Introduction: Why This Decision Matters More Than You Think

Choosing a mining pool isn't like picking a streaming service. You're not just selecting where to point your hashpower for a month. You're making a decision that affects your daily earnings, your operational costs, and whether you realize it or not the future of Bitcoin itself.

Here's what most guides won't tell you: there is no "best" mining pool. There's only the pool that best matches your priorities, your equipment, and your values. A pool that's perfect for a multi-million dollar mining farm in Texas might be completely wrong for someone running a single ASIC in their garage.

This guide will help you understand how mining pools actually work, what really matters when choosing one, and how to match a pool to your specific situation. By the end, you'll be able to make an informed decision based on your needs, not just follow the crowd.

Part 1: Understanding Mining Pools from First Principles

Why Do Mining Pools Even Exist?

Let's start with a reality check. The Bitcoin network's total hashrate is currently over 750 EH/s (exahashes per second). If you're running a single Antminer S19 Pro producing 110 TH/s, you control roughly 0.000015% of the network's total mining power.

What does this mean for solo mining? With that hashrate, you would find a block approximately once every 127 years. That's not a typo. One hundred and twenty-seven years. And when you finally do find that block (assuming Bitcoin is still around), you'd earn the block reward plus transaction fees all at once.

Mining pools solve this problem by combining the hashpower of thousands of miners. Instead of waiting over a century for one massive payout, you contribute your hashrate to a collective effort and receive smaller, regular payments based on your contribution.

The core trade-off: You exchange the astronomical variance of solo mining for predictable, steady income. You give up the possibility of finding a full block yourself in exchange for daily or weekly payments you can actually count on.

How Mining Pools Actually Work: The Technical Reality

When you connect to a mining pool, here's what happens:

- Work Distribution: The pool sends your mining hardware specific mathematical problems to solve (called "shares"). These shares are easier to find than actual Bitcoin blocks.

- Share Submission: When your miner finds a valid share, you submit it to the pool as proof you're working. The pool tracks how many valid shares you submit.

- Block Discovery: Eventually, someone in the pool finds a share that's also a valid Bitcoin block. The pool broadcasts it to the network and collects the 3.125 BTC block reward (as of 2025 after the halving) plus transaction fees.

- Reward Distribution: The pool distributes the block reward among all miners based on how many shares they contributed. Your share of the reward matches your share of the work.

Think of it like a lottery pool at work. Everyone chips in a few dollars. When someone wins, the prize is split among everyone who contributed, proportional to how much they put in.

The Three Core Payout Models (And Why They Matter)

This is where mining pools differ dramatically. The payout model determines how and when you get paid, how much risk you take on, and how much you pay in fees.

💰Pay-Per-Share (PPS): Maximum Predictability

How it works: The pool pays you a fixed amount for every valid share you submit, regardless of whether the pool finds a block. If the pool has bad luck and doesn't find blocks for hours, you still get paid. If the pool has great luck, your payment doesn't increase.

What you're getting: Completely predictable earnings. You can calculate exactly how much you'll earn per day based on your hashrate.

The catch: The pool takes on all the risk, so they charge higher fees (typically 2-4%). You're paying for stability.

Best for: Miners who need predictable cash flow, can't weather income variance, or are running on thin margins where income stability matters more than maximum returns.

💰Full Pay-Per-Share (FPPS): PPS Plus Transaction Fees

How it works: Identical to PPS, but your payment includes an estimate of transaction fees from blocks, not just the base block reward.

What you're getting: Maximum predictability with slightly higher earnings than basic PPS.

The catch: Even higher fees (typically 3-4%) because the pool is taking on even more risk by guaranteeing transaction fee payments.

Best for: Operations prioritizing stability above all else and willing to pay premium fees for zero income variance.

💰Pay-Per-Last-N-Shares (PPLNS): Maximum Long-Term Returns

How it works: You only get paid when the pool finds a block. Your payout is based on how many shares you contributed recently (the "last N shares"). If the pool doesn't find blocks for a day, you earn nothing that day. If the pool finds three blocks in an hour, you might earn three times your average.

What you're getting: Over the long run, higher total earnings because pool fees are much lower (often 0-2%). You're sharing the risk with the pool.

The catch: Extreme income variance. Some weeks you'll earn 50% more than average. Other weeks you'll earn 50% less. You need substantial hashpower or deep pockets to weather the swings.

Best for: Large operations with significant hashpower that can absorb variance, miners who are in it for the long haul, and anyone who wants to maximize returns over time rather than stabilize day-to-day income.

The Hidden Mathematics of Pool Fees

Let's make this concrete with real numbers.

Assume you're running 100 TH/s at current Bitcoin difficulty and prices, generating roughly $45 per day in mining revenue.

Scenario 1: PPS at 3% fee

- Daily fee cost: $1.35

- Annual fee cost: $492.75

- Five-year fee cost: $2,463.75

Scenario 2: PPLNS at 1% fee

- Daily fee cost: $0.45

- Annual fee cost: $164.25

- Five-year fee cost: $821.25

The difference: $1,642.50 over five years. That's the price you pay for income stability.

Now, some pools offer 0% PPLNS. Over five years, that's $2,463.75 in your pocket instead of the pool's. For a small miner, that might be the difference between profitability and operating at a loss.

The key insight: Fee percentages sound small, but they compound dramatically over time. A 2% difference in pool fees can represent thousands of dollars over your mining operation's lifetime.

Part 2: What Actually Matters When Choosing a Pool

Factor 1: Payout Frequency and Minimum Threshold

Every pool has a minimum payout threshold, the amount of Bitcoin you need to accumulate before they'll send a payment.

Common thresholds:

- High threshold: 0.01 BTC (roughly $1,000 at current prices)

- Medium threshold: 0.001 BTC (roughly $100)

- Low threshold: 0.0001 BTC (roughly $10)

Why this matters: With 100 TH/s, you earn about 0.00007 BTC per day.

- At a 0.01 BTC threshold, you wait 143 days for your first payout

- At 0.001 BTC, you wait 14 days

- At 0.0001 BTC, you wait just over a day

If you're a small miner, a high payout threshold effectively locks up your earnings for months. During that time, the pool holds your Bitcoin. If they get hacked, have technical problems, or—worst case—exit scam, you lose everything you've accumulated.

The rule: Choose a payout threshold you can reach in 7-14 days maximum. This minimizes the Bitcoin you have at risk with the pool at any given time.

Factor 2: Geographic Location and Server Latency

Mining is a race. When the network finds a new block, all miners immediately start working on the next one. If you're still working on the old block because you haven't received the update yet, you're submitting "stale shares" that don't count.

The math on latency:

- Industry average latency: 85 milliseconds

- Top pools with global infrastructure: 4.7 milliseconds

- Poor server placement: 200+ milliseconds

Higher latency means more stale shares. More stale shares means less income. The difference between 5ms and 200ms latency can cost you 1-2% of your earnings—potentially more than you save by choosing a pool with lower fees.

What to do: Most pools have servers in multiple regions (North America, Europe, Asia). Always connect to the server geographically closest to you. Don't use the default server unless you know it's optimal.

Factor 3: Pool Size and Centralization Trade-offs

Here's the uncomfortable truth: the largest pools aren't necessarily the best pools. In fact, mining with the largest pools creates a problem that threatens Bitcoin's fundamental value proposition.

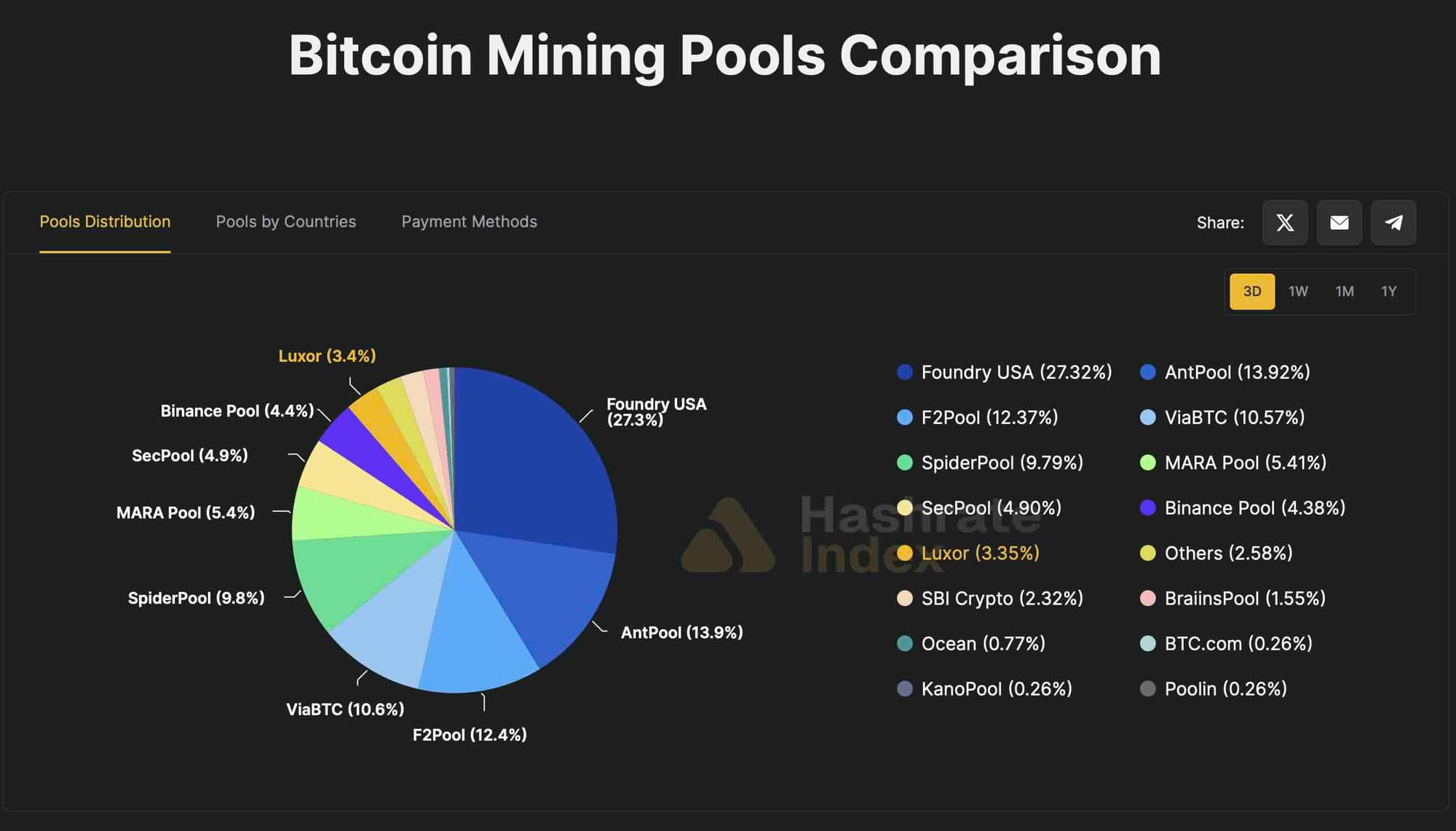

Current market concentration:

- Foundry USA: ~30% of network hashrate

- AntPool: ~19% of network hashrate

- Combined: Nearly 50% of Bitcoin's mining power

When two entities control half of Bitcoin's mining power, we have a serious problem:

- Censorship risk: If governments pressure these pools to filter certain transactions (like they did with F2Pool in 2023), Bitcoin loses its censorship resistance.

- 51% attack surface: While neither pool alone could execute a 51% attack, the concentration makes coordination easier.

- Protocol influence: Large pools gain outsized influence over Bitcoin's development and potential forks.

- Your choice matters: Every terahash you point at Foundry is a vote for more centralization. Every terahash you point at a smaller pool is a vote for decentralization.

- The practical trade-off: Larger pools find blocks more frequently, so your PPLNS payouts are more regular (though not larger on average). Smaller pools find blocks less frequently, meaning higher payout variance. But you're supporting Bitcoin's decentralization.

Factor 4: Security, Uptime, and Track Record

Pool security failures cost miners real money. Here's what to evaluate:

- DDoS protection: In 2020, several major pools suffered DDoS attacks that took them offline for hours. During downtime, miners earn nothing. Check if the pool has CloudFlare or similar DDoS protection.

- Wallet security: Some pools offer "wallet lock" features, once you set your Bitcoin payout address, it can't be changed for 24-48 hours even if someone compromises your account. This prevents instant theft.

- Two-factor authentication (2FA): Mandatory. Any pool that doesn't offer 2FA should be avoided.

- Historical uptime: Has the pool been hacked? Have they had extended outages? Check their status page history and community discussions.

- Age and reputation: A pool that's operated successfully for 5+ years has demonstrated competence. New pools might offer better features, but they haven't proven their reliability.

Factor 5: Transparency and Operational Practices

This is where pools' values become visible:

- Transaction filtering: Does the pool filter transactions based on government sanctions or other criteria? F2Pool filtered OFAC-sanctioned transactions in 2023. They reversed course after backlash, but showed they're willing to compromise Bitcoin's neutrality.

- Block template transparency: Some pools (like Ocean) show you exactly which transactions they're including in blocks. Others operate as black boxes.

- Fee transparency: Are all fees clearly disclosed, or are there hidden charges?

- Open source: Does the pool contribute to Bitcoin open-source development? Do they publish their pool software?

- Company structure: Who owns the pool? Where are they based? What are their regulatory obligations?

Part 3: The Complete Pool Landscape

Now that you understand what matters, let's examine the actual pools you can choose from. I'm organizing these not by size, but by philosophy and intended user.

Foundry USA: The Institutional Standard

Market position: 30% of network hashrate (~277 EH/s) Payout model: Tiered FPPS fees based on hashrate Minimum payout: 0.001 BTC

What sets it apart:

- SOC 2 Type 2 certification (enterprise-grade security standards)

- Comprehensive analytics and reporting dashboard

- Treasury management and custody services for large operations

- Dedicated account management for major clients

The requirements:

- Mandatory KYC (Know Your Customer) verification

- AML (Anti-Money Laundering) compliance

- Designed for institutional and large-scale operations

Who should use it:

- Mining operations requiring regulatory compliance

- Institutional investors with fiduciary duties

- Large farms needing professional services and detailed reporting

- Anyone who prioritizes enterprise-grade infrastructure over privacy

Who should avoid it:

- Privacy-focused miners

- Anyone concerned about contributing to centralization

- Small miners who don't need institutional features

- Miners in jurisdictions where KYC is problematic

Real talk: Foundry is the "corporate" choice. It's professional, compliant, and designed for serious business operations. But you're explicitly trading Bitcoin's privacy and decentralization ethos for institutional comfort.

AntPool: The Flexible Giant

Market position: 19% of network hashrate (~133 EH/s) Payout models: Three options—PPLNS (0% fee), PPS+ (2.5% fee), FPPS (4% fee) Minimum payout: 0.001 BTC

What sets it apart:

- Owned by Bitmain (the largest ASIC manufacturer)

- Three different payout models let you choose your risk tolerance

- Global server infrastructure in every major region

- Supports Bitcoin, Bitcoin Cash, and Litecoin

The advantages:

- 0% fee PPLNS is genuinely competitive if you can handle variance

- Seamless integration if you're running Bitmain hardware (S19, S21 series)

- Strong uptime history dating back to 2014

- Daily payouts once you hit threshold

The considerations:

- 4% FPPS fee is on the high end

- Size contributes to centralization concerns

- Interface can feel dated compared to newer pools

- Bitmain's market dominance raises some eyebrows

Who should use it:

- Miners who want payout flexibility

- Bitmain hardware operators who benefit from ecosystem integration

- Operations that can benefit from the 0% PPLNS option

- Miners prioritizing reliability and established track record

Who should avoid it:

- Anyone uncomfortable with mining centralization

- Miners who exclusively want the lowest fees (other options exist)

- Those who prefer modern, streamlined interfaces

ViaBTC: The Multi-Coin Specialist

Market position: 14% of network hashrate (~84 EH/s) Payout models: PPS (4% fee), PPLNS (2% fee) Minimum payout: 0.0001 BTC (lowest among major pools)

What sets it apart:

- Supports 20+ cryptocurrencies beyond Bitcoin

- Auto-conversion feature automatically converts your Bitcoin earnings to other coins

- Extremely low payout threshold accessible to small miners

- Integrated cloud mining (though I'm generally skeptical of cloud mining)

The killer features:

- 0.0001 BTC minimum threshold means small miners get paid frequently

- Auto-conversion lets you DCA into altcoins using your mining revenue

- Global server infrastructure with strong regional coverage

- Mobile apps for iOS and Android with full functionality

The trade-offs:

- 4% PPS fee is among the highest

- 2% PPLNS fee is higher than competitors

- You're paying a premium for multi-coin convenience

- Cloud mining integration may tempt inexperienced users into poor decisions

Who should use it:

- Small miners who need frequent payouts

- Multi-coin miners managing diverse portfolios

- Miners who want to auto-convert Bitcoin to other assets

- Anyone who values convenience features and doesn't mind paying for them

Who should avoid it:

- Bitcoin maximalists who don't care about altcoin features

- Cost-conscious miners who prioritize lowest fees

- Large operations that don't benefit from the low payout threshold

Luxor Mining: The Developer's Pool

Market position: Smaller pool (~20 EH/s) Payout model: FPPS with 0.7% fee (hourly payouts) Minimum payout: 0.004 BTC

source : https://hashrateindex.com/hashrate/pools

What sets it apart:

- SOC 2 Type 2 certified (institutional-grade security)

- Catalyst service: mine altcoins, receive Bitcoin payments

- Developer-friendly API with extensive documentation

- Hourly FPPS payouts (most frequent among major pools)

The innovations:

- Catalyst automatically converts altcoin mining (Zcash, Dash, etc.) to Bitcoin

- Advanced analytics and custom reporting

- Tax reporting integration (automatically generates tax docs)

- Firmware management and monitoring tools

The considerations:

- 0.004 BTC minimum is higher than most (roughly 4 days of mining for 100 TH/s)

- Smaller pool size means less frequent block discoveries with PPLNS

- No merged mining support

- Primarily focused on North American infrastructure

Who should use it:

- Technical miners who want API access and automation

- Operations needing detailed analytics and monitoring

- Miners who want the flexibility to mine profitable altcoins while receiving Bitcoin

- North American miners benefiting from regional infrastructure

- Anyone who needs integrated tax reporting

Who should avoid it:

- Small miners who can't reach the 0.004 BTC threshold quickly

- Non-technical users who don't need advanced features

- Miners outside North America who might face higher latency

Ocean Mining: Maximum Transparency

This is where many guides stop. They cover the largest pools and call it a day. But they're missing the most important options for anyone who cares about Bitcoin's long-term health.

Market position: Small pool (hashrate varies) Payout model: TIDES (non-custodial, block reward goes directly to miners) Minimum payout: None (you receive block rewards directly)

What makes Ocean revolutionary:

- Non-custodial: The pool never holds your Bitcoin. Block rewards go straight to your wallet.

- Full transparency: Every block template is publicly visible. You can see exactly which transactions the pool is including.

- No pooled funds: Because you receive rewards directly from blocks, there's zero counterparty risk.

- Censorship resistance: Ocean is committed to including all valid transactions without filtering.

The TIDES payout model: Traditional pools collect block rewards, hold them, and pay miners later. Ocean does something different. When the pool finds a block, it constructs the coinbase transaction (block reward) to pay miners directly based on their recent share contributions. You receive Bitcoin straight from the block, not from the pool's wallet.

What this means:

- No minimum payout threshold (you're paid from every block the pool finds)

- Zero custody risk (the pool can't be hacked, can't exit scam, can't freeze funds)

- Maximum transparency (you can verify everything on-chain)

- True decentralization (you maintain complete control of your funds)

The trade-offs:

- Higher payout variance (small pool finds blocks less frequently)

- More complex setup (you need to understand non-custodial systems)

- Potentially longer time between payouts

- Less hand-holding (you're responsible for your own security)

Who should use it:

- Miners who prioritize decentralization over convenience

- Anyone concerned about counterparty risk with traditional pools

- Bitcoin purists who want maximum transparency

- Technical miners comfortable with non-custodial systems

- Anyone willing to accept higher variance for true ownership

Who should avoid it:

- Small miners who need frequent, predictable payouts

- Non-technical users who want simplified operations

- Anyone uncomfortable with income variance

- Miners prioritizing maximum convenience

Real talk: Ocean Pool represents what Bitcoin mining should be, transparent, non-custodial, censorship-resistant. It's not the easiest option. It's not the most profitable day-to-day. But it's the most aligned with Bitcoin's founding principles.

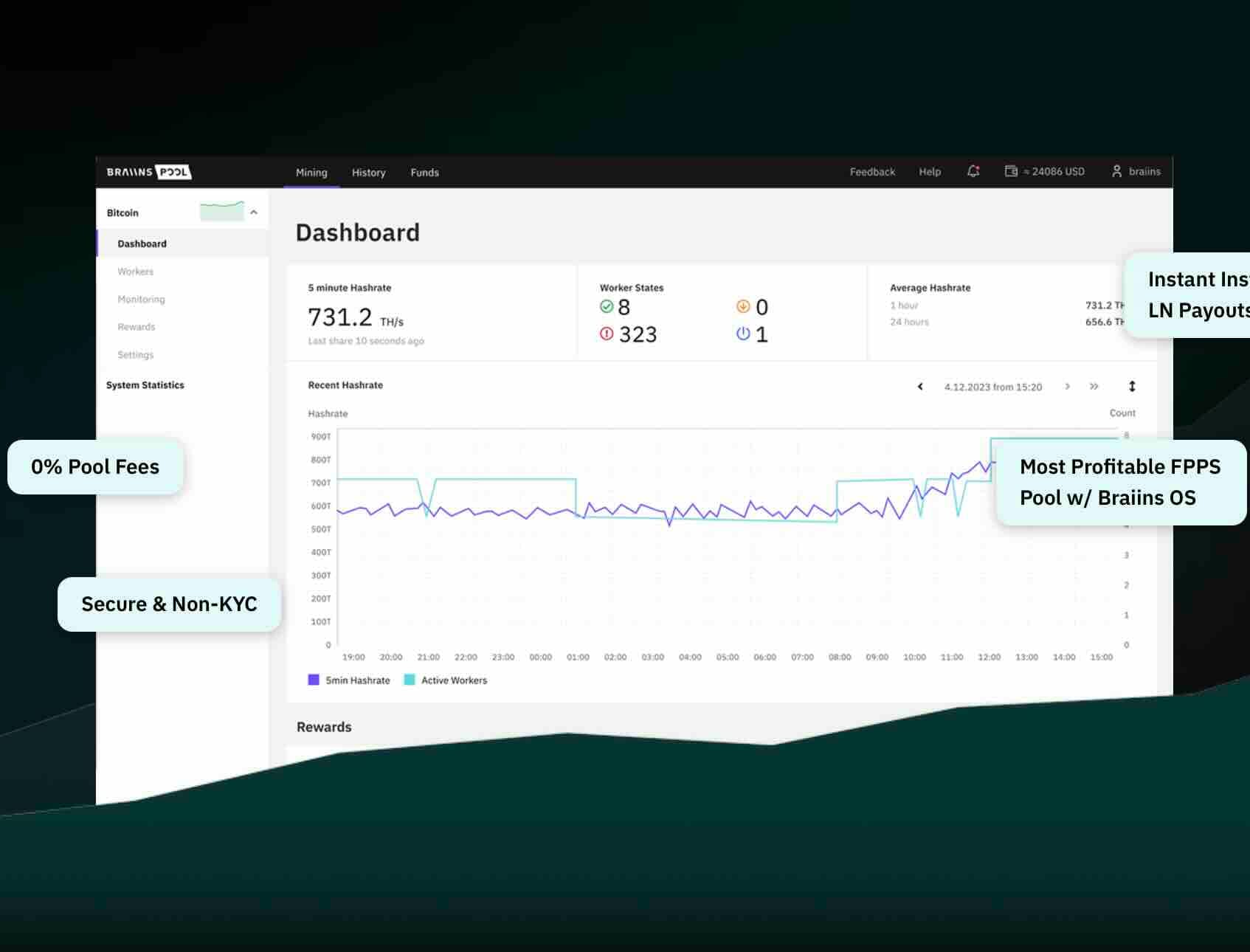

Braiins Pool (Formerly Slush Pool): The Original Pool

The historical significance: Braiins Pool launched in 2010 as Slush Pool, the very first Bitcoin mining pool. The creator, Marek Palatinus (slush), invented the concept of pooled mining. Every mining pool that exists today is built on innovations first introduced by Slush Pool.

Market position: Medium-sized pool (~15-20 EH/s) Payout model: Score-based system (variant of PPLNS) Minimum payout: 0.001 BTC

What sets it apart:

- Score-based rewards (discourages pool hopping while remaining variance-reduced)

- Stratum V2 protocol support (next-gen mining protocol with better efficiency and security)

- Open-source development (Braiins actively develops Bitcoin mining software)

- Transparent operations (detailed documentation of all systems)

- Lower fees than industrial giants (typically around 2%)

The technical innovations:

- Stratum V2: Improved security, reduced bandwidth, and better decentralization

- BraiinsOS: Open-source firmware for ASICs that improves efficiency

- Transparent block templates: You can audit what transactions are being included

- Score-based rewards: Balances payout variance with fairness

The philosophy: Braiins operates with a strong ethos of supporting Bitcoin's decentralization and open-source development. They contribute significantly to Bitcoin Core and mining infrastructure projects. When you mine with Braiins, you're supporting a team that actively builds the tools that make Bitcoin better.

The considerations:

- Smaller than industrial pools (higher payout variance than Foundry)

- Requires understanding score-based rewards (more complex than simple PPS)

- May not be optimal for miners exclusively chasing maximum short-term profits

Who should use it:

- Miners who value Bitcoin's history and want to support the original pool

- Anyone who prioritizes open-source development and transparency

- Technical miners interested in Stratum V2 and cutting-edge protocols

- Miners willing to accept moderate variance for stronger decentralization

- Anyone who wants to support a pool aligned with Bitcoin's original values

Who should avoid it:

- Miners requiring maximum income stability (PPS pools are better)

- Non-technical users who want the simplest possible experience

- Large operations that need institutional services and compliance features

The Geographic Specialists

Some pools focus on serving specific regions with optimized infrastructure:

North American pools:

- Lower latency for U.S. and Canadian miners

- Often aligned with local regulatory requirements

- May offer hosting services or equipment financing

Asian pools:

- Optimized for miners in China, Japan, Korea, Southeast Asia

- Often have better support for local payment methods

- May have multi-language interfaces

European pools:

- GDPR compliant

- Euro-denominated reporting options

- Optimized server locations throughout Europe

Why region matters: A pool with servers in Singapore won't serve a Texas miner as well as one with U.S. infrastructure, regardless of other features.

Part 4: Making Your Decision

You now understand how pools work, what factors matter, and what's actually available. Let's put it together into a decision framework.

Step 1: Define Your Priorities

Answer these questions honestly:

Question 1: What's your hashrate?

- Less than 50 TH/s: You're a small miner

- 50-500 TH/s: You're a medium miner

- 500+ TH/s: You're a large miner

Question 2: What's your primary goal?

- Maximum profitability over the long term

- Predictable income I can budget around

- Supporting Bitcoin's decentralization

- Learning and experimentation

Question 3: Can you handle income variance?

- I need steady income to cover electricity costs

- I have cushion to weather irregular payments

- I'm in this for the long haul and variance doesn't bother me

Question 4: How important is privacy?

- Critical (no KYC under any circumstances)

- Important (prefer to avoid it)

- Not a concern (fine with KYC)

Question 5: Are you Bitcoin-only or multi-coin?

- Bitcoin only

- Bitcoin + a few specific altcoins

- Actively mining many cryptocurrencies

Question 6: What's your technical comfort level?

- Beginner (need simple, straightforward operations)

- Intermediate (comfortable with some complexity)

- Advanced (want maximum control and technical features)

Step 2: Match Your Profile to a Pool

Based on your answers, here's my recommendation framework:

- Profile: Small miner, need predictability, simple operation → ViaBTC (low threshold, PPS option, simple interface) or AntPool (if you have Bitmain hardware)

- Profile: Small miner, value decentralization, technical comfort → Braiins Pool (support Bitcoin's ecosystem, reasonable fees) or Ocean (if you can handle variance and want zero custody)

- Profile: Medium miner, maximize long-term returns, can handle variance → AntPool PPLNS (0% fees) or Braiins Pool (transparent operations, good balance)

- Profile: Medium miner, need stability, don't mind fees → Luxor (if in North America) or Foundry (if you're okay with KYC)

- Profile: Large institutional operation, need compliance → Foundry USA (enterprise features, SOC 2 certified, full compliance)

- Profile: Large miner, maximize profits, comfortable with variance → AntPool PPLNS (0% fees, proven infrastructure) or split between AntPool and Braiins (hedge centralization)

- Profile: Ideologically motivated, maximum decentralization → Ocean (non-custodial, transparent) or Braiins (open-source, historical significance) or Demand (grassroots)

- Profile: Multi-coin miner, need flexibility → ViaBTC (20+ coins, auto-conversion) or F2Pool (40+ coins, but consider the censorship history)

- Profile: Technical miner, want advanced features → Luxor (API, analytics) or Braiins (Stratum V2, open-source tools)

Step 3: Do a Real-World Test

Don't commit 100% of your hashpower immediately. Here's the smart approach:

- Choose two pools based on your profile

- Split your hashpower: 70% to primary choice, 30% to secondary

- Monitor for 30 days: Track actual earnings, stale share percentage, uptime, ease of use

- Compare real performance: Calculate effective earnings after fees, convenience, and any issues

- Make final decision: Commit to the pool that performed best in practice, not theory

What to track:

- Actual Bitcoin received (not theoretical calculations)

- Stale share percentage (should be under 1%)

- Pool uptime (check their status page)

- Payment reliability (did payouts arrive on schedule?)

- Support responsiveness (if you had questions)

- Dashboard usability (can you monitor effectively?)

Step 4: The Decentralization Consideration

Here's something most miners don't think about: your pool choice is a vote.

If everyone chooses the largest pools because they're "safe," we end up with centralized Bitcoin. At that point, Bitcoin loses the core property that makes it valuable—censorship resistance and decentralization.

A balanced approach:

- Point 60-70% of your hashpower at your optimal pool (maximum earnings)

- Point 30-40% at a smaller, decentralization-focused pool (support the network)

Yes, this might cost you 0.5-1% in total earnings. But it's insurance for Bitcoin's long-term value. If Bitcoin becomes centralized and loses its core value proposition, your earnings become worthless anyway.

Pools that support decentralization:

- Ocean (non-custodial, small)

- Braiins (open-source, transparent)

- Demand (grassroots, explicitly anti-centralization)

- Any pool with less than 5% of network hashrate

Part 5: The Practical Setup (Getting It Right)

You've chosen your pool. Now let's make sure you don't lose money to avoidable mistakes.

Step 1: Proper Hardware Configuration

Power supply sizing: Your ASIC's nameplate wattage isn't its actual draw. An Antminer S19 Pro is rated at 3,250W but actually pulls closer to 3,400W at the wall due to inefficiencies.

Rule: Your PSU should be rated for 20% above actual draw. For an S19 Pro, that means a 4,000W+ PSU. Undersized power supplies cause instability, crashes, and lost earnings.

Network connection: Use wired Ethernet, never WiFi. Wireless adds latency and creates packet loss. Every dropped packet is a potential lost share. The Ethernet cable costs $5. The earnings it protects are worth thousands.

Step 2: Optimal Pool Connection

Server selection: Don't use the default Stratum URL. Find your pool's regional servers:

- If you're in Texas, use the North American server

- If you're in France, use the European server

- If you're in Singapore, use the Asian server

Why this matters: The difference between 5ms latency (nearby server) and 200ms (cross-globe server) is 1-2% of your earnings in stale shares. Over a year, that's $164-$328 for a 100 TH/s operation.

How to find the optimal server:

# Test latency to each pool server

ping -c 10 us.pool.com

ping -c 10 eu.pool.com

ping -c 10 asia.pool.com

# Choose the one with lowest average latency

Step 3: Payout Configuration

Choosing your threshold: Calculate how long it takes you to reach different thresholds:

With 100 TH/s earning ~0.00007 BTC/day:

- 0.0001 BTC threshold = 1.4 days

- 0.001 BTC threshold = 14 days

- 0.005 BTC threshold = 71 days

The balance:

- Lower threshold = more frequent payments but higher transaction fees

- Higher threshold = fewer transaction fees but more Bitcoin at risk with the pool

My recommendation: Choose a threshold you can reach in 7-14 days. This minimizes risk while keeping transaction costs reasonable.

Step 4: Security Hardening

Mandatory security measures:

- Enable 2FA: Use Google Authenticator or Authy, never SMS

- Enable wallet lock: Prevents instant payout address changes

- Use a unique, strong password: Never reuse passwords across pools

- Enable email notifications: Get alerted to payout address changes, password changes, worker disconnections

- IP address whitelisting: If your IP is static, restrict account access to it

What you're protecting against:

- Account takeover (attacker changes payout address, steals future earnings)

- Pool hack (pool database compromise exposing user data)

- Man-in-the-middle attacks (someone intercepting your credentials)

Step 5: Monitoring and Optimization

Daily checks:

- Hashrate (is it where it should be?)

- Stale share percentage (should be <1%)

- Rejected share percentage (should be <0.5%)

- Pool uptime (check status page for any issues)

- Temperature (ASICs should run at 60-75°C)

Weekly checks:

- Actual earnings vs. theoretical (calculate expected earnings, compare to actual)

- Pool fee charges (verify they match advertised rates)

- Payout accuracy (confirm math is correct)

Monthly optimization:

- Review alternative pools (are there better options now?)

- Check Bitcoin difficulty changes (how does this affect earnings?)

- Evaluate electricity costs (did rates change?)

- Review profitability (should you continue operating?)

Part 6: The Uncomfortable Truths About Mining

Let's talk about what the pool marketing doesn't tell you.

Truth 1: Most Small Miners Aren't Profitable

After the 2024 halving, block rewards dropped from 6.25 BTC to 3.125 BTC. This cut all mining revenue in half overnight. At the same time, network hashrate keeps climbing, increasing difficulty.

The math:

- Electricity cost >$0.10/kWh: You're likely operating at a loss or breaking even

- Modern ASIC (S19 series): Profitable at $0.06-0.08/kWh

- Older hardware (S9, S17): Profitable only under $0.04/kWh

Reality check: If you're paying retail electricity rates ($0.12-0.15/kWh), you're almost certainly losing money. Pool choice won't save you. You need cheaper power or newer hardware.

Truth 2: Pool Choice Matters Less Than These Factors

In order of impact on profitability:

- Electricity cost (60% of profitability determination)

- Hardware efficiency (25% of profitability determination)

- Operational discipline (10% of profitability determination)

- Pool choice (5% of profitability determination)

Pool choice matters, but it's not magic. A miner paying $0.15/kWh won't become profitable by switching pools. A miner paying $0.04/kWh will be profitable regardless of pool choice.

The implication: Optimize your power cost first, your hardware second, your operations third, and your pool fourth.

Truth 3: The Centralization Crisis Is Real

Three pools (Foundry, AntPool, ViaBTC) control over 60% of Bitcoin's hashrate. This is a genuine threat to Bitcoin's core value proposition.

What can happen with concentrated mining power:

- Transaction censorship (already happened with F2Pool in 2023)

- Block withholding or selfish mining

- Consensus manipulation

- Protocol governance capture

- Regulatory pressure compliance

Your responsibility as a miner: You're not just choosing a business partner. You're participating in Bitcoin's security model. Every pool choice either strengthens or weakens Bitcoin's decentralization.

Truth 4: Mining Is No Longer Passive Income

The era of "set it and forget it" mining ended years ago. Modern mining requires:

- Daily monitoring and optimization

- Rapid response to hardware failures

- Constant evaluation of profitability

- Electricity contract negotiation

- Hardware maintenance and replacement

- Tax compliance and reporting

- Market timing for Bitcoin sales

If you can't commit to active management, mining probably isn't for you. Buy Bitcoin instead.

Final Recommendations: Choose Based on What Matters to You

After everything we've covered, here's my honest recommendation framework.

If You're Brand New to Mining

Start here: ViaBTC or AntPool Why: Simple interfaces, low minimum payouts, PPS options for predictable learning, good documentation Duration: Mine for 3 months, learn the basics, then re-evaluate

If You're Serious About Profitability

Primary pool: AntPool (0% PPLNS) or Braiins Pool Secondary pool: Split 20-30% to Ocean or another small pool Why: Maximize long-term earnings with 0% fees while supporting decentralization Requirement: Must have hashpower to handle PPLNS variance (200+ TH/s recommended)

If You're Ideologically Motivated

Primary pool: Ocean Mining Secondary pool: Braiins Pool Why: Maximum alignment with Bitcoin's values—non-custodial, transparent, censorship-resistant Acceptance: You're trading some profitability for principles, and that's a valid choice

If You're Running an Institution

Only viable option: Foundry USA Why: SOC 2 compliance, KYC/AML processes, enterprise features, professional support Accept: You're contributing to centralization as a necessary trade-off for institutional requirements

If You're Technical and Want Control

Primary pool: Braiins Pool (Stratum V2, open-source) Secondary pool: Luxor (API access, advanced analytics) Why: Maximum technical features, control, and innovation Benefits: Learn cutting-edge protocols, contribute to Bitcoin development

My Personal Approach (If I Were Mining Today)

Here's what I would do with 500 TH/s and $0.06/kWh power:

- 60% to AntPool PPLNS (0% fees, maximize earnings)

- 30% to Braiins Pool (support open-source development, reasonable fees)

- 10% to Ocean (support decentralization, accept the variance)

Reasoning: Optimizes for profitability while meaningfully supporting Bitcoin's decentralization and open-source ecosystem. The 10% to Ocean is essentially a donation to the network's health, insurance that Bitcoin remains valuable long-term.

Conclusion: There Is No Perfect Pool, Only the Right Pool for You

We've covered a lot of ground:

- How mining pools actually work (and why they exist)

- The three payout models and their real-world implications

- What factors actually matter (fees, latency, security, values)

- The complete landscape from corporate giants to grassroots operations

- How to match your specific situation to the right pool

- The uncomfortable truths about mining profitability in 2025

The key insight: Pool selection is about trade-offs, not absolutes.

You're balancing:

- Profitability vs. decentralization support

- Income stability vs. maximum long-term returns

- Convenience vs. control

- Privacy vs. institutional features

- Short-term optimization vs. long-term network health

No pool is perfect across all dimensions. The pool that's perfect for an institutional investor is wrong for a Bitcoin idealist. The pool that's optimal for a small hobbyist is inadequate for a large operation.

Point at least some of your hashpower toward smaller pools, open-source operations, or transparent organizations. Yes, it might cost you 1-2% in earnings. But it's insurance for Bitcoin's core value. If Bitcoin loses its decentralization and becomes just another payment network, your mining earnings won't matter anyway.

Mine profitably. But mine responsibly.

Disclaimer: This article is for educational purposes only and does not constitute financial or investment advice. Bitcoin mining involves significant capital investment, technical expertise, and electricity costs. Mining profitability depends on Bitcoin price, network difficulty, electricity rates, and hardware efficiency, all of which fluctuate.

Pool selection is just one variable in a complex profitability equation. Perform your own due diligence, calculate your specific costs and expected returns, and consider consulting with financial and technical advisors before making mining-related decisions. Mining pool centralization presents real risks to Bitcoin's censorship resistance; choose pools that align with your values and risk tolerance.

Sources and Further Reading:

- Bitcoin Mining Pool Statistics: https://hashrateindex.com/

- Pool Comparison Data: https://asicmarketplace.com/

- Stratum V2 Documentation: https://stratumprotocol.org/

- Ocean Mining Documentation: https://ocean.xyz/

- Braiins Pool Information: https://braiins.com/pool

Foundry USA: The Institutional Powerhouse

F

AntPool: The Multi-Currency Veteran

Backed by Bitmain since 2014, AntPool commands close to 19% of network hashrate with approximately 132.7 EH/s.

What sets it apart: Three payout options give you flexibility. PPLNS at 0% fees (transaction fees excluded) is the best deal if you can handle variance. PPS+ at 2.5% and FPPS at 4% offer stability for different risk tolerances.

Global server infrastructure means lower latency regardless of location. The pool supports Bitcoin Cash and Litecoin if you want to diversify.

The downside: The 4% FPPS fee is steep compared to competitors. Some users find the interface clunky. And like Foundry, AntPool's size raises centralization concerns.

Daily payouts: Once you hit 0.001 BTC, earnings arrive every 24 hours. Security includes 2FA, DDoS protection, and wallet locks.

Best for: Miners who want payout flexibility and don't mind Bitmain's ecosystem. The 0% PPLNS option attracts cost-conscious operators with significant hashpower.

ViaBTC: The Swiss Army Knife

ViaBTC holds approximately 14% of network hashrate with around 83.5 EH/s. What it lacks in size, it makes up for in features.

The killer feature: Auto-conversion. Your Bitcoin earnings automatically convert to other cryptocurrencies without manual trading. This is huge if you're managing a diversified portfolio.

Why we like it: Support for over 20 cryptocurrencies means you can pivot strategies without changing pools. The 0.0001 BTC minimum threshold is the lowest among major pools, making it accessible for small miners.

Global servers, 2FA, and wallet locks provide solid security. Mobile apps let you monitor on the go.

The trade-off: PPS fees hit 4%, and PPLNS sits at 2%—both higher than some competitors. Cloud mining options exist, but I'm skeptical of cloud mining in general due to market volatility risks.

Ideal for: Miners who want cryptocurrency diversity, low payout thresholds, and don't mind paying slightly higher fees for convenience features.

Luxor Mining Pool: The Developer's Choice

Luxor contributes about 20 EH/s to the network. Smaller than the giants, but that's not a weakness—it's a feature.

What makes Luxor brilliant: The Catalyst service lets you mine altcoins like Zcash or Dash while receiving Bitcoin payouts. This simplifies portfolio management without splitting your hashpower across multiple pools.

SOC 2 Type 2 certification matches Foundry's security standards. The developer-friendly API and advanced analytics appeal to technical operations.

The innovative part: Hourly FPPS payouts at 0.7% fees. That's competitive pricing with faster payment frequency than most pools. Tax reporting integration automates compliance headaches.

The drawbacks: The 0.004 BTC minimum payout is higher than most competitors, making it less convenient for small-scale miners. No merged mining support means you can't mine multiple coins simultaneously under a single algorithm.

Perfect for: Technical miners who want advanced analytics, frequent payouts, and the flexibility to earn Bitcoin while mining altcoins. North American operations benefit from strong regional server infrastructure.