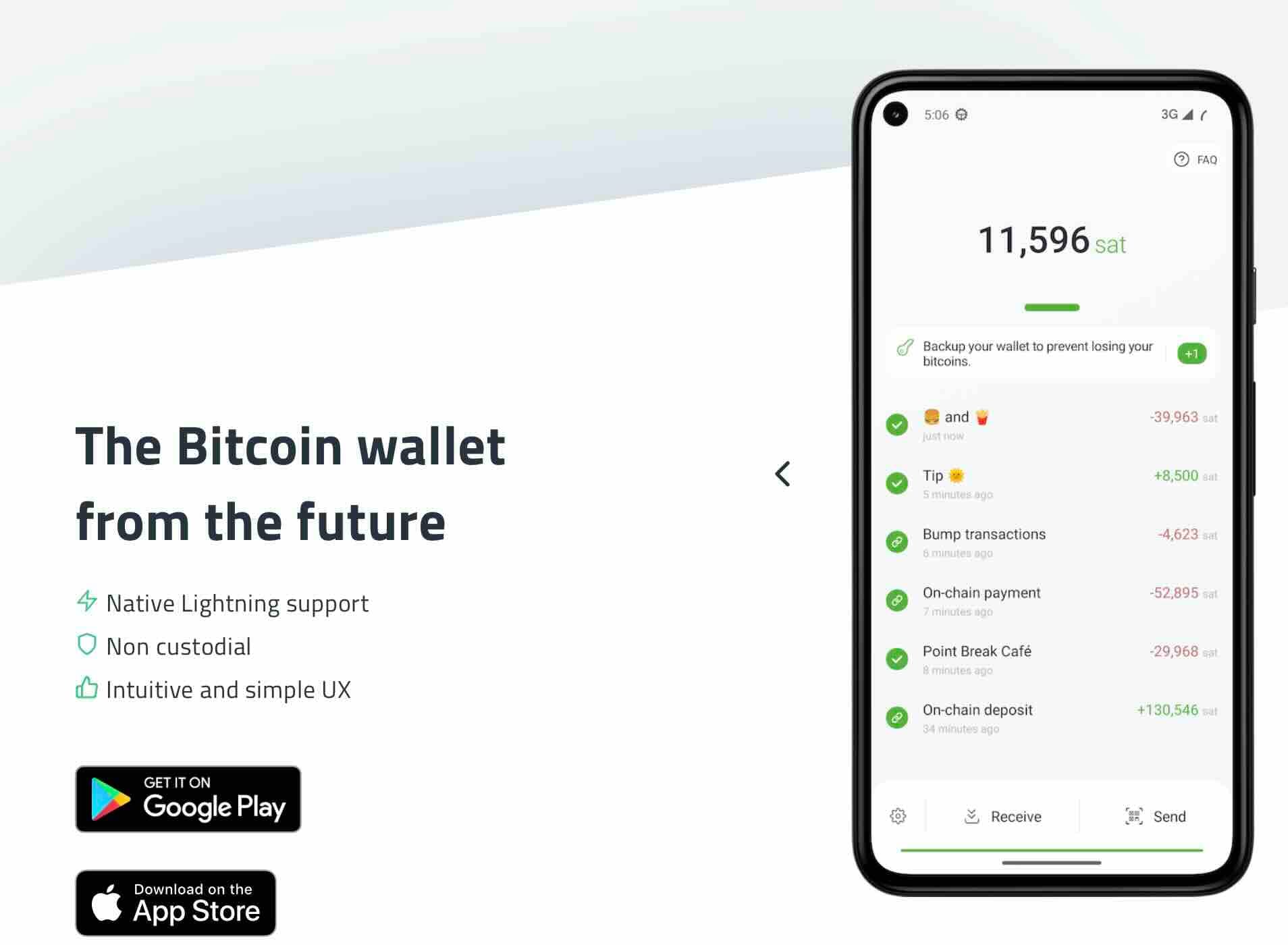

The Self-Custodial Wallet That Just Works

Let's be real: Lightning Network wallets have traditionally sucked for normal people. Channel management, liquidity issues, routing failures, backup nightmares—the UX has been brutal. Early Lightning wallets felt like they were designed by engineers, for engineers.

Phoenix said "forget that" and built what Lightning wallets should have been from day one: self-custodial, lightning-fast, and dead simple. No channels to manage. No liquidity headaches. No PhD required. Just a wallet that works. This is how you bring Lightning to the masses without sacrificing self-sovereignty.

What is Phoenix?

Phoenix is a self-custodial Bitcoin wallet built by ACINQ, one of the OG Lightning Network companies. It's mobile-first (iOS and Android), Lightning-native, and designed to make you forget you're even using Lightning. Under the hood, Phoenix runs a real Lightning node on your phone. You hold the keys. You control the funds. But unlike every other non-custodial Lightning wallet, Phoenix handles all the complexity automatically.

What makes Phoenix special is its use of splicing—a Lightning tech that lets the wallet dynamically resize your channel on the fly. Instead of managing multiple channels that fragment your liquidity, Phoenix maintains a single dynamic channel that grows and shrinks as needed. Receiving payment but don't have inbound liquidity? Phoenix auto-splices funds into your channel. Want to send on-chain? Splice it out. No manual channel opens. No waiting for confirmations to use new channels. It just works.

Origin and Creation Context

Phoenix was launched on December 12, 2019, by ACINQ, a French Bitcoin technology company that's been building Lightning infrastructure since the early days. ACINQ isn't some random startup—they operate one of the largest Lightning nodes in the entire network and created Eclair, one of the three major Lightning implementations (alongside LND and Core Lightning).

Before Phoenix, ACINQ had released Eclair Mobile in 2017, one of the first mobile Lightning wallets. But Eclair Mobile was technical. Really technical. Users had to manually manage channels, understand inbound/outbound liquidity, handle channel closures, and deal with all the Lightning complexity that makes engineers excited but sends normal people running.

Phoenix was a ground-up redesign. The name itself is symbolic—the mythical bird rising from ashes. ACINQ took everything they learned from Eclair Mobile and rebuilt the experience around one principle: make Lightning feel like a regular Bitcoin wallet. No exposed complexity. No confusing terminology. No channel management screens. Just send and receive Bitcoin, instantly and cheaply.

The initial release was labeled "second-generation Lightning wallet." But the real game-changer came in 2023 with the splicing update—what ACINQ calls the "third generation." By implementing channel splicing, Phoenix eliminated the 1% inbound liquidity fee and moved to a model where users only pay actual mining fees for on-chain operations. This made Phoenix not just easy to use, but also more predictable and fair.

The US Exit: In April 2024, Phoenix exited the US market. Following the arrest of Samourai Wallet founders on money laundering charges, ACINQ made the tough call to remove Phoenix from US app stores effective May 3, 2024. The move was precautionary—US authorities were signaling that self-custodial wallet providers, Lightning service providers, and even Lightning nodes might be classified as Money Services Businesses requiring licensing.

Rather than risk prosecution, ACINQ pulled out. It was a dark day for US Bitcoin users and a stark reminder that regulatory hostility can kill innovation. Phoenix still works everywhere else, and US users who sideload can still use it but the precedent sucks.

Why Phoenix is the People's Lightning Wallet

Phoenix nailed the balance that every Lightning wallet struggles with: powerful enough for Bitcoiners, simple enough for your mom. Here's why it works:

Zero Channel Management

With traditional Lightning wallets, you're constantly thinking about channels. Do I have inbound liquidity? Should I open another channel? What's my channel capacity? Phoenix makes all of this invisible. The wallet automatically manages your single dynamic channel using splicing. Receiving a payment? Phoenix splices in capacity. Sending on-chain? Phoenix splices out. You literally never think about channels. They just work.

Splicing Magic

Splicing is the killer feature. Instead of creating new channels every time you need liquidity (the old Phoenix model), the wallet resizes your existing channel on the fly. This means one on-chain UTXO instead of scattered liquidity across multiple channels. It's cleaner, cheaper, and more predictable. When you pay for liquidity, you're only paying the actual mining fee—no percentage-based fees. Phoenix's splicing implementation is so good that ACINQ predicts all Lightning wallets will eventually adopt it.

Simple Backup and Recovery

Lightning wallet backups have historically been a nightmare because channel states change with every transaction. Phoenix solves this with a traditional 12-word seed phrase that actually works. Lose your phone? Download Phoenix on a new device, enter your seed phrase, and your channels and funds are restored. ACINQ's nodes cooperate in the recovery process because they have reserves in the channels too—it's in everyone's interest to recover properly.

Instant Onboarding

First-time Bitcoin users face a paradox with Lightning: you need Bitcoin to receive Bitcoin (because opening channels costs sats). Phoenix handles this elegantly. When you receive your first payment, Phoenix automatically opens a channel using ACINQ's liquidity. The channel is "trusted until confirmed"—meaning you can start using it immediately, before the on-chain transaction confirms. It's like accepting zero-conf Bitcoin transactions, but built into the Lightning experience.

Transparent Fees

Pre-splicing Phoenix charged a 1% fee for inbound liquidity plus 3,000 sats minimum. It worked, but felt arbitrary. Post-splicing Phoenix shows you the exact mining fee for on-chain operations and charges a fixed 0.4% for Lightning routing. No surprises. No hidden costs. You see the fee before confirming. This transparency builds trust and aligns incentives between users and ACINQ.

BOLT12 Support

Phoenix supports BOLT12 offers—reusable, static Lightning payment requests that don't expire. Think of them as Lightning's version of Bitcoin addresses. Perfect for donations, tips, or paying friends repeatedly. You generate a BOLT12 offer once and share it everywhere. People can pay you multiple times without you generating new invoices. It's a massive UX improvement over traditional Lightning invoices that expire in minutes.

Multi-Wallet Support

Phoenix lets you manage multiple wallets in parallel, each with its own name and avatar. Want to separate spending money from savings? Create two wallets. Want a dedicated wallet for donations? Create another. Each wallet operates independently with its own channels and seed phrase. This is clutch for organization and privacy.

Advantages

- True Self-Custody: You hold the keys. Phoenix never has custody of your funds. It's your Bitcoin, your responsibility.

- Zero Channel Management: Splicing handles everything automatically. You never think about channels, liquidity, or capacity.

- Lightning Fast: Instant payments. Near-zero fees for Lightning transactions. This is what Bitcoin payments should feel like.

- Simple Backup: 12-word seed phrase that actually works. No complicated channel backup schemes.

- On-Chain + Lightning: Seamlessly send and receive both Lightning and on-chain Bitcoin. Best of both worlds.

- Mobile Native: Built for iOS and Android from the ground up. Actually works on mobile networks.

- Open Source: Fully transparent code. Community audited. No black boxes.

- Trusted Team: Built by ACINQ, Lightning OGs with the largest node on the network. They know what they're doing.

- Clean UI: Minimal, beautiful interface. Everything you need, nothing you don't.

- Taproot Channels: Supports Taproot for better privacy and lower on-chain fees.

Disadvantages

- US Exit: Removed from US app stores in May 2024 due to regulatory pressure. US users must sideload or use alternatives.

- ACINQ Dependency: Phoenix only connects to ACINQ nodes. While this enables the great UX, it means ACINQ sees your payment metadata (amounts, destinations). Not fully decentralized.

- Limited Privacy: Because all channels go through ACINQ, they have visibility into your Lightning activity. Better than centralized exchanges, but not as private as fully decentralized solutions.

- Mobile Only: No desktop version. If you want Lightning on your computer, look elsewhere.

- On-Chain Fees for Splicing: Every splice operation hits the blockchain and costs mining fees. During high-fee periods, this can add up.

- Single Point of Failure: If ACINQ's infrastructure goes down, Phoenix wallets can't route payments. The centralization trade-off for better UX.

- Learning Curve: While easier than most Lightning wallets, there's still friction for complete Bitcoin beginners. Lightning concepts can confuse newcomers.

- Can't Choose Payment Channels: Advanced users who want control over channel peers and routing are out of luck. Phoenix abstracts everything.

Phoenix vs. Other Lightning Wallets

| Feature | Phoenix | Zeus | Wallet of Satoshi |

|---|---|---|---|

| Custody | Self | Self | Custodial |

| Ease of Use | Excellent | Advanced | Easiest |

| Setup | 2 min | 30+ min | 30 sec |

| Node Required | No | Yes | No |

| Privacy | Moderate | High | Low |

| Best For | Most users | Node runners | Beginners |

Getting Started: Setup Guide

Getting Phoenix running takes about 2 minutes. Here's how:

Download and Install

- iOS: Download from the App Store (non-US regions only). Search "Phoenix Wallet" or visit phoenix.acinq.co for the link.

- Android: Download from Google Play (non-US regions) or grab the APK directly from phoenix.acinq.co.

- US Users: Phoenix was removed from US stores in May 2024. You can still sideload the APK (Android) or use alternative methods, but do so at your own risk regarding regulatory implications.

Initial Setup

- Create New Wallet: Open Phoenix and tap "Create New Wallet."

- Write Down Seed Phrase: Phoenix generates a 12-word recovery phrase. Write this down. Do not screenshot. Do not store digitally. Physical paper in a safe place. Lose this and your funds are gone forever.

- Verify Seed Phrase: Phoenix will test you on the seed words. This ensures you wrote them down correctly.

- Set PIN (Optional): Add a spending PIN for extra security. Recommended if your phone lacks biometric security.

Receiving Your First Payment

- Tap Receive in Phoenix.

- Lightning Invoice: For Lightning payments, Phoenix generates an invoice. Share the QR code or copy the invoice string.

- On-Chain Address: Tap "Bitcoin Address" to get an on-chain address. Use this for your first deposit if you're receiving from a centralized exchange or on-chain wallet.

- First Payment Auto-Setup: When you receive your first payment (Lightning or on-chain), Phoenix automatically creates your channel. You'll see a notification showing the fee (mining cost). The funds will be available immediately, even before blockchain confirmation.

- Wait for Confirmation: On-chain deposits need blockchain confirmations. Lightning is instant.

Sending Payments

- Tap Send in Phoenix.

- Scan QR Code: Scan a Lightning invoice, BOLT12 offer, or Bitcoin address. Phoenix auto-detects the type.

- Enter Amount: If the invoice doesn't specify an amount, enter how much you want to send.

- Review Fee: Phoenix shows the routing fee (0.4% for Lightning) or mining fee (for on-chain). Confirm it's acceptable.

- Send: Hit send. Lightning payments settle in seconds. On-chain takes longer depending on fee rate and network congestion.

Pro Tips

- Use Lightning for Small Payments: Coffee, tips, online purchases—Lightning is perfect for daily transactions. Instant and cheap.

- Use On-Chain for Large Amounts: Moving significant funds? On-chain is more robust for big transfers. Phoenix makes it seamless.

- Generate BOLT12 Offers: Go to Settings > BOLT12 Offers. Create a reusable payment link for donations or recurring payments.

- Monitor Your Channel: Tap "Channels" to see your channel status. Phoenix handles everything, but it's cool to see how splicing works.

- Backup Regularly: Your seed phrase is your backup. But double-check you have it written down safely, especially before updating Phoenix or your OS.

Final Assessment

Phoenix is what happens when Lightning veterans actually listen to user feedback. ACINQ could have built another technical wallet for node operators and called it a day. Instead, they went back to first principles and asked: what would a Lightning wallet look like if normal people were the target audience? The answer is Phoenix.

The splicing implementation is genuinely revolutionary. Before Phoenix's splicing update, every Lightning wallet forced users into an awkward dance of managing multiple channels, scattered liquidity, and unpredictable fees. Phoenix's single dynamic channel model is so obviously superior that it's embarrassing other wallets haven't adopted it yet. One UTXO per user. Predictable fees. No liquidity fragmentation. This is the future.

But Phoenix isn't perfect, and we need to be honest about the trade-offs. The biggest issue is ACINQ dependency. Every Phoenix wallet connects exclusively to ACINQ nodes. This enables the seamless UX—automatic channel management, instant onboarding, reliable routing—but it comes at a privacy cost. ACINQ sees your payment metadata: amounts, frequencies, destinations. They've never abused this visibility (as far as we know), and their business model doesn't incentivize surveillance, but the centralization is real.

For hardcore privacy advocates, this is a dealbreaker. If your threat model includes avoiding any third party seeing your payment patterns, Phoenix isn't for you. Run your own node with Zeus or use fully decentralized solutions. But for 95% of Lightning users, Phoenix's privacy trade-off is acceptable given what you get in return: a wallet that actually works without requiring a CS degree.

The US exit stings. Phoenix was one of the best on-ramps for American Bitcoiners wanting to try Lightning. ACINQ made the prudent call—regulatory risk in the US is insane right now—but it sucks for American users. You can sideload, you can VPN, you can work around it, but the message is clear: the US government views self-custodial Lightning wallets as a threat. That's terrifying and depressing.

Despite the US exit and the ACINQ centralization, Phoenix remains the gold standard for self-custodial Lightning wallets. If you want sovereignty (your keys, your Bitcoin) without the headache of channel management, Phoenix is unmatched. The UX is smooth, the recovery is reliable, and the splicing tech is years ahead of competitors.

Who Should Use Phoenix?

Phoenix is perfect for:

- Lightning beginners who want self-custody without complexity

- Daily Bitcoin users who need a reliable spending wallet

- People who want Lightning's speed but don't want to run a node

- Anyone tired of custodial Lightning wallets (RIP Wallet of Satoshi)

- Non-US residents who want the easiest self-custodial Lightning experience

Phoenix might not be for:

- Privacy maximalists who need full routing control

- Node operators who want to manage everything manually

- US users unwilling to sideload or deal with regulatory gray areas

- Anyone needing a desktop Lightning wallet

Conclusion

Phoenix proves that self-custody doesn't have to be painful. For years, the Lightning community accepted a false dichotomy: either you go custodial for ease of use (Wallet of Satoshi) or you go self-custodial and suffer through technical complexity (basically everything else). Phoenix shattered that assumption by making self-custody genuinely easy.

The splicing update in 2023 elevated Phoenix from "pretty good" to "best-in-class." By managing a single dynamic channel instead of fragmenting liquidity across multiple channels, Phoenix delivers what users actually want: a wallet that just works. No liquidity issues. No channel management screens. No confusing balance splits. Just Bitcoin that moves instantly and cheaply.

ACINQ's pedigree matters. These aren't random developers who spun up a Lightning wallet over a weekend. They've been building Lightning infrastructure since 2017, they operate the largest Lightning node on the network, and they created Eclair, one of the three major Lightning implementations. When Phoenix handles your channels, you're trusting people who understand Lightning at the protocol level. That expertise shows in the product.

The US exit is a dark chapter, but it's not Phoenix's fault. The US regulatory environment has become hostile to Bitcoin innovation, particularly anything involving privacy or self-custody. ACINQ made the prudent choice to exit before facing potential prosecution. It's a stark reminder that geographical location matters in Bitcoin—freedom-loving jurisdictions will attract development while hostile ones will drive it away.

Yes, Phoenix has trade-offs. The ACINQ dependency means you're trusting their infrastructure and accepting their visibility into your payment metadata. For some users, this is a dealbreaker. But for most people, Phoenix strikes the right balance: self-custody where it matters (you hold the keys), pragmatic centralization where it improves UX (automatic channel management), and transparency about what's happening under the hood (open source, clear fee structure).

The Lightning Network is Bitcoin's scaling solution. Phoenix is Lightning's UX solution. Together, they're making Bitcoin viable as everyday money. That's the mission. Phoenix is executing it better than anyone else.

For anyone outside the US who wants to hold their own keys while using Lightning, Phoenix isn't just a good choice—it's the obvious choice. Download it. Use it. Experience Lightning the way it should work. Then wonder why every other wallet is still stuck in 2019.

DISCLAIMER: This article is provided for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. Bitcoin-builder.com is not affiliated with, sponsored by, or receiving compensation from Phoenix, ACINQ, or any related entities. The information presented reflects research and analysis conducted independently.

About Bitcoin-builder.com: Bitcoin-builder.com is an independent educational resource dedicated to providing unbiased information about Bitcoin, cryptocurrency technologies, and financial sovereignty. We maintain editorial independence and do not accept payment for coverage or reviews.