In the evolving landscape of cryptocurrency finance, Bitcoin holders increasingly seek ways to access liquidity without selling their assets or compromising their privacy. This comprehensive review examines Lendasat, a peer-to-peer Bitcoin lending platform that enables users to borrow against their Bitcoin or earn interest by providing loans, all while maintaining control of their funds through a non-custodial approach.

Lendasat represents a new generation of Bitcoin-backed lending services that prioritize user sovereignty and financial freedom. Unlike traditional centralized lenders that require extensive Know Your Customer (KYC) verification and custody of your assets, Lendasat operates as a decentralized marketplace where borrowers and lenders connect directly. Through innovative use of multi-signature escrow and open-source technology, the platform allows individuals to unlock the value of their Bitcoin holdings without surrendering control to third parties or exposing sensitive personal information.

Whether you're a Bitcoin holder looking to access cash without triggering a taxable sale, or an investor seeking yield on stablecoins through Bitcoin-backed loans, Lendasat offers a transparent, non-custodial solution that puts you in control of your financial future.

Lendasat is ideal for:

- Bitcoin holders who need liquidity but don't want to sell during bull markets

- Long-term Bitcoin investors who want to access their wealth without triggering taxable events

- Users seeking non-custodial alternatives to centralized lending platforms

- Lenders looking for Bitcoin-backed passive income opportunities

Lendasat's Key Features

👉 Non-Custodial Security The platform uses multi-signature escrow where multiple parties must approve transactions, meaning even Lendasat cannot move funds alone . This eliminates single points of failure common in centralized lending services.

👉 Loan Options Borrowers can access loans in stablecoins (USDC, USDT) across multiple blockchains including Polygon, Ethereum, Solana, Starknet, and Liquid Network, or receive fiat currency . The platform also offers a unique virtual debit card option for instant spending.

👉 Collateralization All loans require Bitcoin collateral worth at least 110% of the loan value . This over-collateralization protects lenders while allowing borrowers to maintain their Bitcoin holdings during market appreciation.

👉 Interest Rates & Terms Lenders can earn up to 15% APY with monthly payouts, choosing loan terms ranging from 1-24 months . The platform uses fixed-term contracts where lenders receive full principal and interest regardless of early repayment.

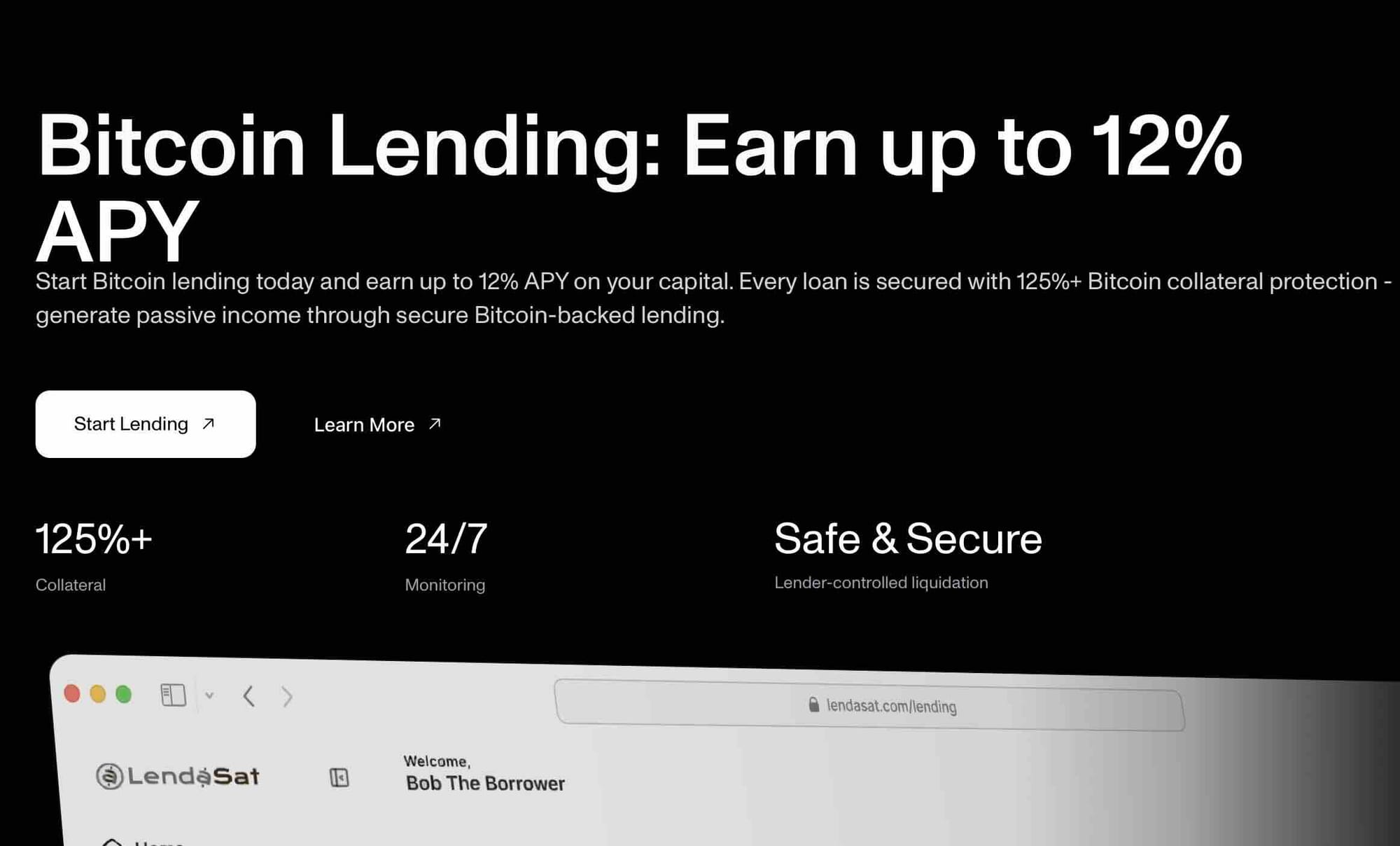

Lendasat's Lending Platform for Passive Income

Lendasat offers lenders the opportunity to earn up to 12% APY by providing stablecoins for Bitcoin-backed loans. The platform emphasizes security through over-collateralization, requiring at least 125% Bitcoin collateral for every loan, which protects lenders from potential losses.

With 24/7 monitoring capabilities and lender-controlled liquidation, users maintain oversight of their investments while generating passive income. The platform's interface welcomes users with a personalized dashboard, making it straightforward to start lending and track loan performance.

This lending opportunity allows investors to earn competitive yields on their capital while benefiting from the security of Bitcoin-backed collateral, creating a lower-risk profile compared to unsecured lending options.

User Experience

The platform leverages Bitcoin's native scripting capabilities and runs on open-source, verifiable technology. During their closed beta, Lendasat uses a 2-of-3 multisig contract with keys distributed among the borrower, lender, and Lendasat.

➡️ Ease of Use Customer reviews on Trustpilot paint a positive picture. Users report the platform is easy to use with fast payouts and responsive support. Recently, Lendasat launched Lendaswap, an atomic swap exchange powered by the Arkade protocol that enables instant, non-custodial trades between Bitcoin and stablecoins.

➡️ Transparency Users appreciate that they can communicate directly with the founders through Discord, which adds a layer of transparency uncommon in financial platforms.

➡️ Integration with Bringin The Bringin partnership allows users to receive borrowed euros via a vIBAN registered in their name, making it harder for banks to flag transactions as cryptocurrency-related. This bridges decentralized finance with traditional banking.

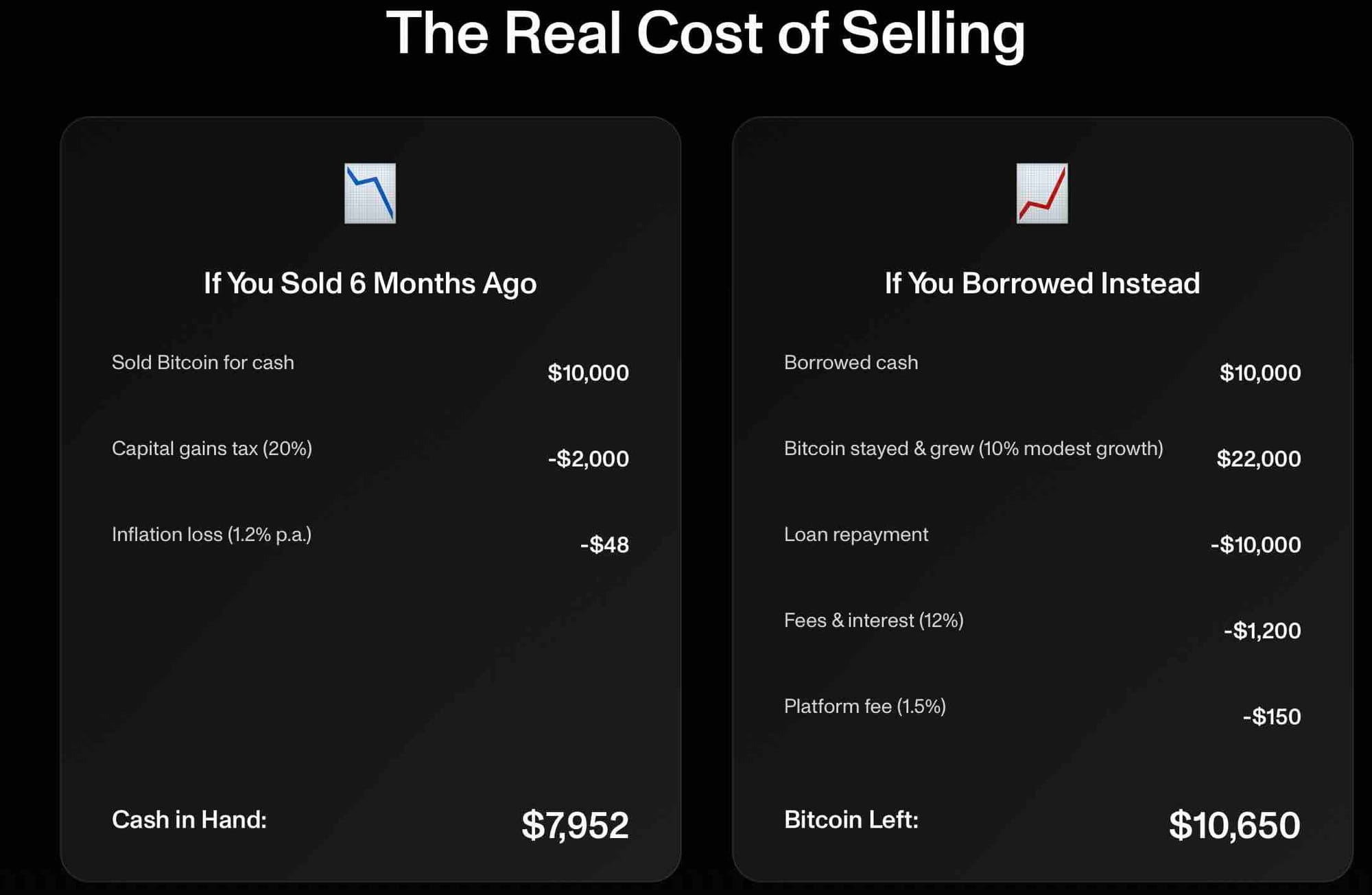

Why Choose a Loan Instead of Selling Bitcoin?

Many Bitcoin holders face a dilemma when they need cash: sell their Bitcoin or find another way to access liquidity. Here's why taking a loan against Bitcoin has become an increasingly popular choice:

Maintaining Long-Term Growth Potential - Bitcoin holders who believe in the long-term appreciation of their asset don't want to sell during temporary cash needs. By borrowing against their Bitcoin, they can access liquidity today while keeping their position for potential future gains. If Bitcoin doubles in value, they benefit from that appreciation while still having met their immediate financial needs.

Avoiding Taxable Events - In many jurisdictions, selling Bitcoin triggers capital gains taxes. A Bitcoin-backed loan, however, is not a taxable event since you're borrowing, not selling. This can result in significant tax savings, especially for long-term holders sitting on substantial gains.

Preserving Investment Strategy - Many Bitcoin investors practice "HODLing" (holding long-term regardless of volatility) as a core investment philosophy. Selling disrupts this strategy and forces them to time the market, which historically has been difficult. Loans allow them to maintain their investment thesis while accessing needed funds.

Opportunity Cost - Selling Bitcoin to pay for something means missing out on any future price appreciation. If you sell $10,000 worth of Bitcoin to buy something, and Bitcoin doubles, you've effectively paid $20,000 for that purchase in retrospect. With a loan, you pay interest, but you keep the upside potential.

Market Timing Avoidance - Nobody wants to be forced to sell during a market dip due to cash needs. Loans provide flexibility to wait for better market conditions if you eventually do need to sell, or to never sell at all if Bitcoin continues appreciating and you can repay the loan from other income sources.

Pros

- True non-custodial ownership - Users maintain control of their Bitcoin throughout the process

- Over-collateralization protects lenders while allowing borrowers to keep their Bitcoin exposure

- Multiple disbursement options including stablecoins, fiat, and virtual debit cards

- Strong user reviews - 4.4/5 stars on Trustpilot with all reviews being 5-star ratings

- Open-source technology provides transparency and auditability

- Global accessibility with multilingual support

- Direct communication with founders via Discord

- No early repayment penalties for borrowers

- Guaranteed full returns for lenders even with early repayment

Cons

- Origination fees - 1.5% charge on the total loan amount

- High collateralization requirements : Need roughly 2x the loan value in Bitcoin

- Limited review sample : Only 10 Trustpilot reviews, though all are positive

- Virtual card limitations - Cards cannot currently be added to Apple Pay or Google Pay ( so far).

Fees

For Borrowers

| Fee Type | Range/Amount | Details |

|---|---|---|

| Interest Rates | 3% - 15% annually | Varies based on platform, loan-to-value ratio, collateral type, and market conditions |

| Origination Fee | 0.5% - 2% | One-time fee charged when loan is created (Lendasat charges 1.5%) |

| Collateral Requirements | 125% - 200% | Amount of Bitcoin needed to secure the loan (Lendasat requires ~110-200%) |

| Blockchain Transaction Fees | Variable | Depends on Bitcoin network congestion at time of transfer |

For Lenders

| Fee Type | Range/Amount | Details |

|---|---|---|

| Annual Yields | 2% - 12% typically | Returns earned on loans provided (Lendasat offers up to 15% APY) |

| Platform Fees | 10% - 30% | Percentage of interest earned taken by the platform |

| Transaction Fees | Variable | Fees for deposits and withdrawals on various blockchains |

| Opportunity Costs | N/A | Capital is locked for the loan duration (1-24 months on Lendasat) |

Lendasat-Specific Fees

- Borrowers: 1.5% origination fee + Bitcoin blockchain fees + interest rates negotiated with lenders

- Lenders: Platform takes a percentage of earnings (specific percentage not publicly disclosed) + blockchain withdrawal fees

Platform Comparison: Lendasat vs Competitors

| Platform | Type | Origination Fee | Interest Rates (APR) | LTV Ratio | Custody Model | Min. Loan | Loan Terms | Key Features |

|---|---|---|---|---|---|---|---|---|

| Lendasat | P2P Non-Custodial | 0.5-1.5% | 3-15% (negotiable) | 110-200% | 2-of-3 Multisig | Varies | 1-24 months | • Virtual debit cards • Bringin integration for EUR • Open-source protocol • Lendaswap exchange |

| HodlHodl | P2P Non-Custodial | 0.5-1.5% (1 day: 0.5% 1wk-5mo: 1% 6-12mo: 1.5%) | User-set (P2P) | 125-200% | 2-of-3 Multisig | $50 | Flexible | • No KYC required • Crypto-to-crypto only • USDT, USDC, L-BTC, WBTC • No early repayment fees |

| SALT | Centralized (CeFi) | $0 (Limited promo) | 8.95-14.45% (0.95% minimum) | 30-70% | Custodial | $1,000-$5,000 | 12-60 months | • No origination fees • No prepayment penalties • Stabilization feature • SALT Shield™ (no liquidation) • KYC required |

| Ledn | Centralized (CeFi) | 2% (waived US/Canada) | Standard: 12.4% Custodied: 13.4% | 50% max | Custodial or Non-Custodied option | $1,000 BTC | 12 months | • Proof of Reserves • B2X (double BTC exposure) • No prepayment penalties • No rehypothecation option • Monthly Open |

Company Background and Founding

Lendasat was founded by Philipp Hoenisch, a Bitcoin developer and entrepreneur based in Sydney, Australia. Hoenisch brings significant expertise to the project, holding a doctorate in Computer Science from Vienna University of Technology and having previously founded 10101, a platform that enabled trust-minimized trading and synthetic stablecoins using Discrete Log Contracts (DLCs) on the Lightning Network.

His technical background includes work with several notable organizations including CoBloX, CSIRO's Data61, and Senacor Technologies.

The platform is relatively new to the market, with development beginning in 2024. The company reached a significant milestone on November 26, 2024, when it launched Phase 1 of its closed beta program. During this initial week-long beta phase, the platform successfully processed 34 loans totaling $54,600 USD with 1.34 BTC in total value locked, demonstrating the viability of their non-custodial lending model.

Following the successful closed beta testing, Lendasat transitioned to a public beta in late 2024, making the platform accessible to a broader audience while continuing to refine its features and user experience.

The Bottom Line

Non-KYC Bitcoin lending and borrowing platforms fill an important niche in the cryptocurrency ecosystem, providing privacy-focused financial services to users worldwide. They offer genuine advantages in terms of accessibility, speed, and financial sovereignty.

However, these benefits come at the cost of increased risk, reduced consumer protection, and regulatory uncertainty. The landscape remains experimental and volatile, with platforms regularly emerging and disappearing.

For most users, a hybrid approach may be wisest: using regulated platforms for the majority of your cryptocurrency activities while exploring non-KYC options with smaller amounts to maintain privacy where it matters most.

The future of non-KYC cryptocurrency finance remains uncertain but promising. As privacy technologies improve and decentralized finance matures, these platforms may become more secure and user-friendly while maintaining their core privacy principles. Until then, proceed with caution, educate yourself thoroughly, and never risk more than you can afford to lose.

Rating: 4.4/5

💪 Recommended for: Bitcoin holders seeking non-custodial loans while maintaining their long-term investment position

🤚 Not recommended for: Those needing immediate liquidity without sufficient Bitcoin collateral, or users uncomfortable with cryptocurrency technology.

Disclaimer : This article is provided for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. Bitcoin-builder.com is not affiliated with, sponsored by, or receiving compensation from Bisq or any related entities. The information presented reflects research and analysis conducted independently. Cryptocurrency trading carries significant risk, including the potential loss of capital.

Readers should conduct their own research and consult with qualified professionals before making any financial decisions. The views expressed are those of the author and do not necessarily represent the official position of Bitcoin-builder.com.