer S21 models range from $3,000-6,000. Sazmining sells these at cost without markup, which you can verify by comparing to manufacturer or authorized reseller pricing.

The company occasionally offers used equipment at discounted rates when customers upgrade or exit positions. These "gently used" machines come with remaining warranty coverage and represent good value for budget-conscious miners.

Monthly Service Fees

Service fees vary by location due to different electricity rates:

Paraguay (Hydro): Approximately $50-120 per month per rig, depending on model and power consumption. The facility benefits from exceptionally low hydroelectric rates around $0.035-0.045/kWh.

Norway: Slightly higher due to different power agreements, typically $70-140 per month per rig.

Ethiopia: Similar to Paraguay, around $55-125 per month per rig with clean energy sources.

These fees cover all operational costs: electricity, cooling, facility security, maintenance staff, monitoring systems, and network connectivity. Importantly, you never pay for electricity you don't use—billing reflects actual consumption.

Revenue Share

Sazmining takes a percentage of mined Bitcoin as their profit:

- Paraguay and Ethiopia: 15% of mining rewards

- Norway: 20% of mining rewards

This revenue share is taken after mining pool fees but before Bitcoin reaches your wallet. It represents Sazmining's only profit mechanism, aligning their success directly with yours.

Additional Costs

Warranty Repairs: Included for the first year. After warranty expires, repair costs apply if components fail.

Hashboard Repairs: NOT covered under warranty or service fees. Hashboard failures (the most critical component of ASIC miners) incur additional costs.

Equipment Termination: If you exit before one year, you forfeit equipment to Sazmining. After one year, you can dispose of equipment ($100 per ASIC), transfer ownership to Sazmining, sell independently ($100 transfer fee per ASIC), or have it shipped to you at your cost.

Profitability Analysis

The critical question for any mining operation: does it actually make money?

Current Mining Economics

Based on Sazmining's own calculations for December 2025, mining 14,356 satoshis (0.00014356 BTC) costs approximately $7.45 in electricity through their renewable-powered facilities. Purchasing the same amount on an exchange at current Bitcoin prices ($90,000-105,000) costs around $11.86, representing a 37% discount.

This math demonstrates mining's potential advantage over direct purchase, but it requires context. That calculation excludes:

- Initial hardware costs

- Service fees beyond electricity

- Mining difficulty increases over time

- Bitcoin price volatility

- Equipment depreciation

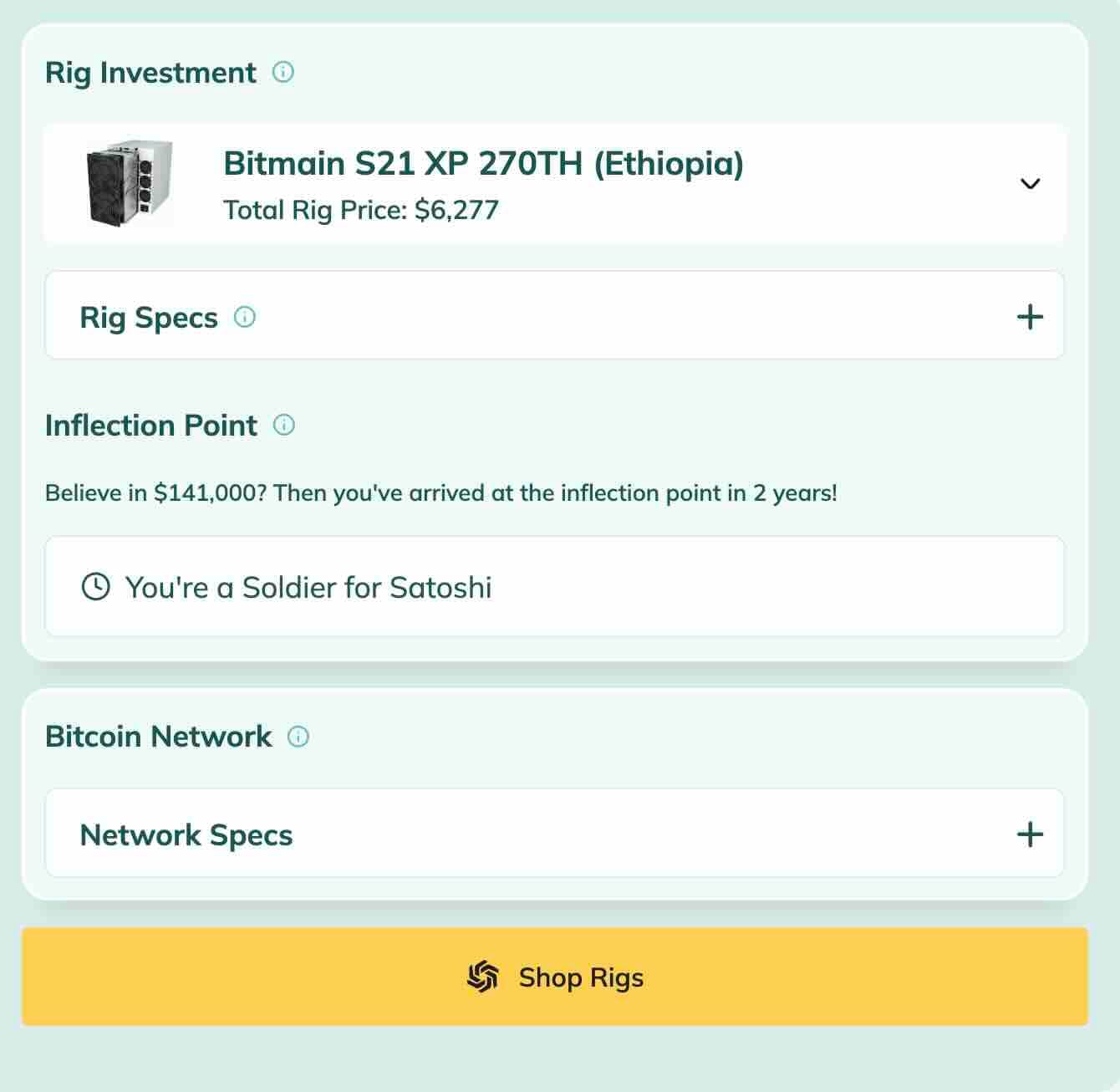

ROI Timeframes

A realistic ROI analysis for a single high-performance rig (like an S19 XP) in Sazmining's Paraguay facility:

Hardware Cost: $2,500

Monthly Service Fee: $85

Monthly Revenue Share: 15%

Estimated Monthly Mining (gross): $400-600 depending on Bitcoin price and difficulty

Net Monthly Income: $260-425 after service fee and revenue share

This suggests a break-even period of 6-10 months under favorable conditions (stable Bitcoin price, no major difficulty increases). After breaking even, the rig generates positive cash flow for its remaining operational life of 3-5 years.

However, this scenario assumes:

- Bitcoin price remains stable or increases

- Network difficulty doesn't spike dramatically

- Your equipment maintains performance

- No major hardware failures outside warranty

The calculation becomes more favorable if you:

- Purchase multiple rigs to scale income

- Enter during low difficulty periods

- Hold mined Bitcoin for price appreciation

- Benefit from Bitcoin price increases

Comparison to Buying Bitcoin

If you invested the same $2,500 directly into Bitcoin at $95,000, you'd acquire approximately 0.0263 BTC. That Bitcoin would need to appreciate for you to see returns, and you'd pay exchange fees plus potential KYC compromises.

Data Center Locations

Sazmining operates multiple strategically located facilities, each with unique characteristics.

Paraguay (Hydro)

The flagship location, powered entirely by hydroelectric energy from Paraguay's extensive dam infrastructure. This facility offers some of the lowest electricity costs globally, making it highly competitive for mining profitability.

Energy Source: 100% hydroelectric

Electricity Rate: ~$0.035-0.045/kWh

Revenue Share: 15%

Climate: Suitable for natural cooling assistance

Uptime: Reported as excellent by customers

Paraguay's surplus hydroelectric capacity makes it an ideal location for energy-intensive operations. The country generates more electricity than it can consume domestically, creating opportunities for favorable industrial power agreements.

Norway

Located in the Arctic Circle region, Norway's facility benefits from naturally cool temperatures (reducing cooling costs) and renewable energy sources including hydroelectric and wind power.

Energy Source: Mix of hydroelectric and wind

Electricity Rate: Slightly higher than Paraguay

Revenue Share: 20%

Climate: Arctic temperatures provide natural cooling

Unique Feature: Some heat from mining warms local buildings

A recent partnership even routes waste heat from mining operations to heat buildings in a Norwegian fishing village, demonstrating innovative approaches to mining's energy consumption.

Ethiopia

The newest location, leveraging Ethiopia's growing renewable energy infrastructure and favorable regulatory environment for Bitcoin mining.

Energy Source: Renewable (hydro and other clean sources)

Electricity Rate: Competitive with Paraguay

Revenue Share: 15%

Development: Newer facility with room for growth

Ethiopia has invested heavily in hydroelectric dams and renewable energy, creating excess capacity that mining can absorb while supporting infrastructure development.

Performance and Uptime

Mining profitability depends heavily on equipment actually running and producing hashrate. Downtime directly erodes earnings.

Reported Uptime

Customer reviews consistently praise Sazmining's uptime, with many reporting 95%+ operational availability. The company provides a status page where users can check site-wide issues, and individual rig performance appears in customer dashboards.

When issues occur, customers note that Sazmining communicates proactively. Monthly town hall meetings with CEO Kent Halliburton provide forums for addressing concerns and asking questions directly.

Performance Guarantee

Sazmining offers an Annual Rig Performance Guarantee—if your rig underperforms at the end of 365 days relative to its rated hashrate, the company compensates you. This industry-first guarantee demonstrates confidence in their operational capabilities and incentive alignment.

Maintenance and Repairs

During the one-year warranty period, all eligible repairs are included at no additional cost. The company's technicians diagnose issues, source parts, and perform repairs to maintain performance.

The notable exception is hashboard repairs, which aren't covered under warranty or service fees. Hashboards are the critical computing components of ASIC miners, and their failure represents the most significant potential additional cost.

After warranty expiration, repair costs become the owner's responsibility. This is standard in the industry, but it's worth budgeting for potential maintenance expenses in years 2-5 of operation.

Monitoring and Dashboard

Customers access a web dashboard showing:

- Individual rig hashrate and status

- Historical performance graphs

- Energy consumption tracking

- Payout history

- Mining pool connection status

The interface receives consistent praise for clarity and usability. Real-time monitoring helps customers verify their equipment is operating optimally and catch issues early.

Customer Experience

Customer service quality significantly impacts the mining-as-a-service experience, especially for users new to Bitcoin mining's technical aspects.

Onboarding Process

Multiple reviews highlight the enrollment process as straightforward. The customer success team provides guidance through purchase, setup, and initial operation. First-time miners appreciate the educational approach rather than assuming technical knowledge.

Some customers note quick response times when questions arise, with several mentioning CSA team members by name (Petar and Krish receive specific praise in reviews) for their knowledge and responsiveness.

Support Quality

Sazmining offers a 12-hour support resolution commitment for customer inquiries. Based on customer reviews, the company appears to meet or beat this timeline frequently. Support channels include email, their customer portal, and a private Telegram group for rig owners.

The Telegram community provides peer-to-peer support and direct access to company staff, including developers, operations personnel, and leadership. This transparency and accessibility stands out in an industry where some providers hide behind automated support systems.

Communication and Transparency

Monthly town hall meetings allow customers to ask the CEO questions directly and receive updates on company developments, facility expansions, and industry trends. Customers consistently mention this as a valuable trust-building practice.

When issues arise—whether site-specific problems, equipment delays, or network-wide mining challenges—Sazmining appears to communicate proactively rather than waiting for customers to discover problems themselves.

Common Customer Feedback

Positive Themes:

- Transparent operations and communication

- Strong customer support responsiveness

- Easy onboarding for non-technical users

- Aligned incentive model feels fair

- Environmental sustainability commitment

- Ownership of actual hardware vs. cloud mining contracts

Critical Themes:

- Bi-weekly mining payout variations confuse some users (this is normal difficulty adjustment, not a Sazmining issue)

- Initial deployment wait times can extend 2-4 weeks

- Hashboard repair exclusion from warranty coverage surprises some customers

- Learning curve for understanding mining economics

Advantages of Sazmining

Several factors distinguish Sazmining in the competitive mining service landscape.

Aligned Incentive Model

The revenue-share structure genuinely aligns company and customer interests. Unlike hosting services charging fixed fees regardless of performance, Sazmining only profits when your rigs mine successfully. This incentivizes maximum uptime, optimal performance, and quick issue resolution.

Hardware Ownership

You own the equipment, not a cloud mining contract that could become worthless if the company fails. Physical ownership means you can potentially recover value even if Sazmining ceases operations (though this would be disruptive).

No Price Gouging

Selling hardware at cost and providing transparent electricity billing eliminates common industry practices of marking up equipment prices or overcharging for power. You can verify hardware costs against manufacturer pricing.

Renewable Energy Commitment

For Bitcoiners concerned about mining's environmental impact, Sazmining's 20%+ above-network-average commitment to carbon-free energy provides measurable impact. The company publishes energy source information for each facility.

Retail Accessibility

Sazmining democratizes access to professional mining infrastructure. Individual investors can participate at the same efficiency level as large operations without needing to build their own facilities, negotiate power agreements, or develop operational expertise.

Educational Approach

The company invests in educating customers about mining economics, difficulty adjustments, and realistic expectations. This reduces disappointment from misunderstanding how mining profitability works and creates more informed Bitcoin participants.

Disadvantages and Risks

No investment or service is without drawbacks. Prospective customers should consider these limitations.

Bitcoin Price and Difficulty Risk

Mining profitability depends on factors beyond Sazmining's control: Bitcoin's price and network difficulty. If Bitcoin crashes or difficulty spikes dramatically, mining becomes less profitable regardless of how efficiently Sazmining operates.

Long Break-Even Periods

Depending on entry timing, breaking even on hardware costs could take 6-12+ months. This represents capital locked in equipment rather than liquid Bitcoin. For users wanting immediate Bitcoin exposure, direct purchase provides instant access.

Hardware Depreciation

ASIC miners have finite lifespans (3-5 years typically) before becoming obsolete. New, more efficient miners continuously enter the market, gradually making older equipment less competitive. Your equipment loses value over time.

Limited Geographic Flexibility

You can't easily move your rigs between facilities or take them home if circumstances change. The $100 per ASIC transfer fee and forfeiture terms for exiting before one year create friction if you need to change strategies.

Hashboard Repair Exclusion

The most critical and expensive component—hashboards—isn't covered under warranty or service fees. If hashboards fail, you face significant unexpected costs. This represents the largest financial risk after initial purchase.

Competition from Buying Direct

If Bitcoin's price increases significantly, you would have been better off buying Bitcoin directly rather than mining it. Mining provides dollar-cost averaging at below-market rates, but if Bitcoin 10x's shortly after you start mining, direct purchase would have been more profitable.

Regulatory Uncertainty

Bitcoin mining faces regulatory scrutiny in various jurisdictions. While Sazmining operates in mining-friendly countries, regulatory changes could impact operations. Energy policies, taxation, or outright bans in host countries represent potential risks.

Who Should Use Sazmining?

Sazmining fits specific user profiles better than others.

Ideal Candidates

Bitcoin Accumulators: If your goal is slowly accumulating Bitcoin over years rather than speculating short-term, mining provides systematic acquisition below market rates similar to dollar-cost averaging.

Privacy-Conscious Users: Mining produces "virgin" Bitcoin with no transaction history. You acquire Bitcoin without KYC requirements beyond the initial hardware purchase, maintaining greater privacy than exchange purchases.

Environmental Bitcoin Enthusiasts: If mining's energy consumption concerns you, Sazmining's renewable energy commitment provides a way to acquire Bitcoin with minimal carbon footprint.

Small-Scale Investors: With equipment costs starting around $1,500-3,000, Sazmining makes professional mining accessible to individuals who couldn't justify building their own facility or negotiating industrial power contracts.

Long-Term Thinkers: If you believe Bitcoin will appreciate over 3-5 years and want to accumulate during that period while potentially profiting from both mining and price increase, the model works well.

Poor Fits

Short-Term Speculators: If you want immediate Bitcoin exposure to capitalize on near-term price movements, direct purchase provides instant access. Mining's 6-12 month break-even makes it unsuitable for quick trades.

Highly Risk-Averse Investors: Mining involves equipment risk, price risk, and difficulty risk. If market volatility causes anxiety, buying and holding Bitcoin might suit you better.

Maximum Profitability Seekers: The most profitable mining operations build their own facilities, negotiate direct power agreements, and operate at massive scale. Sazmining's convenience comes at the cost of some profitability compared to DIY operations.

Users Needing Liquidity: Your capital locks into equipment for months during break-even. If you might need that money available on short notice, mining isn't appropriate.

Comparison to Alternatives

Understanding Sazmining relative to other options helps clarify its value proposition.

vs. Cloud Mining

Cloud mining services rent you hashrate from their equipment. You never own hardware, and many cloud mining operations have proven to be scams or unprofitable. Sazmining provides actual hardware ownership with verifiable serial numbers and physical existence.

vs. DIY Home Mining

Running miners at home seems appealing but faces challenges: high residential electricity rates (often $0.15-0.30/kWh vs. Sazmining's $0.035-0.045/kWh), noise (miners are extremely loud), heat production, and technical complexity of setup and maintenance. Sazmining eliminates these issues at the cost of revenue sharing.

vs. Other Hosting Services

Traditional hosting services charge fixed monthly fees regardless of mining performance. If difficulty spikes or Bitcoin crashes, you still pay full hosting costs, potentially operating at a loss. Sazmining's revenue share model means during difficult periods, their take decreases proportionally with your earnings.

vs. Direct Bitcoin Purchase

Buying Bitcoin provides immediate exposure and liquidity. You can sell anytime without equipment considerations. However, you pay market price plus exchange fees, undergo KYC, and don't benefit from mining's below-market acquisition over time. For belief in long-term Bitcoin appreciation, mining can outperform direct purchase despite longer time horizons.

Recent Developments and Future Outlook

Sazmining continues evolving its service and expanding infrastructure.

Recent Expansions

The Ethiopia facility represents the company's newest location, providing additional capacity and geographic diversification. This expansion demonstrates growth and commitment to increasing customer access.

The Norway Arctic Circle facility with heat recapture for local buildings showcases innovative approaches to mining's energy use, turning "waste" heat into productive output.

Mining Pool Options

Adding OCEAN as a pool option alongside Luxor gives customers choice between optimized centralized pooling (Luxor) and more decentralized mining (OCEAN). This philosophical flexibility respects different views within the Bitcoin community.

Industry Trends

As Bitcoin mining difficulty continues increasing and older equipment becomes obsolete, the advantage of services like Sazmining may grow. Individual miners face increasing challenges competing with industrial operations, making hosted services more attractive for retail participation.

The 2024 halving reduced block rewards from 6.25 to 3.125 BTC, putting pressure on mining profitability. This makes efficiency and low electricity costs even more critical—areas where Sazmining's renewable energy facilities provide advantages.

Sustainability Focus

As environmental scrutiny of Bitcoin mining intensifies, Sazmining's commitment to renewable energy positions the company well. Customers increasingly consider mining's carbon footprint, and the 20%+ above-average renewable usage provides marketing differentiation and genuine impact.

Security and Trust Considerations

When sending thousands of dollars for equipment deployed overseas, trust becomes paramount.

Company Transparency

Sazmining publishes energy sources, facility locations, team members, and operational details. The monthly town halls with direct CEO access demonstrate unusual transparency for the industry.

Hardware Verification

Each rig receives a unique serial number registered to its owner. This provides traceability and proof of ownership, though physical verification would require visiting facilities.

Bitcoin Custody

Sazmining never holds customer Bitcoin—payouts flow directly from mining pools to customer wallets. This eliminates custody risk, as the company can't run off with your mined Bitcoin.

Operational History

Founded in the early 2020s, Sazmining has operated for several years with consistent customer reviews and public presence. While not a decades-old institution, the track record shows steady operations without major scandals or disappearances.

Customer Reviews

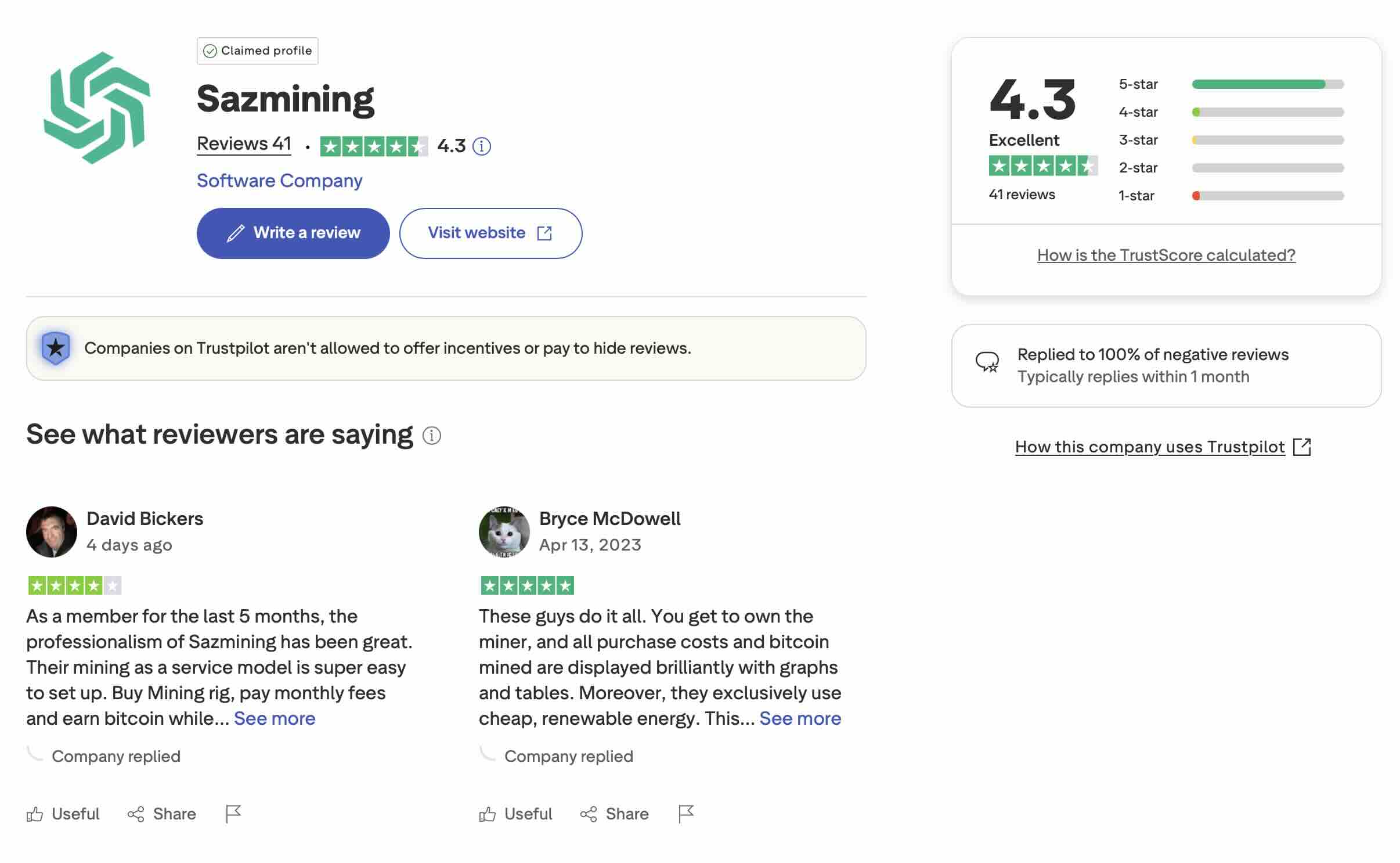

Reviews across platforms (Trustpilot, Glassdoor, Bitcoin forums) show generally positive experiences. The 4.5-4.6 star averages with substantial review volumes indicate legitimate operations satisfying most customers.

Risk Mitigation

No investment is risk-free. Consider:

- Start with a single rig to test the service

- Verify equipment prices against manufacturers

- Monitor performance regularly through dashboard

- Participate in community forums and town halls

- Understand you're trusting Sazmining with equipment security and operations

Conclusion

Sazmining occupies a valuable niche in Bitcoin mining: making professional-grade infrastructure accessible to retail investors who want to participate in securing the network without operational headaches.

The Bottom Line

For the right user profile, Sazmining delivers on its core promise: you purchase mining equipment, they handle everything operational, and you receive Bitcoin mined below market purchase prices. The aligned incentive model, renewable energy commitment, and transparent operations create a trust-worthy framework for what is typically a complex and risky endeavor.

The economics work under reasonable assumptions: stable-to-rising Bitcoin prices, controlled difficulty increases, and multi-year time horizons. Break-even periods of 6-12 months followed by 2-4 years of positive cash flow provide paths to profitability that beat direct Bitcoin purchases for patient investors.

The service quality exceeds many competitors based on consistent customer praise for communication, support responsiveness, and operational transparency. The company appears genuinely committed to customer success rather than extracting maximum fees.

Who Benefits Most

Sazmining suits Bitcoin accumulators who:

- Believe in Bitcoin's long-term value appreciation

- Want to acquire Bitcoin systematically below market rates

- Value privacy and mining's KYC-free acquisition

- Care about renewable energy and environmental impact

- Prefer professional management over DIY complexity

- Accept 6-12 month break-even periods for long-term gains

Who Should Look Elsewhere

The service doesn't fit:

- Short-term speculators needing immediate Bitcoin exposure

- Users maximizing absolute profitability over convenience

- Highly risk-averse investors uncomfortable with equipment and market risks

- Anyone needing capital liquidity on short notice

Final Verdict

Sazmining represents a legitimate, transparent Bitcoin mining service that delivers on its core value proposition. While mining always involves risks—Bitcoin price volatility, difficulty increases, equipment failures—the company's operational execution, aligned incentives, and customer-first approach make it a credible option for retail Bitcoin mining participation.

For individuals who understand mining economics and accept the inherent risks, Sazmining provides professional infrastructure, renewable energy, and genuine hardware ownership at transparent costs. That combination is rare enough in the Bitcoin mining industry to merit serious consideration from appropriate investors.

Rating: 4.2/5

The service excels at operations, transparency, and customer experience. Minor deductions for hashboard repair exclusions, geographic inflexibility, and the inherent risks of any mining operation that are beyond Sazmining's control.

Frequently Asked Questions

Is Sazmining legitimate or a scam?

Based on multiple years of operations, consistent customer reviews, transparent business practices, and verifiable physical infrastructure, Sazmining appears to be a legitimate service. However, all Bitcoin mining involves risks, and due diligence is always recommended.

How long does it take to profit from mining with Sazmining?

Break-even typically occurs in 6-12 months depending on Bitcoin prices, network difficulty, and your specific equipment. After break-even, profitable operation can continue for 2-4+ years depending on hardware lifespan and competitiveness.

Can I withdraw my Bitcoin anytime?

Bitcoin mined by your rigs transfers directly to your wallet from the mining pool. Sazmining never holds your Bitcoin, so you have immediate access once payouts occur (typically weekly).

What happens if Bitcoin price crashes?

Mining becomes less profitable, but Sazmining's revenue share model means their take decreases proportionally with your earnings. Service fees still apply, so deep price crashes could make mining temporarily unprofitable until prices recover.

Can I visit my mining rigs?

Physical facility visits aren't standard, but Sazmining may accommodate requests. The company provides detailed dashboard monitoring as the primary verification method.

How do I know my rigs actually exist?

Each rig has a unique serial number registered to your account. The dashboard shows real-time hashrate, and you receive actual Bitcoin payouts directly from mining pools. While this doesn't guarantee physical verification, it provides strong evidence of operational rigs.

What if Sazmining goes out of business?

You technically own the hardware, so it could potentially be recovered or transferred. However, this would likely involve significant complications and costs. This represents a risk of any hosted mining service.

Is mining better than buying Bitcoin?

It depends on timeframe and goals. Mining provides systematic accumulation below market rates over 3-5 years, offering potential advantages if Bitcoin appreciates. Direct purchase provides immediate exposure and liquidity. Neither is universally "better"—they serve different investment strategies.

Disclosure

This article may contain affiliate links. If you purchase through our links, we may earn a commission at no additional cost to you. This helps support our blog and allows us to continue providing free, in-depth Bitcoin content. We only recommend services we've thoroughly researched.