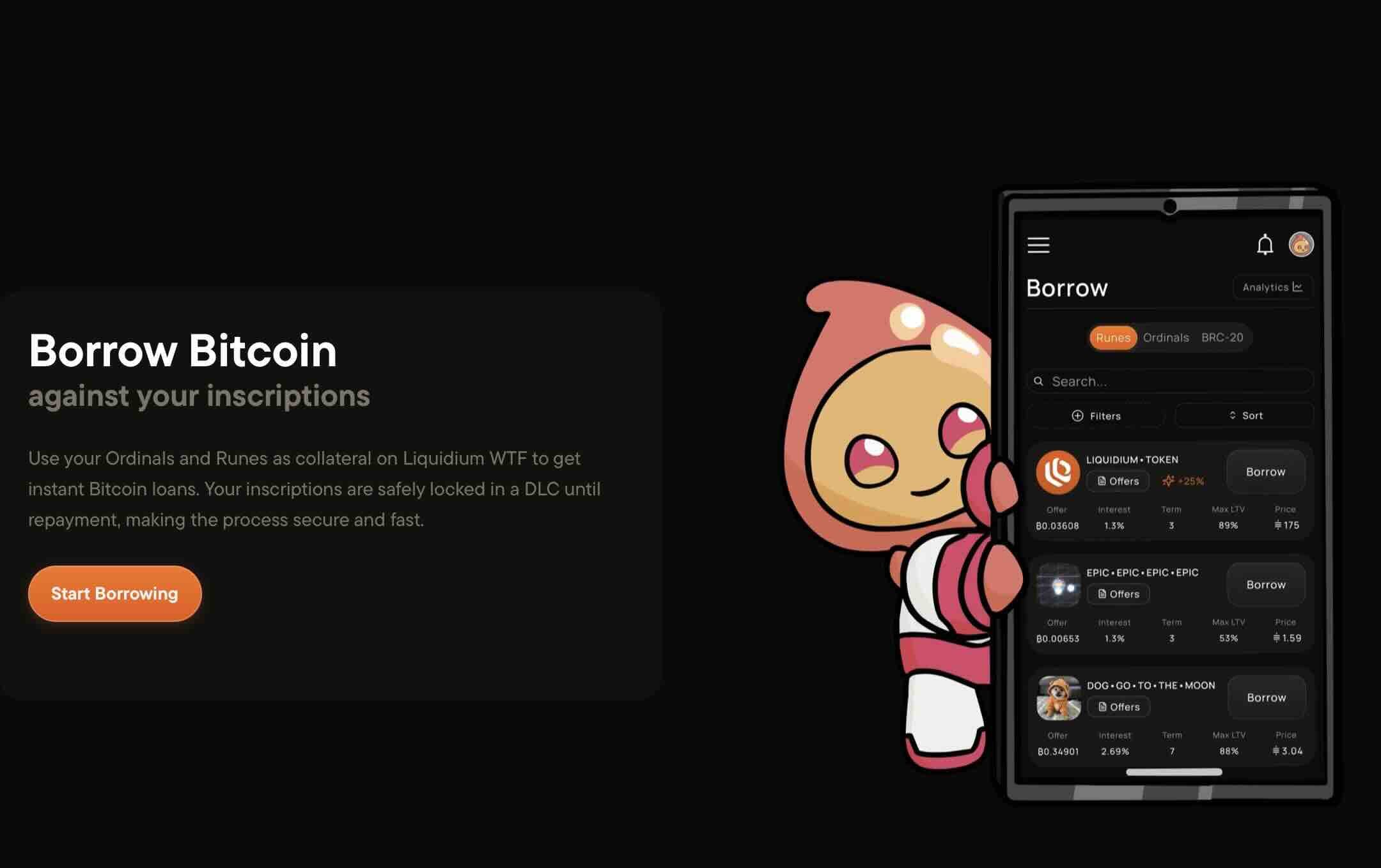

Liquidium WTF (liquidium.wtf) is a decentralized peer-to-peer Bitcoin lending protocol that enables users to borrow and lend Bitcoin using Bitcoin-native digital assets as collateral. The platform supports three types of collateral:

- Ordinals - Unique digital assets inscribed on individual satoshis (Bitcoin NFTs)

- Runes - Bitcoin-native fungible tokens

- BRC-20 tokens - Bitcoin-based fungible tokens

The platform operates entirely on Bitcoin Layer 1, using advanced Bitcoin technologies including:

- Discreet Log Contracts (DLCs) for secure non-custodial escrow

- Partially Signed Bitcoin Transactions (PSBTs) for trustless loan execution

- 2-of-3 multisig wallets for collateral protection

Note: In early 2025, the original Liquidium product rebranded to "LiquidiumWTF" to embrace its community-driven, meme-heavy culture. The Liquidium brand is being reserved for a new institutional product launching at Bitcoin 2025 in Las Vegas on May 28, 2025.

As of July 2024, Liquidium has:

- 4,200+ BTC in total loan volume (~$150-200 million USD)

- 100,000+ loans executed

- 80+ BTC paid in yield to lenders (~$2.6-5 million USD)

The platform has become the leading Bitcoin DeFi lending protocol for Ordinals, Runes, and BRC-20 tokens.

Who Created Liquidium & Investors ?

Liquidium was founded in August 2022 by three young entrepreneurs:

- Robin Obermaier - CEO & Co-Founder (Background in Design & Management)

- Julian Mezger - CMO & Co-Founder (Background in Marketing & Management)

- Peter Giammanco - CTO & Co-Founder (Background in Computer Science)

The founders are graduates of the Bitcoin Startup Lab and Bitcoin Frontier Fund accelerator, making them the youngest team to complete both programs.

Liquidium has raised $4 million in total funding over 3 rounds from 17 investors, including: Portal Ventures, DeGods, Newman Capital, AGE Crypto, NGC, ACP Partners, Viden.vc and Wise3 Ventures.

The most recent seed round was in July 2024 for $2.75 million.

Who is Liquidium For?

Borrowers

Liquidium is ideal for:

- Ordinal collectors who need liquidity but don't want to sell their NFTs

- Runes holders looking to access Bitcoin without liquidating their positions

- Bitcoin DeFi users seeking to leverage their digital assets

- Traders who want to maintain exposure to their assets while accessing capital

- Anyone avoiding taxable events by borrowing instead of selling

Lenders

The platform appeals to:

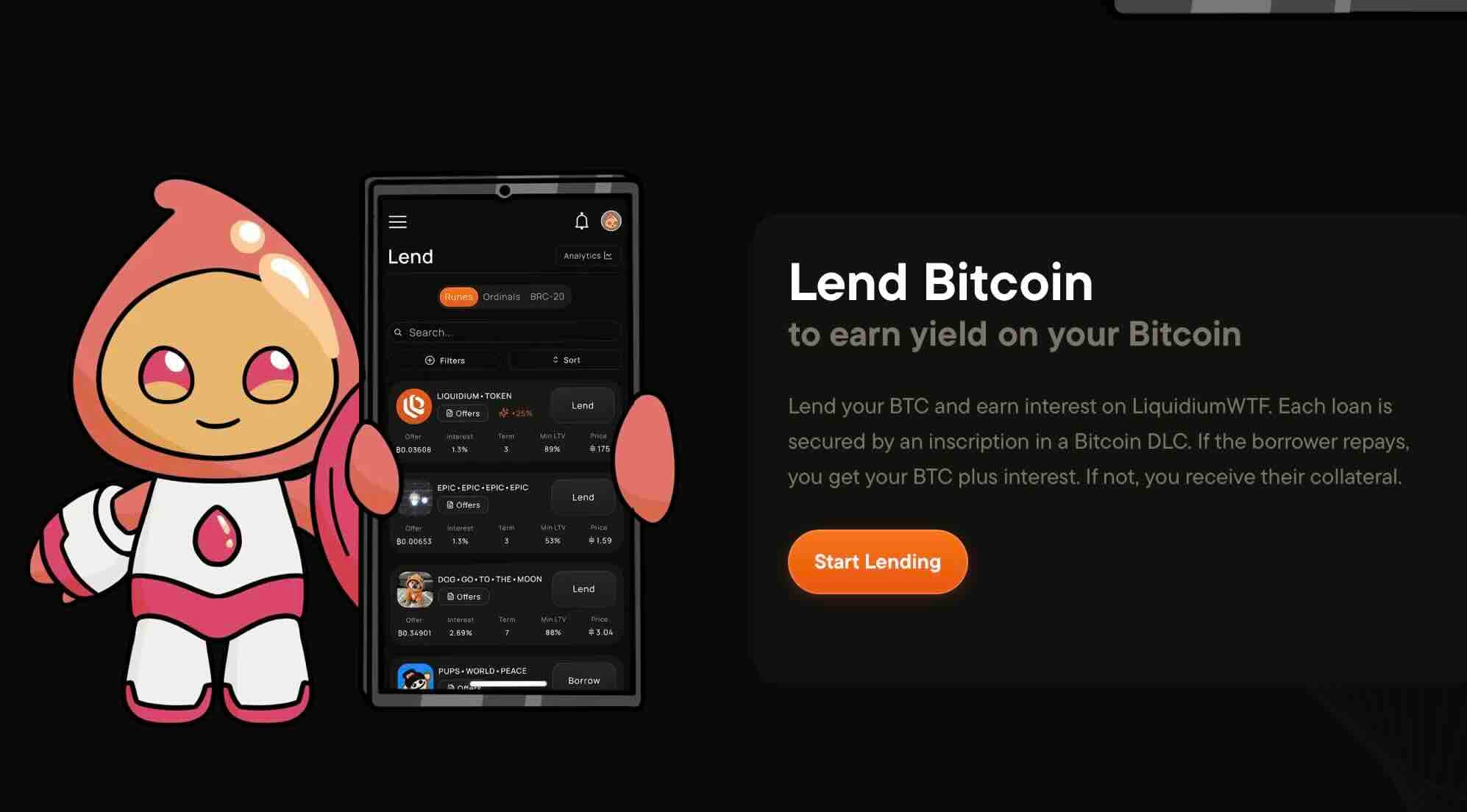

- Bitcoin holders seeking high-yield opportunities (up to 380% APY on select collateral)

- Investors comfortable with Bitcoin-native asset valuations

- DeFi participants looking for Bitcoin-based lending opportunities

- Users who want to earn passive income on their BTC holding.

Additional Features

Runes Swaps - Buy Runes tokens directly with BTC by connecting your wallet

Instant Loans - Runes instant loans represent 98% of all Runes volume

Loan Extensions - Roll over active loans without closing and reopening

OTC Loans - Direct negotiations between parties for custom terms

Compatible Wallets

Liquidium supports the following Bitcoin wallets:

- Xverse : Beginner-friendly, supports Bitcoin L1/L2, Ordinals, Runes, BRC-20, stacking

- UniSat : Advanced features, Bitcoin-focused, open-source, supports Fractal Bitcoin

- Leather : Bitcoin and Stacks focused wallet

Most wallets are available as browser extensions and mobile apps.

Advantages

For Borrowers

✅ Access Liquidity Without Selling - Keep your digital assets and exposure while borrowing Bitcoin

✅ No Taxable Events - Borrowing doesn't trigger capital gains taxes like selling would

✅ Fast Access to Bitcoin - Instant loans once terms are agreed

✅ Maintain Asset Ownership - Your Ordinals/Runes remain yours if you repay

✅ Flexible Terms - Customize loan amount, duration, and interest rates

✅ Portfolio Leverage - Use assets as put options to protect your portfolio

For Lenders

✅ High Yields - Earn up to 380% APY on selected collateral ( be careful always with high yields !)

✅ Collateralized Loans - Every loan is backed by valuable Bitcoin assets

✅ Earn from Defaults - Receive valuable collateral if borrower doesn't repay ✅ Direct Control - Choose exactly which loans to fund based on your risk tolerance

✅ Transparent Process - All transactions visible on Bitcoin blockchain

Liquidium WTF - Disadvantages & Risks Table

| Category | For Borrowers | For Lenders |

|---|---|---|

| Primary Risk | Default Risk - If you don't repay on time, you permanently lose your collateral | Collateral Value Risk - The Ordinal/Rune you receive on default may drop in value |

| Asset Volatility | Collateral Volatility - If your collateral's value drops significantly, you still owe the same BTC amount | Market Volatility - Bitcoin-native assets can be extremely volatile |

| Liquidity Issues | Limited Loan Amounts - Loan size depends on collateral value and lender willingness | Illiquidity Risk - Some collateral assets may be difficult to sell |

| Cost/Evaluation | Interest Costs - High APY rates mean expensive borrowing if held long-term | Due Diligence Required - Must carefully evaluate each collateral piece |

| Technical/Protection | Technical Complexity - Requires understanding of Bitcoin assets, wallets, and UTXO management | No Insurance - Unlike traditional finance, there's no FDIC or similar protection |

Important Considerations

UTXO Management

- Ordinals and Runes exist within Bitcoin UTXOs

- For Ordinals: Must manually manage UTXOs to avoid burning assets

- For Runes: Liquidium automatically splits Runes UTXOs

- Always separate NFTs from regular BTC in your UTXO layout

- Use UTXO-aware wallets

Transaction Fees

- Bitcoin network fees can vary significantly based on congestion

- Budget for gas fees when borrowing or lending

- CPFP (Child Pays For Parent) can accelerate stuck transactions

Collateral Evaluation

- Research floor prices and trading volume

- Consider rarity traits for Ordinals

- Assess market depth and liquidity

- Top collections include: NodeMonkes, Taproot Wizards, OMB (Ordinal Maxi Biz), Bitcoin Puppets

Loan Terms

- Shorter durations = less risk but higher APY

- Longer durations = more risk but potentially lower APY

- Consider your ability to repay before expiration

LIQUIDIUM TOKEN

On July 22, 2024, Liquidium launched the LIQUIDIUM•TOKEN (LIQ), the first governance token on the Runes token standard. The token aims to:

- Decentralize the Liquidium protocol

- Enable community governance

- Foster ecosystem participation

Future Roadmap

Liquidium has announced several upcoming features:

- Instant Loans for Ordinals (following Runes success)

- Loan Extensions (already launched)

- Major Product Launch at Bitcoin 2025 conference (May 28, 2025 in Las Vegas)

- Expansion toward a full DeFi hub similar to Aave but on native Bitcoin

- Liquidity pools for passive income and borrowing

Community and Support

Discord & Telegram - Active communities for:

- Loan negotiations

- OTC deals

- Technical support

- General discussion

Comparison to Competitors

While Liquidium faces competition from platforms, it distinguishes itself through:

- Bitcoin-native focus (no bridging or wrapping)

- Support for Ordinals and Runes (unique to Bitcoin L1)

- Non-custodial design (true DeFi principles)

- DLC technology (eliminating rug pull risk)

- Community-driven culture (WTF branding embraces Bitcoin culture)

Best For

✓ Experienced Bitcoin users comfortable with DeFi ✓ Ordinals/Runes collectors needing liquidity ✓ High-risk tolerant lenders seeking yield ✓ Those who understand Bitcoin-native assets

Not Recommended For

✗ Complete beginners to Bitcoin ✗ Risk-averse investors ✗ Those unfamiliar with Ordinals/Runes markets ✗ Users expecting traditional banking protections

Disclaimer

This review is for informational purposes only and does not constitute financial advice. Cryptocurrency lending and borrowing involves substantial risk, including:

- Total loss of collateral

- Volatility of digital assets

- Smart contract vulnerabilities

- Market liquidity issues

Always conduct your own research, understand the risks, and never invest more than you can afford to lose. Consult with a financial advisor before making investment decisions.

Liquidium WTF is an experimental DeFi protocol operating in a rapidly evolving regulatory environment. Users should be aware of potential regulatory changes that could affect the platform.

Useful Links

- Main Platform: https://app.liquidium.wtf

- X ( Twitter) : https://x.com/LiquidiumWTF

Last Updated: December 2025 Review based on publicly available information and platform documentation