Bitcoin mining has evolved significantly over the years, and cloud mining services have emerged as an accessible entry point for those who want to participate without the hassle of managing hardware.

21 Mining is one such service that promises to simplify Bitcoin mining through hosted solutions. But is it worth your time and money? Let's dive deep into what 21 mining offers.

What Is 21 Mining?

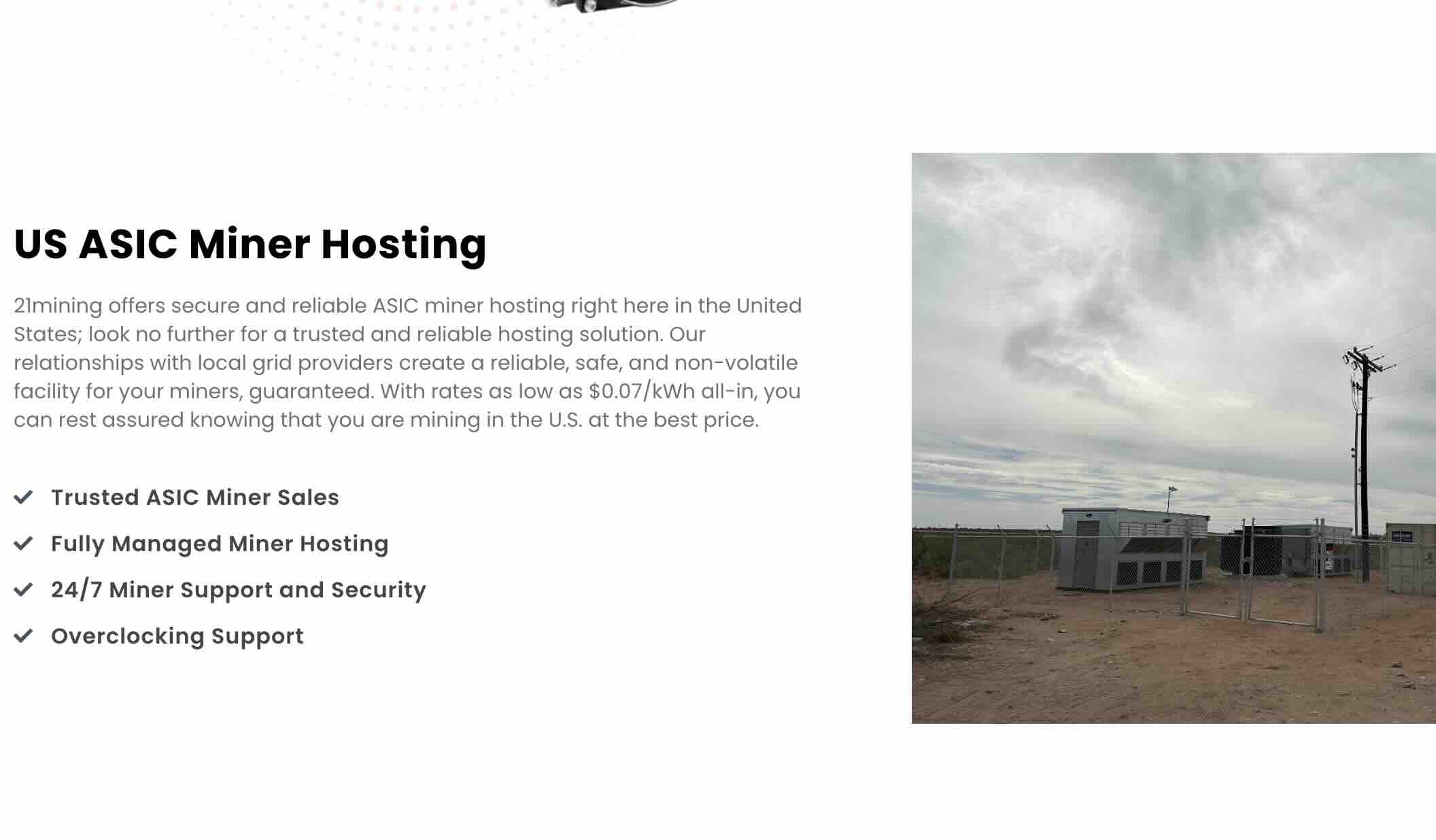

21 Mining is a Bitcoin cloud mining and hosting platform that allows users to mine cryptocurrency without purchasing and maintaining their own hardware. The service operates mining facilities where they host ASIC miners on behalf of customers, handling everything from electricity costs to cooling and maintenance.

The platform targets both newcomers to Bitcoin mining and experienced miners looking to scale their operations without the logistical headaches of running a home mining setup.

Company Background

21 Mining was established to democratize access to Bitcoin mining during a period when industrial-scale operations began dominating the network. The company operates mining facilities in locations with competitive electricity rates, which is crucial for mining profitability.

While the exact founding date varies depending on the source, 21 Mining has been operating in the hosting mining space for several years, positioning itself as a turnkey solution for Bitcoin mining.

How Does 21 Mining Work?

The process is straightforward:

- Choose a Plan: Users select from various mining packages based on hashrate and contract duration

- Make Payment: Purchase the selected plan using Bitcoin or other accepted payment methods

- Start Mining: The platform allocates mining power and begins mining Bitcoin on your behalf

- Receive Payouts: Mined Bitcoin is credited to your account, typically on a daily basis

The company handles all technical aspects including hardware maintenance, cooling, security, and pool management.

Pricing and Plans

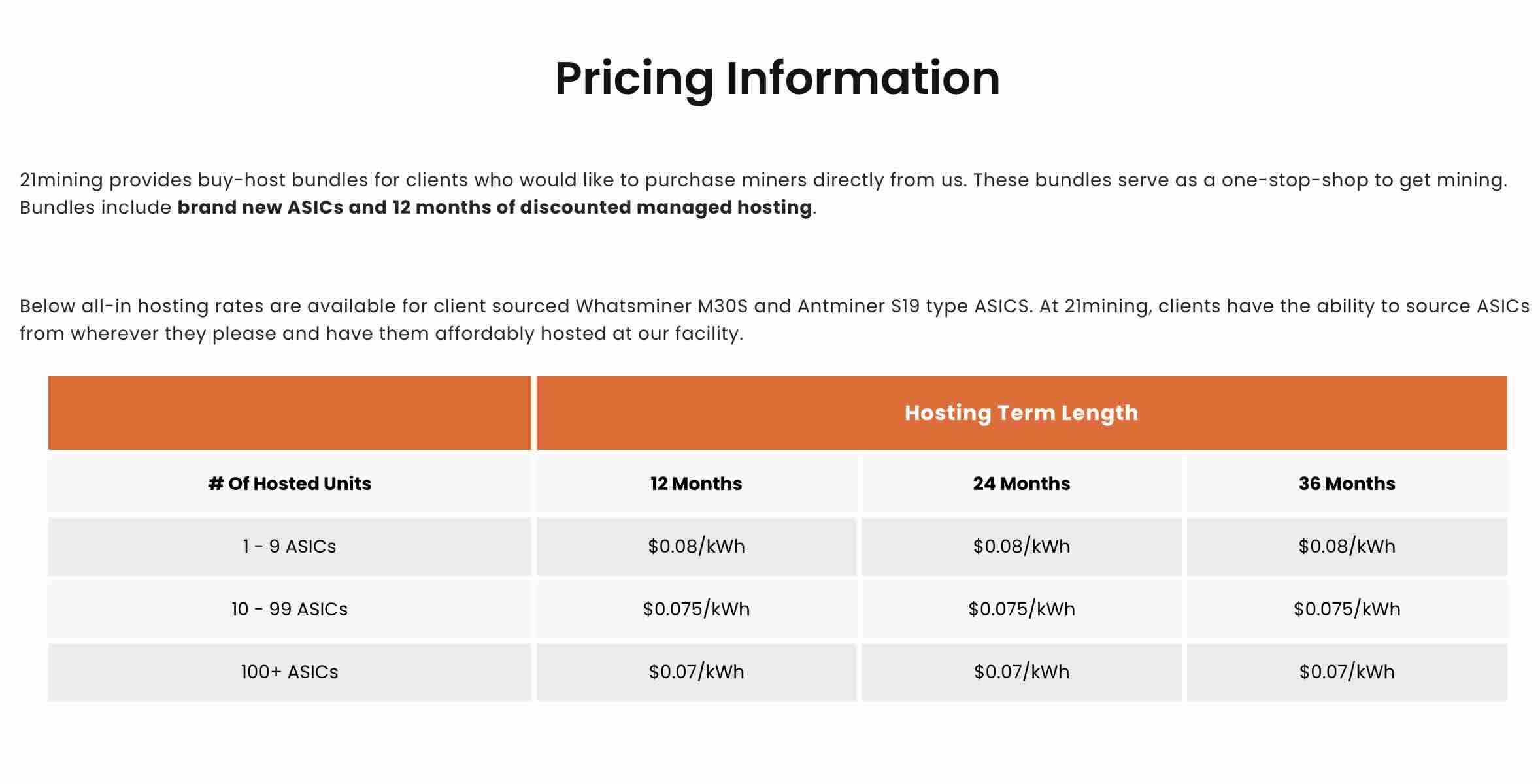

21 Mining offers a unique hosting model where they provide buy-host bundles that include brand new ASICs and 12 months of discounted managed hosting. This is a one-stop-shop approach to get mining without the complexity of sourcing hardware and hosting separately.

The platform also offers all-in hosting rates for client-sourced Whatsminer M30S and Antminer S19 type ASICs, giving flexibility to those who already own equipment or prefer to source their own miners.

Hosting Rates by Scale:

Small Scale (1-9 ASICs)

- 12 Months: $0.08/kWh

- 24 Months: $0.08/kWh

- 36 Months: $0.08/kWh

Mid-Scale (10-99 ASICs)

- 12 Months: $0.075/kWh

- 24 Months: $0.075/kWh

- 36 Months: $0.075/kWh

Enterprise Scale (100+ ASICs)

- 12 Months: $0.07/kWh

- 24 Months: $0.07/kWh

- 36 Months: $0.07/kWh

What's Included: These all-in rates cover electricity, cooling, maintenance, security, and pool management. The pricing structure rewards scale, with larger operations receiving better rates per kilowatt-hour.

Key Advantages: The electricity rates offered by 21 Mining are competitive with industrial rates and significantly better than residential electricity costs in most regions. For context, residential electricity in the US averages $0.12-0.15/kWh, making the $0.07-0.08/kWh rates quite attractive for mining profitability.

Contract durations range from 12 to 36 months across all tiers. Notably, 21 Mining doesn't offer better rates for longer commitments, which provides flexibility for miners who want shorter-term exposure without sacrificing on pricing.

Is 21 Mining Legitimate?

This is the critical question for any cloud mining service. Based on available information:

Positive Indicators:

- The company has maintained operations for multiple years ( 4 years)

- Verifiable payout history from some users

- Responsive customer support presence

- Clear terms of service and contract details

Concerns to Consider:

- Cloud and Hosting mining has historically been plagued by scams and unsustainable business models

- Limited transparency about mining facility locations and operations

- Profitability calculations should be approached with caution

Profitability Analysis

Let's be realistic about cloud mining profitability. Several factors determine whether you'll make money:

Break-Even Timeline: Most contracts take 12-18 months to break even under favorable conditions. This assumes stable or increasing Bitcoin prices and relatively stable network difficulty.

Electricity Costs: One advantage of 21 Mining is professional-grade electricity rates, which are typically better than residential rates.

Network Difficulty: As more miners join the Bitcoin network, difficulty increases, reducing individual returns. This is outside anyone's control.

Bitcoin Price: This is the biggest variable. A significant price increase can turn a marginal investment into a profitable one, while a prolonged bear market can make even the best mining contracts unprofitable.

Pros and Cons

Advantages

- No hardware management or technical expertise required

- No noise, heat, or space concerns

- Professional-grade electricity rates

- Scalable without physical constraints

- No equipment depreciation risk for the user

Disadvantages

- Lower profit margins compared to owning hardware (if you have cheap electricity)

- Contract lock-in periods

- Limited control over mining operations

- Profitability heavily dependent on market conditions

- Less transparent than self-mining

Our Verdict

21 Mining represents a convenient option for those interested in Bitcoin mining without the technical and logistical challenges of running their own operation. However, it's not a guaranteed path to profits.

Best For:

- Beginners wanting exposure to Bitcoin mining without hardware investment

- People without access to cheap electricity

- Those who value convenience over maximum profit potential

- Investors looking to diversify their Bitcoin acquisition strategy

Not Ideal For:

- Those seeking quick returns or guaranteed profits

- People with access to very cheap electricity who could mine more profitably at home

- Anyone uncomfortable with the inherent risks of cloud mining

- Those expecting cloud mining to match the returns of direct Bitcoin investment

Bottom Line: 21 Mining can be a legitimate way to participate in Bitcoin mining, but approach it with realistic expectations. The service is more about steady, modest Bitcoin accumulation than striking it rich. Given the historical volatility of cloud mining services, never invest more than you can afford to lose, and consider whether simply buying and holding Bitcoin might better serve your goals.

For those who do proceed, start with a smaller contract to test the service before committing significant capital. Calculate your break-even point conservatively, accounting for potential increases in network difficulty and Bitcoin price volatility.

Cloud mining services like 21 Mining fill a niche in the Bitcoin ecosystem, but they're not magic money machines. Do your research, understand the risks, and make informed decisions based on your individual circumstances and risk tolerance.

Disclaimer: This review is for informational purposes only and does not constitute financial advice. Cryptocurrency mining involves significant risk, and past performance does not guarantee future results. Always conduct your own research before making investment decisions.