What You Need to Know

Bitstamp holds a special place in crypto history—it's the longest-running Bitcoin exchange still operating today. Founded back in 2011 when Bitcoin was just getting started, Bitstamp has survived every market crash, regulatory challenge, and competitive threat thrown its way. That's no small feat in an industry where exchanges come and go like summer rain.

In June 2025, Robinhood acquired Bitstamp for $200 million, bringing one of crypto's most trusted names under the wing of a major fintech player. This wasn't a distress sale, it was a strategic move that positions Bitstamp for global expansion while maintaining the reliability that made it a household name among serious crypto traders.

What makes Bitstamp stand out isn't flashy features or the lowest fees—it's consistency, security, and regulatory compliance. While other exchanges chase trends, Bitstamp focuses on being the exchange that simply works, day after day, year after year.

The Story Behind Bitstamp ( The Garage Startup That Refused to Die)

Back in August 2011, two young Slovenian entrepreneurs—Nejc Kodrič and Damijan Merlak—started Bitstamp in a garage with just €1,000, one server, and two laptops. Bitcoin was trading around $5, Mt. Gox controlled 70% of all Bitcoin trading, and the whole crypto industry was basically an experiment.

Kodrič and Merlak saw a problem: Mt. Gox was based in Japan and dominated the market, but Europeans needed a trustworthy, locally-focused alternative. They wanted to build something different—a regulated, transparent exchange that would treat cryptocurrency trading with the same professionalism as traditional finance.

The name "Bitstamp" itself was intentional—combining "bit" (the digital unit) with "stamp" (suggesting authority and verification). They weren't trying to be edgy or revolutionary; they wanted to be reliable.

From Slovenia to Luxembourg

The company started in Slovenia but quickly realized they needed better financial infrastructure. In April 2013, they relocated to the UK, and in 2016, they moved to Luxembourg—a strategic choice that gave them access to EU-wide regulatory approvals.

That Luxembourg move paid off. In April 2016, the Luxembourg government granted Bitstamp a license as a fully regulated payment institution across all 28 EU member states. This made Bitstamp one of the first properly licensed cryptocurrency exchanges in Europe—a status that would prove invaluable as regulations tightened worldwide.

Bitstamp has survived every market crash (and there have been many)

Bitstamp's journey wasn't smooth. In February 2014, they faced a DDoS attack and extortion attempt. The attackers demanded 75 bitcoins from Kodrič. He refused, calling them "terrorists" and standing firm on principle despite the operational disruption.

Then came January 2015—the big one. Hackers used a phishing attack on employees, distributing files with malware that compromised Bitstamp's servers. They stole nearly 19,000 bitcoins (worth about $5 million at the time). The exchange suspended operations, rebuilt their security from scratch, and reopened stronger than before.

That hack could have killed Bitstamp. Instead, it proved their resilience. They reimburse customers, upgraded security massively, and earned back trust through transparency. Today, 95% of customer funds sit in cold storage—offline vaults where hackers can't reach them.

The NXMH Acquisition

In October 2018, Brussels-based private equity firm NXMH (one of Bitstamp's earliest investors) acquired the company. Kodrič stayed on as CEO, and importantly, operations didn't change. NXMH wanted to help Bitstamp expand globally, not transform it.

This acquisition gave Bitstamp the financial backing to invest in technology and scale internationally. NXMH also owns Korean exchange Korbit, but wisely, they kept the two companies separate, allowing each to maintain their distinct identities and markets.

The Robinhood Era

On June 2, 2025, Robinhood completed its $200 million acquisition of Bitstamp. This wasn't your typical crypto acquisition—it was a strategic move by Robinhood to gain instant international presence and institutional capabilities.

What did Robinhood get? Over 50 active crypto licenses globally, 500,000 retail users, 5,000 institutional clients, established infrastructure for trading, lending, and staking, and most importantly, credibility. Bitstamp's 14-year track record of reliability was worth the price.

Johann Kerbrat, General Manager of Robinhood Crypto, explained it simply: "Through this strategic combination, we are better positioned to expand our footprint outside of the US and welcome institutional customers to Robinhood."

For now, Bitstamp operates independently with the same team and leadership. The platform you know hasn't changed—but with Robinhood's resources behind it, the future looks expansive.

Current Leadership and Operations

Jean-Baptiste Graftieaux serves as CEO, leading a team of experienced professionals focused on compliance and security. The company maintains offices in Luxembourg (headquarters), UK, Slovenia, Singapore, and the US.

Bitstamp now holds over 50 licenses and registrations globally, making it one of the most compliant exchanges in the industry. They're registered with the Financial Conduct Authority in the UK, hold a BitLicense in New York, and operate under MiCA regulations in the EU.

The company employs hundreds of people focused on everything from technology development to regulatory compliance. They're audited by EY, one of the "Big Four" accounting firms, adding another layer of credibility.

Why Bitstamp Exists

When Bitstamp launched in 2011, Bitcoin trading was the Wild West. Mt. Gox handled most of the world's Bitcoin transactions, but it was sketchy—slow customer service, banking problems, and (as we'd learn later) massive fraud.

Europeans particularly struggled. Sending money to Japan took time, fees were high, and the whole process felt risky. There was no trusted, regulated, European-focused exchange where people could confidently buy and sell Bitcoin.

Kodrič and Merlak set out to solve this with three core principles:

Regulation first: Instead of fighting regulators or ignoring them, Bitstamp would embrace compliance. They'd be the first to get proper licenses, follow KYC rules, and operate transparently.

Security obsession: After seeing how easily exchanges got hacked, Bitstamp prioritized security from day one. Cold storage, multi-signature wallets, insurance—they invested heavily in protection.

Institutional-grade infrastructure: While other exchanges catered to retail traders, Bitstamp wanted to build something that banks, hedge funds, and professional traders would trust. That meant reliable uptime, deep liquidity, and professional-grade APIs.

The market needed an exchange that wouldn't disappear overnight, that governments wouldn't shut down, and that serious money managers could actually use. Bitstamp set out to be exactly that boring, reliable, and trustworthy.

What Bitstamp Does

Core Exchange Services

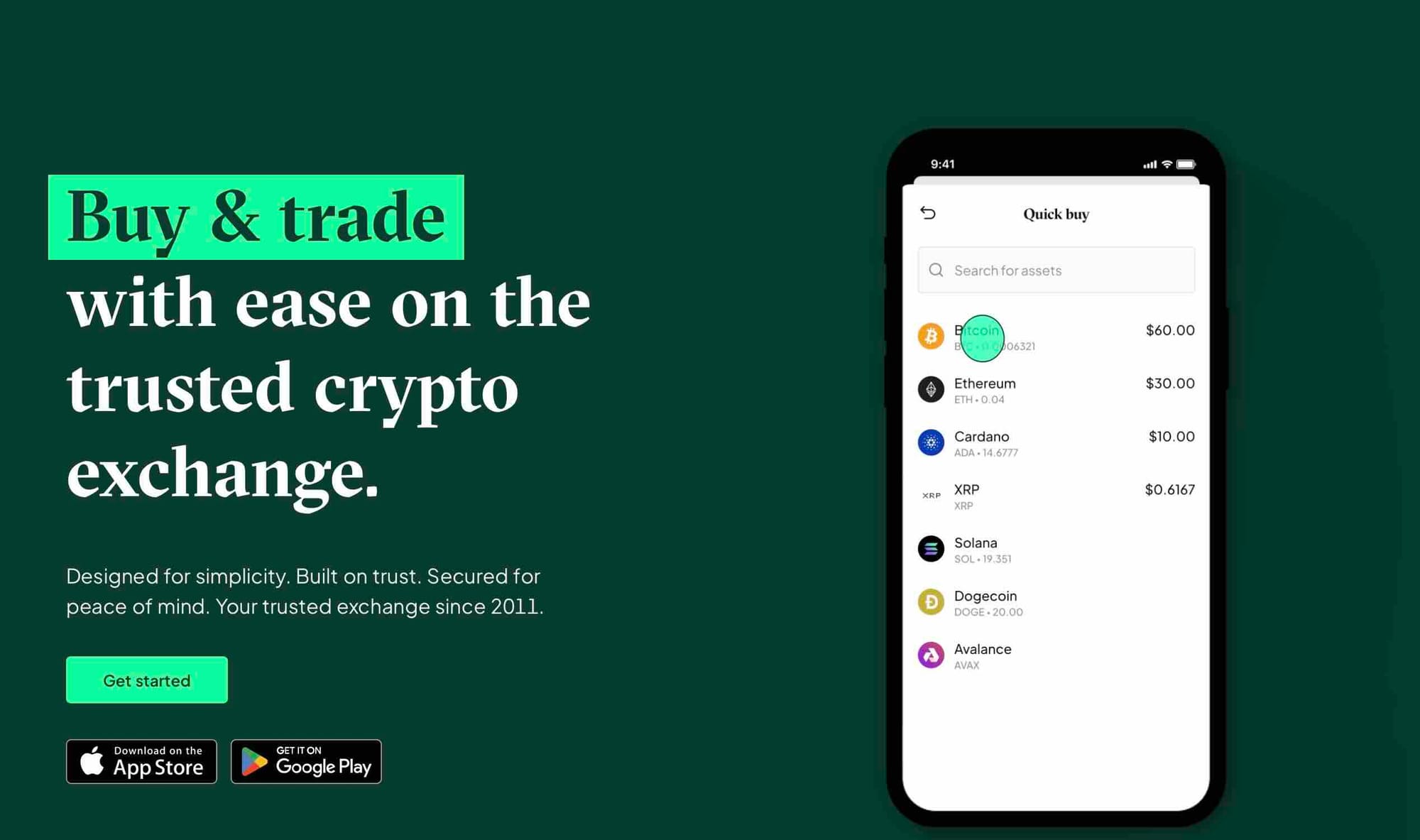

At its heart, Bitstamp is a cryptocurrency exchange where you trade digital assets for fiat currency (dollars, euros, pounds) or other cryptocurrencies.

Spot Trading: Buy and sell cryptocurrencies at current market prices. Bitstamp supports about 85 tradable assets including Bitcoin, Ethereum, XRP, Litecoin, and many others. You can trade against USD, EUR, and GBP.

Trading Modes: Two interfaces serve different needs. Basic mode offers a clean, simple interface perfect for straightforward buying and selling. Pro mode provides advanced charting from TradingView, multiple order types, and tools for serious traders.

Order Types: Beyond simple market orders, Bitstamp supports limit orders (specify your price), stop orders (trigger orders at certain prices), trailing stop orders (lock in profits while riding trends), iceberg orders (hide order size from the market), and FOK orders (fill-or-kill for immediate execution).

Fiat On-Ramps: Unlike many crypto exchanges, Bitstamp handles traditional currency well. You can deposit via SEPA (for Europeans), international wire transfers, and credit cards. This makes getting money in and out relatively straightforward.

Institutional Services

Bitstamp isn't just for individual traders—it's a major institutional platform.

OTC Trading: Over-the-counter trades let institutions move large amounts ($100,000 to $2 million per transaction) without affecting market prices. Dedicated account managers handle these deals personally.

Bitstamp-as-a-Service: A white-label solution lets other companies offer crypto trading using Bitstamp's infrastructure. They get the technology and liquidity without building an exchange from scratch.

API Trading: Professional-grade APIs with FIX protocol support enable algorithmic trading, high-frequency trading strategies, and automated portfolio management. After integrating Nasdaq's matching engine, Bitstamp can execute orders in under a millisecond.

Institutional Lending: Qualified institutions can borrow cryptocurrency for various strategies, with rates and terms negotiated based on amount and duration.

Staking Services: Bitstamp offers staking for proof-of-stake cryptocurrencies, letting both retail and institutional clients earn rewards on holdings without running their own validators.

Additional Features

Bitstamp Earn: Earn passive income on cryptocurrency holdings through staking and other yield-generating products. Returns vary by asset and market conditions.

Recurring Buy/Sell: Automate dollar-cost averaging strategies by setting up automatic purchases at regular intervals—daily, weekly, or monthly.

Mobile Apps: Full-featured iOS and Android apps mirror the desktop experience with additional biometric security (fingerprint, Face ID).

Address Whitelisting: Add an extra security layer by pre-approving withdrawal addresses. Once enabled, you can only send funds to addresses you've explicitly whitelisted.

Multiple Currencies: Trade and hold balances in USD, EUR, GBP, and various cryptocurrencies without constant conversions.

Technology Architecture

The Nasdaq Matching Engine

In September 2020, Bitstamp made a massive technological leap by integrating Nasdaq's matching engine—the same technology that powers traditional financial markets.

What's a matching engine? It's the core system that connects buyers with sellers, taking bid and ask orders and finding the best possible match between them. Think of it as the heart of the exchange.

Bitstamp used to run a custom-built matching engine they'd upgraded since 2011. It worked fine for average traders, but they wanted institutional-grade performance. So they partnered with Nasdaq Market Technology to implement the same engine used by the world's top traditional exchanges.

The results were dramatic: Orders now match up to 1,250 times faster than before, platform throughput increased by up to 400 times, and trade execution can happen in under one millisecond for API traders.

This isn't just about speed—it's about capacity and reliability. During extreme volatility when everyone's trying to trade at once (like "Crypto Black Thursday" in March 2020), exchanges often crash or lag severely. Bitstamp's Nasdaq engine handles these volume spikes gracefully.

David Osojnik, Bitstamp's CTO, explained: "The new matching engine from Nasdaq doesn't just bolster Bitstamp's performance, it gives us a great foundation from which to build new features."

The upgrade happened gradually, starting with lower-volume trading pairs and finishing with Bitcoin pairs in February 2020. This cautious rollout ensured stability throughout the transition.

Security Infrastructure

Bitstamp's security approach is multi-layered and paranoid in the best way.

Cold Storage Dominance: A full 95% of customer funds sit in cold storage—offline vaults that have never touched the internet. Only 5% remain in hot wallets for immediate liquidity and withdrawals.

Multi-Signature Wallets: Withdrawals from cold storage require multiple authorized signatures, preventing any single person from accessing funds.

Crime Insurance: Bitstamp carries insurance policies protecting customers against theft or hacks. While they don't publicly disclose the coverage amount, it adds a safety net beyond their own security measures.

Two-Factor Authentication: Required for all accounts, with support for SMS, Google Authenticator, email codes, and biometric options (fingerprint, Face ID).

PGP Encryption: Pretty Good Privacy encryption protects sensitive information sent via email or support requests, ensuring uploaded documents remain private.

Regular Security Audits: Independent security firms regularly audit Bitstamp's systems to identify vulnerabilities before attackers can exploit them.

ISO/IEC 27001 and SOC2 Type 2 Certifications: These internationally recognized certifications verify that Bitstamp maintains proper information security management systems.

The company earned a security score of 86.95 AA on CertiK, placing it among the highest-rated exchanges for security. They also achieved seven consecutive AA ratings from CCData and rank third on Forbes' 2025 list of the world's most trustworthy crypto exchanges.

Banking and Fiat Operations

Unlike many crypto exchanges that struggle with banking relationships, Bitstamp has solid partnerships.

Gorenjska Banka: This Slovenian bank founded in 1955 handles many of Bitstamp's fiat transactions. As an EU-regulated bank, it provides SEPA transfer access across Europe.

BCB Group: A payment service provider that operates a real-time gross settlement system, enabling faster funding of large client accounts.

No Tether Dependence: Bitstamp doesn't rely on Tether (USDT) for liquidity, instead maintaining direct fiat currency relationships. This insulates them from any potential Tether-related issues.

Performance and Uptime

One of Bitstamp's underrated strengths is simply staying online. During 2012-2013, when competitors like Mt. Gox frequently went down, Bitstamp maintained continuous uptime.

That reliability continues today. The exchange handles billions in daily trading volume without choking, processes withdrawals promptly, and rarely experiences the "maintenance" downtime that plagues other platforms during crucial trading moments.

Who Should Use Bitstamp

Perfect For:

Professional Traders: The combination of Nasdaq's matching engine, advanced order types, TradingView integration, and reliable execution makes Bitstamp ideal for serious traders. If you're making multiple trades daily or running algorithmic strategies, the infrastructure supports you.

Institutional Investors: Banks, hedge funds, family offices, and other institutions need regulatory compliance, deep liquidity, reliable APIs, and professional service. Bitstamp delivers all four. The OTC desk and white-label solutions specifically serve institutional needs.

European Traders: With headquarters in Luxembourg, full EU licensing, SEPA support, and multiple European fiat currencies (EUR, GBP), Bitstamp is built for European markets in a way US-based exchanges aren't.

Security-Conscious Users: If you prioritize safety over cutting-edge features, Bitstamp's track record speaks volumes. The 95% cold storage, insurance, certifications, and 14 years without major incidents (after recovering from 2015) provide peace of mind.

Regulatory Compliance Seekers: For users who want to stay on the right side of regulations—whether for legal reasons or tax simplicity—Bitstamp's licenses, KYC procedures, and transparent reporting make compliance straightforward.

Long-Term Holders Using Earn: If you're staking cryptocurrencies for passive income, Bitstamp provides a trusted platform with decent yields and the security of an established exchange.

Dollar-Cost Averaging Investors: The recurring buy feature automates DCA strategies, perfect for investors who want to accumulate Bitcoin or other assets systematically without timing the market.

Maybe Not For:

Absolute Beginners: Bitstamp isn't particularly beginner-unfriendly, but simpler alternatives exist. The KYC verification, bank wire deposits, and trading interface have a learning curve. If you've never used crypto before, you might want to start elsewhere and graduate to Bitstamp.

Fee-Sensitive Traders: Bitstamp's fees (0.1% to 0.4% depending on volume) aren't the highest, but they're not the lowest either. If you're making frequent small trades, fees can add up. Some competitors offer cheaper trading.

Altcoin Enthusiasts: With about 85 cryptocurrencies supported, Bitstamp covers the major players but lacks the hundreds of obscure tokens available on exchanges like Binance. If you want to trade new or niche altcoins, look elsewhere.

Margin and Derivatives Traders: Bitstamp focuses on spot trading and doesn't offer leveraged trading, perpetual contracts, or complex derivatives. If you want to trade with leverage, you need a different platform.

Privacy Maximalists: The extensive KYC requirements, regulatory reporting, and centralized custody model mean Bitstamp knows exactly who you are and what you're trading. If privacy is paramount, peer-to-peer or decentralized alternatives better suit your needs.

US Retail Traders Looking for Low Barriers: While Bitstamp operates in the US (with proper licensing), American retail users often prefer Coinbase or Kraken for simpler onboarding and more features tailored to US customers.

What's Great About Bitstamp

Unmatched Longevity: Fourteen years of continuous operation through multiple market cycles, regulatory changes, and competitive challenges. They've outlasted countless competitors. This track record isn't luck—it's discipline.

Regulatory Gold Standard: Over 50 active licenses globally, including full EU regulation, UK FCA registration, New York BitLicense, and MiCA compliance. When regulators crack down, Bitstamp doesn't scramble—they're already compliant.

Institutional-Grade Technology: The Nasdaq matching engine puts Bitstamp's infrastructure on par with traditional financial markets. Sub-millisecond execution, 400x throughput increase, and the capacity to handle extreme volume spikes reliably.

Security That Actually Works: Since recovering from the 2015 hack, Bitstamp hasn't had major security incidents. The 95% cold storage, multi-sig wallets, insurance, and multiple certifications aren't marketing—they're real protections that work.

Professional Service Level: When institutional clients need support, they get it. Dedicated account managers for OTC trades, professional-grade APIs with excellent documentation, and responsive customer service that actually understands complex issues.

Deep Liquidity: Years of operation have built substantial order book depth, meaning large orders execute without massive slippage. This matters tremendously for professional traders and institutions.

Fiat Integration Done Right: Unlike exchanges that treat fiat as an afterthought, Bitstamp handles USD, EUR, and GBP professionally with established banking relationships and reasonable deposit/withdrawal times.

Transparent Operations: Regular audits by EY, clear fee structures, published reserves information, and straightforward communication. They're not hiding anything because they don't need to.

Survived and Thrived: The 2015 hack could have ended Bitstamp. Instead, they reimbursed users, rebuilt security, and came back stronger. That resilience and commitment to customers is rare in crypto.

Robinhood Backing: The 2025 acquisition by Robinhood provides financial resources for expansion while (so far) maintaining Bitstamp's independent operations and reputation.

What Could Be Better

Higher Fees Than Some Competitors: The 0.1% to 0.4% trading fee structure is reasonable but not the cheapest. Binance, for example, offers lower fees for similar volume levels. The fees reflect Bitstamp's compliance costs and security investments, but they still hurt for high-frequency traders.

Limited Cryptocurrency Selection: Eighty-five cryptocurrencies sounds like a lot until you compare it to Binance's hundreds or even Kraken's broader selection. If you want to trade obscure altcoins, you'll need multiple exchanges.

No Leverage or Derivatives: The focus on spot trading means sophisticated traders wanting margin, futures, or options must use other platforms. This limits Bitstamp's appeal to certain trading strategies.

Basic Mobile Experience: While functional, the mobile apps lack the polish and feature set of competitors like Coinbase. They work fine for basic trades but feel dated compared to newer apps.

Customer Support Can Be Slow: Despite improvements, customer support response times sometimes lag, especially for retail customers. Institutional clients get better service, which is understandable but frustrating for smaller users.

No P2P Trading: Unlike some competitors, Bitstamp doesn't offer peer-to-peer trading options. All trades go through the centralized order book.

Staking Yields Not Competitive: While Bitstamp offers staking, the yields often trail specialized staking platforms. You pay for convenience and security but sacrifice some returns.

Limited Educational Resources: The learning center exists but isn't comprehensive. Beginners might struggle without the extensive educational materials offered by exchanges like Coinbase.

Withdrawal Fees: Cryptocurrency withdrawal fees are standard but not negligible, and international wire transfer fees (0.09%, minimum $15) add up for frequent withdrawals.

How It Compares

vs. Coinbase: Coinbase wins for US retail users with simpler onboarding, more educational resources, and a cleaner mobile app. Bitstamp wins for European users, institutional clients, and anyone prioritizing lower fees and deeper liquidity. Coinbase charges higher fees but offers more hand-holding.

vs. Kraken: Both are old-school, security-focused exchanges with strong reputations. Kraken offers more cryptocurrencies, margin trading, and futures. Bitstamp has better fiat integration and institutional services. Choose Kraken for trading flexibility; choose Bitstamp for regulatory compliance and simplicity.

vs. Binance: Binance dwarfs Bitstamp in trading volume, cryptocurrency selection, and features like margin trading and DeFi integration. But Binance faces ongoing regulatory challenges, has higher security risks, and operates in a gray area legally. Choose Binance for maximum options; choose Bitstamp for peace of mind and regulatory certainty.

vs. Gemini: Gemini and Bitstamp are similar—both prioritize compliance and security over bleeding-edge features. Gemini is US-focused with FDIC insurance on USD deposits. Bitstamp is global with broader European presence. Both are solid choices for security-conscious users.

vs. Bybit: Bybit focuses on derivatives trading with high leverage and complex products. It's for active traders and speculators. Bitstamp focuses on spot trading and institutional services. Completely different audiences—Bybit for derivatives traders, Bitstamp for spot traders and long-term investors.

vs. Robinhood (pre-acquisition): Robinhood Crypto appealed to US retail investors wanting simple crypto exposure alongside stocks. Bitstamp offered more cryptocurrencies, better liquidity, and true exchange functionality. Post-acquisition, they complement each other—Robinhood for casual US investors, Bitstamp for everyone else.

What It Costs / Trading Fees

Bitstamp uses a maker-taker fee model based on 30-day trading volume:

- $0 - $10,000 volume: 0.40% maker / 0.40% taker

- $10,000 - $20,000: 0.25% / 0.40%

- $20,000 - $100,000: 0.20% / 0.35%

- $100,000 - $1,000,000: 0.15% / 0.25%

- $1,000,000 - $2,000,000: 0.14% / 0.24%

- $2,000,000 - $10,000,000: 0.13% / 0.22%

- $10,000,000 - $50,000,000: 0.12% / 0.20%

- $50,000,000+: 0.10% / 0.15%

Higher volume traders get significant discounts. The fee structure rewards consistent trading.

Deposit Fees

- Credit card deposits: 5% fee (expensive—use bank transfers instead)

- SEPA transfers: €0.90 fee (great for Europeans)

- International wire (USD): 0.1%, minimum $15

- Cryptocurrency deposits: Free

Withdrawal Fees

- SEPA transfers: €0.90 (same as deposits)

- International wire (USD): 0.09%, minimum $15

- International wire (GBP): 0.09%, minimum £10

- Cryptocurrency withdrawals: Varies by coin (e.g., Bitcoin ~0.0005 BTC, Ethereum ~0.001 ETH)

Additional Costs

- Instant buy/sell: Slightly higher fees than regular trading (convenience markup)

- Staking: Bitstamp takes a cut of staking rewards (percentage varies by asset)

- No account fees: No monthly charges, inactivity fees, or account minimums

Bottom Line

Bitstamp isn't flashy, it's not trying to be everything to everyone, and it won't blow your mind with innovation. What it will do is work reliably, day after day, year after year.

After 14 years in an industry where most exchanges don't last 14 months, Bitstamp has proven something valuable: boring reliability beats exciting chaos. They've survived Mt. Gox's collapse, the 2017 bubble, the 2018 crash, the 2020 pandemic volatility, the 2022 crypto winter, and countless regulatory challenges.

The Robinhood acquisition adds a new chapter, but the fundamentals remain. Bitstamp offers institutional-grade infrastructure with enough simplicity for retail users, regulatory compliance that works globally, security measures that actually prevent disasters, and liquidity built over years that competitors can't easily match.

Is it perfect? No. The fees could be lower, the cryptocurrency selection broader, and the mobile app slicker. But these aren't deal-breakers for Bitstamp's core audience.

Who is that audience? Professional traders needing reliable execution, institutions requiring regulatory compliance, Europeans wanting proper fiat integration, security-conscious users who've seen too many exchange hacks, and anyone who values longevity and trust over new features and hype.

The crypto industry desperately needs more Bitstamps—exchanges that prioritize stability, embrace regulation, and focus on doing the basics exceptionally well. In a space full of platforms chasing yield farming trends or listing every meme coin imaginable, there's something deeply reassuring about an exchange that just… works.

👋 Use Bitstamp if: You're a serious trader or institution, you value security and regulatory compliance, you're based in Europe or need multi-currency support, or you want an exchange that'll still be here in five years.

Skip it if: You're a complete beginner looking for maximum hand-holding, you want to trade obscure altcoins, you need leverage and derivatives, or you're purely optimizing for the lowest possible fees.

Our take: Bitstamp won't excite you, but it won't disappoint you either. It's the sensible choice—the Volvo of crypto exchanges. And in an industry where most platforms are more like used dirt bikes with questionable brakes, that's worth a lot more than it sounds.

Transparency Note

This review was written independently without sponsorship from Bitstamp, Robinhood, or any competing exchange. We've used publicly available information, platform testing, and assessment of Bitstamp's role in the crypto ecosystem. As always, do your own research—what works for us might not work for you.

Trading cryptocurrency carries risk. Exchanges can fail, get hacked, or face regulatory action. Never invest more than you can afford to lose, and remember that past performance doesn't guarantee future results. Bitstamp's 14-year track record is impressive but doesn't make them invincible.