Bitdeer has established itself as one of the most recognized cloud mining platforms in the cryptocurrency mining industry. But is it worth investing with them in 2025? In this comprehensive review, we'll examine all aspects of Bitdeer to help you make an informed decision.

Bitdeer was created in January 2021 following a spin-off from Bitmain, the Bitcoin mining chip giant. The company was founded by Jihan Wu, an iconic figure in the crypto industry.

Jihan Wu Profile:

- Born in 1986 in Chongqing, China, Wu studied at Peking University, obtaining dual degrees in Economics and Psychology in 2009

- Co-founded Bitmain Technologies in 2013, which became the world's largest designer and manufacturer of chips and hardware for Bitcoin mining

- After the spin-off, Bitdeer established its headquarters in Singapore, where Wu resides

- Currently serves as Executive Chairman and CEO of Bitdeer

Company Evolution

Bitdeer was listed on Nasdaq in April 2023 with a valuation of $1.18 billion. The company currently employs 211 people and generated S$485,975,304 in revenue in 2023.

Bitdeer #BTC Weekly Update

— Bitdeer (@BitdeerOfficial) January 10, 2026

🔹 BTC Holdings: 1,900.9 (pure holdings, excluding customer deposits)

🔹 BTC Output: 137.7 BTC

🔹 BTC Sold: 137.9 BTC

🔹 Net BTC Added: -99.1 BTC

📅 Data as of January 9, 2026.#Bitcoin #BTC #BitcoinHoldings #BitcoinCommunity #BTCMining $BTDR pic.twitter.com/WzcbQqdnPX

Advantages of Bitdeer

1. Robust Infrastructure and Computing Power

2025 Performance:

- In October 2025, Bitdeer reached 41.2 EH/s of hash rate, exceeding their 40 EH/s target

- Between May and September 2025, hash rate increased from 13.6 EH/s to 35 EH/s

- Monthly production: approximately 450 BTC mined each month in September 2025

Proprietary Technology:

- Bitdeer manufactures its own SEALMINER A3 miners, with models reaching up to 660 TH/s at 12.5 J/TH

- Their first SEAL04 chip achieved promising results of approximately 6-7 J/TH in testing

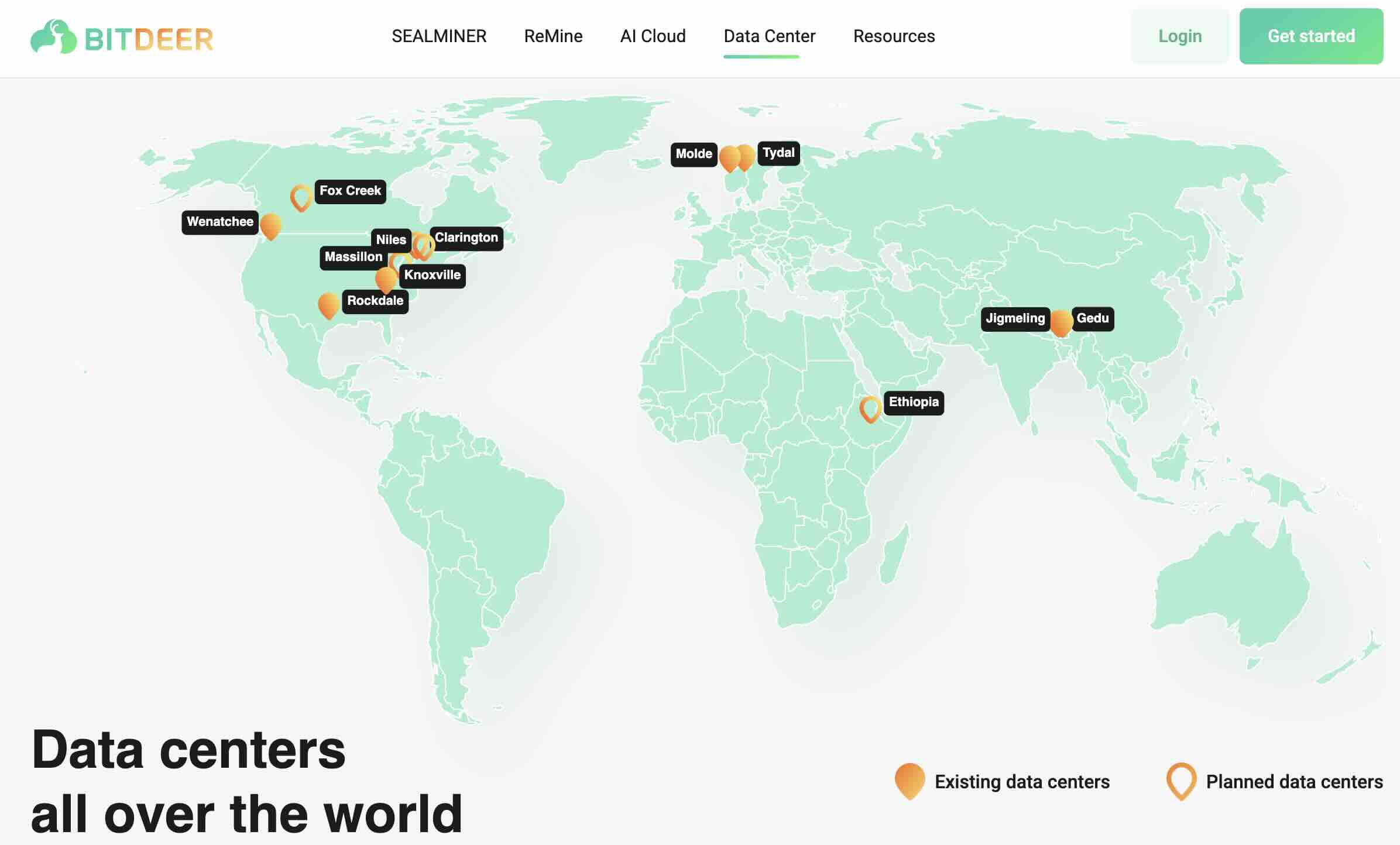

2. Global Data Centers

Bitdeer operates data centers in several strategic regions:

Site Locations:

- United States: Texas (Rockdale - 100 MW), Tennessee, Washington, Ohio (multiple sites)

- Norway: Tydal site with 175 MW fully powered by hydroelectricity

- Bhutan: 367.5 MW online with 99% renewable energy

- Ethiopia: 50 MW project with 40 MW already online

3. Competitive Energy Costs

Bitdeer benefits from an energy cost of approximately $0.045 per kWh, giving it a significant competitive advantage. This efficiency allows the company to remain profitable even with relatively low Bitcoin prices.

4. Environmental Commitment

In Norway, hydroelectric power covers almost all operations, complemented by ambient cooling. In Bhutan, Bitdeer operates on a 99% renewable grid.

5. Diversification into AI

Since 2023, Bitdeer has been building a global AI infrastructure powered by thousands of NVIDIA GPUs, including GB200 NVL72, B200, and soon GB300 NVL72 and B300.

How Cloud Mining Works with Bitdeer

Available Plan Types

Bitdeer offers different types of cloud mining contracts:

- Classic Hash Rate Plans: Stable output with 100% revenue sharing

- Accelerated Plans: Enhanced performance but higher energy consumption

- Blended Contracts: Ability to mine multiple cryptocurrencies

Pricing Structure

Each plan includes a one-time hashrate fee along with a separate electricity charge, which depends on the data center location.

Features:

- Minimum investment: starting from $20 for new users

- Electricity payment: prepayment required (at least 3 days of electricity)

- Flexibility: choice of miner model, plan duration, and hashrate capacity

Transparency and Monitoring

Bitdeer regularly publishes updates on operational performance, uptime metrics, and energy consumption. Users can track their operations in real-time via a personalized dashboard.

Legitimacy and Reliability

Is Bitdeer Legitimate?

Bitdeer has earned a reputation for contract clarity, which has helped quiet many concerns when people ask whether Bitdeer is a scam or legitimate.

Reliability Indicators:

- Nasdaq-listed company (BTDR) since 2023

- Public and audited financial reports

- Verifiable infrastructure with real data centers

- Documented payment history

- Benchmark analyst "buy" rating with a price target of $13

Strategic Partnerships

- Tether acquired a $100 million stake in Bitdeer in 2024

- Partnership with the government of Bhutan in 2023 to increase mining capacity and create a fund of up to $500 million

- Collaboration with NVIDIA for GPU cloud services

Pricing and Profitability

Cost Analysis

Factors Affecting Profitability:

- Hashrate fees (one-time payment)

- Electricity fees (variable by site)

- Network difficulty

- Bitcoin price

- Contract duration

Profitability Calculation

At 35 EH/s and 14 J/TH, Bitdeer's active fleet draws about 490 MW of power. At $0.045 per kWh, daily energy expense is roughly $530,000.

Break-even Point: Bitdeer can remain profitable even if Bitcoin trades in the mid-$30k range - a resilience few miners can claim.

Geographic Restrictions

Services Not Available:

- United States (for cloud mining)

- Mainland China

- Seychelles

It's important to verify eligibility before subscribing to a service.

Comparison with Competition

Market Position

Marathon Digital runs around 31 EH/s, CleanSpark 22 EH/s, and IREN 15 EH/s. Bitdeer's 35 EH/s - heading toward 40 EH/s - places it squarely among the top global miners by proprietary hashrate.

Distinctive Advantages

- Vertical Integration: Manufacturing its own miners

- Energy Efficiency: Among the lowest costs in the industry

- Diversification: Expansion into AI with NVIDIA

- Renewable Energy: Strong commitment to sustainability

Risks and Considerations

Risks to Consider

- Bitcoin Volatility: Revenue fluctuates with BTC price

- Network Difficulty: Constant increase in competition

- Variable Electricity Fees: Can be adjusted based on actual costs

- No Revenue Guarantee: Bitdeer makes no promises about specific future income

- Geopolitical Risks: Operations in multiple jurisdictions

Important Warnings

- Not suitable for investors seeking guaranteed returns

- Requires understanding of crypto market dynamics

- Past performance does not guarantee future results

- Bitdeer makes no promises about your future earnings. All figures mentioned are estimates and assumptions

Future Outlook

2025-2026 Goals

- Target: reach 50 EH/s by 2026

- SEAL04 chip mass production expected in Q1 2026

- Continued data center expansion

- Growth in AI cloud services

Technological Innovation

Next-generation SEAL04 development is significantly delayed, but test results are promising with power efficiency of approximately 6-7 J/TH.

Final Verdict: Should You Mine with Bitdeer?

Who Is Bitdeer Suitable For?

Suitable Profiles:

- Investors seeking mining exposure without hardware

- People wanting to avoid technical mining hassles

- Those looking for an established and transparent platform

- Investors with a long-term vision of Bitcoin

Less Suitable Profiles:

- People seeking quick and guaranteed returns

- Investors who don't tolerate volatility

- Those needing immediate liquidity

- Residents of restricted countries (USA, China, Seychelles)

Summarized Strengths

- ✅ Verified legitimacy: Publicly traded company with proven track record

- ✅ Robust infrastructure: 41.2 EH/s with continuous expansion

- ✅ Competitive energy costs: ~$0.045/kWh

- ✅ Proprietary technology: SEALMINER miners with advanced chips

- ✅ Environmental commitment: Sites powered by renewable energy

- ✅ Transparency: Regular reports and detailed dashboard

- ✅ Customer support: Available 24/7

- ✅ Diversification: Expansion into AI with NVIDIA

Summarized Weaknesses

- ❌ No revenue guarantee: Dependent on market conditions

- ❌ Variable fees: Electricity can be adjusted

- ❌ Geographic restrictions: Not available in certain countries

- ❌ Limited availability: Popular plans quickly sold out

- ❌ Purchase limitation: Maximum 3 simultaneous contracts

Final Recommendation

For those exploring cloud mining in 2025, Bitdeer continues to stand out as a legitimate platform offering both strong infrastructure and steady returns.

Our Opinion:

Bitdeer represents a serious and credible option for cloud mining in 2026. With its renowned founder (Jihan Wu), Nasdaq listing, and verifiable infrastructure of 41.2 EH/s, the platform offers legitimacy guarantees superior to most competitors.

User reviews are predominantly positive, with testimonials documenting regular payments over several years. The company distinguishes itself through operational transparency, detailed monthly reports, and commitment to renewable energy.

However, like any cryptocurrency mining investment, it carries inherent risks. Profitability depends heavily on Bitcoin price, network difficulty, and electricity fees. There is no guarantee of profit.

Recommendation: Bitdeer is suitable for investors seeking Bitcoin mining exposure via an established and transparent platform, provided they have:

- Understanding of crypto market risks

- Medium/long-term investment perspective (6-12+ months)

- Financial capacity to absorb potential losses

- Tolerance for revenue volatility

For beginners, starting with a small investment (the $20 minimum) allows testing the platform before committing larger sums.

Useful Resources

- Official Website: https://www.bitdeer.com

- Investor Relations: https://ir.bitdeer.com

- Nasdaq: BTDR

- Mining Calculator: https://www.bitdeer.com/cloud-mining/calculator

This review was written in January 2025 based on publicly available information. Conditions, prices, and performance may evolve. Always do your own research before investing.