Most traders think finding a no-KYC exchange is about avoiding government surveillance. That's not the real issue. The actual problem? Your data is worth more than your Bitcoin to hackers, and every verified account you create becomes another honeypot waiting to be breached.

I've tested 24 platforms claiming to offer anonymous trading. Only seven deserve your attention in 2026. Here's what nobody tells you about trading without identity verification.

The Problem Nobody Admits: KYC Creates Systemic Risk

Think about this: Coinbase got hacked. Binance faced data leaks. FTX collapsed with millions of user documents. And we're still feeling the consequences in a market that has become very cautious with many disappointed people. What we've learned recently is that even the giants fall, and we have Bitcoin as a safeguard and we must use it properly to avoid future problems.

The crypto industry treats KYC like it's protecting users. In reality, it creates massive centralized databases of wealthy individuals with their home addresses attached. This isn't paranoia; it's risk management.

When you hand over your passport, selfie, and proof of address to a centralized entity, you're not just trusting their security today. You're betting they'll never get compromised, never go bankrupt, and never sell your data. That's a terrible bet.

Why Traditional Exchanges Love Your Data

Regulated platforms need your identity for compliance. That's the official story. The technical reality? Your verified profile lets them:

- Restrict withdrawals based on arbitrary "risk scores"

- Freeze accounts during volatile markets

- Share information with governments and third parties

- Build psychological profiles of trading behavior

When you trade on a no-KYC platform, you're not just protecting privacy. You're avoiding counterparty risk from centralized data storage.

The Fiat Problem

You cannot easily convert USD to crypto without some form of verification. Banks operate under strict AML regulations. This creates the fundamental limitation of no-KYC trading: you need crypto first.

Most privacy-focused traders solve this by:

- Buying small amounts through Bitcoin ATMs (which still track location)

- Using peer-to-peer cash trades

- Earning crypto directly through mining or services

- Accepting higher fees on instant swap services

Critical insight: The entry point into crypto is the weak link in anonymity. Once you're holding digital assets, staying anonymous becomes exponentially easier.

The Seven Platforms That Actually Deliver

After months of testing with real funds, these platforms stand out for different use cases.

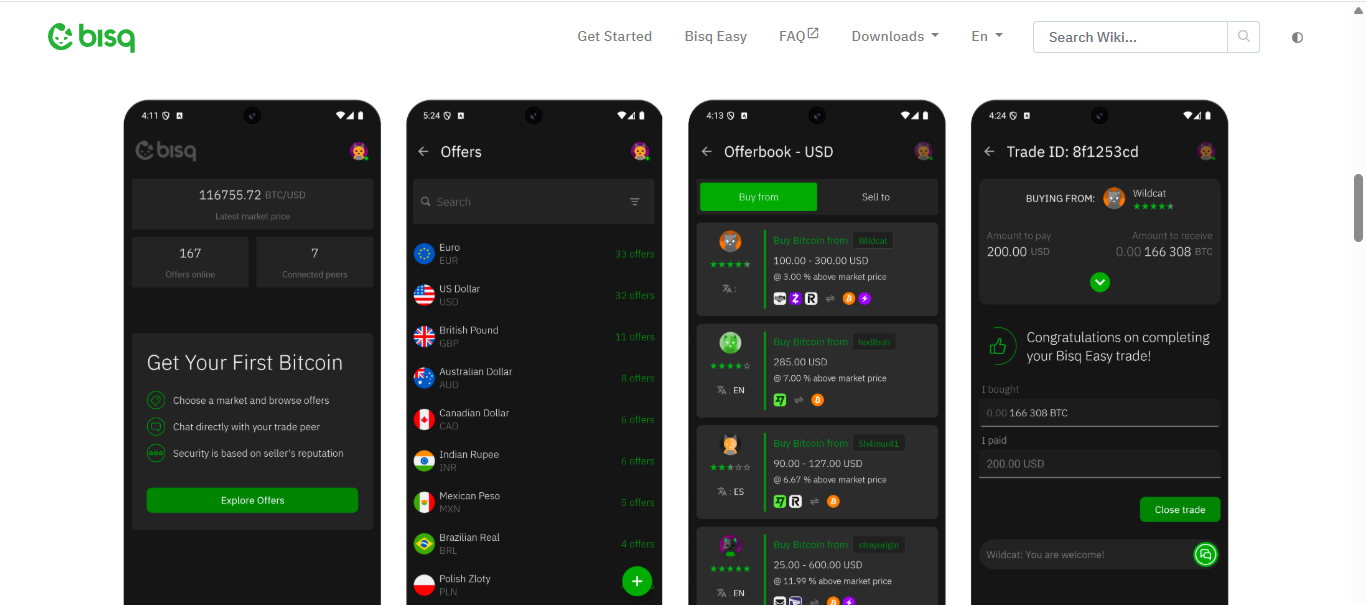

1. Bisq : The Decentralized Pioneer

Bisq operates as a fully decentralized peer-to-peer exchange where no company holds your funds or personal data. The software runs on your computer, connecting you directly with other traders through a global network. You're trading Bitcoin the way Satoshi intended—without intermediaries.

No-KYC Trading Conditions:

- Daily Withdrawal Limit: Unlimited (non-custodial)

- VPN Policy: VPN encouraged for additional privacy

- Fees: 0.1% maker / 0.7% taker (goes to DAO)

- Fiat Options: Bank transfers, cash deposits, Zelle, Revolut, gift cards, altcoins

- Supported Coins: BTC, XMR, and 50+ altcoins

Pros:

- Completely decentralized, no company can freeze your account or leak your data

- True censorship resistance with Tor integration built-in

- Multi-signature escrow protects both buyers and sellers

- Open-source code that's been battle-tested since 2014

Cons:

- Requires downloading desktop software (Windows, Mac, Linux)

- Lower liquidity means you might wait hours or days for trades to fill

- Security deposits required for both parties can tie up capital

- Steeper learning curve than centralized platforms

Why it's brilliant: Bisq doesn't just offer privacy, it's architecturally impossible for anyone to deanonymize users. The trade-off is patience. This isn't for day traders, but for those who understand that true financial sovereignty requires eliminating trusted third parties entirely.

2. Hodl Hodl - Non-Custodial Marketplace

Hodl Hodl created a global P2P marketplace where traders never surrender custody of their Bitcoin. Multi-signature escrow contracts lock funds on-chain while you arrange payment with your counterparty. The platform simply facilitates connections.

No-KYC Trading Conditions:

- Daily Withdrawal Limit: Unlimited (non-custodial)

- VPN Policy: VPN friendly

- Fees: 0.6% per completed trade (split between parties)

- Fiat Options: 60+ currencies via bank transfer, cash, payment apps

- Supported Coins: BTC, USDT, and 30+ other cryptocurrencies

Pros:

- Multi-sig escrow means Hodl Hodl can't steal your funds even if they wanted to

- Lend and borrow Bitcoin with your trading counterparties

- International reach with traders in 100+ countries

- Reputation system helps identify reliable trading partners

Cons:

- Lower liquidity than major centralized exchanges

- Platform fees higher than spot trading on CEXs

- Dispute resolution depends on platform mediation

- Some payment methods carry chargeback risk

Why it's brilliant: Hodl Hodl pioneered non-custodial P2P escrow in 2018. Their lending feature lets you earn yield on Bitcoin without KYC. The platform's geographic diversity means you can often find local traders, enabling cash deals and bank transfers in your currency.

3. LocalCoinSwap - Bitcoin and Stablecoins ( world)

LocalCoinSwap built a non-custodial P2P exchange where you control your private keys throughout the entire trading process. Choose your counterparty, lock funds in smart contract escrow, complete the trade. Your coins never touch a centralized wallet.

No-KYC Trading Conditions:

- Daily Withdrawal Limit: Unlimited (non-custodial model)

- VPN Policy: VPN and Tor fully supported

- Fees: 1% trading fee (0.5% per side)

- Fiat Options: Bank transfers, PayPal, Western Union, gift cards, cash deposits, mobile wallets

- Supported Coins: Bitcoin, Ethereum, Litecoin, Dash, and 10+ other cryptocurrencies

Pros:

- True non-custodial architecture—you hold your keys at all times

- Multi-currency support beyond just Bitcoin

- Competitive fee structure compared to other P2P platforms

- Global payment method flexibility accommodates diverse markets

Cons:

- Moderate liquidity : finding counterparties can take time

- Learning curve for users unfamiliar with non-custodial wallets

- Slower transaction finalization due to blockchain confirmations

- Limited customer support compared to centralized alternatives

Why it's brilliant: LocalCoinSwap solved the custody problem that plagues most P2P exchanges. Their smart contract escrow means neither party controls the funds during disputes, and you're never trusting a third party with your private keys. Perfect for sovereignty-focused traders.

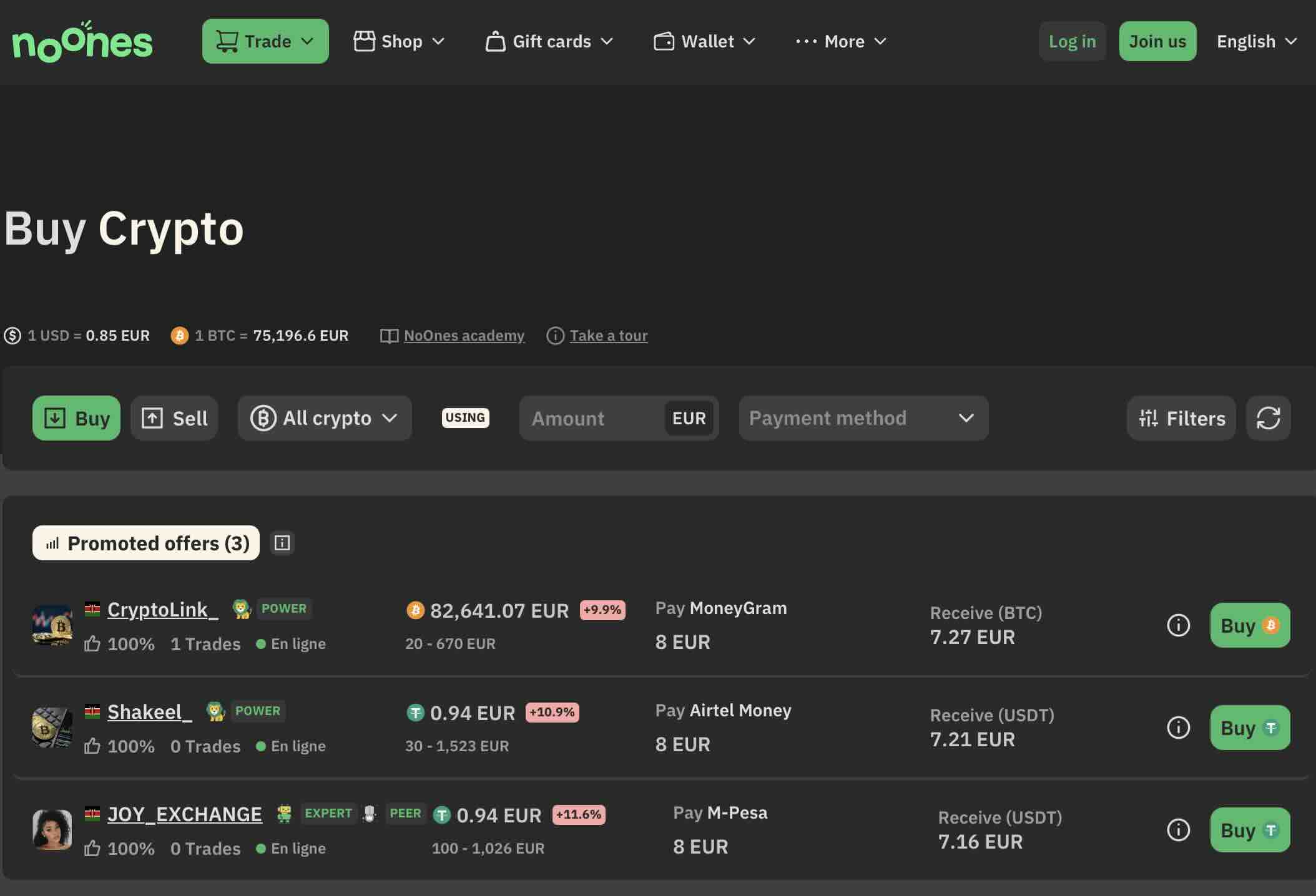

4. Noones - Global P2P Marketplace

Noones emerged from Paxful's rebranding as a global P2P marketplace connecting buyers and sellers across 190+ countries. Browse thousands of offers, select your preferred payment method, trade directly with verified users. Mass market P2P with worldwide reach.

No-KYC Trading Conditions:

- Daily Withdrawal Limit: Up to $1,000 without KYC (Tier 1)

- VPN Policy: VPN permitted, Tor not officially supported

- Fees: Free for buyers; 1% fee for sellers

- Fiat Options: 300+ payment methods including bank transfers, gift cards, mobile money, cash apps, PayPal, Western Union

- Supported Coins: Bitcoin, Ethereum, USDT (Tether)

Pros:

- Massive global user base with excellent liquidity in emerging markets

- Extensive payment method options—virtually any fiat rail available

- Buyer-friendly fee structure (zero fees for purchasers)

- Strong escrow system with dedicated dispute resolution team

Cons:

- $1,000 withdrawal limit restricts larger no-KYC transactions

- Premium spreads of 5-15% above market rates are common

- Account verification required for higher limits (defeats no-KYC purpose)

- Platform retains trade data, reducing privacy compared to fully decentralized options

Why it's brilliant: Noones dominates emerging markets where traditional crypto on-ramps don't exist. Their gift card marketplace is particularly robust—turn unwanted Amazon or iTunes cards into Bitcoin within minutes. The platform's scale creates network effects that keep spreads reasonable despite being a premium service.

5. RoboSats - Lightning-Fast Privacy

RoboSats is a Tor-native P2P exchange built exclusively on Bitcoin's Lightning Network. Every session generates a temporary robot identity, ensuring no persistent digital footprint. Trades settle in minutes, not hours.

No-KYC Trading Conditions:

- Daily Withdrawal Limit: Unlimited (Lightning Network)

- VPN Policy: Tor-only (built-in privacy)

- Fees: ~0.2% coordinator fee + Lightning routing fees

- Fiat Options: PayPal, Zelle, Strike, Revolut, cash by mail, 100+ methods

- Supported Coins: Bitcoin only (Lightning)

Pros:

- Instant settlement through Lightning Network eliminates counterparty risk

- Temporary identities mean zero data accumulation over time

- Accessible through Tor browser—no software installation required

- Growing coordinator network increases censorship resistance

Cons:

- Trade sizes typically capped at $500-$1,000 per order

- Requires basic Lightning Network knowledge (channels, invoices)

- Limited fiat on-ramp options for complete beginners

- Disputes rely on coordinator intervention

Why it's brilliant: RoboSats solves P2P trading's biggest pain point—settlement time. Lightning escrow means trades complete in minutes rather than days. The temporary identity system is genius: even if a coordinator were compromised, there's no historical data to leak.

6. Azteco - Cash to Bitcoin in Minutes

Azteco sells Bitcoin vouchers through 10,000+ retail locations worldwide. Walk into a convenience store, buy a voucher with cash, redeem it for Bitcoin. No app, no account, no email address, just a 16-digit code.

No-KYC Trading Conditions:

- Daily Withdrawal Limit: Varies by retailer ($10-$500 typical)

- VPN Policy: N/A (voucher-based)

- Fees: 4-8% markup over spot price

- Fiat Options: Cash at retail partners (convenience stores, gas stations)

- Supported Coins: Bitcoin only

Pros:

- Ultimate simplicity—anyone who can buy a gift card can buy Bitcoin

- True cash-to-crypto with zero digital footprint

- Perfect for gifting Bitcoin to non-technical friends and family

- Redemption works with any Bitcoin wallet

Cons:

- Limited geographic availability (mainly US, UK, Europe, Australia)

- Higher fees than P2P trading or exchanges

- Low per-transaction limits compared to other methods

- Retailer availability can be inconsistent

Why it's brilliant: Azteco turned Bitcoin into a retail product. The voucher model is pure genius for financial privacy—there's literally no way to connect your identity to the transaction if you pay cash. It's how gift cards would work if gift cards were actually valuable.

7. Peach Bitcoin : Mobile-First European Solution

Peach Bitcoin designed a mobile app specifically for European traders who value privacy. Their focus on SEPA instant payments creates near-instant settlement times while maintaining no-KYC principles. It's Venmo meets Bitcoin, without the surveillance.

No-KYC Trading Conditions:

- Daily Withdrawal Limit: €1,000 per trade (€10,000 with reputation)

- VPN Policy: VPN friendly

- Fees: 2% service fee

- Fiat Options: SEPA, SEPA Instant, Revolut, Wise, and 10+ European methods

- Supported Coins: Bitcoin only

Pros:

- Mobile-first design feels natural on smartphones

- SEPA instant enables same-day settlement for most trades

- Escrow system with dispute resolution protects both parties

- Growing European user base increases liquidity

Cons:

- Geographic limitation—primarily serves Europe

- Newer platform (launched 2023) means smaller track record

- Higher fees than mature P2P platforms

- Limited payment options outside SEPA zone

Why it's brilliant: Peach Bitcoin recognized that mobile banking is how Europeans actually move money. By optimizing for SEPA instant payments, they achieved traditional exchange speed with P2P privacy. Their grouphug feature for batched withdrawals reduces fees while maintaining non-custodial principles.

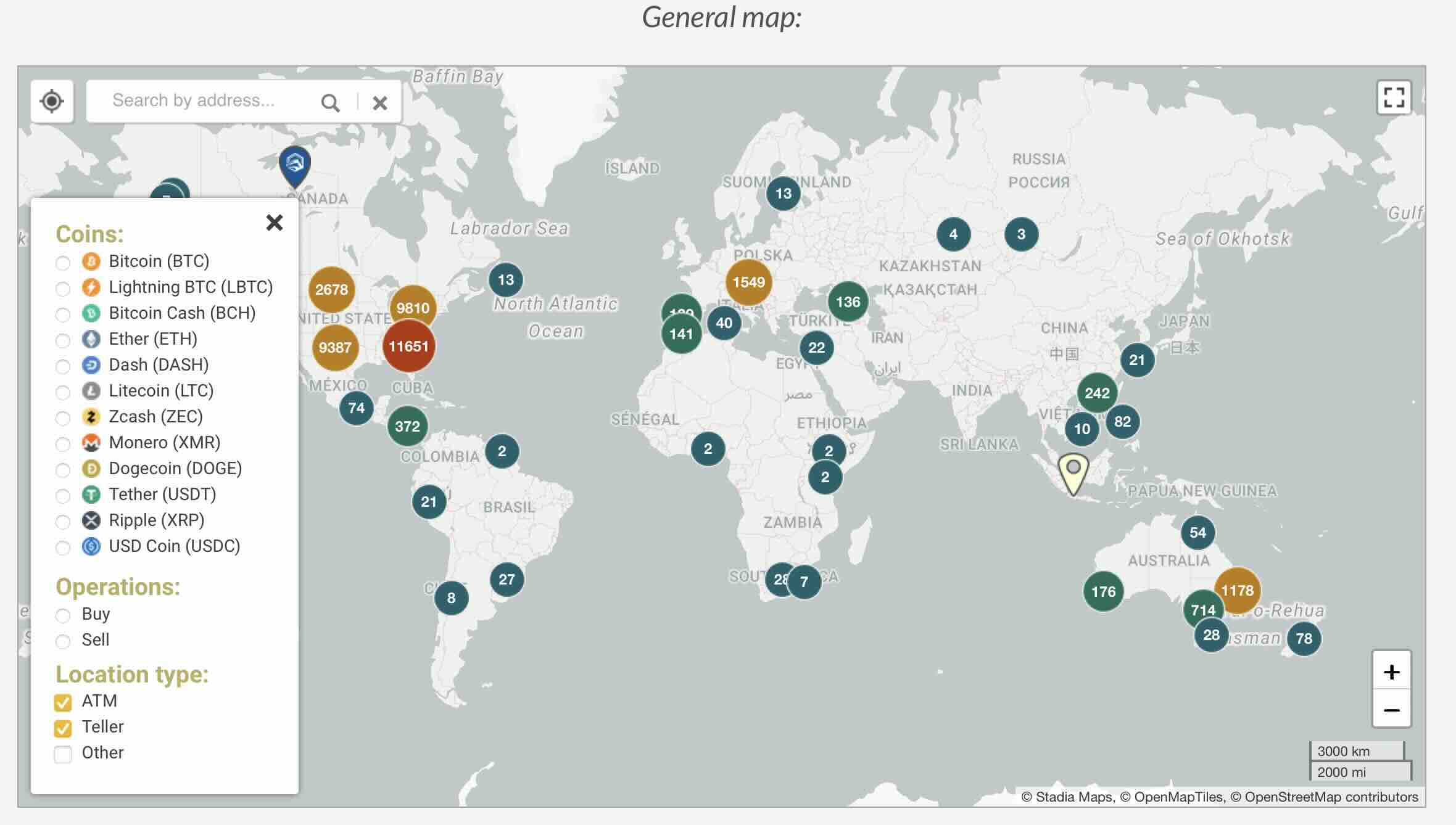

Bonus. Bitcoin ATMs - Instant Local Access

Bitcoin ATMs transformed vacant corner spaces into cryptocurrency on-ramps. Over 40,000 machines globally let you insert cash and receive Bitcoin to your wallet within minutes. Different operators have varying policies, but many allow smaller transactions without identification.

No-KYC Trading Conditions:

- Daily Withdrawal Limit: $500-$3,000 depending on operator and KYC tier

- VPN Policy: N/A (physical location)

- Fees: 5-15% markup (average 8%)

- Fiat Options: Cash, debit cards (varies by machine)

- Supported Coins: BTC, ETH, LTC, and 20+ others depending on operator

Pros:

- Instant transactions : walk in with cash, walk out with Bitcoin

- Available 24/7 in many locations (convenience stores, malls, gas stations)

- Some machines require only phone verification for larger amounts

- Ideal for immediate needs without waiting for P2P trades

Cons:

- Highest fees in the entire no-KYC ecosystem

- KYC requirements increasing—many now require ID scans above $500

- Location-dependent availability and pricing

- Machine reliability varies (out of service, cash jams)

💡 Why it's brilliant: Bitcoin ATMs prove cryptocurrency adoption is accelerating into mainstream retail. Despite brutal fees, they serve a crucial role: converting physical cash into digital bearer assets instantly. For people in restrictive banking situations, that convenience is priceless.

How to Choose the Right Platform

With so many options, finding the right no-KYC exchange requires due diligence. You aren't just looking for anonymity; you're looking for safety.

- Withdrawal Limits: The Dealbreaker: Many exchanges allow no-KYC trading but trap your funds with tiny withdrawal limits. Always check the daily cap before depositing. MEXC's 30 BTC daily limit is industry-leading. CoinEx's $10k limit works for most retail traders.

- Security Beyond Anonymity : Just because a platform doesn't require ID doesn't mean it's secure. Look for:

- Proof of Reserves transparency

- Mandatory two-factor authentication

- Cold wallet storage for majority of funds

- Clean history without major hacks : True anonymity extends to data policies. Does the exchange log your IP address? Using a VPN is recommended, but ensure the platform is "VPN Friendly."

- Trading Fees and Liquidity : Privacy shouldn't cost a premium. The best no-KYC exchanges compete on fees. High liquidity is crucial to avoid slippage. If you're trading during US hours via VPN, ensure there's enough volume.

- Reputation Is Your Only Safety Net : Since no-KYC exchanges are often unregulated, reputation becomes critical. Check community forums and reviews. Have they frozen funds arbitrarily? Do they have a history of hacks? Trust is hard to earn. One exit scam can wipe out your capital.

- User Experience Matters : Whether you're trading for the first time or executing complex derivatives, the interface matters. The best platforms offer mobile apps and clean dashboards that rival fully regulated exchanges.

The Risks Nobody Talks About

While anonymous trading is appealing, it comes with specific risks you must accept.

- Account Freezes and Shadow Bans : The most significant risk is sudden AML (Anti-Money Laundering) triggers. An exchange might let you deposit and trade, but flag your account when you withdraw, demanding KYC to unlock funds. This is a common complaint with opaque platforms. Sticking to reputable exchanges with clear policies helps mitigate this.

- Zero Customer Support : If you lose access to your 2FA or send funds to the wrong address on a decentralized platform, there's no help. Even on centralized no-KYC exchanges, support can be limited compared to regulated giants.

- Regulatory Crackdowns : Governments aggressively target non-compliant platforms. A popular exchange US traders use today could be geo-blocked tomorrow. This regulatory pressure forces many platforms to constantly update domains or policies.

- Asset Delisting Without Warning : No-KYC exchanges often list exotic or low-cap coins. These assets are volatile and prone to being delisted without warning, leaving you with "dust" that cannot be withdrawn.

- Geoblocking Creates Legal Gray Areas : Many exchanges officially ban users from strict jurisdictions like the US or China. While VPNs allow access, you're technically violating Terms of Service. If caught, your funds could be frozen.

The Philosophy: Features, Not Limitations

The best no-KYC exchanges embrace certain "limitations" as design principles.

- No Fiat Is Actually a Feature

Removing fiat on-ramps eliminates the weakest privacy link. You cannot have true anonymity while interfacing with the traditional banking system. Crypto-to-crypto only is the price of sovereignty.

- Lower Limits Force Better Security

Generous but capped withdrawal limits discourage whales from storing massive amounts on centralized platforms. This aligns with crypto's original ethos: not your keys, not your coins.

- No Support Means No Central Point of Failure

Decentralized platforms can't help you recover lost funds. This sounds harsh, but it also means nobody can arbitrarily freeze your account or deny service.

Who Should Use No-KYC Exchanges (And Who Shouldn't)

Be honest about your needs before choosing anonymity.

Perfect for:

- Traders who value privacy over convenience

- Users in countries with unstable banking systems

- People building DeFi portfolios

- Experienced crypto users comfortable with self-custody

Not ideal for:

- Complete beginners needing hand-holding support

- Traders wanting to cash out large amounts to fiat regularly

- Users who lose passwords frequently

- Anyone uncomfortable with regulatory gray areas

Final Thoughts: The Shrinking But Essential Market

Anonymous trading is shrinking, but demand for no-KYC exchanges remains strong in 2026. Platforms like Bisq, Hodlhodl, and others continue providing sanctuary for those who value privacy and financial autonomy.

They prove you can still access deep liquidity without surrendering personal data. However, vigilance is mandatory. No-KYC exchanges aren't immune to regulatory pressure. Always diversify holdings and never leave significant capital on any exchange longer than necessary.

Disclaimer: This article is for informational purposes only and does not constitute financial or legal advice. Cryptocurrency trading involves substantial risk. No-KYC exchanges may operate in legal gray areas in your jurisdiction. Always conduct your own research and consult professionals before trading.