What You Need to Know

NoOnes is what happens when someone who actually gets it builds a Bitcoin platform. While most exchanges are designed in Silicon Valley for Silicon Valley, NoOnes was built specifically for Africa, Latin America, Southeast Asia, and everywhere else that traditional finance either ignores or exploits.

Founded by Ray Youssef (the brain behind Paxful), NoOnes lets you buy and sell Bitcoin using whatever payment method actually works where you live—mobile money, bank transfers, gift cards, even cash. No fancy requirements, no gatekeeping, just peer-to-peer trading that respects reality.

Here's what makes it special: over 500 payment methods (seriously), minimal KYC (just email to start), escrow protection (your crypto stays safe), and a founder who describes himself as a "pan-Africanist" who genuinely believes Bitcoin can end economic apartheid. That last part might sound dramatic, but when you understand how traditional banking excludes billions of people, it makes perfect sense.

The Story Behind NoOnes

From Egypt to Revolution (And Back to Bitcoin)

Ray Youssef's story reads like a movie script. Born in Egypt, his family moved to New York when he was just two years old. Growing up, he started working odd jobs at age eight (entrepreneurial spirit showing early), studied history at Baruch College, then fell in love with computers at 19 and taught himself to code.

After working as a software engineer and running several startups (most failed, as startup stories go), Youssef learned about Bitcoin in 2011. But instead of jumping in immediately, he did something unexpected—he went back to Egypt to support the revolution happening there. He joined protests in downtown Cairo, nearly died on the first night of fighting, and got arrested by the military as a possible CIA agent (because apparently being Egyptian-American and supporting democracy looks suspicious).

That experience shaped everything that came next. Youssef saw firsthand how broken financial systems oppress ordinary people and how revolutions fail without economic empowerment. Bitcoin clicked not as a get-rich-quick scheme but as a tool for financial freedom.

Building Paxful (And Watching It Crumble)

In 2015, Youssef co-founded Paxful with Artur Schaback, creating one of the world's first major P2P Bitcoin exchanges. The mission was clear: give people in Africa and the Global South access to Bitcoin using payment methods they actually have—mobile money, gift cards, bank transfers.

Paxful exploded. By 2021, they'd hit $5 billion in trading volume with 12 million users across 140+ countries. Nigeria, Kenya, India, China—markets that traditional finance ignored became Paxful's strongholds. Time Magazine listed them as one of the most influential companies of 2022.

But success brought problems. Youssef and Schaback diverged on the company's future. Schaback prioritized profits and US market compliance. Youssef wanted to stay true to the Global South mission, even if it meant leaving money on the table. The partnership imploded spectacularly in 2023, with lawsuits flying and Paxful temporarily shutting down.

Schaback accused Youssef of migrating Paxful's IP and user data to a new platform. Youssef accused Schaback of pure greed, saying "he wouldn't get his nine-figure payday if the company dissolved, so he sued." Later, Schaback pleaded guilty to federal conspiracy charges for failing to maintain proper anti-money laundering programs between 2015-2019, admitting Paxful had been used for money laundering and sanctions violations.

The whole mess nearly destroyed what Youssef had built. Instead of giving up, he doubled down on the original vision—just without his former partner.

Building Something Better (This Time From The Global South)

In December 2023, Youssef became CEO of NoOnes, a platform that had quietly built 400,000+ users in just four months. The timing was perfect. Youssef brought his network, his experience, and most importantly, his philosophy.

"I have been talking about Africa and the Global South for the past 10 years," Youssef explained. "And then it struck me: if I am really building something for the Global South, why not do it there? In a company of people from the Global South that works for people of the Global South."

NoOnes isn't incorporated in the US (avoiding the regulatory nightmare that complicated Paxful). The team is distributed globally, with people from Africa, Latin America, and Asia making decisions about what their markets actually need. It's Bitcoin infrastructure built by the people who'll use it, not by Silicon Valley entrepreneurs making assumptions.

By November 2024, NoOnes had attracted over 1.8 million users. The platform now facilitates trades in 190 countries with 500+ payment methods. And unlike Paxful's messy ending, NoOnes is Youssef's vision without compromise.

His mission statement is bold: "End economic apartheid and unleash the power of the Global South." Whether he achieves it or not, at least he's actually trying.

Why NoOnes Exists

Here's the problem: traditional banking doesn't work for billions of people. If you live in Nigeria, Kenya, Venezuela, Argentina, or dozens of other countries, your options suck:

✅ High remittance fees: Sending money home costs 8-15% through services like Western Union. That's not a fee—that's theft disguised as a fee.

✅ Limited banking access: Want a bank account? Hope you have the right documents, minimum balances, and live near a branch (good luck if you're rural).

✅ Currency controls: Your government might restrict how much foreign currency you can buy, how you can use it, or freeze your accounts entirely during crises.

✅ Inflation destruction: When your local currency loses 50% of its value yearly (looking at you, Argentina and Zimbabwe), saving money means watching it evaporate.

✅ Payment method mismatches: Lots of places don't have widespread credit card adoption but do have mobile money or cash. Global platforms don't care—they want cards or bank transfers.

Now enter Bitcoin: theoretically perfect for solving these problems. It's borderless, censorship-resistant, and holds value better than most local currencies. But here's the catch: buying Bitcoin isn't easy if you're in these markets.

Big exchanges like Coinbase require identity verification, bank accounts, and often don't support your country at all. Even when they do, they don't accept mobile money, M-Pesa, or the payment methods people actually use. They're built for Americans and Europeans, then awkwardly ported elsewhere.

NoOnes exists because someone finally said "let's build Bitcoin infrastructure for where people actually need it most." Instead of assuming everyone has a bank account and credit card, they built a platform that works with mobile money, cash deposits, gift cards—whatever people actually have access to.

As Youssef puts it: "The internet, mobile phones, and a wave of disruptive startups failed to truly disrupt money. At NoOnes, we believe that Bitcoin is the way."

What NoOnes Does

P2P Trading (The Core)

At its heart, NoOnes is a marketplace where people buy and sell Bitcoin directly with each other, using whatever payment method they agree on.

How It Works:

- Sellers post offers: "I'll sell $500 of Bitcoin for mobile money transfer in Kenya"

- Buyers browse offers and find one that works for them

- When you accept an offer, Bitcoin goes into escrow (safe holding)

- Buyer sends payment directly to seller using agreed method

- Seller confirms payment received and releases Bitcoin from escrow

- Bitcoin lands in your NoOnes wallet

The beauty is flexibility. Want to buy Bitcoin with M-Pesa in Kenya? Done. With Pix in Brazil? Easy. With bank transfer in Nigeria? No problem. Gift cards in the US? Sure. Cash in person anywhere? Absolutely.

Cryptocurrencies Supported: Bitcoin (BTC), Tether (USDT), USD Coin (USDC), Ethereum (ETH), Solana (SOL), and 40+ other cryptocurrencies depending on your region.

Payment Methods: Over 500 options including bank transfers, mobile money (M-Pesa, EcoCash, MTN, etc.), digital wallets (PayPal, Venmo, Cash App), gift cards, cash in person, and more.

Countries: Available in 190 countries (though some like Canada, Cuba, Iran, North Korea, Russia, and Syria are restricted).

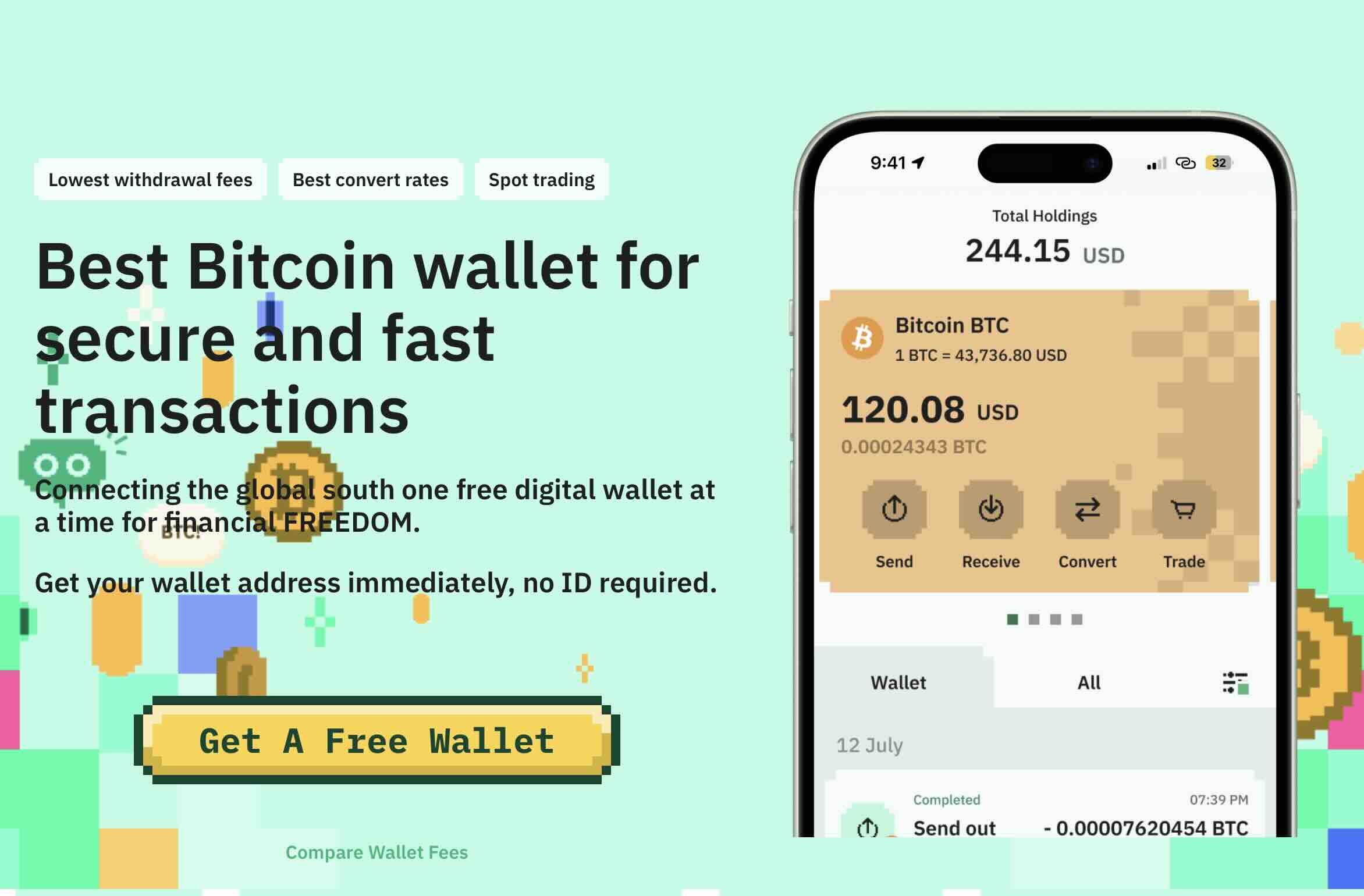

The Wallet (Your Crypto Home)

NoOnes provides a custodial wallet where you can store, send, and receive Bitcoin and other cryptocurrencies.

What's Included:

- Bitcoin storage (on-chain)

- Lightning Network support (for instant, cheap transactions)

- Ethereum, Solana, and multiple stablecoins

- Direct buying with Visa/Mastercard, Google Pay, Revolut Pay, SEPA (fees: 4-8%)

- Send and receive to external wallets

Lightning Integration: You can send and receive Bitcoin via Lightning Network for near-instant, nearly free transactions. This is huge for small payments and frequent transactions.

Limits: For Lightning, there's a $1,000 limit per transaction when sending and $5,000 when receiving.

Gift Cards (Crypto to Shopping)

NoOnes has a built-in gift card marketplace where you can use your crypto to buy gift cards for major brands globally.

How It Works: Convert your Bitcoin or stablecoins into gift cards for Amazon, iTunes, Google Play, and dozens of other retailers. This effectively lets you spend crypto at places that don't accept crypto directly.

Why It Matters: In many countries, getting gift cards for US stores is difficult. NoOnes bridges that gap, and for some users, buying gift cards with crypto then selling them locally is actually a business model.

Swap (Instant Conversion)

Need to quickly convert between cryptocurrencies? The Swap feature lets you exchange between different cryptos instantly without going through P2P trading.

Fees: Range from 0.09% to 1% depending on the pair, plus provider fees. For example, BTC/USDT swaps cost 0.09-0.15%, while XMR/USDT costs 1%.

Crypto Visa Card (Spend Your Bitcoin)

NoOnes offers a prepaid Visa card you can top up with cryptocurrency and use anywhere Visa is accepted.

Fees:

- Card activation/termination: 1 USDT

- Top-ups under $100: 2 USDT flat

- Top-ups over $100: 1.5% (minimum 2 USDT)

- International (non-US) transactions: 3% + $0.50

This is particularly valuable if you want to spend crypto for daily expenses without constantly converting to fiat.

OTC Desk (Big Trades)

For larger transactions, NoOnes operates an over-the-counter desk where you can trade significant amounts with personalized service and better rates.

Messenger (Built-In Chat)

Every trade happens through NoOnes' encrypted messenger. You communicate with your trading partner, share payment proof, and resolve any issues—all within the platform.

Why It Matters: Keeping communication on-platform protects both parties. If disputes happen, NoOnes support can review the entire conversation to resolve fairly.

Technology: How It Actually Works

Escrow Protection (Your Safety Net)

Every P2P trade uses escrow—a secure holding system that protects both buyer and seller.

Here's The Flow:

- When a buyer accepts an offer, the seller's Bitcoin automatically moves into escrow

- The Bitcoin is now locked—the seller can't access it, and neither can NoOnes alone

- The buyer sends fiat payment directly to the seller (outside the platform)

- Once the seller confirms receiving payment, they release Bitcoin from escrow

- Bitcoin goes directly to the buyer's wallet

What If There's A Problem?: If the seller doesn't release Bitcoin (claiming they didn't receive payment), or if the buyer claims they paid but seller disagrees, either party can open a dispute. NoOnes support reviews evidence (payment screenshots, chat logs) and makes a decision. The escrow ensures money stays safe during disputes.

The Key: NoOnes holds the Bitcoin during trades, but they can't unilaterally steal it—they can only release it according to agreed terms or dispute resolution. This makes them a trusted intermediary rather than a custodian you're blindly trusting.

Custodial Wallet (The Trade-Off)

Unlike non-custodial platforms (Hodl Hodl), NoOnes holds your Bitcoin in their wallet. This means:

Pros: Easier to use, faster trades, better for beginners, integrated features (gift cards, visa card, swaps).

Cons: You're trusting NoOnes with custody, it's not "your keys, your coins," regulatory risk if governments go after custodial services.

For the target audience (Global South users prioritizing access over maximum sovereignty), this trade-off makes sense. It's easier to use, and Ray Youssef has explicitly warned users: "Despite all assurances, exchanges are normal businesses and can go out of business. Don't keep large amounts on any exchange."

KYC Requirements (Lighter Than Most)

Unlike major exchanges requiring full identity verification upfront, NoOnes takes a graduated approach:

To Sign Up: Just email and password. That's it. No ID, no selfies, no proof of address.

When KYC Kicks In:

- Transactions over $10,000 require verification

- Total trading volume exceeding $50,000 triggers KYC

- For Nigeria and Ghana bank transfers or mobile money: Different thresholds apply based on volume

The Verification Process: Handled by Sumsub (third-party KYC provider). You photograph a passport or driver's license and complete a quick liveness check (proving you're a real person, not a photo). To trade certain assets, you'll also need to confirm your address.

Why This Matters: Low-barrier entry means people can start trading immediately with small amounts, then verify later if they need higher limits. This is crucial for markets where getting proper ID documents is difficult.

Security Features

✅ Two-Factor Authentication (2FA): Required for account security. Use app-based 2FA (Google Authenticator) or SMS codes.

✅ Reputation System: Every trader has a public history showing completed trades, satisfaction rate, and user reviews. Before trading, check your counterparty's reputation.

✅ Verification Badges: "Verified" traders have completed KYC and generally offer safer trades. You can filter to only show verified traders when browsing offers.

✅ Escrow Timeouts: Trades have time limits. If a buyer doesn't mark "I have paid" within the specified time, the trade auto-cancels and Bitcoin returns to the seller. This prevents buyers from tying up seller's funds indefinitely.

✅ Support Response: 24/7 customer support via chat, though response times vary based on issue complexity.

How To Use NoOnes: Complete Step-By-Step Guide

Getting Started (5 Minutes)

Step 1: Sign Up

- Go to NoOnes.com (use VPN if you're in a restricted country like Nigeria)

- Click "Create Your Account"

- Enter your email address

- Create a strong password

- Check your email and click the confirmation link

Step 2: Security Setup

- Enable two-factor authentication (Settings > Security)

- Download Google Authenticator or Authy

- Scan the QR code NoOnes shows you

- Save your backup codes somewhere safe (not on your phone!)

Step 3: Explore Your Dashboard

- Home: Overview of your activity and quick access

- Wallet: Where your crypto lives

- Marketplace: P2P trading section

- Convert: Swap between different cryptocurrencies

- Gift Cards: Buy gift cards with crypto

Bonus: Watch Ray Youssef's welcome video to earn 500 free satoshis (about $0.35) credited to your affiliate account. You can withdraw once you reach $5 in affiliate earnings.

Buying Bitcoin (Your First Purchase)

Let's walk through a complete Bitcoin purchase using bank transfer (the most common method).

Step 1: Navigate to P2P Marketplace

- Click "Trade" in the top menu

- Select "P2P" from the dropdown

- The marketplace opens showing available offers

Step 2: Filter Offers

- Choose "Buy" (since you're buying Bitcoin)

- Select cryptocurrency: Choose "BTC" (Bitcoin)

- Select your fiat currency: Pick your local currency (USD, NGN, KES, etc.)

- Choose payment method: Select "Bank Transfer" (or whatever you'll use)

- Optional: Click "More filters" and toggle "Verified Only" for safer trades

Step 3: Browse and Select a Seller

You'll see a list of sellers with offers matching your criteria. Each listing shows:

- Price: How much they're charging (usually as a percentage above market rate)

- Available amount: How much Bitcoin they have to sell

- Limits: Minimum and maximum purchase amount

- Payment window: How long you have to make payment

- Seller stats: Number of trades, satisfaction rate, response time

How To Choose:

- Look for 95%+ satisfaction rate

- Check they have lots of completed trades (50+)

- Verify they're online now (green dot)

- Read their terms carefully (some have specific requirements)

- Prioritize "Verified" badge sellers if you're new

Step 4: Initiate The Trade

- Click "Buy" button next to your chosen seller

- Enter the amount you want to buy (in fiat currency or BTC)

- Review the total cost including any fees

- Read the seller's payment instructions carefully

- Click "Buy BTC" to start the trade

Step 5: Bitcoin Goes Into Escrow

The seller's Bitcoin automatically moves into escrow. It's now locked—safe from both the seller and NoOnes. The trade timer starts (usually 15-30 minutes).

Step 6: Make Payment

The trade chat window opens. The seller will provide their payment details:

- Bank account number

- Account name

- Bank name

- Any specific payment reference to include

Important Rules:

- Pay from an account in YOUR name (not a friend's account)

- Include the exact reference number or message the seller requests

- Take a screenshot of your successful payment

- Keep all communication in NoOnes chat (never move to WhatsApp, Telegram, etc.)

Step 7: Send Payment

- Open your banking app or visit your bank

- Transfer the exact amount to the seller's provided account

- Include any reference number they specified

- Double-check account details before confirming

- Take a clear screenshot of the successful transfer

Step 8: Confirm Payment in NoOnes

- Return to the NoOnes trade window

- Click "I Have Paid" button (ONLY after actually paying!)

- Upload your payment screenshot

- Add a message: "Payment sent from [Your Account Name]"

Step 9: Wait for Release

The seller receives notification that you've paid. They'll:

- Check their bank account to confirm payment arrived

- Verify the amount and sender name match

- Release Bitcoin from escrow

Typical wait time: 5-30 minutes, depending on how quickly the seller checks and how fast your banking system processes transfers.

Step 10: Receive Your Bitcoin

Once released, Bitcoin appears in your NoOnes wallet immediately. The trade is complete!

Step 11: Rate Your Experience

Rate the seller (1-5 stars) and leave a comment. This helps other buyers know who's reliable. Good sellers respond quickly, have clear instructions, and release Bitcoin promptly after confirming payment.

What If Something Goes Wrong?

Seller Doesn't Release Bitcoin: If you paid but the seller doesn't release after reasonable time (30+ minutes):

- DON'T PANIC—your money is safe in escrow

- Check the trade chat to see if seller sent a message

- If no response, click "Open Dispute"

- Upload your payment proof

- Explain what happened clearly

- NoOnes support will review and make a decision (usually within 24-48 hours)

You Sent Payment To Wrong Account: If you messed up payment details:

- Immediately tell the seller in chat

- Contact your bank to try reversing the transfer (doesn't always work)

- Don't click "I Have Paid" in NoOnes

- If the trade timer expires, Bitcoin returns to seller automatically

- You can try again with a new trade (being more careful this time!)

Payment Failed But You Clicked "I Have Paid": If your payment failed but you already marked it complete:

- Immediately message the seller explaining the situation

- If seller hasn't released yet, they can cancel the trade

- If they already released, you need to send payment ASAP or contact support

Selling Bitcoin (Turning Crypto Into Cash)

The process is similar but in reverse.

Step 1: Navigate to P2P

- Go to Trade > P2P

- This time, select "Sell" tab

Step 2: Filter Buyers

- Choose "BTC" (or whatever crypto you're selling)

- Select your desired fiat currency

- Pick your preferred payment method

- Enable "Verified Only" for safety

Step 3: Select a Buyer

Look for:

- Good reputation (95%+ satisfaction, 50+ trades)

- Reasonable price (close to market rate)

- Clear terms

- Currently online

Step 4: Start The Trade

- Click "Sell" next to your chosen buyer

- Enter amount you want to sell

- Review buyer's payment details and requirements

- Click "Sell BTC"

Step 5: Your Bitcoin Goes to Escrow

Your Bitcoin automatically moves to escrow. You no longer control it—it's held safely until you release it.

Step 6: Wait For Buyer's Payment

The buyer should send payment to your provided bank account/mobile money/payment method.

Check These Things:

- Payment comes from the buyer's verified name (not a third party)

- Amount is exactly correct

- Any reference code matches what you requested

Step 7: Confirm and Release

Once you verify payment arrived in your account:

- Click "Release Bitcoin" in NoOnes

- Buyer receives their Bitcoin immediately

- Rate the buyer

If Buyer Doesn't Pay: Wait until the trade timer expires. If they marked "I Have Paid" but you didn't receive anything:

- Don't release Bitcoin!

- Check your account thoroughly (sometimes payments take time)

- Ask buyer for payment proof in chat

- If they can't provide proof, open a dispute

Creating Your Own Offers (For Advanced Users)

Instead of accepting existing offers, you can post your own buy or sell offers at your preferred prices.

Step 1: Go To "Create Offer"

- Navigate to Trade > P2P

- Click "Create Offer" button

Step 2: Set Your Terms

- Choose Buy or Sell

- Select cryptocurrency

- Set your price (usually as % above/below market rate)

- Choose payment methods you accept

- Set minimum and maximum trade amounts

- Define payment window (how long buyers have to pay)

- Write clear instructions

Step 3: Publish

Your offer appears in the marketplace. When someone accepts it, you receive a notification and the trade begins.

Tips For Good Offers:

- Price competitively (check what others charge)

- Write crystal-clear payment instructions

- Set reasonable limits (not too small, not too large)

- Respond quickly when trades start

- Be professional in all communications

Using The Wallet Features

Depositing Crypto From External Wallet:

- Go to Wallet > Receive

- Select which cryptocurrency

- Choose the network (make sure it matches your sending wallet!)

- Copy your deposit address

- Send from your external wallet

- Wait for blockchain confirmations (typically 10-30 minutes)

Withdrawing to External Wallet:

- Go to Wallet > Send

- Select cryptocurrency and network

- Paste recipient address

- Enter amount

- Confirm transaction

- Pay network fee

- Complete 2FA verification

Lightning Network Transfers (For Fast, Cheap Bitcoin):

- Choose Bitcoin > Lightning Network

- For receiving: Generate Lightning invoice

- For sending: Paste Lightning invoice or scan QR code

- Transactions complete in seconds with tiny fees

Buying Gift Cards With Crypto

Step 1: Navigate to Gift Cards section

Step 2: Browse available cards

- Amazon

- iTunes/App Store

- Google Play

- Spotify

- And dozens more

Step 3: Select card and amount

Step 4: Pay with your crypto balance

Step 5: Receive card code instantly

Use Cases:

- Shopping at stores that don't accept crypto

- Gifting

- Converting crypto to spendable value without KYC

- Reselling gift cards locally for profit (common business in some markets)

Who Should Use NoOnes

Perfect For:

People in the Global South: If you're in Africa, Latin America, Southeast Asia, or anywhere traditional banking sucks, NoOnes is built for you. The payment methods, the philosophy, the team—everything is designed around your reality.

Mobile Money Users: Got M-Pesa in Kenya? MTN in Ghana? Pix in Brazil? NoOnes supports them all. Most global exchanges don't even know these exist.

The Unbanked or Underbanked: No bank account? No problem. You can trade with cash, mobile money, or gift cards. Traditional exchanges would shut you out immediately.

People Facing Currency Controls: If your government restricts foreign currency access or your local currency is collapsing, Bitcoin via NoOnes offers an escape valve.

Gift Card Traders: Lots of people in emerging markets buy US gift cards (Amazon, iTunes) at discount, convert them to Bitcoin on NoOnes, then sell Bitcoin locally for profit. It's an entire business model.

Remittance Senders: Sending money home? Using Bitcoin via NoOnes can cut fees from 8-15% down to 1-2%. The savings are massive.

Privacy-Conscious Users: The minimal KYC (just email initially) gives you more privacy than Coinbase or Binance requiring full verification upfront.

People Avoiding Banking Fees: Bank charges eating your money alive? Bitcoin transactions via Lightning Network cost pennies, and P2P trades avoid banking fees entirely.

Traders With Unusual Payment Methods: Want to buy Bitcoin with something weird? Crypto vouchers? Specific local payment systems? If someone else uses that method, you can trade on NoOnes.

Maybe Not For:

Complete Crypto Beginners: While NoOnes is easier than it sounds, if you've never touched cryptocurrency before, the P2P model, escrow, and wallet management might confuse you. Maybe start with something simpler (like Cash App Bitcoin) then graduate to NoOnes.

People Wanting Instant Purchases: P2P trading requires waiting for counterparties, negotiating, confirming payments. If you want "click button, get Bitcoin instantly," use a regular exchange.

Large-Scale Traders: The P2P model works great for personal amounts but becomes tedious for institutional-scale trading. There are better platforms for moving millions.

US Residents Wanting P2P Trading: While the wallet and some features work in the US, P2P trading isn't available for Americans due to regulatory reasons. You'd need alternatives like Bisq or LocalCoinSwap.

People Who Lose Passwords: As a custodial wallet, if you lose access to your NoOnes account and can't reset it (lost email, lost 2FA), your crypto is gone. NoOnes can't just "give it back" without proper security verification.

Those Needing Maximum Custody Security: If "not your keys, not your coins" is your religion, NoOnes won't satisfy you. It's custodial, meaning they hold your Bitcoin. For maximum security, you'd want non-custodial solutions.

People Allergic To Risk: P2P trading involves counterparty risk. While escrow protects you, disputes happen, scammers exist, and you need to be alert. If this sounds stressful, stick to regular exchanges.

What's Great About NoOnes

Actually Serves The Markets That Need Bitcoin Most: Unlike exchanges that pay lip service to "financial inclusion," NoOnes is built from the ground up for the Global South. The payment methods, the team, the philosophy—everything aligns with this mission.

500+ Payment Methods (No Really, Five Hundred): From M-Pesa to Venmo to obscure local payment systems, NoOnes supports it all. This flexibility is unmatched.

Minimal KYC To Start: Just email to sign up. No ID documents, no proof of address, no invasive verification unless you hit higher trading volumes. This accessibility matters tremendously in markets where getting proper documentation is difficult.

Escrow Protection Works: The escrow system genuinely protects both buyers and sellers. Your Bitcoin stays safe during trades, and disputes get resolved fairly based on evidence.

Ray Youssef's Track Record: Say what you want about the Paxful drama, but Youssef successfully built a platform that served 12 million users in underserved markets. He knows this space better than almost anyone.

Lightning Network Integration: Support for Lightning means you can send and receive Bitcoin almost instantly with negligible fees. This makes Bitcoin actually usable for daily transactions, not just large transfers.

Gift Card Marketplace: Being able to convert crypto to gift cards solves a real problem—how to spend crypto at places that don't accept it. This also creates arbitrage opportunities some users turn into businesses.

Crypto Visa Card: The ability to spend your Bitcoin anywhere Visa is accepted (after converting to the card) bridges the crypto-fiat gap elegantly.

Transparent Fee Structure: NoOnes publishes their fees clearly. No hidden charges, no surprise deductions. You know what you're paying upfront.

Not Incorporated In The US: This might sound weird, but not being subject to US regulations means fewer compliance restrictions, broader country access, and less risk of sudden regulatory shutdowns.

Built-In Encrypted Messenger: Having communication integrated means dispute resolution has full context. You're not trying to screenshot WhatsApp conversations or email chains—everything's in-platform.

Active Development: The platform continues adding features, improving UX, and expanding to more markets. It's not a "finished" product that stagnates.

What Could Be Better

Still Custodial: You're trusting NoOnes with your Bitcoin. While Ray has repeatedly warned people not to keep large amounts on exchanges, the custody model still introduces counterparty risk.

Limited Liquidity vs Major Exchanges: Finding perfect offers (exact amount, best price, preferred payment method) sometimes requires patience. Big exchanges have instant liquidity; P2P requires finding the right counterparty.

Price Premiums: P2P Bitcoin often trades 2-8% above spot price, especially for popular payment methods or when buying without KYC. You pay for the convenience and privacy.

Customer Support Can Be Slow: With 1.8+ million users, support sometimes takes days to resolve disputes or answer questions. This is frustrating when your trade is in limbo.

VPN Required In Some Markets: Nigeria, for example, restricts crypto access, so users need VPNs to reach NoOnes. This adds complexity and potential security concerns.

Payment Method Confusion: With 500+ payment methods, new users can feel overwhelmed. Which one should you use? Are some safer than others? More guidance would help.

Scam Risk Exists: While escrow helps, scammers still try creative tricks (fake payment screenshots, phishing, impersonation). New users need to stay vigilant and follow all safety guidelines.

Withdrawal Fees Can Add Up: Network fees for withdrawing Bitcoin to external wallets vary but can be $5-15 during high congestion. For small amounts, this eats into your balance.

How It Compares

vs. Binance P2P: Binance offers zero-fee P2P trading with massive liquidity but requires full KYC upfront and is heavily regulated. Choose Binance for maximum liquidity and established brand trust; choose NoOnes for lighter KYC and better focus on underserved markets.

vs. Hodl Hodl: Hodl Hodl is truly non-custodial using multisig escrow, offering maximum sovereignty. But it's harder to use, has lower liquidity, and lacks integrated features (gift cards, visa card, swaps). Choose Hodl Hodl if custody matters above all; choose NoOnes for easier access and more features.

vs. Bisq: Bisq is fully decentralized (desktop software, no company) with maximum privacy and no KYC ever. But it's complicated, requires running Bitcoin Core, has low liquidity, and intimidates beginners. Choose Bisq for absolute decentralization; choose NoOnes for actual usability.

Final Verdict

Noones positions itself as a practical P2P on-ramp for users in the Global South, where access to traditional banking and regulated exchanges remains limited. Its strength lies in local liquidity, peer-to-peer flexibility, and support for everyday payment methods that reflect on-the-ground realities.

While it does not offer the same level of sovereignty or privacy as fully non-custodial P2P protocols, Noones plays a functional role in Bitcoin adoption by lowering entry barriers for millions of users. For individuals seeking access rather than ideology, it can be a useful gateway — provided users remain aware of custody, counterparty, and regulatory trade-offs.

Disclaimer

This content is provided for informational purposes only and does not constitute financial, investment, or legal advice.

Some links may be referral links, which help support Bitcoin Builder at no additional cost to the reader.

Editorial opinions remain independent and are not influenced by partnerships.

Always conduct your own research before using any P2P or financial service.