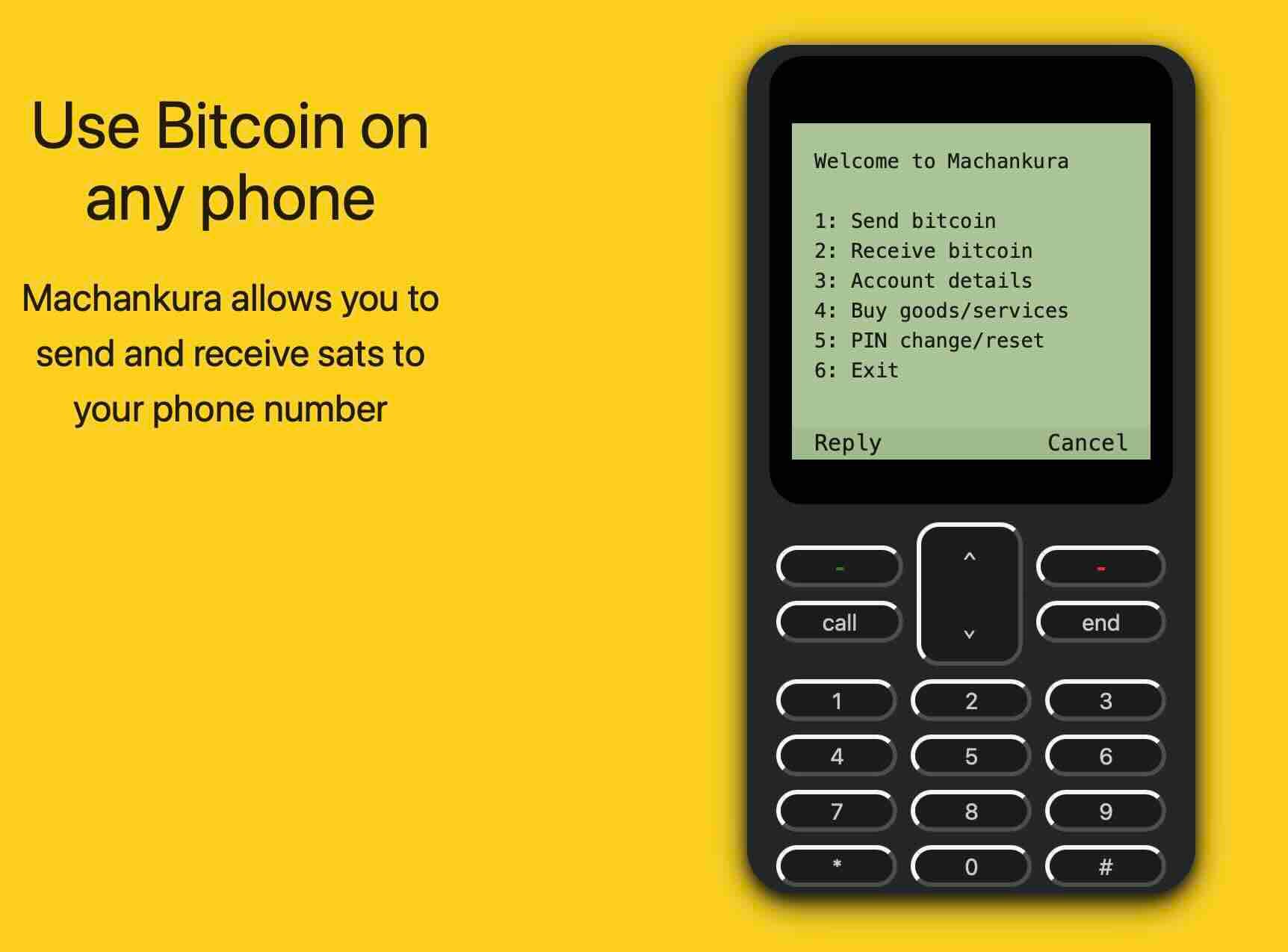

In a world where most crypto services demand smartphones and stable internet, one African entrepreneur is flipping the script. Kgothatso Ngako's Machankura lets users send and receive bitcoin using nothing more than a basic flip phone and USSD codes. No app downloads. No data plans. Just bitcoin, accessible to anyone with a mobile number.

For a continent where internet penetration lags behind global averages and smartphones remain expensive, this approach could unlock financial sovereignty for millions. Here's how Machankura is making it happen.

The Problem Bitcoin Still Hasn't Solved

Since launching in 2009, bitcoin promised to revolutionize financial access for underserved populations. Yet sixteen years later, critical barriers remain for those who need it most.

The Broken Promise of Financial Inclusion

Bitcoin promised financial inclusion for the unbanked and a cheaper alternative to traditional remittances. High transaction fees and scalability issues have limited mainstream adoption, especially in developing regions.

The Lightning Network brought some relief with faster, cheaper payments. But technical complexity remains a barrier. Long alphanumeric addresses and the risk of losing funds through simple mistakes intimidate everyday users.

The Infrastructure Gap

The requirement for smartphones and internet access excludes vast populations in rural Africa. This disconnect between bitcoin's promise and its practical accessibility created an opening. Ngako, a former Amazon Web Services developer, saw it clearly. If bitcoin was meant to bank the unbanked, why did it require expensive devices and constant connectivity?

Enter Machankura: Bitcoin Over USSD

Machankura launched in mid-2022 with a radical premise that bypasses traditional crypto infrastructure entirely. The platform enables bitcoin transactions through basic mobile technology available to billions.

How It Works

The platform enables bitcoin transactions via USSD codes, the same technology that powers mobile money services across Africa. Users dial a simple code on any phone, even decades-old models, and instantly access bitcoin services.

The onboarding process is straightforward. First-time users dial their country-specific USSD code. The system automatically creates a Lightning Network wallet linked to their phone number. Users set a PIN to encrypt the wallet and authorize future transactions. That's it. No KYC forms. No app installations. No email verification.

https://t.co/HHs7assp8E pic.twitter.com/C58pudq25z

— Machankura 📞⚡ 8333.mobi (@Machankura8333) November 3, 2025

Satoshis Make Microtransactions Possible

The service operates in satoshis rather than full bitcoin, making everyday transactions feel natural. One satoshi equals roughly $0.0002, making microtransactions feasible. This matters in economies where people transact in small daily amounts. With 10 dollars buying approximately 142,500 satoshis, the denomination feels accessible rather than abstract.

Transaction fees sit at 1% for sends, competitive with traditional remittance services. The Lightning Network integration keeps costs low while maintaining speed. Users can send and receive payments instantly, regardless of whether the recipient uses Machankura or another Lightning wallet.

Growing Pains and Geographic Expansion

Machankura's journey from concept to reality hasn't been without obstacles. Growth has been steady but reveals critical infrastructure gaps that need solving.

From 3,500 to 13,600 Users

Early adoption came slowly. By April 2023, Machankura had attracted roughly 3,500 users across six countries including Ghana, Kenya, Malawi, Namibia, Nigeria, and South Africa. The platform had already withdrawn from Tanzania and Uganda due to regulatory challenges.

Machankura is live in ~8 African countries.

— Machankura 📞⚡ 8333.mobi (@Machankura8333) January 5, 2023

Try it out by dialing either of these numbers from any of these countries. pic.twitter.com/51z65mkv4P

One year later, the picture looked different. User numbers jumped to 13,600, and the service expanded to seven African nations. Growth accelerated as word spread through communities familiar with mobile money but new to cryptocurrency.

The Fiat Onramp Challenge

The biggest challenge remains onboarding fiat currency into the system. Most deposit methods still require internet access, except in South Africa. There, Azteco operates a widespread voucher network. Users visit local shops, purchase vouchers with cash, and redeem them for bitcoin using their USSD code. This offline onramp doesn't exist yet in other African markets.

"There isn't really a bitcoin onramp that works for people who don't have an internet-connected device," Ngako explained. "The only one I can say works for people without connected devices is Azteco. So far, Azteco only has an extensive vendor network in South Africa."

Solving this chicken-and-egg problem will determine whether Machankura can scale beyond early adopters. The team is working to replicate the Azteco model across more countries, bringing fully offline bitcoin access to new markets.

Machankura : The Self-Custody Revolution

Machankura's next evolution addresses one of crypto's most fundamental tensions between convenience and control. The shift from custodial to non-custodial represents a major technical and philosophical leap.

Why Custodial Services Pose Risks

Machankura currently operates as a custodial service. The platform holds users' private keys, offering convenience and customer support but requiring trust. If something goes wrong, users can call for help. Lost PINs can be reset. Technical issues get resolved.

This custodial model provides comfort for crypto newcomers but carries risks. When governments target crypto platforms, custodial services become pressure points. Nigeria's recent actions against Binance illustrated this danger. Authorities detained executives and demanded the CEO appear in person, creating what Ngako called "a ransom situation."

Introducing the Bitcoin Java Card

The incident pushed Ngako toward a critical decision about Machankura's future architecture. At the January 2024 Adopting Bitcoin conference in Cape Town, he announced the Bitcoin Java Card project. This initiative will transform Machankura into a non-custodial platform, giving users full control of their private keys.

The technology leverages Java Card software embedded in SIM cards. These chips can generate SegWit addresses, sign transactions, and store keys securely. Users insert the upgraded SIM into their basic phones, instantly converting them into hardware wallets. No smartphone required. No internet connection needed.

Technical Implementation

The Java Card solution represents sophisticated engineering adapted for simple devices. "The Java Card project is a chip that's embedded in your SIM card," Ngako explained. "You can program an applet on that chip with bitcoin-related features like signing. We've programmed the ability to generate a SegWit address and are now waiting for the next step, which is communicating with a relay like an Electrum server."

The system will communicate with blockchain data via SMS, receiving balance updates and broadcasting signed transactions. Once complete, users gain true financial sovereignty while maintaining the simplicity that makes Machankura accessible.

Why Banning Bitcoin Might Help

Ngako holds counterintuitive views about regulation that challenge conventional wisdom in the crypto space. His perspective comes from observing how regulatory environments shape technical decisions.

A Provocative Take on Regulation

At last year's African Bitcoin Conference, Ngako made a provocative statement. Asked what African governments could do to support bitcoin adoption, he answered simply: "Ban it."

The response wasn't sarcasm. Ngako argues that prohibition forces entrepreneurs to build censorship-resistant infrastructure from day one. When bitcoin operates legally, developers often take shortcuts, building centralized services that work until regulators intervene.

Building for Resilience

His philosophy has concrete implications for how Machankura develops. "When it's not banned, you do what you can and hope things go well," Ngako said. "If bitcoin is banned, it will be the ideal situation for an African entrepreneur. It forces you to take a heavy, decentralized, censorship-resistant approach, but I think that's the way forward."

This philosophy shaped Machankura's evolution toward self-custody. Living in Africa and working with local teams, Ngako refuses to build a service that could make colleagues targets during regulatory crackdowns. The Java Card project ensures that even if Machankura disappears, users retain control of their funds.

Hybrid Architecture: Learning from Phoenix and Muun

Machankura's technical roadmap borrows strategically from existing Lightning wallets. Rather than reinventing the wheel, Ngako studies what works and adapts it for feature phones.

Combining the Best of Both Wallets

The technical approach merges lessons from successful Lightning implementations. Muun offers strong on-chain multisig security but charges higher fees. Phoenix recently integrated splicing, combining on-chain reliability with Lightning efficiency at lower cost.

Ngako plans to merge both approaches. The hybrid architecture will provide Phoenix's cost efficiency with Muun's security model, adapted for feature phones.

Being Transparent About Costs

Machankura takes an unusually honest approach to fee structures. Users pay an initial setup fee, similar to opening a bank account, then enjoy low-cost Lightning transactions indefinitely.

"In the end, you shouldn't aim for free," Ngako noted. "Consider the first cost like opening a bank account. Opening a bank account is free today, but it wasn't always. It's free at the user's expense. The advantage of Lightning is that once those initial costs are settled and the transaction is launched, you're in a world of bliss."

This transparency about costs reflects Machankura's broader philosophy. Rather than hiding fees in spread or extracting value through obscure mechanisms, the platform charges straightforward transaction fees and explains the economics clearly.

Impact Beyond Transactions

Machankura's significance extends well beyond its technical achievements. The platform addresses real economic problems facing millions of Africans daily.

A Hedge Against Currency Devaluation

In countries experiencing currency devaluation and hyperinflation, bitcoin provides a store of value resistant to government mismanagement. When mobile money services face restrictions or capital controls tighten, Machankura offers an alternative.

The platform also demonstrates bitcoin's adaptability. Critics often dismiss cryptocurrency as a solution for privileged tech enthusiasts in wealthy nations. Machankura proves the opposite. Bitcoin can serve populations with limited infrastructure if developers prioritize accessibility over aesthetics.

User Feedback on Self-Custody

User responses to the self-custody shift reveal interesting tensions between security and convenience. User feedback has been mixed on self-custody. Many appreciate the convenience of custodial services and the ability to call support when problems arise. "People feel they can call me and say, 'This didn't work. Can you fix it?' Many are comfortable with that," Ngako acknowledged.

But the regulatory environment makes custodial services untenable long-term. As bitcoin adoption grows and fiat currencies weaken, governments will seek scapegoats. Non-custodial architecture protects both users and operators from becoming targets.

The Road Ahead

Machankura stands at a critical juncture between proof of concept and mass adoption. The path forward requires solving both technical and logistical challenges.

Challenges to Overcome

Machankura faces significant obstacles in its expansion plans. Expanding offline onramps requires partnerships with local vendors and retailers. Completing the Java Card integration demands solving technical problems around SIM communication and event triggering. Scaling infrastructure to support millions rather than thousands of users requires capital and engineering talent.

A Promising Future

Despite these hurdles, the fundamentals point toward success. Yet the fundamentals look promising. Mobile money adoption across Africa demonstrates demand for accessible financial services. Bitcoin's properties address real needs in economies plagued by inflation and weak currencies. The Lightning Network provides the technical foundation for microtransactions at scale.

If Machankura succeeds, it could reshape bitcoin adoption globally. The platform proves that cryptocurrency doesn't require cutting-edge devices or high-speed internet. It shows that financial sovereignty can reach anyone with a phone number and a desire for economic independence.

A Mission-Driven Approach

For Ngako, the stakes go beyond building a profitable company. "I love living in Africa. I don't want to move to another continent just to say, 'Oh, I'm not affected.' And I love working with my peers. I don't want them to be forced to leave their home country."

That commitment drives Machankura's evolution toward censorship resistance and self-custody. As the platform grows, it's not just connecting Africans to bitcoin. It's proving that bitcoin can deliver on its original promise, one basic phone at a time.