What is Bitkern?

Bitkern Group is a publicly traded company headquartered in Switzerland that operates high-performance data centers focused on cryptocurrency mining, particularly Bitcoin.

Founded in 2017, the company has evolved from its Austrian origins into a global operation with offices in Switzerland, Austria, and the United States, plus operational facilities across North and South America, Europe, and Central Asia.

The company offers comprehensive mining solutions that encompass the entire mining lifecycle, from sourcing and purchasing ASIC mining hardware to installation, hosting, maintenance, and ongoing technical support.

Bitkern operates as a full-service provider, allowing customers to participate in Bitcoin mining without managing the technical complexities themselves.

Founder and Leadership

Stefan Kern serves as the Founder and CEO of Bitkern Group. According to available information, Kern has a background in financial services, having previously worked at WWK Lebensversicherung as a Regional Manager. He attended the University of Continuing Education Krems, where he obtained credentials in Financial Planning and Services between 2016 and 2017.

The leadership team also includes Patrick Stich as CEO of Bitkern USA, Manuel Stich as Head of IT, Matthias Reder as Sales Manager, and Andrew McKinney as Head of Operations. This management structure reflects the company's international expansion and specialized operational needs.

Services Offered

Bitkern provides two primary service packages designed for different customer segments:

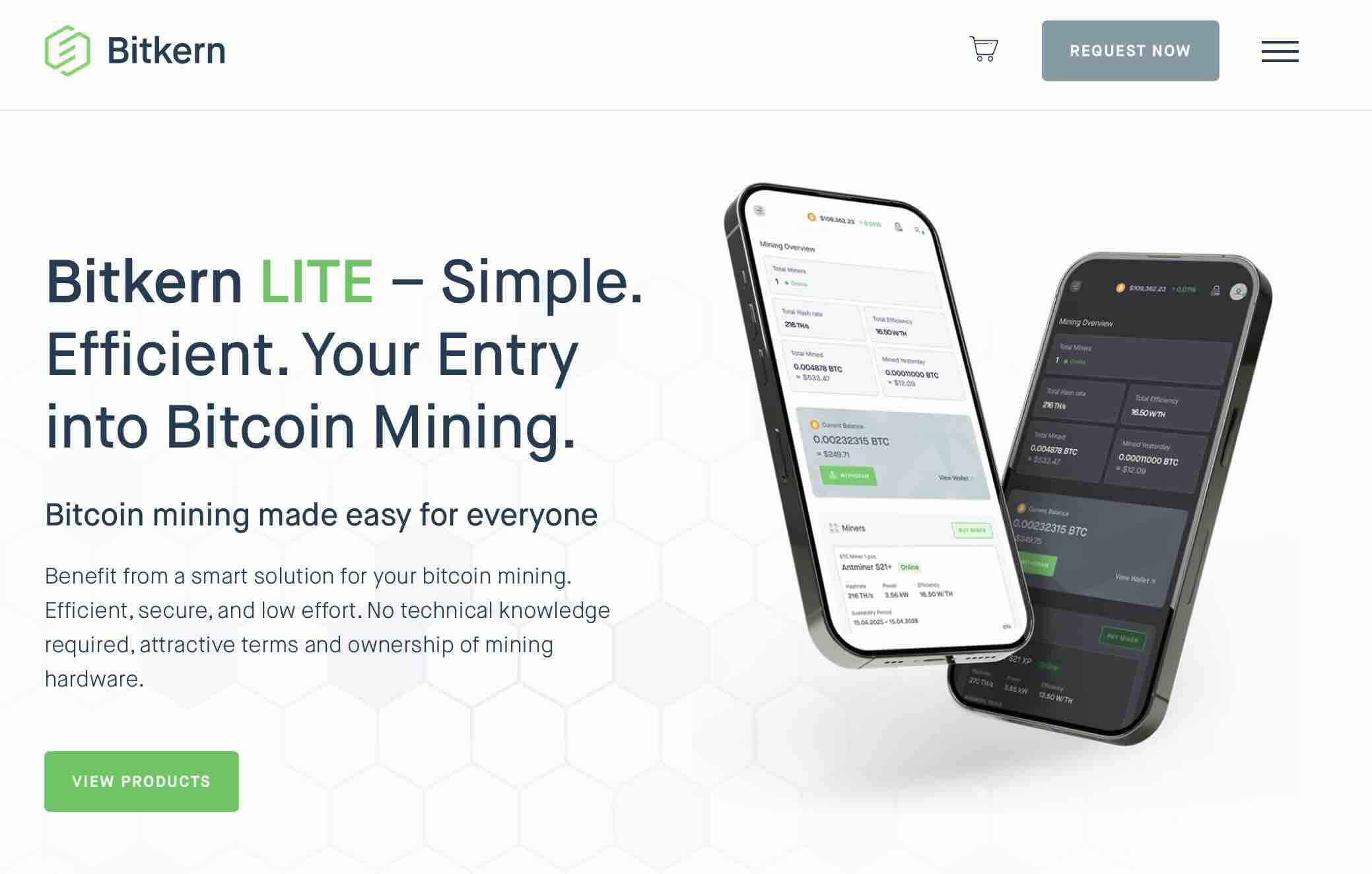

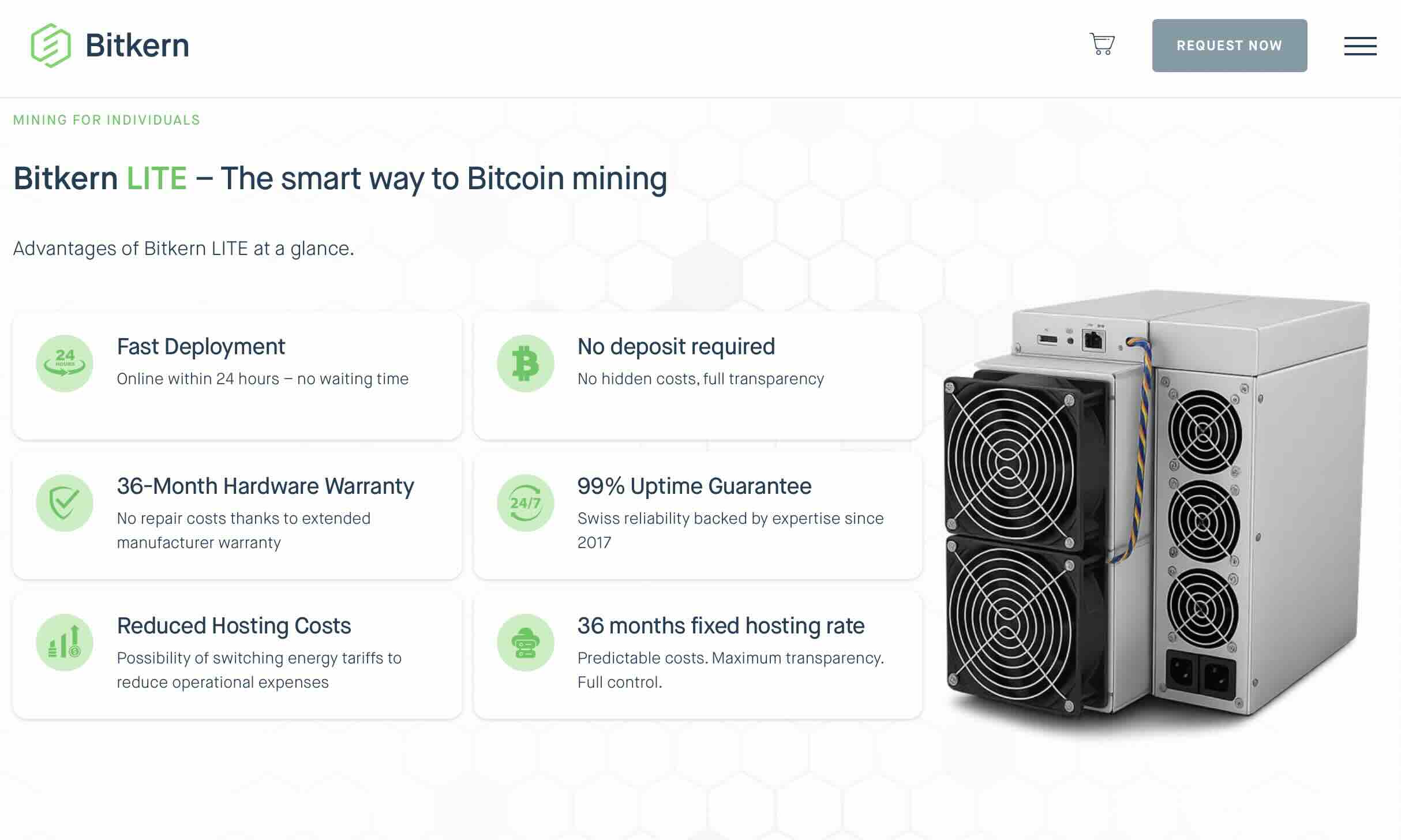

Bitkern LITE

Bitkern LITE is designed for beginners and individuals who want to enter Bitcoin mining with minimal technical knowledge. This package allows customers to purchase ownership of mining hardware starting with just a single miner. The service includes complete management of installation, maintenance, hosting, and operations. Customers receive regular payouts of their mining earnings while Bitkern handles all technical aspects.

Bitkern PRO

Bitkern PRO targets professional miners and businesses looking to invest $50,000 or more in mining hardware. This solution offers greater flexibility, including customizable location choices, advanced control options, and the ability to scale operations across multiple global data centers.

PRO customers benefit from professional-grade service with more involvement in operational decisions.

Additional Services

- Hardware procurement from leading manufacturers

- Data center hosting with 99% uptime guarantee (Hosting Rate A)

- Installation and configuration services

- Ongoing maintenance and repair

- 24/7 multilingual customer support

- Firmware optimization

- Customs clearance and logistics

- Direct mining pool connection

Pricing Structure

Bitkern's pricing model consists of two main components:

Hardware Costs

Customers purchase mining hardware at market-competitive prices. The company claims that listed prices are comprehensive and include shipping, customs duties, and setup costs, eliminating hidden fees. Hardware ownership remains with Bitkern until full payment is received (retention of title clause).

Hosting Fees

The all-inclusive hosting service starts at $0.043 per kWh, though some marketing materials reference $0.045 per kWh. These rates vary by location and are among the company's key competitive advantages. Hosting fees only apply when miners are actively operational, providing some protection against downtime costs.

Bitkern offers two hosting rate structures:

- Hosting Rate A: Guarantees 100% uptime target (99% minimum guarantee)

- Hosting Rate B: Targets 65% uptime (50% minimum guarantee) at presumably lower rates

Global Infrastructure

Bitkern operates 13-14 strategically positioned data centers worldwide, with plans for additional locations. These facilities are distributed across:

- North America (including facilities in North Carolina with 15 MW capacity)

- South America (including Paraguay, marketed for competitive hosting fees)

- Europe (including Sweden and Austria)

- Central Asia (with an 80 MW capacity location featuring Antminer S19 and S21 models)

Advantages

1. Established Track Record

Operating since 2017, Bitkern has weathered three complete Bitcoin market cycles, demonstrating operational resilience through various market conditions including the 2021 China mining ban, multiple Bitcoin halvings, and significant price volatility.

2. Competitive Energy Costs

With hosting rates starting at $0.043 per kWh, Bitkern offers below-average electricity costs compared to many retail mining operations. Access to renewable energy sources in locations like Paraguay, Sweden, and regions with hydroelectric power provides both cost advantages and environmental benefits.

3. Turnkey Solution

The all-inclusive service model eliminates the need for customers to manage technical complexities, deal with hardware logistics, or handle facility operations. This is particularly valuable for institutional investors or individuals without technical mining expertise.

4. Regulatory Compliance

With registered offices in Switzerland and Austria, Bitkern operates under European legal frameworks, providing regulatory certainty. The company maintains transparent business practices and publicly identifies its leadership team.

5. Customer Support

24/7 multilingual support in English, German, and Russian, combined with a customer dashboard for monitoring operations, provides accessibility and transparency. Fast deployment times (claimed 24 hours in some cases) allow quick entry into mining operations.

6. Geographic Diversification

Multiple global locations allow customers to spread risk across different jurisdictions and reduce exposure to single-point regulatory, political, or natural disaster risks.

Disadvantages and Risks

1. No Profitability Guarantees

Bitkern explicitly states in its terms and conditions that it does not guarantee profits. Same for all bitcoin mining companies. Indeed, Bitcoin mining profitability depends on factors outside the company's control, including Bitcoin price volatility, mining difficulty adjustments, and network hash rate changes.

2. Insurance Limitations

Insurance coverage is not guaranteed at all locations. Events classified as force majeure (theft, fire, natural disasters) are considered beyond Bitkern's control, meaning customers may bear some risk of hardware loss.

3. Minimum Investment Requirements

While Bitkern LITE allows single-miner purchases, the PRO tier requires $50,000+ investments. Hardware-only purchases require minimums of 10 devices, and hosting-only services require at least 100 devices, limiting accessibility for smaller operators.

4. Retention of Title

Customers do not receive full ownership of hardware until complete payment is made. If customers default on hosting fee payments for more than 30 days, Bitkern can suspend mining operations.

5. Uptime Variability

While Hosting Rate A guarantees 99% minimum uptime, Hosting Rate B only guarantees 50% minimum. Downtime can significantly impact profitability, and the company reserves the right to reduce availability to minimum levels.

6. Regulatory and Blockchain Risks

Changes in cryptocurrency regulations, blockchain network issues, or mining algorithm changes could disrupt operations. The company's terms acknowledge these external risks that affect all mining operations.

Customer Reviews and Reputation

Customer feedback about Bitkern shows a generally positive but limited pattern:

Positive Feedback 😄

Trustpilot reviews (13 total) emphasize clear communication, prompt responses, and patience from the Bitkern team. Customers particularly appreciate the guidance from team members like Matthias and Stefan. Professional miners describe the team as "true experts" in Bitcoin mining, and there are testimonials about successful multi-location hosting experiences.

One verified customer stated they purchased 10 new S19 miners that have "all worked well so far," confirming the company's legitimacy for larger customers.

Trust Scores

Third-party assessment shows mixed signals:

- ScamDoc: 90% high trust rating

- EvenInsight: 90/100 safety score

The discrepancy between automated security scanners and actual customer reviews suggests that while automated tools flag potential concerns, real customer experiences have been largely positive. The company's public identification of leadership, physical office locations, and multi-year operation support legitimacy claims.

Limited Review Volume

A notable concern is the limited number of public reviews (13 on Trustpilot, minimal presence on other platforms). For a company operating since 2017, this could indicate either a relatively small customer base, limited incentive for customers to leave reviews, or that most business is conducted with institutional clients who don't typically provide public testimonials.

Is Bitcoin Mining with Bitkern Profitable?

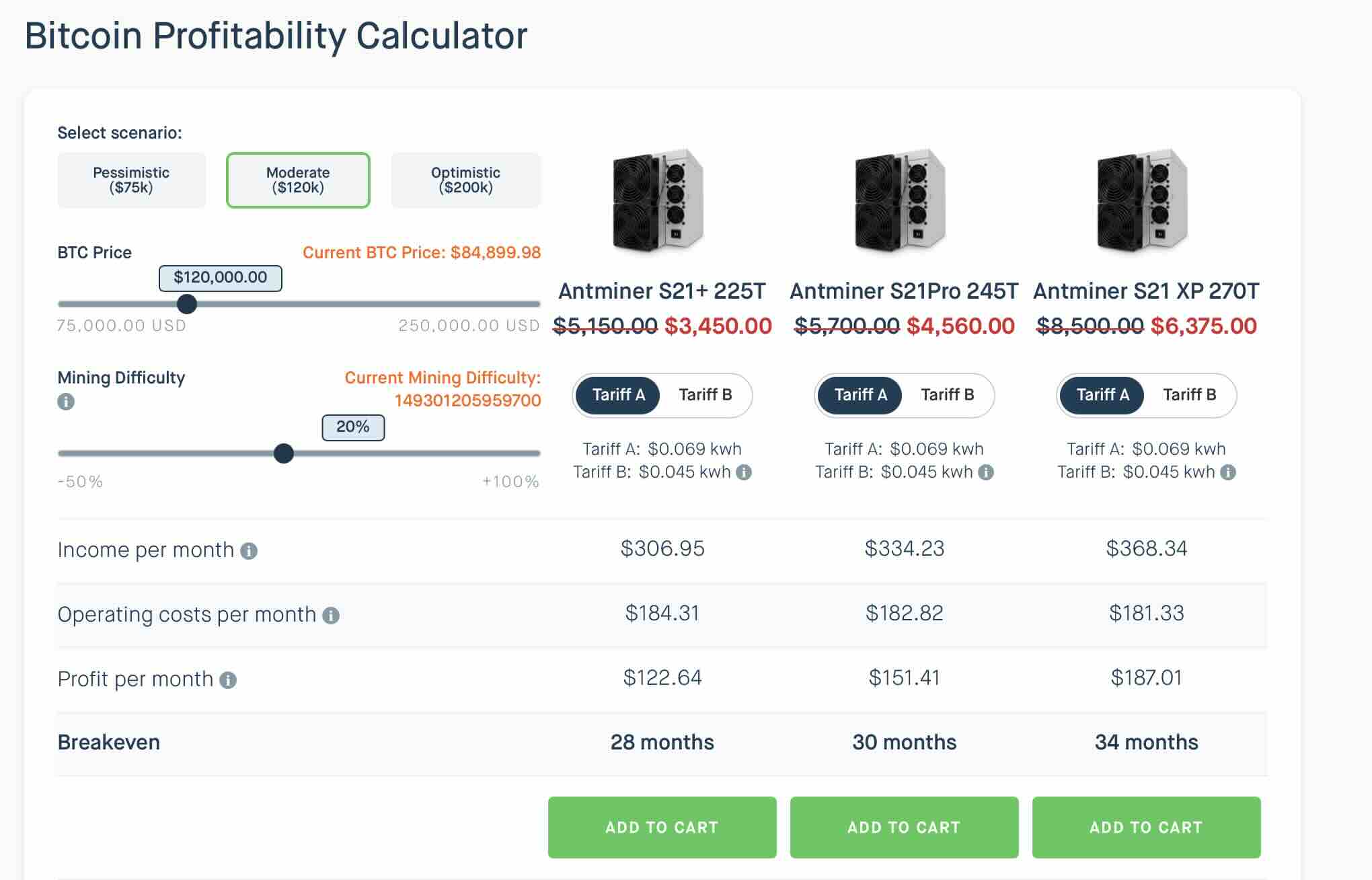

Profitability in Bitcoin mining depends on multiple dynamic factors that change constantly. Current market conditions (as of January 2026) present specific challenges and opportunities.

Key Profitability Factors

- Bitcoin Price: The primary driver of mining revenue. Higher prices improve profitability significantly.

- Network Difficulty: As more miners join the network, difficulty increases, reducing individual miner returns.

- Hardware Efficiency: Newer ASIC models (like Antminer S21) offer better hash rate per watt consumed.

- Electricity Costs: At $0.043-0.045 per kWh, Bitkern's rates are competitive but not the absolute lowest globally.

- Uptime: 99% uptime means 1% downtime, which directly reduces potential earnings.

- Block Reward: Currently 3.125 BTC per block after the April 2024 halving.

Realistic Expectations

Based on current mining profitability calculators, typical ROI periods for Bitcoin mining hardware range from 12-36 months under stable conditions. However, these calculations assume constant Bitcoin prices and difficulty levels, which never occurs in practice.

Bitkern's CEO Stefan Kern acknowledges that "success in mining demands an uncompromising focus on efficiency" and notes that "long-term profitability now hinges on clear strategies and modern, scalable infrastructure." The company positions mining as a long-term investment strategy rather than a get-rich-quick opportunity.

Warning Indicators

Bitkern's own terms explicitly state that their profitability calculator results "do not guarantee future earnings or profitability" and that "actual results may therefore vary considerably." This transparency is important for potential customers to understand that mining carries inherent financial risks.

Comparison with Alternatives

When considering Bitkern, potential customers should compare against several alternatives:

Home Mining

Running miners at home provides complete control but requires dealing with noise (60-75 decibels), heat generation, electrical infrastructure upgrades, and typically higher electricity costs ($0.10-0.15 per kWh in most regions). Bitkern eliminates these concerns but adds hosting fees and removes direct hardware control.

Cloud Mining Services

Many cloud mining platforms don't involve actual hardware ownership, instead selling hash rate contracts. Bitkern differs by offering actual hardware ownership with professional hosting, providing more transparency and control.

Other Hosting Providers

Competitors like Compass Mining, Saszmining, Luxor Mining, and others offer similar services. Bitkern's advantages include European regulatory framework and competitive pricing, while larger competitors might offer more extensive geographic options or additional features.

Direct Bitcoin Investment

Simply buying and holding Bitcoin eliminates operational complexity, hardware risks, and ongoing costs. Mining through Bitkern only makes sense if the customer believes they can accumulate Bitcoin more cost-effectively than direct purchase, which requires careful calculation given hardware depreciation and operational risks.

Who Should Consider Bitkern?

Bitkern appears best suited for:

- Institutional investors seeking professional-grade mining operations with regulatory clarity

- Family offices looking to diversify into cryptocurrency mining without managing infrastructure

- European-based investors who value Swiss/Austrian regulatory frameworks

- Experienced miners wanting to scale operations across multiple global locations

- Individuals with capital ($10,000+) who want hardware ownership but lack technical mining expertise

not ideal for:

- Complete beginners with limited capital (under $5,000)

- Those seeking guaranteed returns or passive income with no risk

- Individuals who want complete technical control over their mining operations

- Short-term speculators looking for quick profits

Final Verdict

Bitkern appears to be a legitimate cryptocurrency mining infrastructure provider with established operations since 2017. The company offers genuine services backed by physical infrastructure, transparent leadership, and regulatory compliance in European jurisdictions.

Legitimacy Assessment

Evidence supporting legitimacy includes operational history through multiple Bitcoin cycles, publicly identified leadership team, physical office locations, customer testimonials from larger investors, partnership announcements with industry figures, and participation in industry media and podcasts. While automated security scanners flag concerns, these appear related to algorithmic assessment rather than actual fraud indicators.

Profitability Reality Check

Mining profitability is highly variable and depends on factors beyond Bitkern's control. The company is transparent about this reality. Prospective customers should:

- Run detailed profitability calculations using current Bitcoin prices, difficulty, and hardware specifications

- Assume Bitcoin price volatility and difficulty increases in their models

- Account for hardware depreciation and eventual obsolescence

- Compare total costs (hardware + hosting over expected lifespan) against simply buying Bitcoin

- Consider only investing capital they can afford to lose

Recommendations

For those seriously considering Bitkern, we recommend taking the following steps before committing capital:

- Request a detailed consultation with their sales team to understand specific costs and terms

- Thoroughly review the complete terms and conditions document

- Verify insurance availability at your selected hosting location

- Start with a smaller initial investment to test the service quality

- Understand the tax implications in your jurisdiction (consult a tax professional)

- Monitor your mining dashboard regularly and track actual performance against projections

- Maintain realistic expectations about returns and be prepared for market volatility

Conclusion

Bitkern represents a professional option for those serious about Bitcoin mining who prefer not to manage the technical infrastructure themselves. The company offers genuine services with established operations, competitive pricing, and regulatory compliance. However, like all Bitcoin mining ventures, success is not guaranteed and depends heavily on market conditions, timing, and individual circumstances.

Potential customers should approach with realistic expectations, conduct thorough due diligence, and only invest capital they can afford to lose. Mining should be viewed as a long-term strategy with inherent risks rather than a guaranteed path to passive income.

For institutional investors and serious miners with appropriate capital and risk tolerance, Bitkern appears to offer a legitimate pathway to participate in Bitcoin mining. For smaller investors or those seeking guaranteed returns, direct Bitcoin purchase or other investment vehicles may be more appropriate.

—Disclaimer: This review is for informational purposes only and does not constitute financial advice. Cryptocurrency mining involves significant financial risks including potential total loss of investment. Always consult with qualified financial and tax professionals before making investment decisions. All information is accurate as of January 2026 but market conditions and company offerings may change.