What is RedotPay?

RedotPay is a Hong Kong-based crypto payment solution that bridges the gap between your digital assets and everyday spending. Think of it as your Bitcoin wallet meeting a traditional Visa/Mastercard, except instead of converting your crypto to fiat manually through exchanges, RedotPay does it automatically when you swipe.

The platform launched with a vision to make crypto payments as seamless as traditional banking, and they've built a solid product that's gained traction with over 5 million users across 100+ countries.

Who Is RedotPay Built For?

After researching user experiences and testing the platform myself, here's who benefits most from RedotPay:

✅ Perfect For:

- Bitcoin holders who want to spend without selling: Keep your BTC in your wallet, load what you need

- Frequent travelers: Accepted at 130M+ merchants worldwide and ATMs globally

- High-volume spenders: Daily limits reach $1M—far beyond most competitors

- People in restrictive banking regions: Crypto-friendly alternative when traditional banking is limited

- Anyone avoiding P2P exchanges: No more sketchy meetups or waiting for bank transfers

❌ Maybe Skip If:

- You're looking for cashback rewards (RedotPay offers Yield)

- You need to support 15+ different cryptocurrencies (they only support 4)

- You want free ATM withdrawals (there's a 2% fee)

- You're extremely fee-sensitive for small transactions

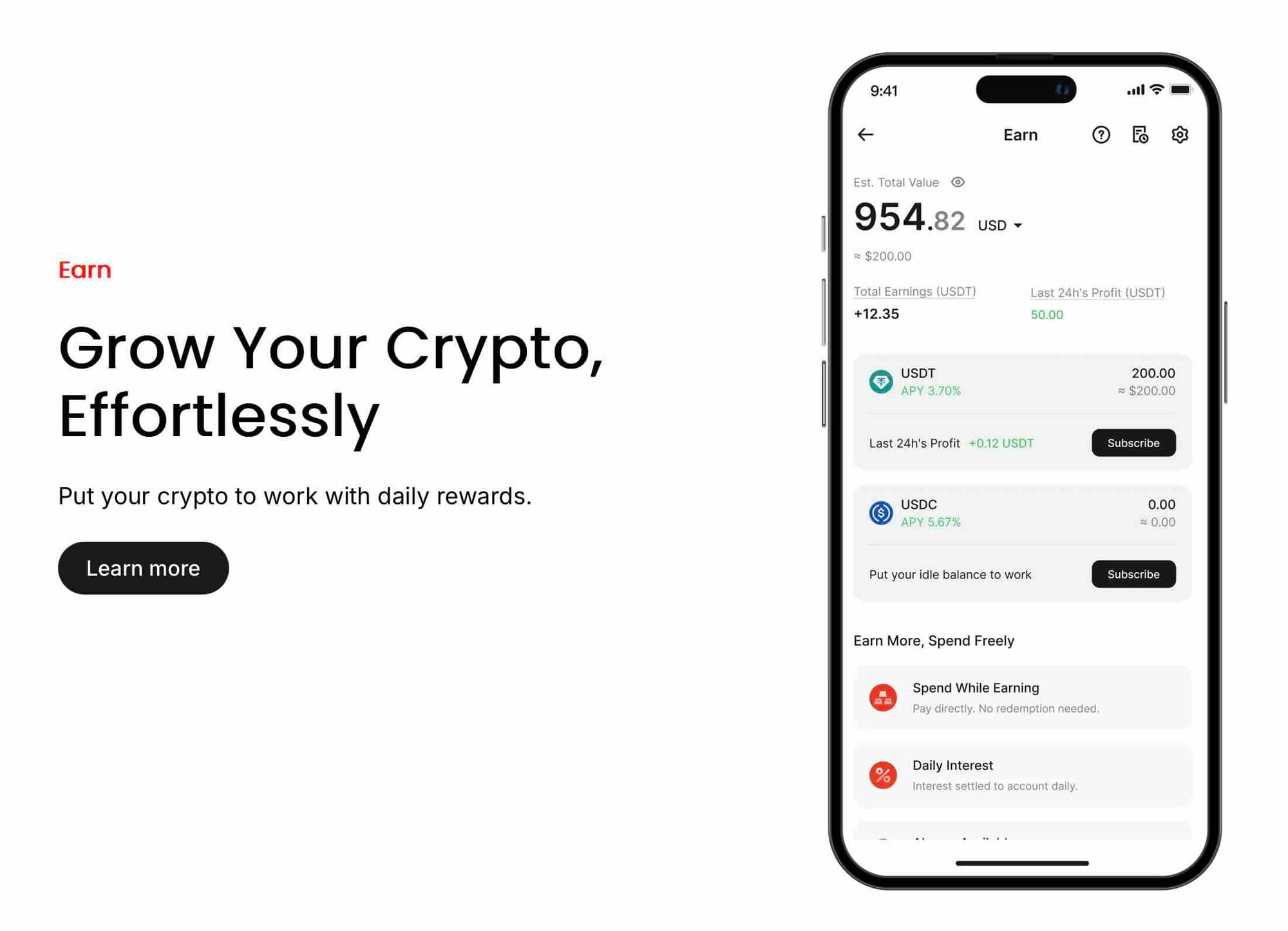

Yield : How Much Can You Earn?

While RedotPay doesn't offer cashback rewards, they do provide yield on your idle crypto balances. Here's what you need to know:

Current Yield Rates:

- USDT: Up to 5% APY

- USDC: Up to 4.5% APY

- BTC: Currently no yield offered

- ETH: Currently no yield offered

The yield is automatically calculated and deposited into your account daily. You don't need to lock up your funds or commit to any minimum holding period—your crypto earns passively while sitting in your RedotPay wallet.

How Does This Compare?

Traditional savings accounts: 0.5-2% APY Competitor crypto cards: Most offer 0-3% on stablecoins DeFi platforms: 3-15% APY (but with higher risk and no spending card)

The Trade-Off:

While 4-5% APY on stablecoins is decent, remember you're still missing out on 2-4% cashback that competitors offer on actual spending. The yield helps offset the lack of rewards, but you'll need to do the math based on your personal usage:

- If you spend $10,000/month with no cashback = $0 in rewards

- Same spending with 2% cashback card = $200/month = $2,400/year

- But if you keep $50,000 USDT in RedotPay earning 5% = $2,500/year

The yield benefit only outweighs the cashback disadvantage if you maintain significant idle balances relative to your spending.

Bottom Line: The yield feature makes RedotPay more attractive for users who keep large stablecoin balances, but it doesn't fully compensate for the lack of spending rewards if you're a high-volume card user.

Real User Experience: The Good

1. It Actually Works (And That's Rare)

One user on Trustpilot mentioned they bought a Samsung Galaxy S25 Ultra in one transaction using the virtual card, no issues. That's the kind of stress-free experience that's rare in crypto cards.

Another reviewer traveling internationally noted: "If you are traveling to a foreign country it's very very reliable to use if you have crypto with you. I haven't had to go to any exchanger since I had this card."

2. Insane Limits

Let's talk numbers:

- $100,000 per transaction (yes, you read that right)

- $1,000,000 daily spending limit

- $116,250 monthly ATM withdrawals

Most competitors cap out at $10K-$50K daily. RedotPay is playing in a different league.

3. Simple Onboarding

KYC verification takes under 5 minutes according to multiple reviews. Download the app, verify your ID, deposit crypto, and you're ready to roll. No waiting weeks for approval like some traditional financial services.

4. Apple Pay Support

The card now supports Apple Pay (though this was temporarily removed due to Apple policy updates and has since been restored). This means you can add your RedotPay card to your iPhone and tap-to-pay anywhere Apple Pay is accepted.

The Not-So-Great Parts

1. Fees Add Up

While RedotPay markets itself as "low-fee," let's break down the actual costs:

- Virtual card issuance: $10

- Physical card issuance: $100

- Crypto conversion fee: ~1%

- Foreign exchange markup: ~1.2%

- ATM withdrawal fee: 2%

- Small transaction fees: Additional charges on declined or very small transactions

Real-world example: A $100 purchase effectively costs you around $102-103 after all fees. Not terrible, but not free either.

One user calculated their $6.75 purchase cost them $6.82 total—about 2% in fees, which aligns with advertised rates.

2. Limited Cryptocurrency Support

RedotPay only supports:

- Bitcoin (BTC)

- Ethereum (ETH)

- USDT (Tether)

- USDC (USD Coin)

That's it. No Solana, no Litecoin, no altcoins. If you're diversified across multiple chains, you'll need to convert everything to these four options first.

3. Customer Support Can Be Hit-or-Miss

Several users reported issues with compromised cards where RedotPay generated fees for fraudulent transactions and then required payment to close the card. Others mentioned the AI chatbot support is "totally useless" for complex issues.

However, positive reviews also exist praising "top class customer service" that resolves issues within reasonable timeframes. It seems inconsistent.

4. Custodial Solution

RedotPay holds your crypto, you don't control the private keys. For Bitcoin maximalists who live by "not your keys, not your coins," this is a dealbreaker. However, they do use licensed custody providers and claim to isolate card assets from your main wallet for added security.

Fee Comparison: How Does RedotPay Stack Up?

| Feature | RedotPay | Average Competitor |

|---|---|---|

| Crypto-to-fiat conversion | ~1.18% | ~1.7% |

| FX markup | 1.2% | Varies |

| ATM withdrawal | 2% | 2-5% (or free up to $200-400) |

| Card issuance | $10-$100 | $0-$50 |

| Cashback | 0% | 2-4% |

| Monthly fees | $0 | $0-$5 |

RedotPay is competitive on conversion rates but loses ground on cashback and card issuance fees.

The Controversial Stuff

1. Apple Pay Ban (Temporary)

In 2024, Apple temporarily banned RedotPay cards from Apple Wallet, frustrating many users. RedotPay claims this was due to Apple's policy changes, not their fault. The feature has since been restored, but it highlighted dependency on third-party platforms.

2. Compliance Delays

Multiple users on Trustpilot reported excessive delays (2+ months) for compliance-related refunds. While KYC/AML procedures are necessary, RedotPay's response times for edge cases appear slow.

3. Bitcoin Deposit Issues

One user lost $20 across two separate BTC deposits below $10 that never reflected in their account. RedotPay apparently has minimum deposit thresholds that aren't always clear upfront.

My Honest Take After Using RedotPay

What I Liked:

- Setup was genuinely fast (about 10 minutes total)

- The virtual card worked immediately for online purchases

- No pre-loading required—just keep crypto in the wallet and spend when needed

- High limits give peace of mind for larger purchases

What Annoyed Me:

- $100 for a physical card feels excessive (competitors charge $0-$20)

- Zero rewards means I'm actively losing money compared to alternatives

- Limited crypto support meant converting some assets first

- The app interface is functional but not particularly elegant

Would I recommend it? It depends.

Yes, if:

- You need extremely high spending/withdrawal limits

- You're traveling internationally frequently

- You're based in Asia (especially Hong Kong) where RedotPay has strong presence

- You want to avoid P2P exchanges and prefer instant liquidity

No, if:

- You're looking to maximize value through cashback/rewards

- You need diverse cryptocurrency support

- You're uncomfortable with custodial solutions

- You make frequent small transactions (fees hurt more)

Alternatives to Consider

Before committing, compare RedotPay against:

- Bleap Card: No fees, 2% USDC cashback, non-custodial, free ATM withdrawals up to $400/month

- Coinbase Card: Direct connection to your Coinbase account, 4% cashback on certain cryptos

- Crypto.com Card: Multiple tier options with cashback rewards up to 5%

- Nexo Card: Spend without selling your crypto (credit line against holdings)

—> Read : Nexo Review

Each has pros/cons depending on your priorities.

Bottom Line: Is RedotPay Worth It?

RedotPay is a solid, functional crypto card that does what it promises—let you spend cryptocurrency globally without jumping through hoops. The limits are industry-leading, conversion fees are competitive, and it works reliably for most users.

However, it's not revolutionary. The lack of rewards, limited crypto support, and custodial nature mean it's not the best choice for everyone. It excels in specific use cases (high-volume spending, international travel) but falls short as an everyday spending solution when competitors offer cashback and lower fees

Best for: Bitcoin holders who prioritize convenience and high limits over maximizing rewards.

Skip if: You want cashback rewards or need diverse cryptocurrency support.

How to Get Started (If You're Convinced)

- Download the RedotPay app (iOS or Android)

- Complete KYC verification (~5 minutes)

- Deposit crypto (BTC, ETH, USDT, or USDC)

- Choose virtual ($10) or physical ($100) card

- Wait for approval (usually instant for virtual)

- Start spending your sats in the real world

Pro tip: Start with the $10 virtual card to test the platform before committing $100 to the physical card.

Final Thoughts

RedotPay isn't perfect, but it's a legitimate option in the growing crypto card space. The platform has real traction (5M+ users), works in 100+ countries, and solves a genuine problem: spending crypto without the hassle of exchanges.

Is it the best crypto card? Probably not—competitors with cashback and lower fees offer better value for most users. Is it a good crypto card? Yes, especially if you fall into their target demographic of high-volume spenders or international travelers.

As the crypto payment space matures, expect RedotPay to face increasing competition. For now, it remains a viable choice, but do your homework and compare against alternatives before committing.

Disclaimer: This review is based on publicly available information, user reviews, and limited testing. Always do your own research before committing funds to any crypto platform. Cryptocurrency services involve risk, including potential loss of funds.