Look, I get it. Bitcoin's price movements can test anyone's patience, and if you've got that hustle mentality like me, you're always looking for ways to make your crypto work harder. That's exactly how I stumbled onto Nexo, a platform promising yields on your idle crypto.

But here's the thing, and this is why I'm specifically talking about $5,000 in this article: Nexo requires you to maintain a minimum portfolio balance of $5,000 to access all their products and perks. Below that threshold, you're basically locked out of the full benefits. So if you're thinking about using Nexo seriously, $5,000 is your entry ticket.

And what do you get for that ticket? Well, they're advertising up to 6.5% per year on BTC, 7.5% on ETH, and up to 13% interest on USDC. Sounds good on paper, right? But before you throw your hard-earned money at it, let me break down what I actually learned from testing this platform.

P.S. – I've actually tested several yield services over the years, and I'm preparing more articles on this topic. I'm starting with Nexo in this one because it's one of the oldest and most established platforms out there, so obviously I'm beginning with the most popular option. Subscribe to get notified when I drop the other reviews if you're interested in comparing different yield platforms..

What Actually Is Nexo?

Nexo is a crypto lending and borrowing platform that launched back in 2018. It was created by the team behind Credissimo, a European fintech company that's been around since 2007. The founders , Antoni Trenchev, Kris Markov, and Georgi Shulev , basically wanted to bridge traditional finance with crypto.

Here's the simple version: you deposit your crypto (Bitcoin, Ethereum, stablecoins, whatever), and Nexo pays you interest on it. They take your deposits and lend them out to other users or institutions, then share the profits with you. Think of it like a savings account, but for crypto.

What Is Yield in Crypto Anyway?

Before we go further, let's talk about what "yield" actually means in crypto because a lot of people throw this term around without understanding where the money comes from.

Yield in crypto is basically interest or returns you earn on your holdings. But unlike a bank savings account where your money is (theoretically) safe, crypto yield comes with real risk. So where does this yield actually come from?

Lending : Platforms like Nexo take your Bitcoin or stablecoins and lend them to other users who need liquidity. Maybe they're traders who want to leverage their positions, or institutions that need short-term capital. The borrowers pay interest, and you get a cut. Simple supply and demand.

Liquidity provision : In DeFi, your crypto can be used to provide liquidity for trading pairs. You earn fees from trades, but that's not really what Nexo does.

Staking rewards : Some chains pay you for helping secure the network. Again, not Nexo's model for Bitcoin.

With Nexo specifically, your yield comes from them lending out your assets. The rates fluctuate based on demand for borrowing. When more people want to borrow Bitcoin, the yield goes up. When demand drops, so does your rate.

The important thing to understand: this isn't free money. You're taking on risk. The platform could fail, borrowers could default, regulations could change.

I've been in crypto for 8 years now, and I've seen platforms promise the moon and then disappear. You're reading this because you're a player who understands the game, so you already know that golden rule: only put on yield what you're ready to lose if things go south.

Here's the simple version: you deposit your crypto (Bitcoin, Ethereum, stablecoins, whatever), and Nexo pays you interest on it. They take your deposits and lend them out to other users or institutions, then share the profits with you. Think of it like a savings account, but for crypto.

What Is Yield in Crypto Anyway?

Before we go further, let's talk about what "yield" actually means in crypto because a lot of people throw this term around without understanding where the money comes from.

Yield in crypto is basically interest or returns you earn on your holdings. But unlike a bank savings account where your money is (theoretically) safe, crypto yield comes with real risk. So where does this yield actually come from?

- Lending – Platforms like Nexo take your Bitcoin or stablecoins and lend them to other users who need liquidity. Maybe they're traders who want to leverage their positions, or institutions that need short-term capital. The borrowers pay interest, and you get a cut. Simple supply and demand.

- Liquidity provision – In DeFi, your crypto can be used to provide liquidity for trading pairs. You earn fees from trades, but that's not really what Nexo does.

- Staking rewards – Some chains pay you for helping secure the network. Again, not Nexo's model for Bitcoin.

With Nexo specifically, your yield comes from them lending out your assets. The rates fluctuate based on demand for borrowing. When more people want to borrow Bitcoin, the yield goes up. When demand drops, so does your rate.

The important thing to understand: this isn't free money. You're taking on risk. The platform could fail, borrowers could default, regulations could change. I've been in crypto for 8 years now, and I've seen platforms promise the moon and then disappear.

You're reading this because you're a player who understands the game, so you already know that golden rule: only put on yield what you're ready to lose if things go south.

The $5,000 Minimum: What You Actually Get

Here's what Nexo promises once you hit that $5,000 portfolio balance:

- Earn up to 6.5% per year on BTC (this is what caught my attention as a Bitcoin guy)

- Earn up to 7.5% on ETH (if you're into that)

- Earn up to 13% interest on USDC (highest yield, most stable)

- Borrow from 2.9% annual interest

- Buy or exchange with up to 0.5% cashback

- Order a physical Nexo Card

- Get up to 2% cashback on Nexo Card purchases

- Free withdrawals on premium networks

- Prioritized client care 24/7

Drop below $5,000? You lose access to most of these perks. That's why this amount matters, it's not just a random number I picked for the title.

Real Talk: $5,000 Yield Scenarios

Let me break down what $5,000 actually earns you in different scenarios, because "up to" numbers on marketing pages mean nothing:

Scenario 1: Bitcoin Maximalist (That's Me)

- $5,000 in BTC at 6.5% APY (top tier rate)

- Annual yield: $325 in BTC

- Monthly: ~$27

- Reality check: You need to hold NEXO tokens to get that 6.5%. Without them, you're looking at more like 3-4%, so $150-200/year

Scenario 2: Stablecoin Player

- $5,000 in USDC at 13% APY

- Annual yield: $650 in USDC

- Monthly: ~$54

- This is the sweet spot if you just want steady income without price volatility

Scenario 3: Split Portfolio

- $2,500 in BTC (4% realistic yield) = $100/year

- $2,500 in USDC (13% yield) = $325/year

- Total: $425/year or ~$35/month

- More balanced risk/reward

Scenario 4: Below $5,000

- You're in the "base tier" with limited access

- Lower rates, no card, no priority support

- Honestly? Not worth it. Either commit the $5,000 or look elsewhere.

The harsh truth: those advertised rates assume you're playing their game with NEXO tokens and maintaining high balances. Most people won't see the maximum yields.

How Does It Actually Work?

You sign up, verify your identity (yeah, KYC is required), deposit your crypto, and boom – you start earning. The yields vary depending on what you deposit and your loyalty tier.

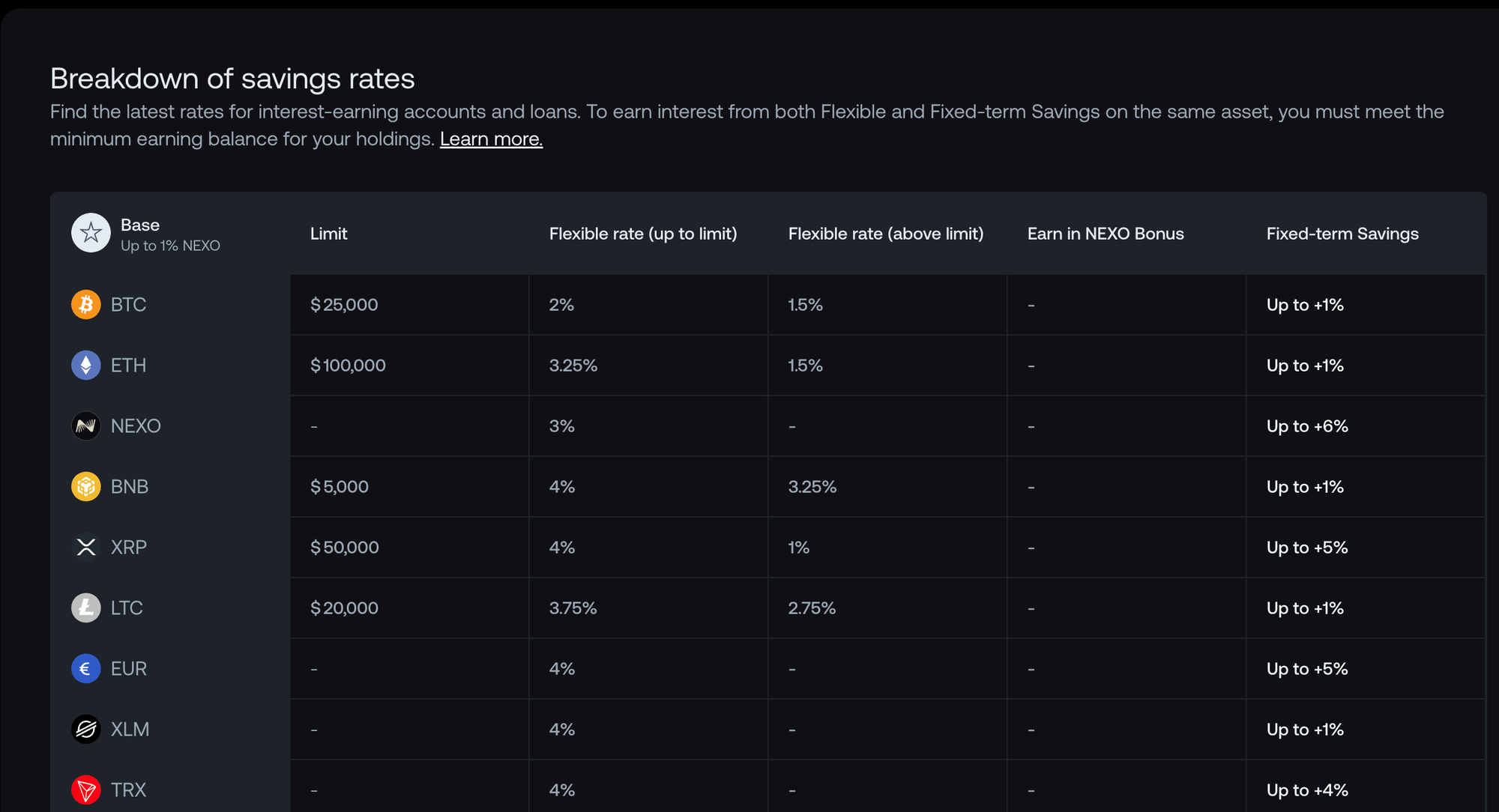

Looking at Nexo's current savings breakdown, here's what you're actually looking at for Bitcoin:

Flexible terms (no lockup): Around 3-4% APY for Bitcoin at base tier, up to 6.5% at platinum Fixed terms (1-3 months locked): Slightly higher, around 4-5% APY base, up to 7% platinum

Stablecoins offer better rates – USDC can hit 13% APY at top tiers – because there's more demand for borrowing stable assets.

There are two main ways to earn:

Daily Interest – Your earnings are calculated and paid out daily. No lockup periods on the flexible term, so you can withdraw whenever you want.

Fixed Terms – Lock your crypto for 1-3 months and get higher rates. Obviously, you can't touch it during that time.

The NEXO Token Thing (And Why I'm Not Interested)

Here's where Nexo tries to lock you into their ecosystem. They have this token called NEXO, and if you hold a certain amount of it, you climb through "loyalty tiers" that unlock higher interest rates and other perks.

The tiers work like this:

- Base tier: Hold 0% of your portfolio in NEXO – get the lowest rates (3-4% on BTC)

- Silver: Hold 1% in NEXO – small rate boost (4-5% on BTC)

- Gold: Hold 5% in NEXO – better rates (5-6% on BTC)

- Platinum: Hold 10% in NEXO – best rates (6.5% on BTC)

Look, I get what they're doing. It's smart business – they want you invested in their token so you're less likely to leave the platform. But here's my problem with it: I'm a Bitcoin-only guy.

I didn't spend 8 years in this space learning about sound money, decentralization, and Bitcoin's fundamentals just to start buying some platform's governance token to squeeze out an extra 2-3% yield. If I wanted to juggle multiple tokens and play loyalty tier games, I'd be deep in DeFi already.

For me, Bitcoin is the play. Everything else is noise. So while the NEXO token might make sense for people who are diversified across multiple cryptos, it's not for me. I'd rather accept the base tier rates on my Bitcoin than dilute my stack with tokens I don't believe in long-term.

If you're like me and you're Bitcoin-focused, just know you're going to be stuck in the lower tiers. That's fine – you still earn something – but don't expect the premium 6.5% rates Nexo advertises unless you're willing to play their token game.

The Benefits (What I Actually Liked)

Passive income on crypto you're holding anyway – If you're a long-term holder, why not earn while you wait? My Bitcoin was just sitting in cold storage doing nothing.

- Daily payouts – Watching those small amounts add up daily is oddly satisfying, not gonna lie.

- No lockup required – The flexible terms mean you're not stuck if you need to pull out fast.

- Decent insurance – Nexo claims to have $775 million in custodial insurance through Ledger Vault and BitGo. That's something, at least.

- Easy to use – The interface isn't complicated. Even if you're not super tech-savvy, you'll figure it out.

- The card perks are real – If you hit $5,000 and get the card, the cashback actually works. It's a nice bonus.

The Risks (The Stuff That Kept Me Up at Night)

- It's not a bank – Your deposits aren't FDIC insured. If Nexo goes under, there's no government bailout coming to save you.

- That $5,000 minimum is a trap – Once you're in, dropping below $5,000 means losing perks. It psychologically keeps you locked in.

- Regulatory uncertainty – Crypto regulations are all over the place. Nexo has faced scrutiny in the US and had to stop offering certain products in some states. Things could change fast.

- Counterparty risk – You're trusting Nexo to manage your funds properly. They lend to others, and if those borrowers default or if there's a major market crash, your funds could be at risk.

- Centralized platform – You don't control your private keys. "Not your keys, not your crypto" is the mantra for a reason. You're essentially trusting a company with your assets.

- Market volatility – If you're earning yield on Bitcoin, a 4% gain in interest means nothing if the price drops 20%. The yield doesn't protect you from price swings.

- The 2022 crypto winter – Remember when platforms like Celsius and BlockFi collapsed? Nexo survived, which is good, but it showed how fragile these platforms can be when things go south.

Who Should Actually Use Nexo?

You're good for Nexo if:

- You can comfortably lock up $5,000+ and maintain that balance

- You're holding crypto long-term anyway and want passive income

- You understand and accept the risks of centralized platforms

- You're diversifying across multiple platforms, not putting everything in one place

- You're okay with KYC and don't mind giving up some privacy

- You want the card benefits and cashback features

Skip Nexo if:

- You can't maintain the $5,000 minimum consistently

- You're risk-averse and can't handle the idea of losing your principal

- You're a "not your keys, not your crypto" purist

- You need guaranteed, predictable returns for bills or essential expenses

- You're already nervous about the crypto market in general

My Personal Take: Would I Put $5,000 on Nexo for Bitcoin Yield?

Honestly? I did put money on Nexo, but nowhere near my entire Bitcoin stack. I've been in this space for 8 years, and I've learned the hard way that when you chase yield, you need to be ready to lose that capital. Period.

Would I put $5,000 there? Maybe, but only if that represented less than 20% of my total Bitcoin holdings and only if I was mentally prepared to wake up one day and find out the platform had issues.

The yields are real, the platform works, and Nexo has survived some serious market chaos. But the risks are also real. This isn't free money – you're taking on counterparty risk and trusting a centralized entity with your funds.

Listen, we're both players here. You didn't click on this article because you're scared of risk – you're here because you want to know if this specific risk is worth taking. I'm not going to sugarcoat it: putting your Bitcoin on a centralized platform for 3-4% yield (realistically, without NEXO tokens) is a trade-off. You're trading security and self-sovereignty for passive income.

For me, I keep the bulk of my Bitcoin in cold storage where I control the keys. The portion I put on Nexo? That's money I'm comfortable losing if the worst happens. That's the only way to sleep at night in this game.

The $5,000 minimum actually helps me here – it forces you to think seriously about whether you're really committed to this strategy. It's not pocket change you throw at something on a whim.

If you're impatient like me and want your Bitcoin to do something productive while you wait for the next bull run, Nexo can be part of your strategy. Just don't bet the farm on it. Only put on yield what you're ready to lose in case shit hits the fan.

The golden rule after 8 years in crypto? Never put all your eggs in one basket, especially when that basket is controlled by someone else. Do your own research, start small (well, $5,000 is your "small" here), and see how it feels. That $5,000 could earn you some decent passive income – or it could be a lesson in why self-custody matters.

Your call, player.

Disclaimer: Let's Keep It Real

I'm not getting paid by Nexo to write this article. Nobody's sponsoring this review, and I'm saying exactly what I think, the good and the ugly.

That said, my conscience tells me I need to be transparent with you: I do have an affiliate link.

Here's the deal : if you sign up through my link, we both get a bonus to share (around $2500 each when you deposit and meet certain conditions). You know I'm a player, so maybe you are too? If you're going to try Nexo anyway after reading this, might as well we both benefit from it.

But listen , don't sign up just because of the bonus. Sign up only if this review convinced you that Nexo fits your strategy and you're comfortable with the risks I laid out.

If you want to use the affiliate link, cool. If not, no hard feelings, go direct to Nexo's website. Either way, make sure you're making the right call for YOUR situation.

We're all here to win, but we play smart.