Five years after President Nayib Bukele made Bitcoin legal tender, El Salvador stands alone. The question isn't whether the experiment worked, it's why no other nation has had the courage to follow.

The Sovereign Sacrifice: El Salvador's Dollar Decades

To understand El Salvador's Bitcoin revolution, you must first understand its monetary imprisonment.

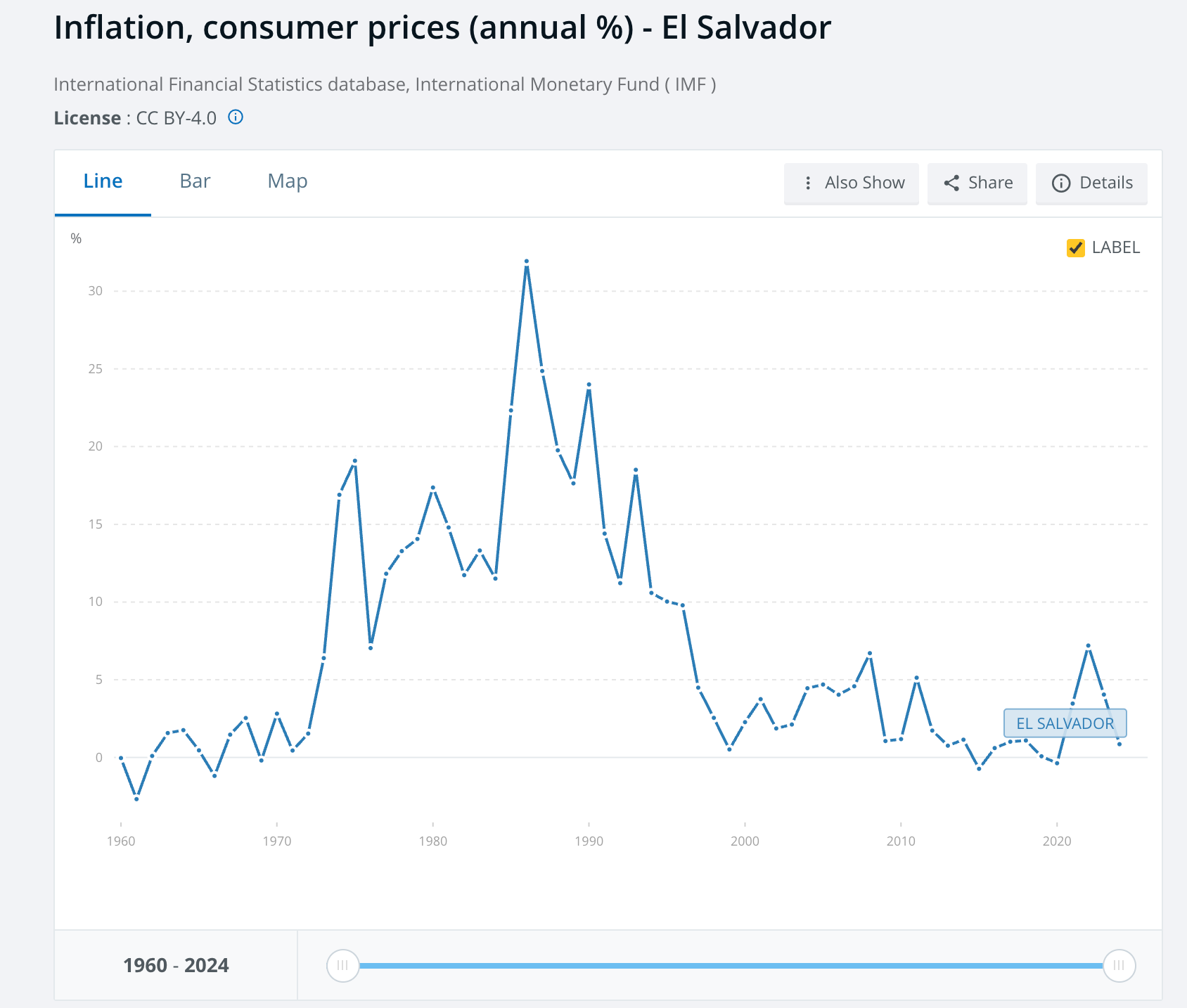

In 2001, after years of currency instability and hyperinflation that ravaged savings and destroyed purchasing power, El Salvador took what seemed like the pragmatic path: full dollarization. The colón was retired. The U.S. dollar became the sole legal tender.

On paper, it brought stability. In practice, it was a Faustian bargain.

For over two decades, 6.5 million Salvadorans lived under a monetary policy designed for 330 million Americans. When the Federal Reserve printed trillions to bail out Wall Street in 2008 and again in 2020, Salvadorans suffered the inflation. When the Fed raised rates to cool an overheating U.S. economy, Salvadoran businesses faced credit crunches despite their own economic conditions. When the dollar strengthened, Salvadoran exports became less competitive through no fault of their own.

El Salvador had sacrificed the most fundamental attribute of sovereignty: control over its own money. It became a monetary colony, importing American monetary policy, exporting its human capital to earn the dollars it could never print, perpetually dependent on $7 billion in annual remittances (24% of GDP) just to keep the economy afloat.

The country couldn't devalue to boost exports. Couldn't lower interest rates to stimulate growth. Couldn't print its way out of debt during emergencies. It was a nation with all the responsibilities of statehood but stripped of the most powerful tool in the sovereign toolkit.

Every Salvadoran understood the bitter irony: they used American money while Americans built walls to keep Salvadorans out.

September 7, 2021: The Declaration of Monetary Independence

When Bukele's Bitcoin Law took effect in September 2021, the global establishment reacted with predictable hysteria. The IMF warned of instability. The World Bank refused to assist. Economists predicted catastrophe. Financial journalists wrote El Salvador's obituary before the experiment began.

Four years later, the country hasn't collapsed. The sky hasn't fallen. Instead, El Salvador has demonstrated something the fiat establishment desperately wants to ignore: a developing nation can chart its own monetary course without permission from Washington, Brussels, or the IMF.

The benefits have been tangible:

- Remittance Revolution: That $7 billion in annual remittances—the lifeblood of the Salvadoran economy, previously bled $700 million annually to Western Union, MoneyGram, and other extractive intermediaries. Lightning Network rails have reduced these fees to near-zero. Families receive more. Workers keep more. Money that once enriched remittance companies now circulates in the Salvadoran economy.

- Financial Inclusion: Before Bitcoin, 70% of Salvadorans had no bank account. The Chivo wallet gave millions their first access to digital finance, no credit check, no minimum balance, no permission needed. In months, El Salvador achieved financial inclusion that traditional banking failed to deliver in decades.

- Monetary Policy Independence: While still using dollars day-to-day, El Salvador now has an alternative store of value outside the Federal Reserve's control. When the Fed debases the dollar, Salvadorans have an escape hatch. When dollar liquidity tightens, Bitcoin provides an alternative settlement layer.

- Geopolitical Optionality: By accumulating Bitcoin in its treasury (currently over 7,474 BTC), El Salvador has built a reserve asset that no foreign power can freeze, sanction, or inflate away. Compare this to traditional reserves held in U.S. Treasury bonds, IOUs denominated in someone else's currency, subject to someone else's policy.

- Tourism and Investment: Bitcoin City, volcano bonds, and the broader narrative of innovation have attracted a new wave of entrepreneurs, investors, and bitcoiners to El Salvador. What was once known for gang violence is now known for monetary innovation.

The Real Question: Why Is El Salvador Still Alone?

Four years is enough time to evaluate results. El Salvador hasn't collapsed. Its economy has grown. Its experiment has worked well enough that Bukele was re-elected in a landslide. Bitcoin's network effect has strengthened. The technology has matured. Lightning Network has proven viable.

So why hasn't a second country followed? A third? A fourth?

The answer isn't economic, it's political.

The IMF's Iron Grip

Most developing nations are trapped in a debt cycle that makes El Salvador's dollarization look like freedom. They borrow from the IMF and World Bank in dollars. They repay in dollars. When they struggle to repay, they borrow more dollars to service existing dollar debt. The cycle perpetuates indefinitely.

The IMF doesn't offer loans, it offers dependency dressed as assistance. And with that dependency comes conditionality: austerity measures, privatization demands, and above all, monetary orthodoxy. Countries that step out of line find credit lines cut, ratings downgraded, and "concerns" raised about their economic management.

When El Salvador adopted Bitcoin, the IMF immediately suspended a $1.3 billion loan program. The message was clear: innovate at your own financial peril.

For most countries drowning in dollar debt, that threat is enough to kill any Bitcoin ambitions before they begin.

The U.S. Dollar's Network Effect

The dollar is the global reserve currency not because it's the best money, it's the most networked money. International trade is invoiced in dollars. Commodities are priced in dollars. Central banks hold reserves in dollars. SWIFT runs on dollars.

Adopting Bitcoin means stepping outside this network, at least partially. It means facing potential friction in international trade, banking relationships, and diplomatic channels. For small nations dependent on good relations with the U.S. and its allies, that's a terrifying prospect.

El Salvador could dare to defy because Bukele had political capital, popular support, and a willingness to burn bridges with institutions he viewed as obstacles anyway. Most leaders lack that combination.

Regulatory Capture and Banking Pressure

Even if a president supports Bitcoin adoption, they face domestic resistance from their own financial establishment. Commercial banks profit from remittance fees, currency controls, and the existing fiat system. They have lobbyists, political connections, and the ability to fund opposition.

Central bankers, trained in Keynesian orthodoxy at Western universities, view Bitcoin as a threat to their technocratic control. They whisper concerns about money laundering, volatility, and financial stability, concerns that conveniently ignore the money laundering facilitated by traditional banks, the volatility of their own currency mismanagement, and the instability of debt-based fiat systems.

The Courage Gap

Perhaps the most significant obstacle is simple: most leaders lack Bukele's courage.

Adopting Bitcoin as legal tender is politically risky. It invites international criticism, domestic skepticism, and genuine uncertainty. It requires a leader willing to endure mockery from The Economist, lectures from the IMF, and potential short-term chaos as systems adapt.

It requires conviction that monetary sovereignty matters more than approval from Davos.

Few politicians possess that conviction. Most would rather manage decline gracefully within the existing system than risk their careers on monetary revolution.

The Countries That Should Be Next

Several nations share El Salvador's conditions and would benefit immensely from Bitcoin adoption:

- Argentina: Decades of hyperinflation, currency controls, and IMF dependency have devastated Argentine purchasing power. President Javier Milei campaigned on dollarization, but Bitcoin would offer actual sovereignty rather than trading peso mismanagement for dollar dependency.

- Lebanon: Its banking system collapsed, wiping out savings. Its currency lost 90% of its value. Capital controls trap citizens in poverty. Lebanon needs a neutral, censorship-resistant monetary system more than almost anywhere.

- Zimbabwe and Venezuela: Both have experienced hyperinflation that destroyed their currencies. Both populations have turned to USD or other foreign currencies informally. Bitcoin would provide a sovereign alternative to re-dollarization.

- Kenya, Nigeria, and other African nations : Facing currency devaluation, capital controls, and remittance dependency, African nations could leapfrog traditional banking just as they leapfrogged landlines with mobile phones.

The Central African Republic's Cautionary Tale:

The CAR briefly seemed poised to become the second domino in April 2022 when President Faustin-Archange Touadéra announced Bitcoin as legal tender. For a moment, hope flickered that El Salvador wouldn't stand alone. But the attempt collapsed within months under IMF pressure and lack of infrastructure. More troubling, Touadéra's focus shifted to launching Sango Coin (the CAR token) a centralized digital currency that fundamentally missed the point. Bitcoin offers sovereignty precisely because no government controls it; no single entity can inflate it, censor it, or manipulate it.

The path El Salvador blazed demands commitment to Bitcoin itself, not watered-down imitations designed to preserve government control while claiming innovation.

The technical and economic case is clear. What's missing is political will.

The Stakes: A Multi-Polar Monetary Future

El Salvador's Bitcoin adoption isn't just about one small country, it's about breaking the monetary monopoly that has governed the post-Bretton Woods era.

For seventy years, the U.S. has enjoyed "exorbitant privilege", the ability to print the world's reserve currency, export inflation, and run perpetual deficits because the world needs dollars. This arrangement has enriched America while extracting wealth from the developing world through inflation, debt traps, and structural dependency.

Bitcoin offers an exit.

Not an exit to chaos, but an exit to a neutral monetary protocol that no single nation controls. A monetary system where small countries aren't subject to the Federal Reserve's whims. Where sanctions can't weaponize money. Where savings can't be inflated away by foreign central bankers.

If a second country adopts Bitcoin as legal tender, it proves El Salvador wasn't a fluke. A third country creates a trend. A fourth creates a movement. At some point, the network effects flip, and suddenly, the risk isn't in adopting Bitcoin, but in being left behind.

The Waiting Game

We're four years into El Salvador's experiment. The data is in. The technology works. The benefits are real. What we're waiting for now isn't proof of concept, it's proof of courage.

Somewhere, a president is weighing the options. A central banker is questioning orthodoxy. A population is demanding monetary sovereignty. The incentives exist. The template exists. The technology exists.

What's needed is a spark. El Salvador lit the first fire. The world is waiting for the second.

Because once it begins, once the dominoes start falling, monetary sovereignty won't be a radical experiment. It will be the obvious choice.

And institutions that have profited from monetary colonialism for generations will finally lose their grip.

We need a second El Salvador. And a third. And a fourth.

The question is: which country will have the courage to be next?

The clock is ticking. The dollar's dominance isn't eternal. And El Salvador has shown the world there's another way.