For years, Bitcoin holders faced a stark choice: HODL and watch your stack sit idle, or risk it on centralized exchanges and wrapped tokens. GOAT Network aims to transform Bitcoin from a passive store of value into a productive asset, offering native BTC yield without sacrificing self-custody or Bitcoin's security guarantees.

This isn't another "wrapped BTC on Ethereum" play or CeFi lending scheme. GOAT Network is the first Bitcoin ZK Rollup offering real BTC yield through trustless infrastructure, native yield generation, and decentralized sequencers. Here's how to actually use it.

Understanding GOAT Network's Yield Model

Before diving into the how-to, understand where the yield comes from. Unlike ponzinomics or inflationary token emissions, yields come from gas fees paid in Bitcoin on GOAT's Layer 2. Users stake Bitcoin into decentralized sequencer nodes, the entities that process rollup transactions, and earn a share of the fees they generate .

The economics are straightforward: gas fees are collected by sequencers, with part paid to validators on the BTC mainnet, and the other part constituting sequencers' revenue. This creates a sustainable yield mechanism backed by actual network activity, not speculative token farming.

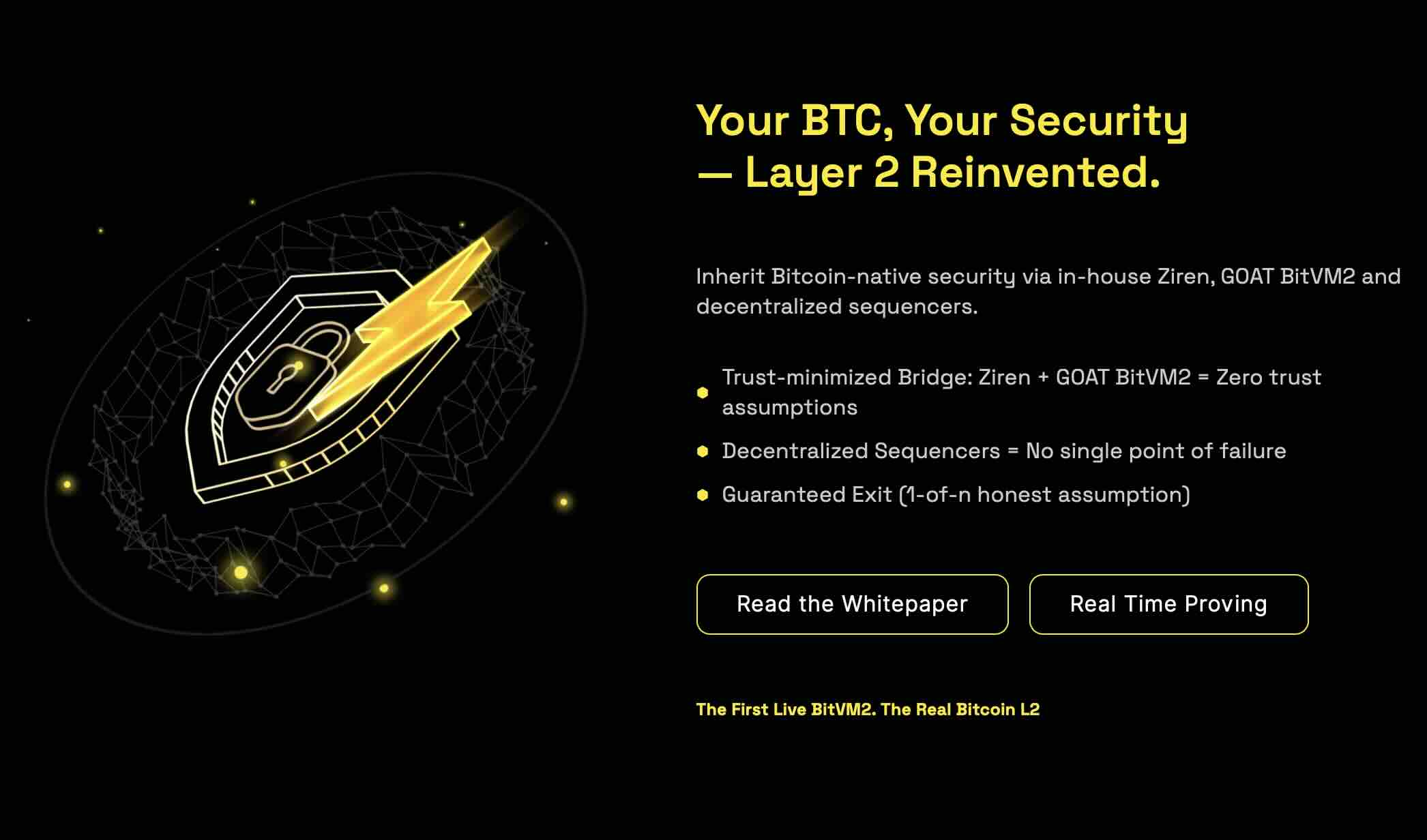

Available Yield Products: Choose Your Risk Profile

GOAT Network offers several yield options ranging from conservative to aggressive:

1. GOAT Safebox (2% APY) - Conservative

Designed for Bitcoin purists, 'GOAT Safebox' is a non-custodial, risk-free yield product offering 2% APY in native BTC. Users can lock BTC for 3 months via a secure enterprise-grade timelock, without bridges or DeFi exposure.

Best for: Bitcoin maximalists who want yield without touching DeFi protocols or wrapped assets.

2. Native BTC Staking (10% APY) - Moderate

Users may bridge native BTC from Bitcoin Layer 1, BTCB from BNB Chain, or DOGEB from BNB Chain to GOAT Network, securing GOAT's decentralized sequencers. The rewards? 10% APY, coming from real BTC gas yield, sequencer rewards, and MEV incentives.

Best for: Users comfortable with Layer 2 bridges who want higher yield while maintaining exposure to BTC.

3. BTCB/DOGEB Vault (5% APY) - Moderate

Users can deposit BTCB or DOGEB on BNB Chain and earn a 5% APY, backed by real gas fees and sequencer rewards.

Best for: Users already holding wrapped BTC on BNB Chain looking for straightforward yield.

4. Advanced BTCFi (Variable APY) - Aggressive

Through protocols like Avalon Finance, Pell Network, and Stable Jack, users can access lending, restaking, and leveraged yield strategies with APYs ranging significantly higher.

Best for: Experienced DeFi users comfortable with smart contract risk and liquidation mechanics. Not for everyone !

Step-by-Step: How to Stake BTC on GOAT Network

Prerequisites

- Web3 wallet (MetaMask, Unsisat, OKX Wallet, or similar)

- Native BTC or BTCB/DOGEB on BNB Chain

- Small amount of BTC for gas fees on GOAT Network

Step 1: Set Up Your Wallet

- Install a compatible Web3 wallet ( metamask is good option)

- Add GOAT Network to your wallet:

- Network Name: GOAT Network

- RPC URL: Available at docs.goat.network

- Chain ID: Check official documentation

- Currency Symbol: BTC

- Block Explorer: Available at official docs

Pro tip: Set the Priority Gas Fee in your preferred wallet to the recommended value of 0.005 Gwei to avoid high transaction fees.

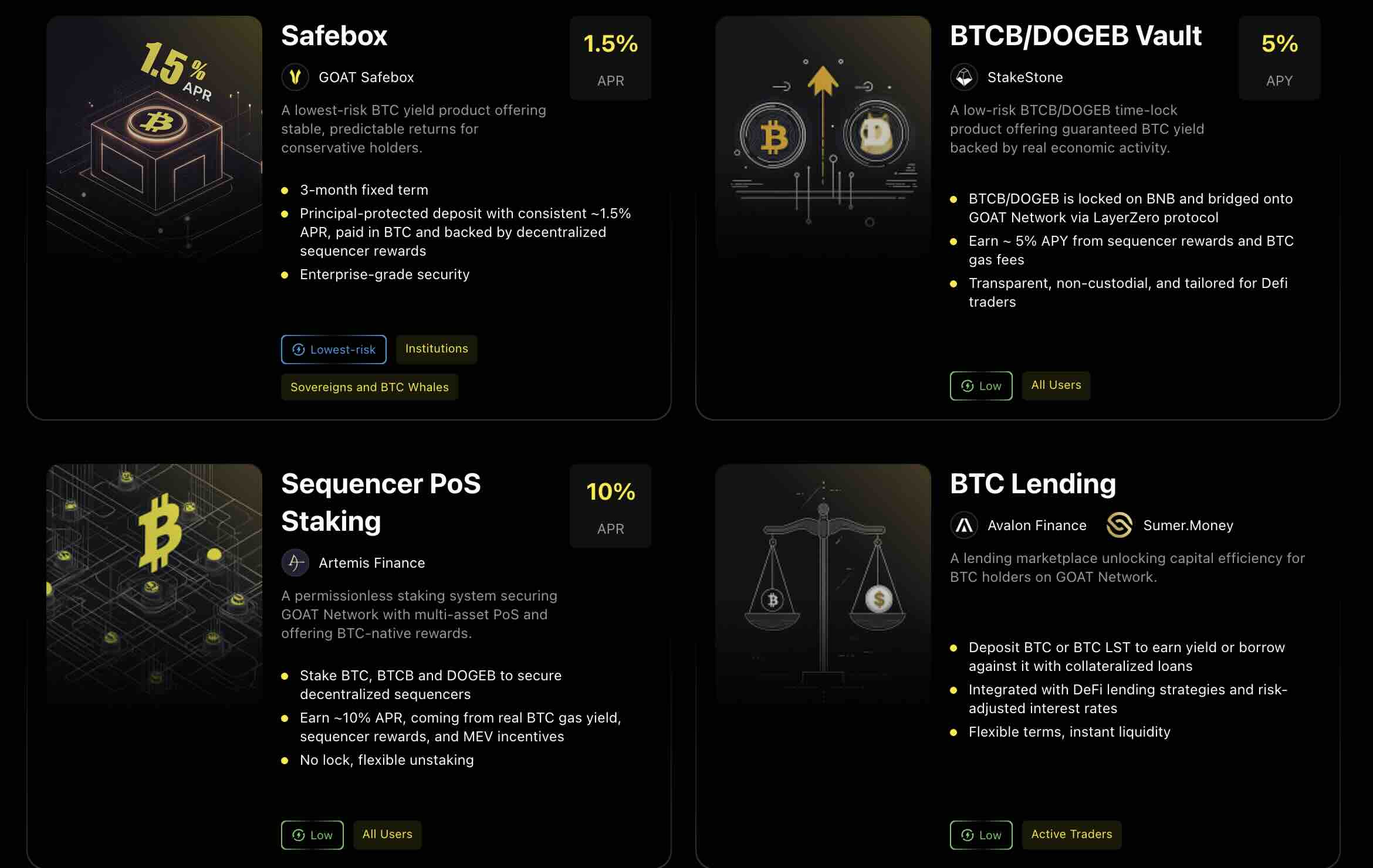

Step 2: Bridge Your Assets

You have multiple bridging options depending on your starting point:

For Native BTC: Bridge BTC from Bitcoin mainnet to GOAT Network using bridge.goat.network

The process:

- Visit bridge.goat.network

- Connect your wallet

- Generate a BTC deposit address linked to your EVM address

- Send BTC to this address (minimum 0.0002 BTC)

- Wait for confirmations (typically 3-6 confirmations)

- Receive BTC on GOAT Network

For BTCB (BNB Chain): Bridge BTCB from BNB Chain to GOAT Network using the same bridge interface.

For Other Assets (ETH, USDT, USDC): Use Stargate.finance to bridge from Ethereum or other chains to GOAT Network.

Step 3: Stake Your BTC

Once your BTC is on GOAT Network, staking is straightforward:

- Navigate to Artemis Finance: Visit artemisfinance.io/stake-goat

- Connect Your Wallet: Click "Connect Wallet" and approve the connection

- Select Asset to Stake: You'll see a button labeled Stake, and a drop-down menu with a list of different tokens you can stake. The default shown token is BTC.

- Enter Amount: Input how much BTC you want to stake

- Approve Transaction: You'll be prompted to approve the transaction, then stake.

- Receive artBTC: You'll receive artBTC (Artemis BTC), a liquid staking token representing your staked position

Important: There's no minimum lock period. You can unstake at any time, though there's a 14-day withdrawal delay for security reasons.

Step 4: Manage Your Position

After staking, you have several options:

Monitor Rewards:

- Rewards accrue daily

- APY varies based on network activity (currently around 10% for BTC staking)

- Rewards are paid in BTC

Use artBTC in DeFi: Your artBTC liquid staking token can be used across GOAT Network's ecosystem:

- Pell Network: Restake artBTC for additional yield

- Avalon Finance: Use artBTC as collateral to borrow additional BTC

- GOATSwap: Provide artBTC liquidity for trading fees

- Stable Jack: Access volatility and yield marketplaces

Unstake When Ready:

- Return to Artemis Finance

- Navigate to the "Redeem" tab

- Select artBTC and enter the amount

- Confirm the redemption transaction

- Wait 14 days for the withdrawal period

- Claim your BTC from the "Withdraw" tab

Advanced Strategy: Maximizing BTC Yield

For users wanting to optimize returns:

Layer 1: Base Staking

Start with native BTC staking on Artemis (10% APY)

Layer 2: Restaking

Deposit your specific GOAT assets into Pell to accumulate Pell Points while earning additional restaking yield. Depositing wrapped BTC or certain assets provides a 1.05X points boost.

Layer 3: Leverage (Advanced)

Use Avalon Finance to:

- Deposit artBTC as collateral

- Borrow additional BTC (maintaining safe collateralization ratio)

- Stake borrowed BTC for more artBTC

- Repeat cautiously to amplify yield

Warning: Leverage amplifies both gains and losses. Only for experienced users comfortable with liquidation risk.

Earning Additional GOAT Points (Airdrop Farming)

GOAT Network tracks user activity through the "One Piece Project":

- Mint Your Capsule NFT: Visit onepiece.goat.network and mint your free NFT

- Complete Activities:

- Trade on GOATSwap or Oku

- Provide liquidity

- Stake on Artemis

- Refer friends

- Earn GEC (GOAT Energy Credits): These track your contribution and convert to GOATED tokens at TGE

- Use Invite Code: UFUZCX (for bonus points)

Bridge the minimum recommended amount: Ensure you bridge at least $50 worth of assets to qualify for New User rewards.

Key Protocols in the GOAT Ecosystem

Staking & Liquid Staking:

- Artemis Finance: Primary staking hub, issues artBTC

- Pell Network: BTC restaking for additional yield layers

Trading:

- GOATSwap: Native DEX for swapping and liquidity provision

- Oku: Uniswap v3 deployment with concentrated liquidity

- GOATUP: Perpetuals trading with up to 50x leverage

Lending & Borrowing:

- Avalon Finance: Lending marketplace for BTC and LSTs

- Sumer Money: Alternative lending protocol

Advanced DeFi:

- Stable Jack: Yield and volatility marketplace

- Lynx Protocol: Perpetual DEX for going long/short on BTC

Risk Considerations

While GOAT Network offers genuine BTC yield, understand the risks:

Smart Contract Risk: All DeFi protocols carry smart contract vulnerabilities. GOAT has undergone audits, but risk remains.

Bridge Risk: Bridging BTC to Layer 2 involves trust assumptions, though GOAT uses BitVM2 for trustless bridging.

Liquidation Risk: If using leverage or borrowing, improper collateralization leads to liquidation.

Complexity: Moving between protocols increases the surface area for user error or exploits.

Network Maturity: GOAT Network launched its alpha mainnet recently. Early-stage protocols carry additional risks.

The Bottom Line

GOAT Network represents a legitimate attempt to bring sustainable yield to Bitcoin holders without compromising the asset's security model. "Nearly every Bitcoin holder we've talked to, large and small, wants yield, but they're not willing to sell their Bitcoin to get it," Liu said.

The yield isn't coming from token emissions or venture capital subsidies—it's generated from actual economic activity on the network. As usage grows, yields should remain sustainable rather than collapsing like many "high APY" schemes.

For Bitcoiners who've watched DeFi flourish on Ethereum while BTC sat idle, GOAT Network offers a path to productivity without leaving the Bitcoin security model. The Layer 2 settles directly to Bitcoin, uses zero-knowledge proofs for verification, and maintains decentralized sequencers to avoid centralization risks.

Getting Started:

- Visit goat.network to explore the ecosystem

- Check yield.goat.network for current APYs

- Start with conservative options (Safebox or native staking)

- Expand into advanced strategies as you gain comfort

Bitcoin can finally be more than digital gold sitting in cold storage. The question is whether you're ready to put it to work.

Disclaimer : This guide is for educational purposes. Always DYOR and never invest more than you can afford to lose. DeFi involves smart contract risk, bridge risk, and liquidation risk.