Every bitcoiner obsesses over security. Hardware wallets, seed phrases, multisig setups, we've built fortresses around our digital gold. But there's a darker question most of us avoid: what happens to your bitcoin when you die?

According to some estimates, millions of bitcoin have vanished forever, not from hacks or exchange collapses, but from something far more mundane, death without a plan. Your ironclad security becomes an impenetrable vault for your loved ones. Nunchuk has built something genuinely different to solve this existential dilemma.

The Inheritance Nightmare Bitcoiners Face

Bitcoin inheritance isn't just tricky, it's a paradox. Give your heirs access to your keys now, and you're inviting theft during your lifetime. Hide them too well, and they'll never be found. Trust a lawyer who doesn't understand cryptographic keys? Good luck with that.

The traditional solutions feel broken from the start. Custodial services defeat the entire point of self-custody. Writing down seed phrases and locking them in a safe deposit box assumes your family knows where to look, understands what they're looking at, and can navigate Bitcoin wallets under the stress of grief. Pre-signed transactions become invalid if you move funds. It's a mess.

Enter Nunchuk, a multisignature Bitcoin wallet that treats inheritance planning as a core feature rather than an awkward afterthought.

What Makes Nunchuk Different

Nunchuk operates as a collaborative custody platform built on multisignature technology. In simple terms: instead of one private key controlling your bitcoin, you need multiple keys to authorize any transaction. Lose one key? No problem, you can still access your funds. Want to spend? You'll need approval from multiple keys, making unauthorized transactions nearly impossible.

But here's where Nunchuk diverges from competitors like Casa or Unchained: it's designed as a coordination layer, not a packaged solution. You choose who holds which keys, configure your own policies, and maintain sovereignty. The platform is open-source, requires zero KYC, and allows you to connect to your own Bitcoin node.

Most critically for inheritance planning, Nunchuk has pioneered the use of a dedicated inheritance key completely separated from your daily spending keys.

The Inheritance Key: How It Actually Works

Traditional inheritance planning forces an impossible choice: involve your beneficiaries now and risk premature access, or keep them in the dark and hope they figure everything out later. Nunchuk's inheritance mechanism sidesteps this entirely through cryptographic timelocks and a dual-secret system.

Here's the architecture: when you set up inheritance planning through Nunchuk's Honey Badger plan, you create a special fourth key that lives on a Tapsigner card. This inheritance key remains completely dormant until an Activation Date you specify. Your beneficiary cannot access it prematurely, the timelock prevents it.

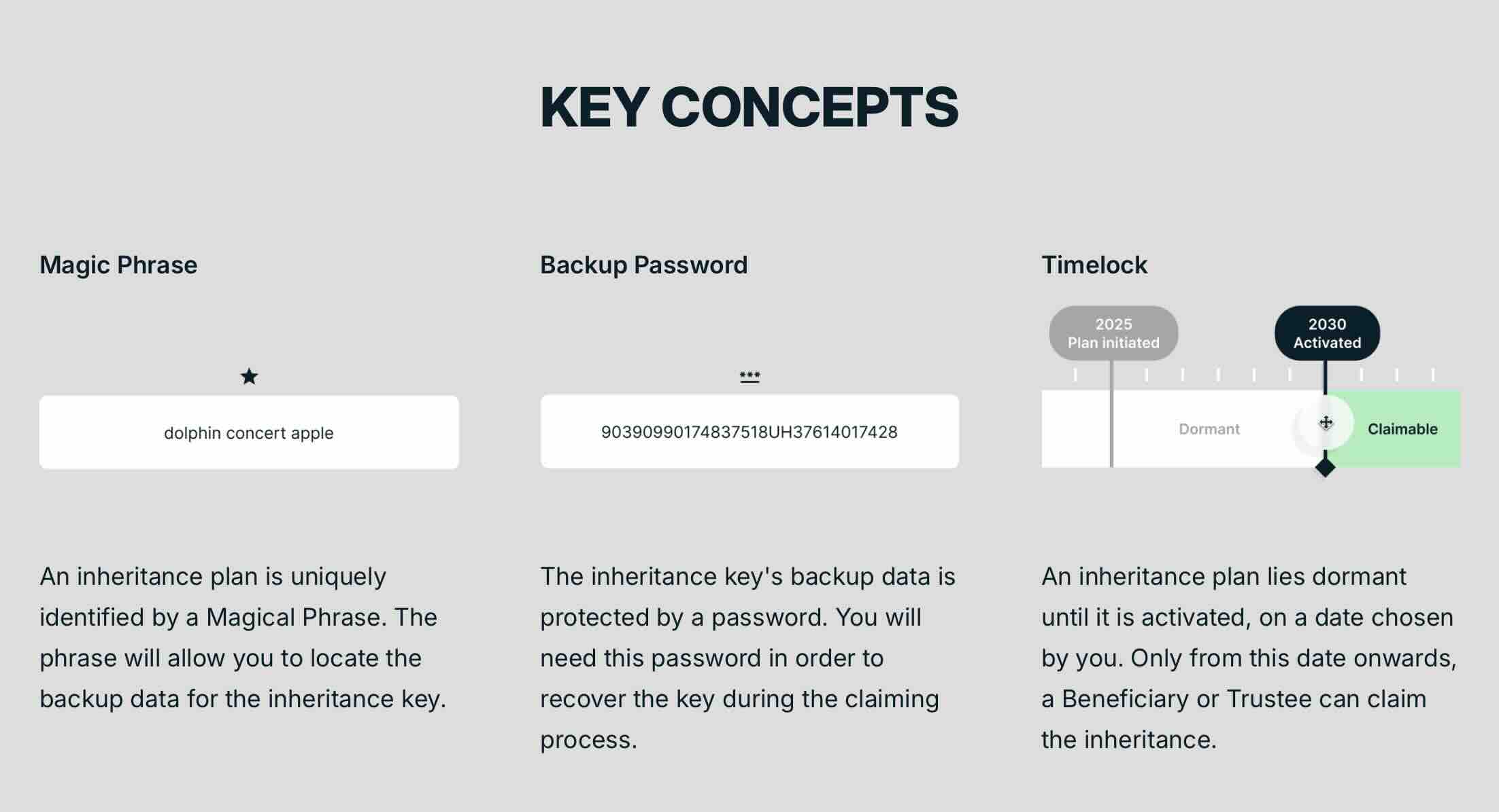

The claiming process relies on two cryptographic secrets:

The Magic Phrase – A unique identifier for your inheritance plan

The Backup Password – Protection for the inheritance data

You have complete flexibility in how you distribute these secrets. Want your spouse to have both? That's direct inheritance. Prefer splitting control between a beneficiary and a trusted advisor? That's joint control. You can even designate a trustee to hold both secrets independently—indirect inheritance.

When you pass away and the Activation Date arrives, your beneficiary initiates a claim by providing both secrets. There's a buffer period (typically seven or thirty days) during which Nunchuk notifies you multiple times. If you're still alive and someone's trying to claim your bitcoin, you can block it instantly. If you've genuinely passed, the silence confirms the claim should proceed.

Three Tiers: From Cypherpunk to Family Planning

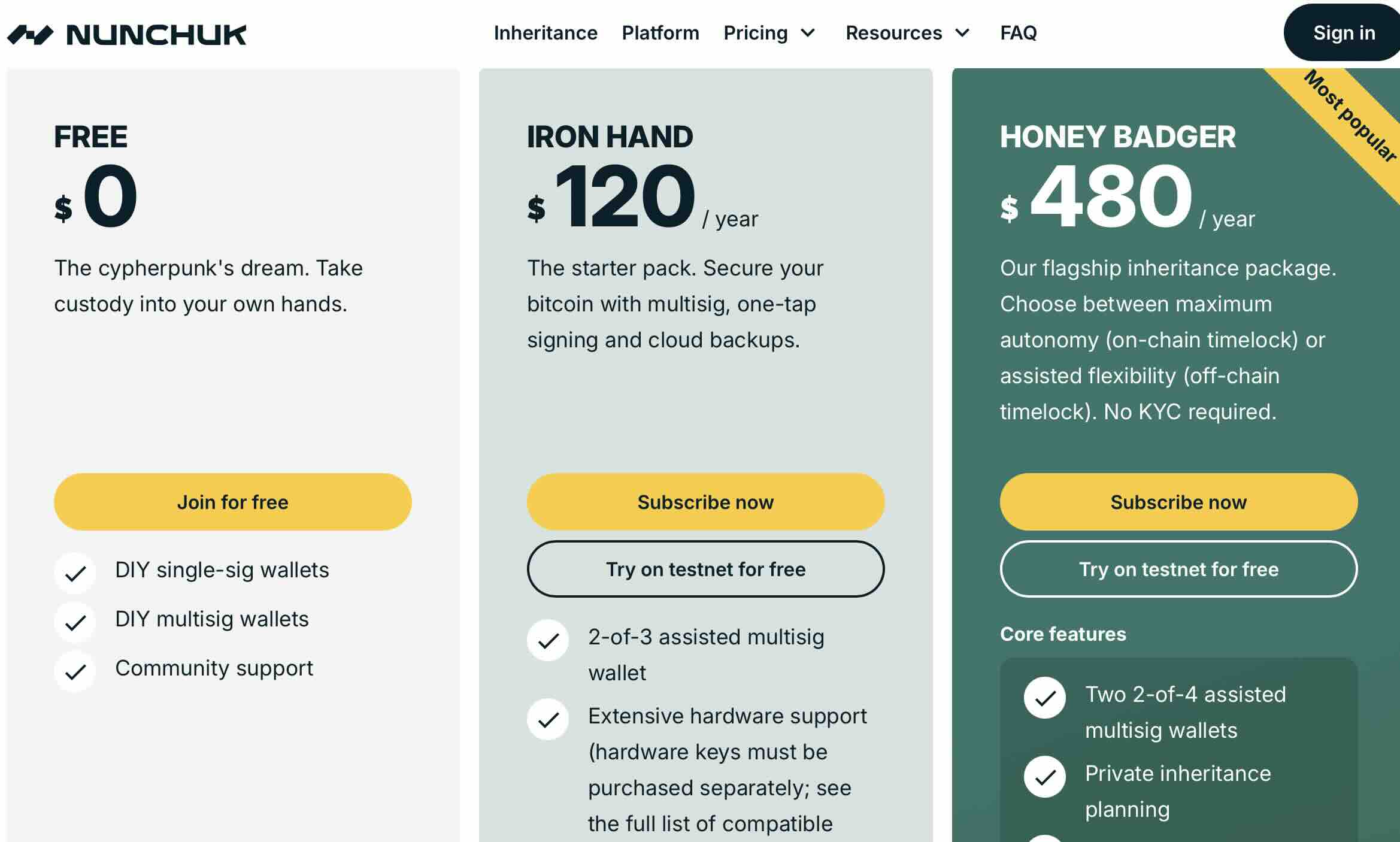

Nunchuk offers a genuinely free tier alongside two paid subscription options:

Free Tier: The Cypherpunk's Dream

Cost: $0

This isn't a neutered trial version. You get full DIY multisig support, the ability to create single-signature or multisignature wallets with any configuration you want, and complete control over your setup. If you're technically savvy and comfortable managing everything yourself, you don't need to pay a dime.

Iron Hand: Entry-Level Assisted Security

Cost: $120/year

This plan introduces Nunchuk's assisted multisig service. You get a 2-of-3 wallet where Nunchuk holds one key while you control the other two through hardware wallets of your choice. It includes cloud backup for wallet configuration, one-tap signing via NFC-enabled cards, spending limits, and co-signing delays to prevent errors or unauthorized transactions.

Iron Hand is ideal for those who want enhanced security without diving deep into inheritance complexity.

Honey Badger: The Complete Package

Cost: $480/year

This is Nunchuk's flagship offering. Everything from Iron Hand, plus:

- 2-of-4 multisig (one additional key for extra redundancy)

- Dedicated timelocked inheritance key

- Full inheritance planning with multiple beneficiary options

- Policy controls over the platform key

- Scheduled transactions up to a year in advance

The Honey Badger plan is what most serious bitcoiners will gravitate toward. At roughly $40 per month, it's pricier than Iron Hand but significantly less expensive than traditional estate planning for high-net-worth individuals—and infinitely more privacy-preserving.

There's also a small 0.1% fee when beneficiaries claim inherited funds, which seems reasonable given the complexity of what's being coordinated.

Privacy Without Compromise

One of Nunchuk's most compelling features is what it doesn't require: your identity.

No KYC. No passport scans. No proof of address. Just an email address to get started—and even that may eventually become optional as Nunchuk plans to implement private key authentication.

The inheritance plan operates on cryptographic secrets rather than proof of identity, meaning both you and your beneficiary can maintain complete privacy throughout the process. This is nearly impossible with traditional estate planning, where lawyers, courts, and financial institutions create extensive paper trails.

For bitcoiners who've spent years practicing operational security, this approach preserves the privacy that makes Bitcoin valuable in the first place.

Hardware Support: Bring Your Own Keys

Nunchuk doesn't lock you into proprietary hardware. The platform supports virtually every major Bitcoin hardware wallet:

- Coldcard (Mk4, Q models)

- Tapsigner

- Ledger (Nano S Plus, Nano X)

- Trezor (Model One, Safe 3, Safe 5, Model T)

- Jade

- Keystone 3 Pro

- Passport Core

- SeedSigner

- Specter DIY

- And more

This flexibility means you can choose devices based on your own security assessment rather than being forced into whatever the platform sells. Combined with the option to run your own Bitcoin node and connect via Tor, Nunchuk offers sovereignty that few competitors match.

The Technical Foundation: Miniscript and Timelocks

Under the hood, Nunchuk uses Bitcoin's native scripting capabilities to enforce inheritance conditions. The current implementation uses off-chain timelocks managed by the Nunchuk platform, but the company is working toward on-chain timelocks using OP_CHECKLOCKTIMEVERIFY once hardware wallet support improves.

The wallet also supports Miniscript, allowing advanced users to create custom spending policies with templates. Want bitcoin that locks immediately upon deposit and only becomes spendable after a specific date? That's the "Zen Hodl" template. Need more complex rules? Build them yourself.

This programmability gives Nunchuk exceptional flexibility compared to more rigid solutions.

What Could Go Wrong?

No system is perfect. Here are the honest limitations:

➔ Learning curve – Nunchuk doesn't hold your hand as much as Casa or Bitkey. If you're new to Bitcoin, the flexibility can feel overwhelming. You'll need to understand multisig concepts and take responsibility for your setup.

➔ Timelock dependency – Currently, the timelock in Honey Badger is enforced off-chain by the Nunchuk platform rather than through Bitcoin's native scripting. If Nunchuk disappears, there's a recovery mechanism, but on-chain timelocks would be more trustless.

➔ Hardware requirements – Unlike Bitkey's all-in-one package, you need to bring your own hardware wallets. This adds upfront cost and complexity.

➔ Beneficiary education – Your heirs still need basic competence with technology. If your beneficiary can't follow instructions to download an app and input two secrets, even the best inheritance plan won't help.

➔ Lost secrets risk – If beneficiaries lose both the Magic Phrase and Backup Password, the inheritance becomes inaccessible. There's no customer support backdoor.

These aren't dealbreakers, but they matter. Nunchuk rewards those who value sovereignty over simplicity.

Who Should Use Nunchuk?

Nunchuk shines for specific types of bitcoiners:

- Privacy-conscious holders who refuse to submit KYC for their inheritance plan

- Technically capable users comfortable with multisig concepts and willing to manage hardware

- Long-term hodlers planning generational wealth transfer

- Those with significant holdings where $480/year for Honey Badger represents trivial insurance

- Those with significant holdings where $480/year for Honey Badger represents trivial insurance

- Technically capable users comfortable with multisig concepts and willing to manage hardware

If you want maximum hand-holding, Casa might suit you better. If you need collateralized Bitcoin loans, Unchained offers that. But for users who want flexible, private, non-custodial inheritance planning with no identity requirements—Nunchuk is currently the best tool available.

The Bigger Picture: Making Bitcoin Survivable

Bitcoin's promise of unstoppable money rings hollow if it doesn't survive the people who hold it. Traditional inheritance solutions are often privacy-invasive, expensive, and tightly integrated into state institutions, recreating the fiat system bitcoiners sought to escape.

Nunchuk offers a genuinely different path: cryptographically enforced inheritance that works independently of courts, lawyers, and custodians. It's not perfect, nothing is, but it represents serious progress toward making Bitcoin genuinely multi-generational.

The platform currently secures over $1 billion in bitcoin for users worldwide. More importantly, it's pioneering a model where inheritance planning doesn't require sacrificing the core principles that make Bitcoin valuable: permissionless access, privacy, and self-sovereignty.

Your bitcoin fortress shouldn't become your family's prison. Nunchuk helps ensure it doesn't.

For more information, visit nunchuk.io or explore their open-source code on GitHub.