A deep dive into Jeff Booth's game-changing book and why every Bitcoiner needs to read it

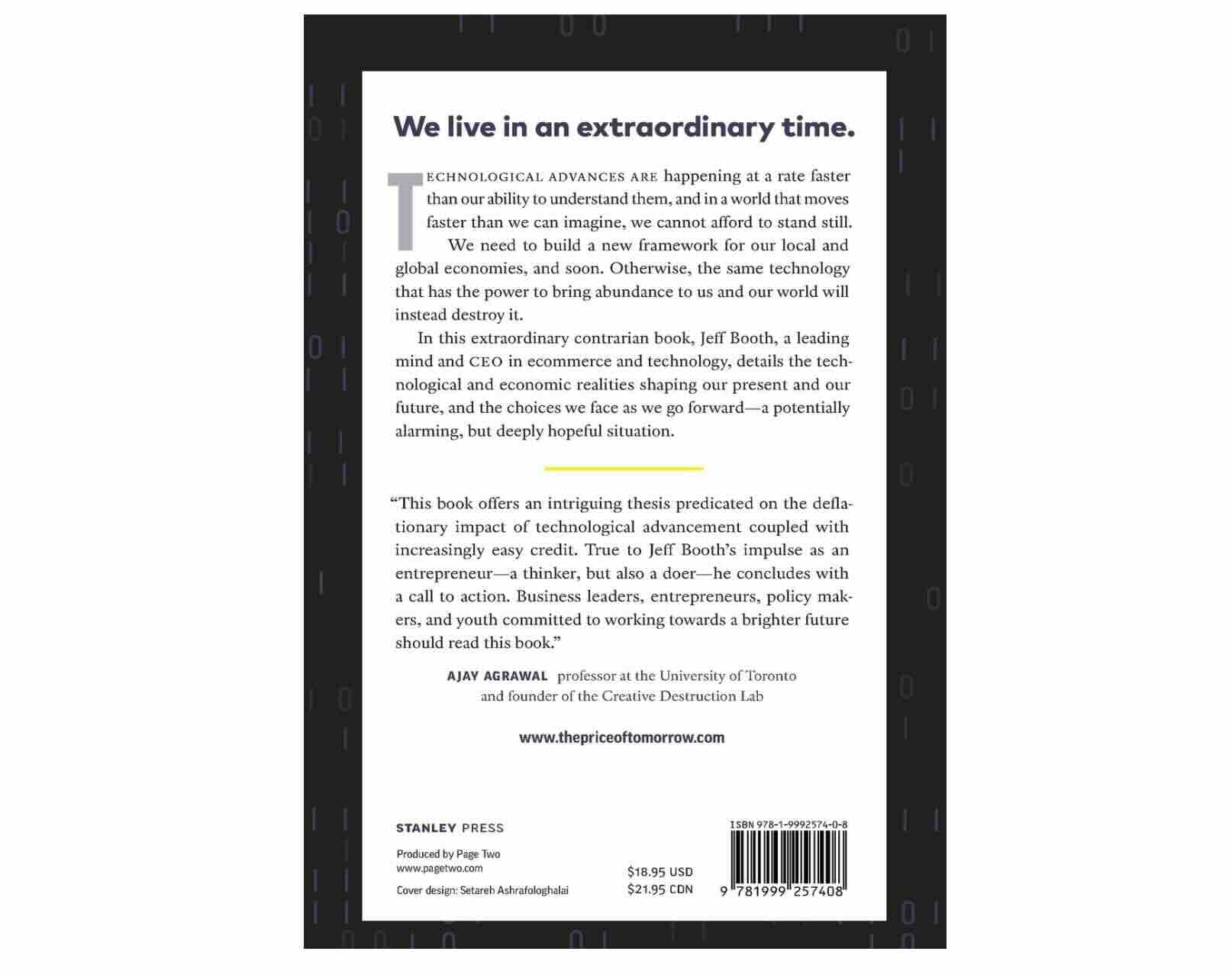

If you've ever wondered why the world feels like it's simultaneously advancing and falling apart, Jeff Booth's "The Price of Tomorrow" might just blow your mind. This isn't your typical finance book—it's a wake-up call about the collision between technology and our outdated economic system.

The Big Idea That Changes Everything

Here's the thesis that makes this book essential reading: Technology is inherently deflationary. Everything tech touches gets cheaper, better, and more abundant. Your smartphone has more computing power than NASA used to land on the moon, and it costs a fraction of what a basic computer cost 30 years ago. This should be amazing news, right?

Plot twist: Our entire economic system is built on the assumption that prices must always go up (inflation). Governments, central banks, and the financial system all depend on perpetual inflation to function. When technology tries to make things cheaper and central banks simultaneously try to force prices higher through money printing, something's gotta give.

Why This Matters to You

Booth argues we're living through a fundamental incompatibility: deflationary technology versus inflationary monetary policy. It's like trying to drive with one foot on the gas and one on the brake.

The result? We get:

- Asset bubbles that make housing unaffordable

- Increasing wealth inequality

- Jobs that technology should have eliminated being artificially propped up

- Economic growth that requires ever-increasing amounts of debt

- A system fighting against the natural abundance technology wants to create

The Bitcoin Connection

Here's where it gets interesting for the Bitcoin community. Booth makes a compelling case that we need a monetary system that embraces deflation rather than fights it. Sound familiar?

Bitcoin's fixed supply of 21 million coins means it's inherently deflationary. As productivity and technology make goods cheaper, a deflationary currency increases in purchasing power—rewarding savers and aligning perfectly with technological progress instead of fighting against it.

The book doesn't just pump Bitcoin (though Booth clearly sees its potential). Instead, it builds the intellectual foundation for why a deflationary money makes sense in a world where technology naturally drives prices down.

What You'll Learn

The hidden costs of inflation: Why your paycheck never seems to go far enough, even when you're technically making more money than ever.

The debt trap: How the current system requires exponential debt growth just to maintain the illusion of stability, and why that's mathematically impossible to sustain.

Technology's true potential: What the world could look like if we stopped fighting deflation and embraced the abundance technology offers.

The coming transition: Why the shift from an inflationary to a deflationary system is inevitable, and what that means for your financial future.

Why This Book Hits Different

Booth writes like someone who's genuinely concerned about where we're headed, not like an economist trying to sound smart. He was a successful tech entrepreneur who saw these patterns firsthand, which gives him a unique perspective that bridges Silicon Valley innovation and economic reality.

The book connects dots most people miss. Once you see the framework Booth lays out, you can't unsee it. Every news headline about inflation, quantitative easing, or economic stimulus takes on new meaning.

The Bottom Line

"The Price of Tomorrow" isn't just another book arguing for Bitcoin—it's the economic foundation that explains why Bitcoin (or something like it) is inevitable. Whether Bitcoin succeeds or not, Booth's core argument stands: we can't have exponential technological deflation and exponential monetary inflation coexisting peacefully forever.

For anyone in the Bitcoin space, this book provides the intellectual ammunition to explain why decentralized, deflationary money isn't just a speculative bet—it's an adaptation to the reality of technological progress.

Read this book if you want to understand:

- Why everything feels broken despite technological progress

- The real reason Bitcoin matters beyond "number go up"

- What's actually happening to the purchasing power of your money

- Why the current economic system is on borrowed time

It's the kind of book that changes how you see the world. And in a space like Bitcoin where understanding the "why" matters as much as the "what," that makes it essential reading.

Ready to dive deeper into the economics of Bitcoin? Subscribe to Bitcoin Builder for more insights on the intersection of technology, money, and the future of finance.