The Apollo II Bitcoin full node promises passive income while strengthening the Bitcoin network. But can a $1,499 device actually generate meaningful returns, or is this just expensive virtue signaling?

I ran the numbers, talked to actual node operators, and dug into the economics that hardware vendors won't tell you.

What is the Apollo II Full Node?

The Apollo II is a plug-and-play Bitcoin full node manufactured by Futurebit. It's a compact device that runs a complete Bitcoin Core node while simultaneously mining Bitcoin through its integrated ASIC chips. Think of it as two products in one: a network validator and a small-scale miner.

Hardware Specifications:

- ASIC Hashrate: ~3.6 TH/s

- Power Consumption: 200W

- Storage: 2TB NVMe SSD

- Network: Gigabit Ethernet

- Software: Bitcoin Core, BTC Pay Server, Lightning Network support

- Dimensions: 6" x 6" x 3.5"

- Price: $999USD (before shipping)

The device is designed for Bitcoin enthusiasts who want to run their own node without dealing with Raspberry Pi setups or repurposed desktop computers. The integrated mining capability is marketed as a way to offset electricity costs and potentially generate passive income.

Revenue Streams: Where Does Profit Come From?

The Apollo II generates revenue through three mechanisms:

1. Bitcoin Mining (Primary Revenue)

The Apollo II mines Bitcoin using its built-in ASIC chip. At 3.6 TH/s, you're contributing to the network's security while earning block rewards and transaction fees.

Current Mining Economics (January 2026):

- Bitcoin Price: ~$102,000

- Network Difficulty: ~110 T

- Block Reward: 3.125 BTC (post-2024 halving)

- Apollo II Hashrate: 3.6 TH/s

- Daily BTC Earned: ~0.00000216 BTC

- Daily Revenue: ~$0.22 USD

Yes, you read that correctly. Twenty-two cents per day.

2. Transaction Fees (Negligible)

Running a full node doesn't directly earn transaction fees. Those go to miners who successfully add blocks to the chain. Your node validates transactions and helps relay them across the network, but this is an altruistic service, the network doesn't compensate you for it.

3. Lightning Network Routing Fees (Variable)

If you run a Lightning Network node with well-connected channels, you can earn routing fees when payments pass through your node. However, this requires:

- Significant capital locked in channels ($1,000-$10,000+)

- Strategic channel partnerships with high-traffic nodes

- Active channel management and rebalancing

- Technical knowledge beyond plug-and-play setup

Realistic Lightning Income: Most home Lightning nodes earn $1-$5 per month. Power users with optimized setups might reach $20-$50 monthly, but this requires constant attention and significant liquidity deployment.

The Real Costs: What They Don't Tell You

Upfront Investment

- Device: $999

- Shipping: $50-$100 (international)

- Total Initial Cost: ~$1,100

Ongoing Operational Costs

Electricity: The Apollo II consumes 200W continuously. Let's calculate monthly costs at different electricity rates:

- $0.10/kWh: $14.40/month ($173/year)

- $0.15/kWh: $21.60/month ($259/year)

- $0.20/kWh: $28.80/month ($346/year)

- $0.30/kWh: $43.20/month ($518/year)

For reference, average electricity costs:

- United States: $0.16/kWh

- Europe: $0.25-$0.35/kWh

- Canada: $0.13/kWh

- Australia: $0.25-$0.30/kWh

Internet: Most users already have internet, so this is typically a sunk cost. However, the Apollo II uses ~500GB/month bandwidth, which could trigger overage charges on capped plans.

Maintenance:

- SSD replacement: ~$150 every 3-5 years

- Potential cooling fans: $20-$40 if needed in hot climates

- Electricity cost increases: Average 3-5% annually

Profitability Analysis: The Brutal Truth

Let's run a 3-year profitability analysis using conservative assumptions:

Assumptions:

- Bitcoin price: $102,000 (no appreciation)

- Electricity cost: $0.16/kWh (US average)

- Device lifespan: 5+ years

- Mining difficulty increases: 15% per year (conservative)

- No Lightning revenue (most users won't optimize this)

Year 1

- Mining Revenue: $80.30

- Electricity Cost: -$259.20

- Net Operating Loss: -$178.90

Year 2

- Mining Revenue: $69.83 (difficulty adjustment)

- Electricity Cost: -$259.20

- Net Operating Loss: -$189.37

Year 3

- Mining Revenue: $60.74 (difficulty adjustment)

- Electricity Cost: -$259.20

- Net Operating Loss: -$198.46

3-Year Cumulative:

- Total Revenue: $210.87

- Total Costs: -$777.60 (electricity only)

- Net Loss: -$566.73

Including Initial Investment:

- Total Invested: $1,100

- Net Position: -$1,166.73

But wait. This sounds pessimistic, but we must also consider the optimistic scenario where Bitcoin price goes up...😄

When Does Apollo II Become Profitable?

For the Apollo II to break even, you need one or more of these scenarios:

Scenario 1: Bitcoin Price Appreciation

If Bitcoin reaches $500,000 (roughly 5x from current levels), your daily mining revenue increases proportionally:

- Daily BTC: 0.00000216 BTC

- Daily Revenue at $500k BTC: $1.08

- Monthly Revenue: $32.40

- Monthly Profit (after $21.60 electricity): $10.80/month

Breakeven timeline at $500k BTC: ~12 years (excluding initial hardware cost)

Scenario 2: Extremely Cheap Electricity

If you have access to electricity at $0.05/kWh or less (hydroelectric regions, solar power):

- Monthly Electricity: $7.20

- Mining Revenue: $6.60

- Monthly Loss: -$0.60

Even with nearly-free electricity, you're barely breaking even on operating costs, and never recovering the $1,600 hardware investment through mining alone.

Scenario 3: Lightning Network Optimization

If you become a Lightning power user with $5,000+ locked in strategic channels and earn $30/month in routing fees:

- Mining Revenue: $6.60

- Lightning Revenue: $30.00

- Total Revenue: $36.60

- Electricity Cost: -$21.60

- Monthly Profit: $15.00

Breakeven timeline: ~9 years (to recover $1,600 hardware cost)

This scenario requires advanced technical knowledge and significant capital deployment, not the "plug and play" experience advertised.

What About Network Difficulty Decreases?

Some bulls argue that if Bitcoin's price crashes or hashrate decreases dramatically, your relative mining rewards increase. While technically true, this scenario means:

- Bitcoin price is lower (reducing dollar value of rewards)

- Major miners are unprofitable and shutting down

- Network security is compromised

- Your fiat-denominated returns are still terrible

A difficulty decrease severe enough to make the Apollo II profitable would signal a crisis in Bitcoin mining economics.

The Non-Financial Benefits: Why People Actually Buy This

Despite terrible mining ROI, the Apollo II sells well because of non-financial value propositions:

1. Network Sovereignty ( Priceless?)

Running your own full node means you:

- Validate all transactions yourself (don't trust, verify)

- Eliminate dependence on third-party services

- Protect your privacy when broadcasting transactions

- Contribute to Bitcoin's decentralization

For hardcore Bitcoiners, these benefits justify the cost even without financial returns.

2. Educational Value

The Apollo II teaches you:

- How Bitcoin mining actually works

- Full node operation and maintenance

- Lightning Network channel management

- Self-custody best practices

Think of it as a $1,600 course in Bitcoin infrastructure—expensive, but comprehensive.

3. Backup Payment Infrastructure

During network attacks, exchange outages, or personal deplatforming, your own node guarantees you can:

- Broadcast transactions

- Verify balances

- Accept Lightning payments

- Operate independently

This is insurance, not investment.

4. Aesthetic and Status Signaling

Let's be honest: the Apollo II looks cool. It's a conversation piece that signals commitment to Bitcoin principles. For some users, that's worth the premium.

5. Supporting Decentralization

Every additional full node strengthens Bitcoin's resistance to censorship and attacks. If you view your Apollo II as a charitable donation to network health rather than an investment, the economics make more sense.

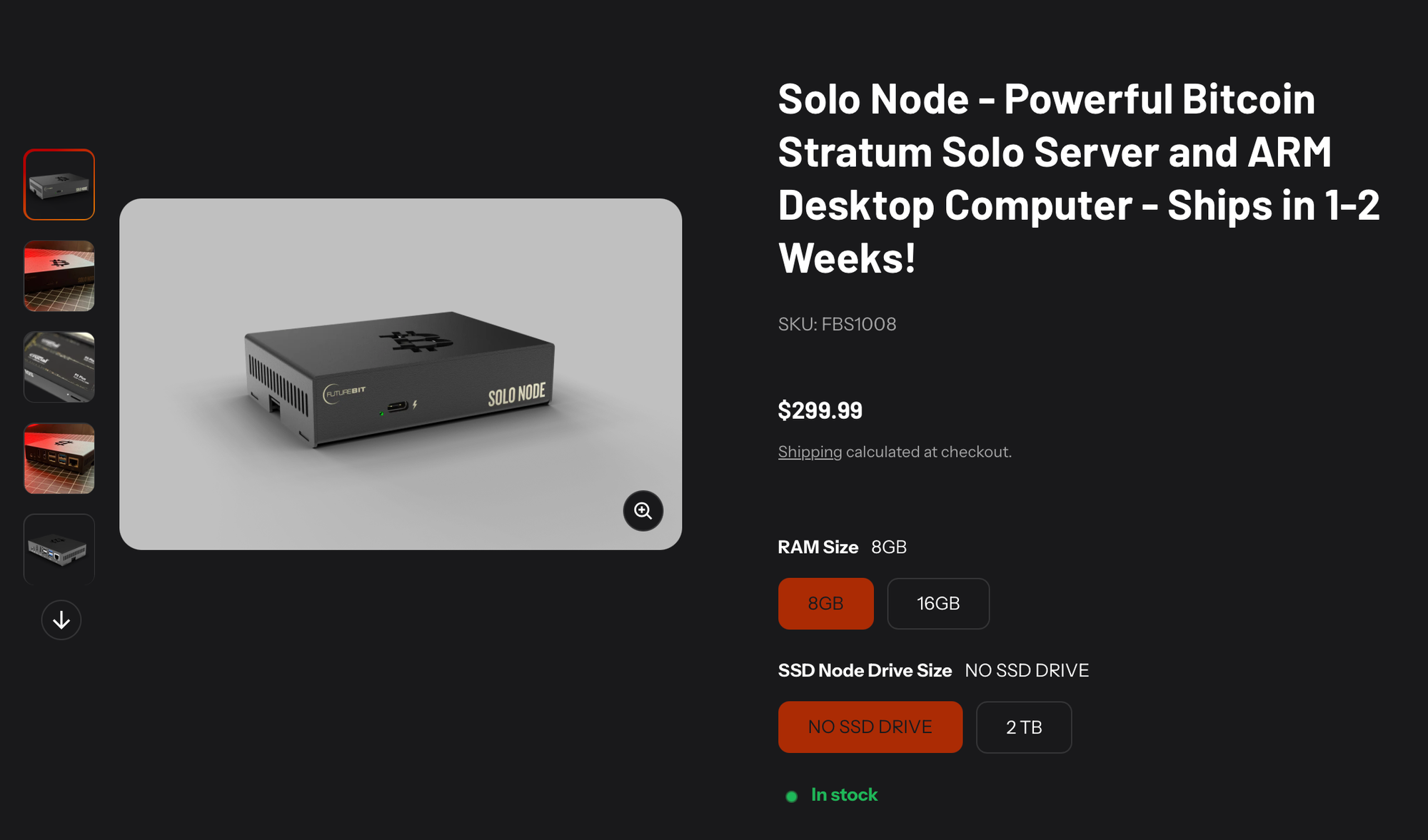

What We Recommend: The Solo Node Alternative

If you're genuinely interested in running a Bitcoin full node without the mining theatrics, consider Futurebit's Solo Node instead.

Priced at $399, this ARM-based desktop computer runs the same Apollo OS without the unprofitable ASIC mining chip. You get identical full node functionality—Bitcoin Core, Lightning Network, BTCPay Server—while consuming only 25W instead of 200W.

The math is brutal but honest:

You'll save $1,100 upfront and $15-25 monthly on electricity. The Solo Node acknowledges what the Apollo II pretends isn't true: home mining died years ago, but sovereign node operation remains essential. You're not buying a lottery ticket disguised as infrastructure, you're buying actual infrastructure.

For most users, this is the smarter choice. Save the $1,100 difference, stack sats with it, and run your node guilt-free knowing you're not hemorrhaging money on electricity to generate $0.22 daily in mining rewards.

Comparing Apollo II to Alternatives

vs. Raspberry Pi Full Node ($150-$300)

Raspberry Pi Pros:

- 80% cheaper upfront

- Lower power consumption (15W vs 200W)

- More customizable software stack

- Nearly identical node functionality

Raspberry Pi Cons:

- Requires technical setup

- No mining capability

- Less polished user experience

- External storage needed

Verdict: If you only want a full node, Raspberry Pi is dramatically more cost-effective. You're paying $1,300+ for the Apollo II's mining ASIC, which won't pay for itself.

vs. Professional ASIC Miners (Antminer S21, Whatsminer M60)

Professional ASIC Pros:

- 200-300 TH/s hashrate (60-80x more powerful)

- Better efficiency (J/TH)

- Realistic mining ROI in low-electricity regions

- Designed for profit, not hobbyists

Professional ASIC Cons:

- $3,000-$8,000 upfront cost

- Extremely loud (70-80 dB)

- High power consumption (3,000-5,000W)

- Requires dedicated space and cooling

- No full node functionality

Verdict: If your goal is mining profit, professional ASICs are the only viable option. The Apollo II's hashrate is so low it's essentially a rounding error in Bitcoin's network.

vs. BTCPay Server on VPS ($5-$20/month)

VPS Pros:

- Near-zero upfront cost

- No electricity costs

- Professional uptime

- Easy scaling

- Remote access from anywhere

VPS Cons:

- Trusted third-party infrastructure

- Less educational value

- No mining capability

- Monthly recurring expense

Verdict: For merchants running BTCPay Server, VPS hosting is more economical and reliable than Apollo II.

Who Should (and Shouldn't) Buy Apollo II

You Should Buy Apollo II If:

1. You're a Bitcoin educator or content creator Physical demonstrations of mining and node operation are valuable teaching tools. The cost is a business expense.

2. You have free or nearly-free electricity If you own solar panels producing excess capacity or have hydroelectric power at <$0.05/kWh, operating costs become negligible.

3. You value sovereignty over ROI Running your own node is a philosophical commitment. You accept that financial return is secondary to network participation.

4. You want a beginner-friendly, all-in-one device The plug-and-play experience has real value for non-technical users. You're paying for convenience and support.

5. You're a Lightning Network enthusiast If you plan to actively manage channels and provide routing services, the Apollo II's hardware makes a solid foundation.

You Should NOT Buy Apollo II If:

1. You expect mining profits At current difficulty and Bitcoin prices, you will never recover the hardware cost through mining revenue alone.

2. You pay high electricity rates Anything above $0.20/kWh turns the Apollo II into a money-losing machine that bleeds cash monthly.

3. You want maximum hash rate per dollar Professional ASICs deliver 60-80x more hashrate for 2-5x the price. The Apollo II is not competitive as a mining device.

4. You're technically proficient If you can configure a Raspberry Pi and manage Bitcoin Core manually, you'll save $1,300+ while achieving identical node functionality.

5. You need quick ROI Even under optimistic scenarios, breakeven requires 8-12+ years. This is a long-term commitment, not a short-term investment.

The Verdict: Investment or Ideology?

As a profit-generating investment: The Apollo II fails spectacularly. You'll lose money on electricity costs while never recovering the $1,600 hardware investment through mining revenue.

As a Bitcoin infrastructure tool: The Apollo II succeeds. It's an elegant, user-friendly device that genuinely contributes to network decentralization while teaching valuable technical skills.

The Real Question: Are you buying this to make money, or to participate in Bitcoin's network sovereignty?

If your answer is profit, buy Bitcoin directly and hold it. A $1,600 spot Bitcoin purchase will outperform the Apollo II's mining revenue by orders of magnitude.

If your answer is sovereignty, education, and supporting decentralization, the Apollo II delivers excellent value—just don't call it profitable.

Practical Recommendations

If You're Buying Anyway:

1. Optimize Your Electricity:

- Run during off-peak hours if you have time-of-use rates

- Connect to solar panels or renewable energy

- Consider relocating to a lower-cost electricity region

2. Maximize Lightning Revenue:

- Deploy $2,000-$5,000 in well-connected channels

- Partner with high-traffic routing nodes

- Use automated channel management tools

- Monitor and rebalance regularly

3. Mine to a Solo Pool: The statistical probability of finding a block solo is infinitesimally small (you'd need to run for ~1,500 years on average), but mining to a solo pool like Solo CK Pool means you'd win the entire block reward (~3.125 BTC + fees) if you hit the jackpot. For hobbyists, the lottery-ticket aspect adds psychological value.

4. Consider It a Hedge: If Bitcoin reaches $1M+ and network difficulty doesn't scale proportionally, your Apollo II's revenue improves dramatically. This is extremely unlikely, but possible.

5. Use It as a Tax Write-Off: If you're a Bitcoin content creator, developer, or educator, the Apollo II is a legitimate business expense. The educational and demonstration value justifies the purchase for tax purposes.

Final Thoughts

The Apollo II represents Bitcoin's philosophical tension: decentralization vs. efficiency. It's financially irrational but ideologically consistent.

Large mining farms are more profitable. Cloud nodes are more practical. Raspberry Pi setups are more economical. But the Apollo II is the only device that elegantly combines full node operation, mining participation, and beginner-friendly design in a single package.

Is it profitable? No.

Is it valuable? For the right user, absolutely. Yes, yes and yes.

The Apollo II isn't an investment, it's a statement. You're declaring that Bitcoin's decentralization matters enough to operate unprofitable infrastructure. That some things are worth doing even when they don't generate ROI.

In a world obsessed with number-go-up, the Apollo II serves a different purpose: keeping Bitcoin weird, independent, and un-capturable. Whether that's worth $1,600 is a question only you can answer.

Bottom Line: Buy Bitcoin if you want profits. Buy Apollo II if you want principles. These are not the same thing.

Disclaimer: Bitcoin-builder is created by Bitcoiners for Bitcoiners. We receive no compensation for writing this article. Always conduct your own thorough research. We're here to share our perspectives, but ultimately, you make your own decisions.