A Bitcoiner's Deep Dive into the Future of Spending Your Sats

The crypto card market is crowded. Really. Binance Card, Nexo, Plutus, Coinbase Card, Redotpay, Wirex dozens of options, each promising the easiest way to spend your crypto. But here's the problem: most force you to choose between convenience and sovereignty. You either give up custody of your coins, or you deal with terrible UX and sky-high fees.

Bleap isn't fully on the market yet, it's currently in beta with limited European access and a full public launch planned for Q1 2026. But for those of us who are curious, who want to understand what's coming before the hype hits, a thorough review is essential.

So what makes Bleap different? Why should Bitcoiners pay attention to yet another crypto card? And most importantly: does it actually respect the principle of self-custody while being practical enough to use daily?

Let's dig in.

What is Bleap?

Bleap is a non-custodial Web3 wallet paired with a Mastercard debit card that lets you spend cryptocurrency (including Bitcoin) directly from your own wallet, without giving up control of your private keys. Think of it as your self-sovereign bank account that lives on the blockchain but works everywhere Mastercard is accepted.

The platform combines three core functions:

- A non-custodial wallet using Multi-Party Computation (MPC) technology

- A Mastercard debit card (physical and virtual) for real-world spending

- DeFi integration for earning yield on stablecoins

The Founders: Ex-Revolut Builders Who Get It

Bleap was founded in 2023 by João Alves and Guilherme Gomes, both former Revolut employees who understand the traditional fintech world intimately. João previously led Revolut's Card Issuing team, while Guilherme led multiple product teams there.

In November 2024, they raised $2.3 million in pre-seed funding led by Ethereal Ventures (founded by ConsenSys founder Joe Lubin), with participation from Maven11, Alliance DAO, Robot Ventures, and angels from Revolut, Phantom, OKX, EigenLayer, and ConsenSys. The funding brought Bleap to a $10 million post-money valuation.

Where Can You Use It?

Current Availability: European Economic Area (EEA) countries

Bleap currently operates in 30 European countries:

- Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and The Netherlands.

Not Available: United States and sanctioned countries (Iran, North Korea, Sudan, Syria, Cuba, Russia)

The platform launched in beta in December 2025 and is planning full public deployment in Q1 2026. They've already onboarded thousands of users and processed over $5 million in transactions, saving users more than $100,000 in fees.

What Can You Do With Bleap?

1. Spend Bitcoin (and Other Crypto) Like Cash

Load your Bleap wallet with Bitcoin, Ethereum, Solana, USDC, USDT, or other supported cryptocurrencies. When you swipe your Bleap Mastercard, the platform handles the conversion in real-time at the point of purchase.

2. Earn 2% Cashback (Paid in USDC)

Every purchase earns you 2% cashback, paid in USDC, a stable, non-volatile asset. This is real value, not some proprietary token that could tank tomorrow.

How the cashback works:

- Earned on every card purchase (online or in-store)

- Paid instantly in USDC to your wallet

- Works with both physical and virtual cards

- Compatible with Apple Pay and Google Pay transactions

- No staking required, no token lock-ups, no complicated tier systems

Cashback limits:

- $10/month standard

- $15/month with successful referrals

Where the cashback comes from: Unlike sketchy operations that pay rewards from new user deposits (Ponzi vibes), Bleap's cashback is sustainable. It comes from:

- Merchant interchange fees (the fees merchants pay when you swipe)

- Partner incentives and revenue sharing

- Future subscription plans (currently free)

The 2% rate is competitive, matching or beating most traditional cashback cards, but the monthly caps ($10-15) mean heavy spenders won't maximize value here. If you're spending $10,000/month on your card, you're capped at $10-15 in rewards instead of the $200 you'd expect from unlimited 2% cashback.

For most users though, especially in Europe where cashback cards are less common, this is solid value with zero strings attached.

3. No Foreign Exchange Fees

Travel the world and spend like a local, zero FX markups, zero conversion fees. This alone can save serious money for digital nomads and frequent travelers. You can hold digital USD, EUR, or GBP balances and spend 1:1 without getting gouged on exchange rates.

4. Free ATM Withdrawals

Withdraw up to €200 per month from any ATM globally without fees.

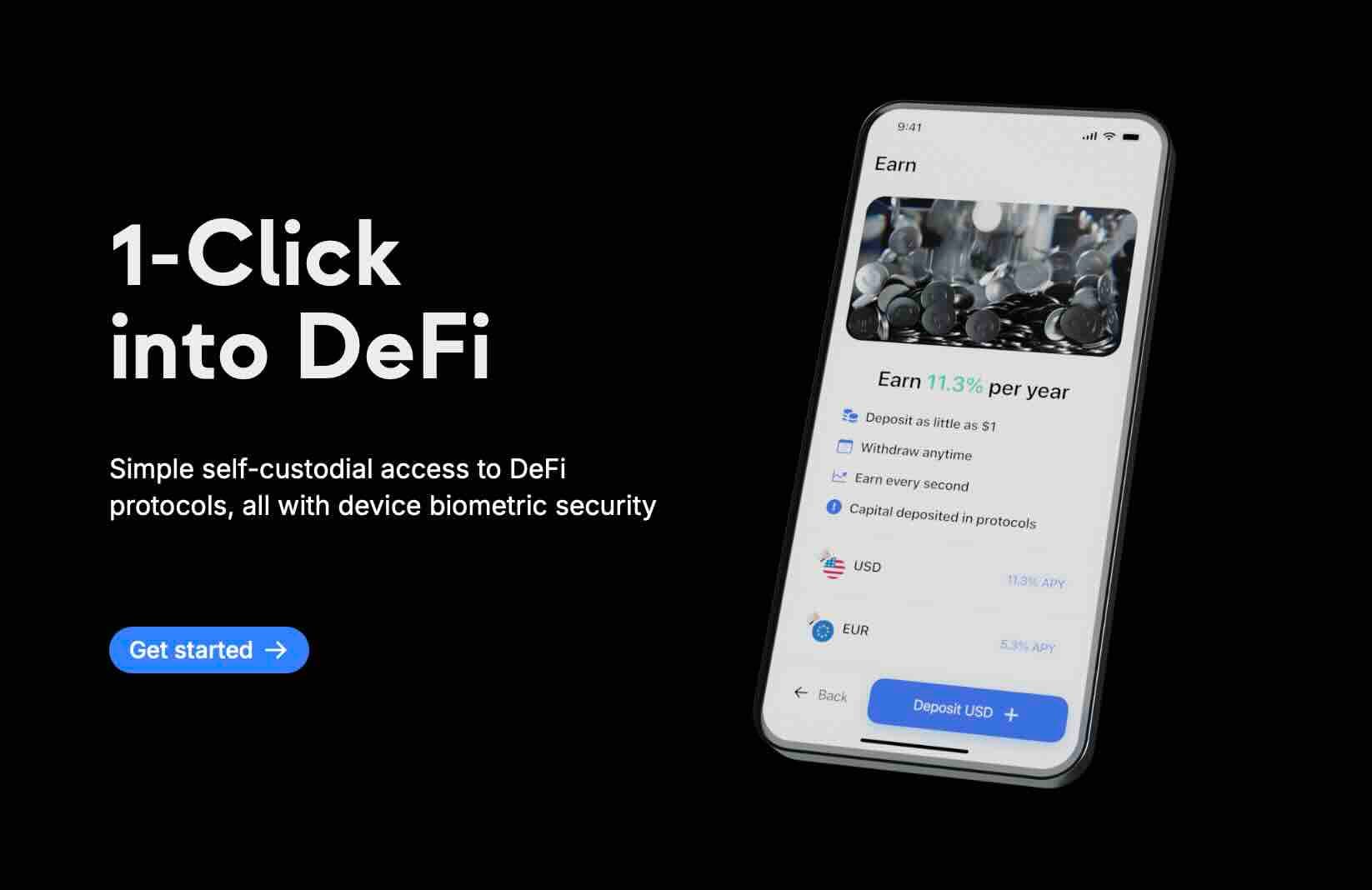

5. Earn Up to 20% APY on Stablecoins

Access curated DeFi protocols through the app to earn yield on your USD, EUR, and GBP stablecoins. No complex DeFi navigation required—Bleap provides one-tap access to vetted yield opportunities.

6. Free Global Transfers

Send and receive fiat and crypto worldwide instantly, with no intermediaries and no fees. Perfect for freelancers, remote workers, and international teams.

7. Fee-Free Buy/Sell

Buy and sell crypto with no fees, getting the real exchange rate through your preferred payment method.

Earn Up to 15% APY on Stablecoins (via Angle Protocol)

This is where Bleap gets interesting beyond just being a spending card. Through their partnership with Angle Protocol, Bleap offers self-custodial access to DeFi yield with genuine returns, up to 15% APY on USD and EUR stablecoins.

How Bleap Earn works:

- Deposit to your Savings Vault - Move stablecoins (USDC, USDT, USDA, EURA) from your main Bleap wallet to your savings vault

- Earn yield instantly - No lockups, no minimums (start with $1), no fees

- Paid every minute - Your balance grows continuously, not monthly or quarterly

- Withdraw anytime - Full liquidity, no penalties

The Angle Protocol advantage:

Bleap doesn't run their own yield engine (smart move, less risk). They've partnered with Angle Protocol, a battle-tested DeFi platform that's been live for years with:

- Full audits (multiple security firms)

- Zero incidents or exploits

- Transparent yield strategies

- Proven track record

Where the yield comes from:

- DeFi lending protocols and strategies

- Tokenized real-world assets (T-bills, government bonds)

- Stablecoin borrowers paying interest

- Diversified across multiple sources to reduce risk

The crucial detail: Self-custody Your funds stay in YOUR wallet the entire time. Bleap and Angle don't take custody. You're interacting with smart contracts directly, with Bleap providing the interface. You retain full control and can withdraw instantly.

Example returns: If you deposit $1,000 at 15% APY, you'd have approximately $1,150 after 12 months. That's $150 in passive income on funds you can access anytime.

Risks (because nothing is risk-free):

- Smart contract vulnerabilities (though Angle is audited and incident-free)

- Collateral risks in underlying protocols

- Oracle failures or market volatility

- Variable APY (not fixed—rates change based on DeFi market conditions)

But compared to leaving stables in a custodial exchange earning 0%, or in a cold wallet earning nothing, this is a compelling option for funds you're holding in stablecoins anyway.

Supported stablecoins: You can deposit from multiple networks (Arbitrum, Ethereum, Polygon, Optimism, Base, Solana), then move those funds into your savings vault to start earning.

No abuse, but fair limits: While technically you can deposit and withdraw unlimited amounts anytime, Bleap sponsors the network fees. They have an "abuse policy" that varies per user to prevent excessive movements in short periods. For normal usage, this won't affect you.

The Self-Custody Advantage: How It Actually Works

This is where Bleap gets interesting for true Bitcoiners. The platform uses Multi-Party Computation (MPC) technology from PortalHQ to maintain self-custody while eliminating seed phrases.

How MPC Works

Your private key is split into multiple encrypted shares:

- One share stays on your device

- Another share is backed up with PortalHQ

- When you sign a transaction, both shares are required

This means:

- No one can access your funds without you—not even Bleap

- No seed phrases to memorize or secure—cloud storage and social logins replace them

- Protection even if one device is compromised—the key is split, not duplicated

- Account abstraction (ERC-4337)—Web2-level UX with Web3-level security

The Smart Contract Architecture

When you create a Bleap account, a smart wallet is deployed on Arbitrum (Ethereum Layer 2). This enables:

- Fast, gasless transactions (Bleap covers gas fees)

- Cost-efficient blockchain settlement

- Programmable permissions (you can revoke card access anytime)

The Advantages: Why Bleap Stands Out

- ✅ True Self-Custody : Your crypto stays in your wallet until you spend it. No custodial risk. No FTX-style collapses. Not your keys, not your coins—Bleap respects this.

- ✅ Transparent Cashback : 2% back in USDC, no conditions, no token staking required. The cashback comes from merchant interchange fees and partner incentives—not from inflated fees hidden elsewhere.

- ✅ Regulatory Compliance : Registered as a VASP in the EU, compliant with MiCA (Markets in Crypto-Assets Regulation). The cards are issued by Unlimit, authorized by the Bank of Cyprus under an e-money institution license.

- ✅ User Experience : Account abstraction means no seed phrases, simple social login, familiar banking UX, but with full self-custody on the backend. They've removed the friction that keeps normies away from crypto.

The Disadvantages: What Bleap Doesn't Get Right (Yet)

- ❌ Limited Geographic Availability : Europe only for now. If you're in the US, Canada, Asia, or elsewhere, you're out of luck. Latin America expansion is coming, but no timeline for broader global rollout.

- ❌ Built on Arbitrum Only : Currently deployed solely on Arbitrum (Ethereum L2). While the on/off ramp supports multiple chains (Ethereum, Polygon, BNB, Solana, Bitcoin), the smart wallet itself is Arbitrum-only. No plans announced for multi-chain deployment.

- ❌ Counterparty Risk Still Exists : While your crypto is self-custodial, you're still trusting: PortalHQ's MPC infrastructure, Bleap's card authorization system, Unlimit as the card issuer, Mastercard's payment network

This is unavoidable when bridging crypto to traditional payment rails, but it's worth acknowledging.

- ❌ No Deposit Insurance : Electronic money products are explicitly NOT covered by the Deposit Insurance System of the Republic of Cyprus. Funds are held in segregated accounts, but this isn't FDIC or FSCS protection.

The Bitcoiner's Verdict

Bleap represents a genuine attempt to solve the self-custody spending problem. It's not perfect, and it's not for everyone, but it's a meaningful step forward.

Bleap is one of the better bridges available today.

👉 For the Practical Bitcoiner: If you live in Europe, travel frequently, or simply want to spend crypto without fees while maintaining self-custody, Bleap is worth serious consideration. The combination of zero fees, genuine self-custody, and global acceptance is rare, possibly unique, in the crypto card market.

👉 For the DeFi-Curious: The integrated yield opportunities (up to 20% APY on stablecoins) provide easy access to DeFi without the complexity. Bleap curates the protocols, handles the gas fees, and presents everything through a simple interface. For someone who wants DeFi exposure without becoming a DeFi expert, this is valuable.

This review is for those who want to understand Bleap before it fully launches. Based on publicly available information as of January 2026. Cryptocurrency and DeFi products carry inherent risks. Always do your own research and never invest more than you can afford to lose.

Read Also :