Suddenly, protecting your Bitcoin matters like never before. When exchanges fail or get breached, the message hits hard, if you do not hold the keys, the coins are not really yours. Taking charge of your private keys might seem heavy, particularly when large amounts are on the line.

Here’s how shared custody setups work now. Leading the field are two firms, Casa stands on one side, Unchained Capital on the other. Each uses multisig protection so you stay in charge, yet still get expert support when needed. Since 2021, their paths have twisted apart sharply.

This guide lays out every detail on Casa versus Unchained Capital, how they protect assets, how much they charge. If your Bitcoin stash measures in thousands or millions, picking a solid storage option makes a difference. One wrong move could leave you exposed.

What Is Multisig?

Imagine a lock that won’t turn unless more than one key works together. That is how multisig wallets function, different keys must agree before anything happens. Picture a safe where two people each hold part of the way in. Usually, three people get keys. Only two are needed when moving funds.

Losing just one key means losing everything, Bitcoin vanishes without trace. A breach happens? Funds disappear fast, no warning. One weak spot breaks the whole system apart.

One key alone can’t unlock everything. Breaking in means cracking several, each tucked away separately. Losing a single piece won’t lock you out for good. Most seasoned Bitcoin users rely on this setup without question.

Collaborative Custody Explained

One key stays with a trusted service, just in case. Usually, you keep two of the three keys yourself. This setup mixes personal control with outside help. It works by teaming up on security without giving full access away.

Most of the time, you are fully in charge. Moving your Bitcoin does not require approval from anyone. Should something go wrong and a key disappears, support steps in to restore what was lost.

Facing total key loss? This approach stops it cold. Inheritance gets easier too, Bitcoin stays reachable when life takes a turn. Relatives team up with the service to unlock assets, should events shift.

Casa: Security Made Simple

Casa launched in 2018 with one mission: make Bitcoin self-custody accessible to everyone. The company focuses on user experience without sacrificing security.

Their approach emphasizes simplicity. Casa handles the technical complexity behind the scenes while you maintain control of your keys. The mobile app guides you through every step, from initial setup to daily management.

Casa Security Features

Casa offers two main vault configurations. The Standard plan uses 2-of-3 multisig with three total keys. The Premium plan expands to 3-of-5 multisig with five keys for maximum security.

You control the majority of keys in both setups. Casa holds one key that serves as your emergency backup. They can view your transaction history through extended public keys (xpubs), but they can never spend your Bitcoin without your approval.

The mobile app makes key management straightforward. You can use popular hardware wallets like Ledger, Trezor, Bitbox02, Keystone, and Foundation Passport. Casa also supports YubiKeys as key alternatives for users who find hardware wallets confusing.

Casa Inheritance Planning

Every Casa plan includes inheritance features at no extra cost. You designate a recipient who gets conditional access to your vault. They receive an encrypted key through the Casa app.

If you become incapacitated, your recipient initiates a transfer request. This triggers a six-month waiting period. Casa notifies you of the pending transfer. If you don't respond, the recipient gains access using their key plus Casa's backup key.

The process requires no invasive KYC or legal documentation for basic inheritance. Your family doesn't need to understand hardware wallets or Bitcoin security. They simply use the Casa app to access funds during an already stressful time.

Casa's Private Client tier offers enhanced verification for U.S. customers who want no waiting period. This option uses government IDs at setup and requires a death certificate for transfer.

Multi-Asset Support

Casa expanded beyond Bitcoin in recent years. Vaults now support Ethereum, USDC, and USDT alongside BTC. This makes Casa the only major collaborative custody provider supporting stablecoins.

For holders diversifying beyond Bitcoin, this matters. Banking instability has driven more people toward dollar-backed stablecoins. Casa lets you secure significant stablecoin holdings with the same multisig security protecting your Bitcoin.

Bitcoin maximalists see this as feature creep. They argue it increases attack surface and distracts from Bitcoin-focused development. Casa made the change based on customer demand and believes the technical implementation is sound.

Casa Pricing

Casa uses a subscription model with three main tiers:

- Free: Single-key mobile wallet. Good for beginners learning Bitcoin basics. No multisig security.

- Standard ($250/year): 2-of-3 multisig vault with inheritance planning and email support. You provide your own hardware wallet. No video verification for sensitive operations.

- Premium ($2,100/year): 3-of-5 multisig vault with personal onboarding, 24/7 support, and video verification. Includes welcome package with three hardware wallets, Faraday bags, and tamper-evident packaging. Supports shared accounts for families.

- Private Client ($5,000+/year): White-glove advisory service for high-net-worth individuals. Bespoke security configurations and enhanced inheritance options with estate planning attorney consultation.

Casa accepts Bitcoin payments for all plans. Your subscription begins once the transaction confirms on the blockchain.

Casa Privacy Approach

Casa doesn't require KYC or AML compliance because they don't have custody of your funds. You can use a pseudonym for your account. The inheritance process requires only a recipient email address.

Casa stores extended public keys to provide user experience features. This lets them show your balance and transaction history in the app. But these keys cannot spend your Bitcoin.

For sensitive operations like using Casa's backup key, Premium members get video verification. This confirms your identity without storing personal documents. Standard tier users don't have this option, which some see as a security gap.

Unchained Capital: The Bitcoin Financial Institution

Unchained Capital started in 2016 as a Bitcoin lending desk. They expanded into collaborative custody and now offer a full suite of Bitcoin financial services.

Unlike Casa, Unchained operates as a regulated financial institution. This shapes everything from their compliance requirements to how they make money. The company remains laser-focused on Bitcoin only.

Unchained Security Model

Unchained uses the same core 2-of-3 multisig setup as Casa's standard offering. You hold two keys, Unchained holds one as backup. You maintain unilateral control and can move Bitcoin without their permission.

The company recently launched enterprise custody features. These allow more complex multi-party arrangements with custom approval hierarchies. Businesses can distribute key control across multiple team members while Unchained provides the backup.

Unchained supports fewer hardware wallets than Casa. Compatible devices include Ledger, Trezor, and COLDCARD. This narrower compatibility bothers some users who prefer devices like Bitbox02 or Blockstream Jade.

The company invested heavily in open-source tools. Their Caravan wallet software lets advanced users expand their multisig beyond the basic offering. Technical users appreciate this flexibility.

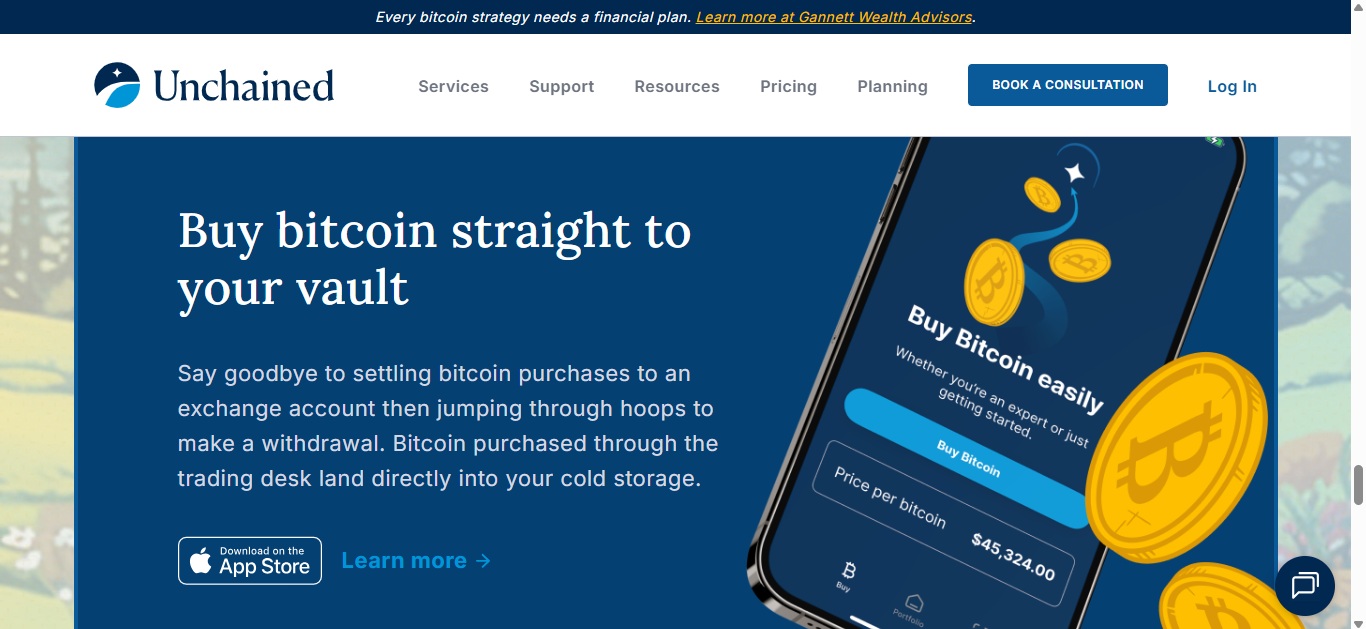

Unchained Additional Services

Operating as a financial institution enables unique service combinations:

- Bitcoin IRA: Tax-advantaged retirement accounts with multisig security. More than one-third of Unchained clients now use this product. It combines IRA benefits with self-custody control.

- Trading Desk: Buy Bitcoin directly into your cold storage vault. No need to purchase on an exchange and withdraw. Minimum trade size is $2,000. Trades over $100,000 require pre-funding.

- Commercial Loans: Bitcoin-backed USD loans for businesses. Minimum $150,000. Uses the same multisig custody model where keys are distributed among Unchained, borrower, and third-party agent.

- Business Vaults: Advanced custody for companies holding Bitcoin on their balance sheet. Supports complex approval structures and compliance needs.

These services create an integrated Bitcoin financial ecosystem. You can accumulate, secure, and leverage your Bitcoin without leaving Unchained's platform.

Unchained Inheritance Solution

Unchained's inheritance planning differs fundamentally because of their financial institution status. Their process covers both legal title transfer and physical possession of Bitcoin.

This matters for estate settlement. Other providers only handle possession transfer. Your heirs still need separate legal documentation proving ownership. Unchained works with your trust or will to handle both aspects.

Concierge onboarding costs $750 for new clients who need guided setup. This includes video walkthroughs of vault creation and inheritance protocol. Some find this expensive compared to Casa's included onboarding.

Unchained Signature Program

The company's premium service tier launched in 2024. Unchained Signature provides white-glove support for serious Bitcoin holders.

Features include:

- Dedicated account manager

- Personal onboarding with security education

- Same-day emergency response

- Reduced trading fees

- Priority access to new features and events

Pricing isn't publicly listed. The service targets high-net-worth individuals and family offices managing substantial Bitcoin holdings.

Unchained Pricing Philosophy

Here's where Unchained diverges dramatically from Casa. The basic personal vault is free to create and maintain.

You only pay $20 when you need Unchained's backup key to co-sign a transaction. This happens in two scenarios: you've lost one of your keys, or you choose to use their key for convenience.

This pricing model offers incredible value. Your long-term savings shouldn't require frequent transactions. When you do need to move Bitcoin, you probably won't need Unchained's key unless you've lost one of yours.

The $250/year fee that Casa charges can be avoided entirely with Unchained. Their annual fee only applies if you want premium features like enhanced support or business accounts.

Unchained makes money through their financial services: trading fees, loan interest, IRA fees, and premium advisory packages. This lets them offer free collaborative custody as a customer acquisition tool.

Unchained KYC Requirements

As a regulated financial institution, Unchained must comply with KYC and AML laws. Account creation requires:

- Full legal name

- Email and phone number

- Social Security number

- Date of birth

- Physical address

- Identity verification

This bothers privacy-focused Bitcoiners. You must reveal your identity and Bitcoin holdings to a corporate entity. That information becomes a target if Unchained suffers a data breach.

The company maintains it stores data securely and follows best practices. But the requirement remains a dealbreaker for users prioritizing anonymity.

Head-to-Head Comparison

Security Architecture

Both companies use industry-standard 2-of-3 multisig as their foundation. Neither has suffered a security breach or customer fund loss. Both distribute keys geographically and use secure hardware.

Casa offers more flexibility in hardware wallet choice. Unchained's restricted compatibility limits options but simplifies support.

Casa's 3-of-5 premium vault provides stronger security than Unchained's standard offering. Advanced users can replicate this with Unchained's open-source Caravan tool, but that requires technical expertise.

User Experience

Simple is what makes Casa stand out. Step by step, the mobile app walks those who aren’t tech-savvy through each part. A clean look gives it a fresh feel. With video checks, safety comes smoothly into play.

Getting started with Unchained asks for a bit more tech confidence. While the setup guides cover everything well, it just seems harder to get going. A new mobile app has made things easier lately, yet Casa remains simpler to use.

Starting out with Bitcoin? Casa walks you through setup without the stress. If you already know multisig and need full command, Unchained fits like a glove.

Privacy Considerations

Some people prefer staying anonymous online. Casa lets them sign up without showing ID. Not everyone likes that approach though. Unchained insists on knowing exactly who you are. That split shapes how each service feels to those watching their data. Privacy minded folks notice it right away.

What happens behind the scenes at Casa might surprise you. Transaction tracking there relies on xpub storage, nothing more. Over at Unchained, personal details get saved, regulators demand it. Your coins stay safe either way, no one touches them. Still, who holds what data? That part varies a lot.

For those who value privacy, Casa stands out. When working within rules feels right, Unchained fits better.

Cost Comparison

Unchained delivers better value for basic collaborative custody:

- Casa Standard: $250/year minimum

- Unchained Vault: Free (pay $20 only when using their key)

For long-term holders who rarely transact, Unchained's model saves hundreds annually.

Casa's Premium tier at $2,100/year includes hardware, onboarding, and 24/7 support. Unchained offers similar white-glove service through Signature but prices it higher for the target market.

If you need stablecoin custody, Casa is your only option. That feature alone justifies the cost for diversified holders.

Additional Services

Built right into Unchained, money tools shape one full Bitcoin experience. Purchase coins, keep them safe, take loans using your stack, even plan life around it, all without handing control to anyone else.

Custody and inheritance sit at the heart of Casa's work. Through collaborations with outside firms, extra help shows up where needed, yet money tools that fit together never appear here. Their path stays narrow, built around legacy planning, not bundled deals.

Aiming high in its own lane, Casa focuses on top-tier custody solutions. Moving beyond storage, Unchained builds toward becoming a complete Bitcoin-powered financial setup.

Customer Support

One thing both businesses care about is how well they help customers. When emergencies pop up at any hour, Premium users of Casa can reach out anytime. For those on the standard plan, getting in touch means sending an email.

Fresh off the start line, Unchained walks newcomers through every step. Praise piles up thanks to consistent support that keeps users happy. Paying more unlocks their concierge team, a move many say is worth it. Even with the added cost, feedback stays glowing.

When it comes to protecting big assets, how good the help is makes a huge difference. Each firm gets that, so they hire people who can deliver. Feedback from users shows strong approval for both, though Casa tends to reply just a bit faster.

Who Should Choose Casa?

Casa makes sense if you:

- Want the simplest possible self-custody experience

- Need to secure stablecoins alongside Bitcoin

- Prefer avoiding KYC requirements

- Value 24/7 emergency support

- Want shared accounts for family members

- Don't mind paying annual subscription fees

Casa serves Bitcoin newcomers exceptionally well. The guided experience reduces setup anxiety and builds confidence. You'll pay more, but the user experience justifies the cost for many.

Who Should Choose Unchained?

Unchained fits better if you:

- Hold Bitcoin only

- Want to minimize ongoing costs

- Need integrated financial services (IRA, loans, trading)

- Value open-source tools and technical flexibility

- Accept KYC as reasonable for financial institutions

- Prefer working with a regulated entity

Technically competent users love Unchained's flexibility. The free vault offering delivers exceptional value. Adding IRAs or trading makes Unchained a one-stop Bitcoin platform.

Making Your Decision

The right choice depends on your specific situation. Consider these factors:

- Holdings Size: Larger holdings justify Casa's Premium tier security and support. Smaller amounts work fine with either standard offering.

- Technical Comfort: Casa suits beginners. Unchained rewards technical users willing to learn.

- Privacy Priority: Anonymity requires Casa. Unchained demands identity disclosure.

- Asset Mix: Stablecoin holders need Casa. Bitcoin purists prefer Unchained.

- Service Needs: Want Bitcoin loans or IRAs? Unchained. Just custody? Either works.

- Budget: Cost-conscious holders benefit from Unchained's free vault.

Neither choice is wrong. Both companies provide legitimate collaborative custody with strong track records. You maintain control of your keys with either option.

Some sophisticated holders use both. They might keep their main stack with Unchained's free vault while using Casa Premium for a family emergency fund that includes stablecoins.

Final Thoughts

What matters most to you decides the pick between Casa and Unchained Capital. Each one offers real shared custody, your hands stay on the wheel.

Casa makes things easier by focusing on how people actually use it, while keeping personal data safe through a clear pay model. For those who own different kinds of assets, handling them together works smoothly here. Starting out feels less overwhelming thanks to step-by-step help built into the process.

What stands out is how Unchained combines tools that usually stay separate. A built-in vault comes at no cost, which fits neatly alongside banking-grade features. People who dive into code tend to favor the control it offers.

One option keeps your money safe from market swings, while another guards against losing everything at once. Real Bitcoin stays under your control, protected the right way. Loved ones can inherit it when needed. What counts is knowing that piece is covered.

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency involves significant risk, including total loss of funds. Always conduct independent research and consult qualified professionals before making custody or investment decisions.