Fold is transforming how people earn and use Bitcoin by integrating it into everyday spending.

Whether you're buying coffee, paying bills, or shopping online, Fold offers a unique way to accumulate satoshis (the smallest unit of Bitcoin) while going about your daily financial activities.

This comprehensive review explores everything you need to know about Fold's platform, features, costs, and whether it's the right choice for your Bitcoin journey.

What is Fold?

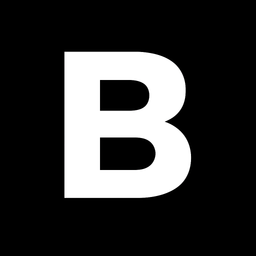

Fold is a Bitcoin-focused financial platform that allows users to earn Bitcoin rewards on everyday purchases. Founded in 2019 by Will Reeves, the platform was created with a simple mission: make Bitcoin more accessible to the general public.

Rather than earning traditional cashback in dollars or rewards points, Fold users earn satoshis (sats) on their spending. The platform has evolved from a simple gift card rewards app into a comprehensive personal finance solution that includes a prepaid debit card, bill payment features, Bitcoin buying and selling capabilities, and various gamified earning opportunities.

Key Features

Fold Visa Prepaid Debit Card

The Fold Card is the centerpiece of the platform. This Visa prepaid debit card, issued by Sutton Bank, allows you to earn Bitcoin rewards on every purchase. Card features include:

- No annual fee or credit check required

- Earn Bitcoin cashback on all eligible purchases

- Fund via direct deposit or ACH transfer

- FDIC insurance up to $250,000 through Sutton Bank (for USD balances)

The Spin Wheel Rewards System

One of Fold's most distinctive features is its gamified spin wheel. After making purchases, users can spin the wheel to determine their Bitcoin cashback rate. Rewards can range from a base rate of 0.5% to as high as 100% back in Bitcoin, with the possibility of winning up to 1 full Bitcoin.

Even free account holders can spin the wheel daily for free satoshis, earning between 5 and 2,500 sats without making any purchases.

Gift Card Purchases

Fold partners with numerous popular retailers, allowing users to purchase gift cards and earn Bitcoin rewards ranging from 1% to 20% back. Partner merchants include major brands like Amazon, Uber, DoorDash, Chipotle, AMC, Adidas, and Home Depot. Rewards are credited immediately upon purchase at current Bitcoin market value.

Bill Payment Features

Fold provides account and routing numbers that allow users to pay bills directly from their Fold account. Users can earn up to 1.5% back in Bitcoin on eligible bill payments, including major expenses like mortgage, rent, and credit card payments. This feature transforms routine bill paying into an opportunity to accumulate Bitcoin.

Bitcoin Buying and Selling

The platform allows users to buy, sell, and send Bitcoin directly through the app. Features include automated Bitcoin purchases through round-ups on card transactions, recurring buys (dollar-cost averaging), and the ability to receive paychecks in up to 100% Bitcoin through direct deposit. Fold+ premium members enjoy zero fees on all Bitcoin transactions.

Pricing Plans: Free vs. Fold+

Fold offers two membership tiers designed to accommodate different usage levels and Bitcoin accumulation strategies.

Comparison Table:

| Feature | Free Plan | Fold+ ($150/year) |

|---|---|---|

| Base Cashback Rate | 0.5% back | 0.5% back |

| Category Boosts | Up to 5% back | Up to 15% back |

| Bitcoin Purchase Fees | Standard fees apply | Zero fees |

| ATM Withdrawal Fees | Standard ATM fees | No Fold fees |

| International Fees | Standard fees | No international fees |

| Spin Frequency | Daily free spins | More frequent spins |

| Maximum Spin Prize | Up to 1 BTC | Up to 1 BTC |

The Fold+ membership costs $150 per year. For frequent users who make regular Bitcoin purchases or significant card spending, the premium tier can pay for itself through fee savings and enhanced rewards.

Pros and Cons

Advantages

- Passive Bitcoin Accumulation: Earn Bitcoin on purchases you would make anyway, building your holdings without additional effort or investment.

- No Annual Fee: The free tier requires no upfront costs, making it accessible to Bitcoin beginners.

- Gamified Experience: The spin wheel adds an element of fun and the potential for outsized rewards beyond typical cashback rates.

- Multiple Earning Methods: Combine card spending, gift card purchases, bill payments, and daily spins to maximize Bitcoin accumulation.

- Fee-Free Bitcoin Purchases: Fold+ members can buy Bitcoin with zero fees, making regular accumulation more cost-effective.

- Full Banking Features: Direct deposit, bill pay, and account routing numbers provide comprehensive personal finance functionality.

Disadvantages

- Variable Rewards: Unlike fixed cashback cards, the spin wheel introduces unpredictability. Your actual rewards may be lower than traditional 2% cashback cards.

- Mixed Customer Reviews: With a Trustpilot score of 2.1 out of 5, user experiences vary significantly. Common complaints include slow withdrawals, frozen accounts, and customer service challenges.

- Decreasing Rewards: Some long-time users report that reward rates have been reduced over time, with maximum spin rates dropping from 2-3% to closer to the 1% base rate.

- Bitcoin Price Volatility: Rewards are paid in Bitcoin, so their dollar value fluctuates with market conditions. If Bitcoin's price drops, your rewards lose value accordingly.

- Transaction Fees: Free tier users face fees on Bitcoin purchases and sales, reducing the value proposition unless you upgrade to Fold+.

- Limited Gift Card Availability: Popular options like Amazon gift cards have been removed from the platform, reducing earning opportunities.

Security and Insurance

Security is a critical consideration for any financial platform, especially one dealing with cryptocurrency. Fold implements several protective measures:

- USD Balances: FDIC insured up to $250,000 through pass-through insurance via Sutton Bank, Member FDIC. This coverage applies only to cash balances, not Bitcoin holdings.

- Bitcoin Holdings: Insured through BitGo, covering theft of private keys, insider theft, and key loss scenarios.

- Transaction Security: Encrypted transactions and fraud monitoring protect against unauthorized access.

- Lightning Network: Fast, low-fee Bitcoin transactions through Lightning Network integration.

However, users should note that Fold is a custodial platform. Your Bitcoin is technically controlled by Fold until you withdraw it to your own wallet. For maximum security, consider regularly withdrawing accumulated Bitcoin to a hardware wallet or other self-custody solution.

How to Get Started

Getting started with Fold is straightforward and takes just a few minutes:

- Download the App: Available free on iOS (App Store) and Android (Google Play).

- Create an Account: Basic accounts can be created anonymously without email verification. However, to access all features including the Fold Card, identity verification will be required.

- Order Your Card: Request the Fold Visa Prepaid Debit Card. You'll receive a virtual card immediately for online purchases while waiting for your physical card to arrive.

- Fund Your Account: Add money through bank transfer (ACH) or direct deposit to start using the card.

- Start Earning: Use your card for purchases, buy gift cards, pay bills, and spin the wheel daily to accumulate satoshis.

Comparing Fold to Alternatives

While Fold focuses exclusively on Bitcoin rewards, several alternatives offer cryptocurrency cashback options:

- Lolli: A browser extension and mobile app that partners with over 25,000 stores to offer Bitcoin cashback rewards. Users can earn up to 30% back in Bitcoin (with an average of 7% back) on purchases from major retailers like eBay, Nike, Sephora, Microsoft, and Groupon. Lolli also features a Card Boosts program that adds Bitcoin rewards to existing debit or credit cards for everyday purchases. The platform has distributed over $10 million in Bitcoin rewards since 2018. Note that rewards can take up to 90 days to be credited, and a minimum of $15 in Bitcoin is required for withdrawal.

- Gemini Credit Card: Offers up to 4% back in Bitcoin on gas and EV charging (up to $200/month, then 1%), 3% on dining, 2% on groceries, and 1% on everything else. US only.

- Wirex Card: Provides Cryptoback rewards with up to 8% per transaction depending on spending levels, with rewards paid in WXT tokens.

- Traditional Cashback Cards: Cards like the Apple Card offer a flat 2% cashback on all purchases, which may provide more consistent and predictable rewards than Fold's variable rate system.

The choice between Fold and alternatives depends on your priorities. If you're committed to accumulating Bitcoin and believe in its long-term appreciation, Fold's direct Bitcoin rewards may be more appealing than converting traditional cashback to crypto later. However, if you prioritize consistent, predictable rewards, traditional cashback cards might be more suitable.

Final Verdict

Fold represents an innovative approach to making Bitcoin accessible and integrating it into everyday financial life. The platform successfully gamifies Bitcoin accumulation and offers multiple earning pathways that can add up over time, especially for users who believe Bitcoin will appreciate significantly.

The app's strengths lie in its no-fee entry point, comprehensive banking features, and the engaging spin wheel mechanic that keeps users coming back. For Bitcoin enthusiasts who make regular purchases, Fold provides a straightforward way to stack satoshis without requiring active trading or large upfront investments. The daily spin alone can accumulate tens of thousands of sats annually at zero cost.

However, the platform's weaknesses cannot be ignored. The low Trustpilot rating of 2.1 out of 5 and reports of customer service issues, frozen accounts, and slow withdrawals raise legitimate concerns. The variable rewards system may disappoint users accustomed to consistent cashback rates, and the reduction in gift card options and reward percentages over time suggests the platform may be optimizing for profitability at the expense of user rewards.

For those convinced of Bitcoin's long-term value and comfortable with the inherent volatility and platform risks, Fold offers a unique value proposition. Start with the free tier to test the platform without financial commitment. If you find yourself using it regularly and buying Bitcoin frequently, the Fold+ membership at $150 per year could pay for itself through fee savings.

Remember to regularly withdraw your accumulated Bitcoin to a personal wallet for maximum security, and approach Fold as one component of a diversified strategy for building your Bitcoin position.

While it won't make you rich overnight, it can contribute meaningfully to a long-term Bitcoin accumulation strategy, assuming Bitcoin's value continues to grow as many believers anticipate.

A solid option for Bitcoin enthusiasts willing to accept variable rewards and platform risks in exchange for passive satoshi accumulation.